dynamic macro portfolios

dynamic macro portfolios

coming soon

dynamic macro portfolios

coming soon

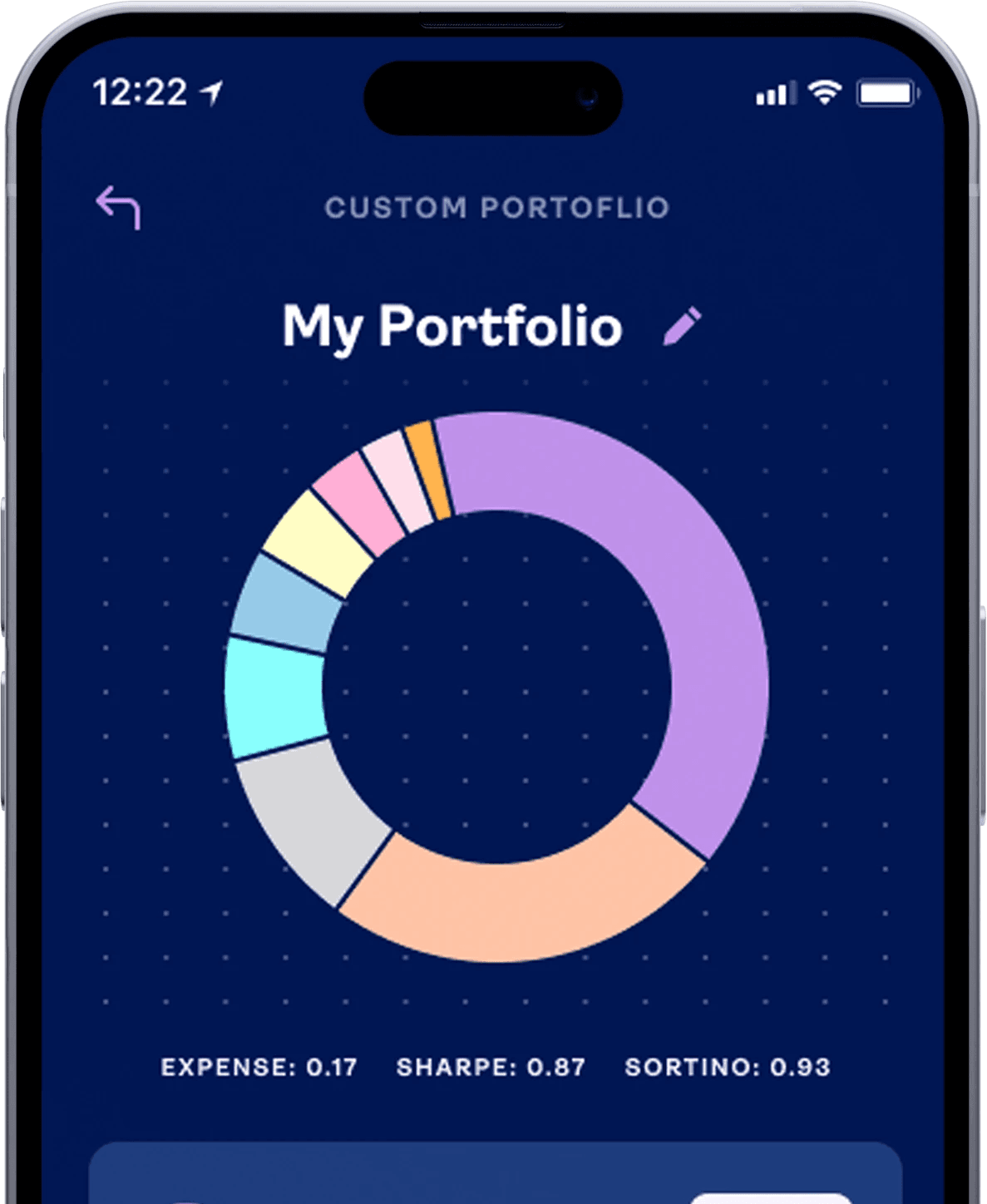

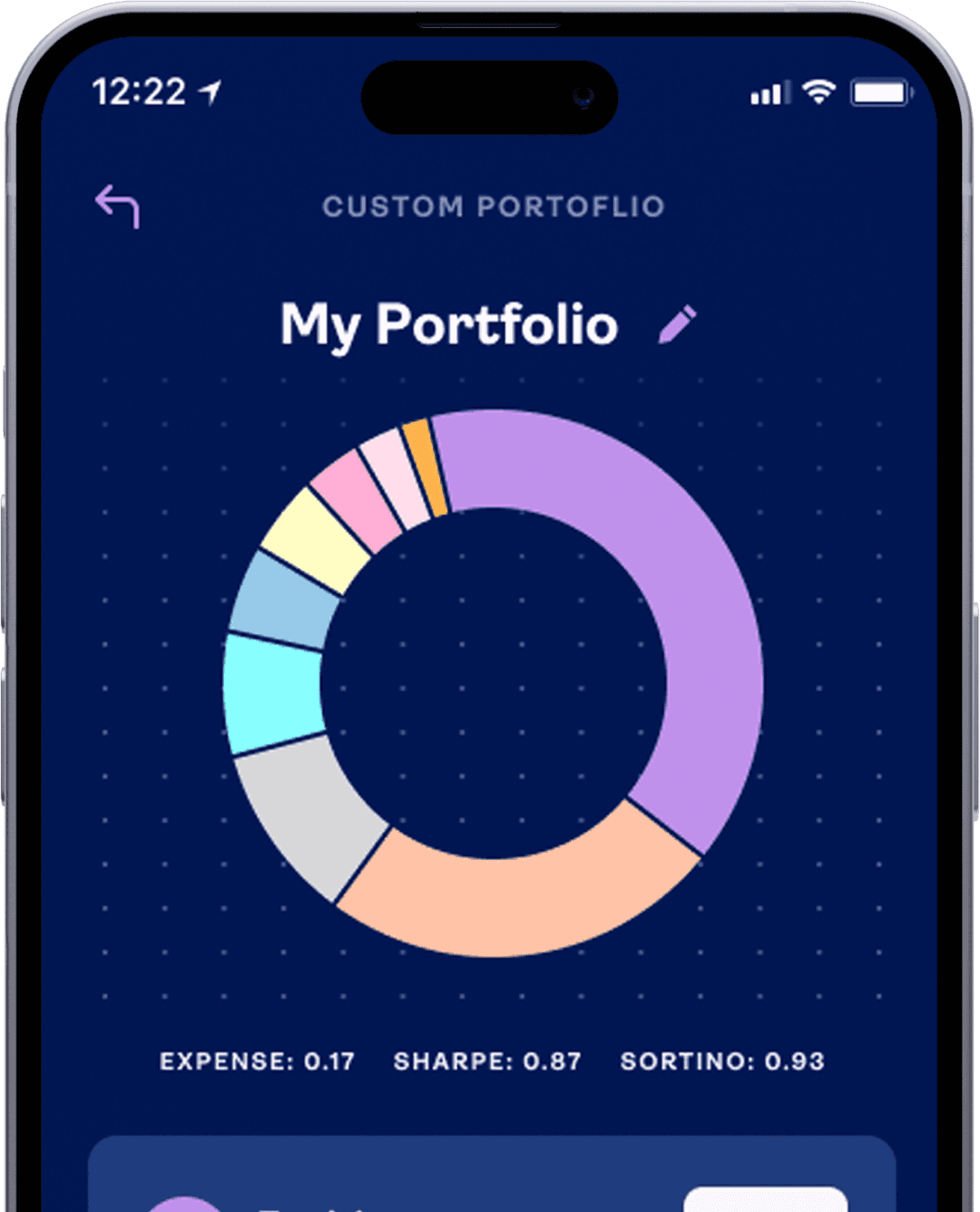

Where sophistication meets simplification.

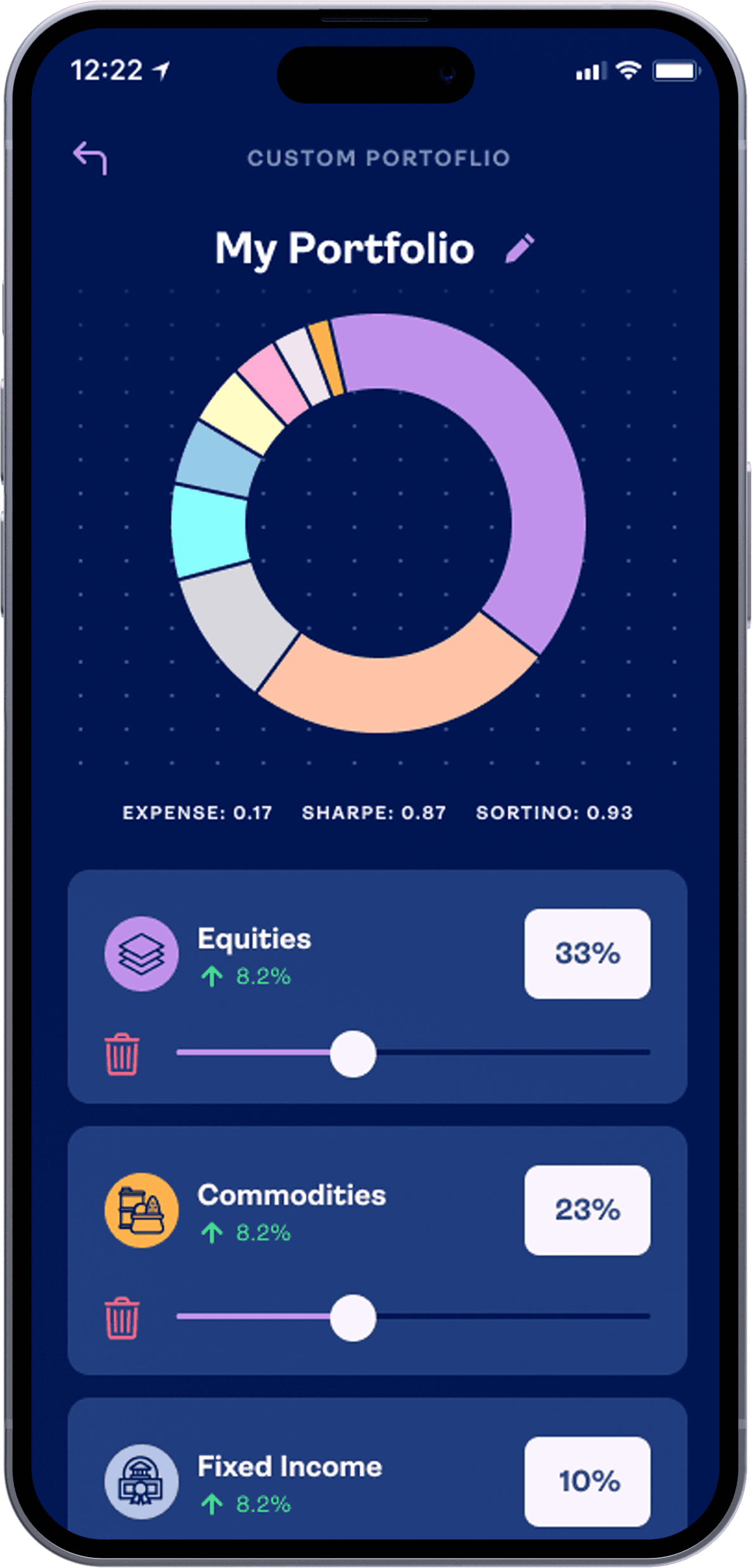

tailor your portfolio with precision.

tailor your portfolio with precision.

Truly personalized investing has never been easier.

Featuring real-time price execution and robust TradingView™ technical analysis, Allio’s Dynamic Macro Portfolios offer an unrivaled investment experience.

Customize your portfolio with the sectors, industries, strategies, and stocks of your choice. We'll take it from there—managing your custom portfolio—keeping it rebalanced and aligned with your goals.

Truly personalized investing has never been easier. With robust TradingView™ technical analysis, Allio’s Dynamic Macro Portfolios offer an unrivaled investment experience.

Customize your portfolio with the sectors, industries, strategies, and stocks of your choice. We'll take it from there—managing your custom portfolio—keeping it rebalanced and aligned with your goals.

Truly personalized investing has never been easier. With robust TradingView™ technical analysis, Allio’s Dynamic Macro Portfolios offer an unrivaled investment experience.

Customize your portfolio with the sectors, industries, strategies, and stocks of your choice. We'll take it from there—managing your custom portfolio—keeping it rebalanced and aligned with your goals.

strategic portfolios

strategic portfolios

strategic portfolios

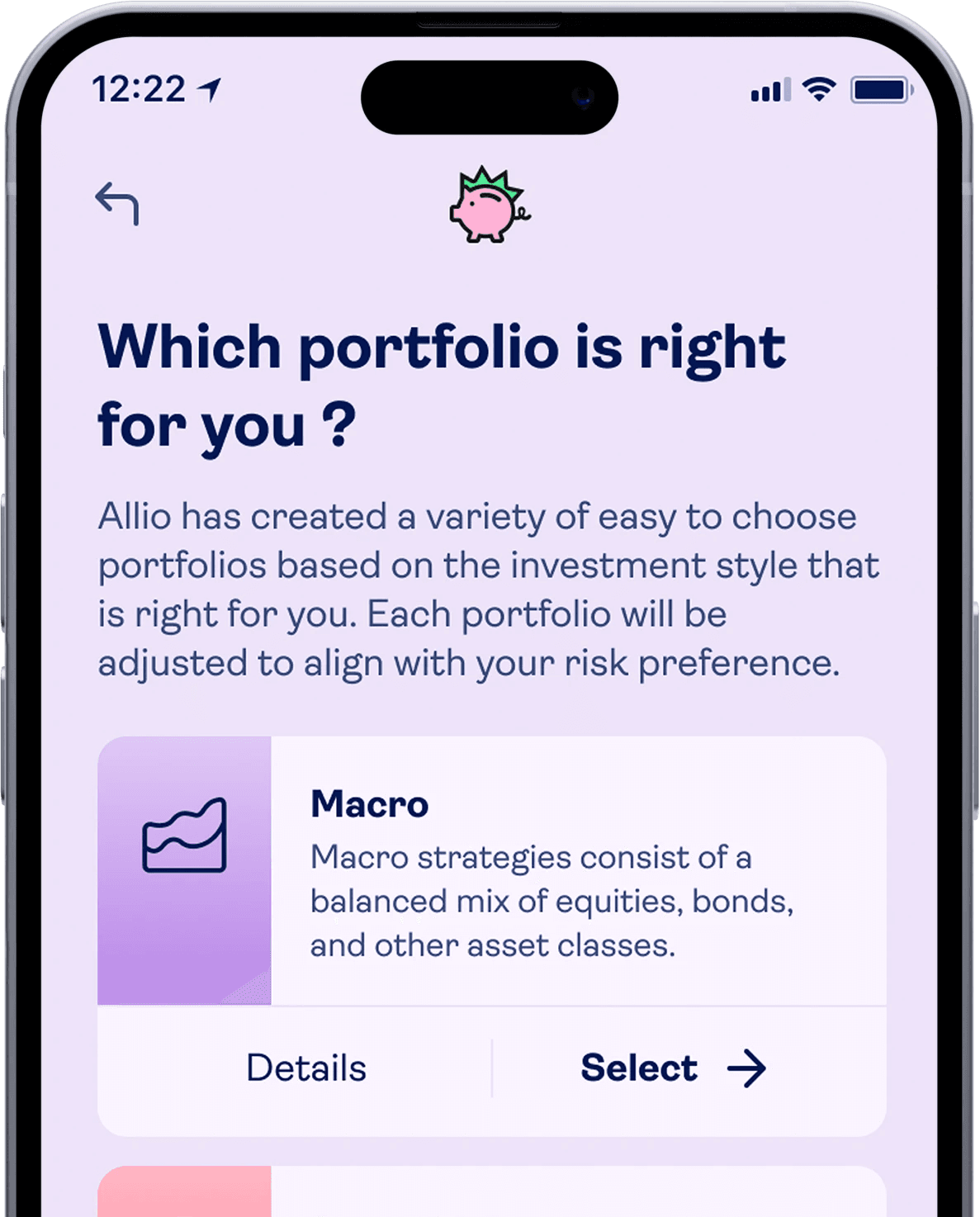

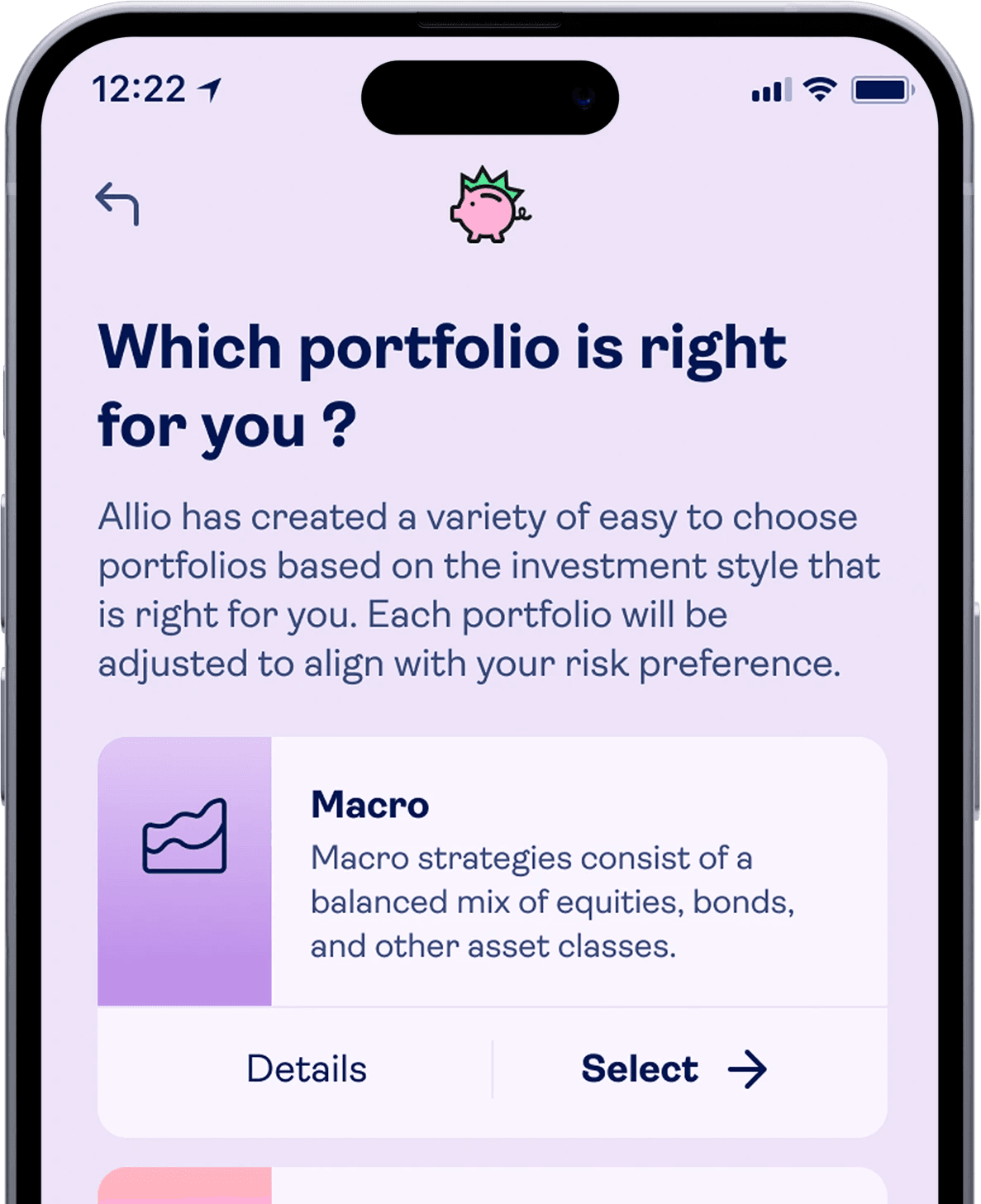

Expert curated

portfolios.

invest in expert curated portfolios.

invest in expert curated

portfolios.

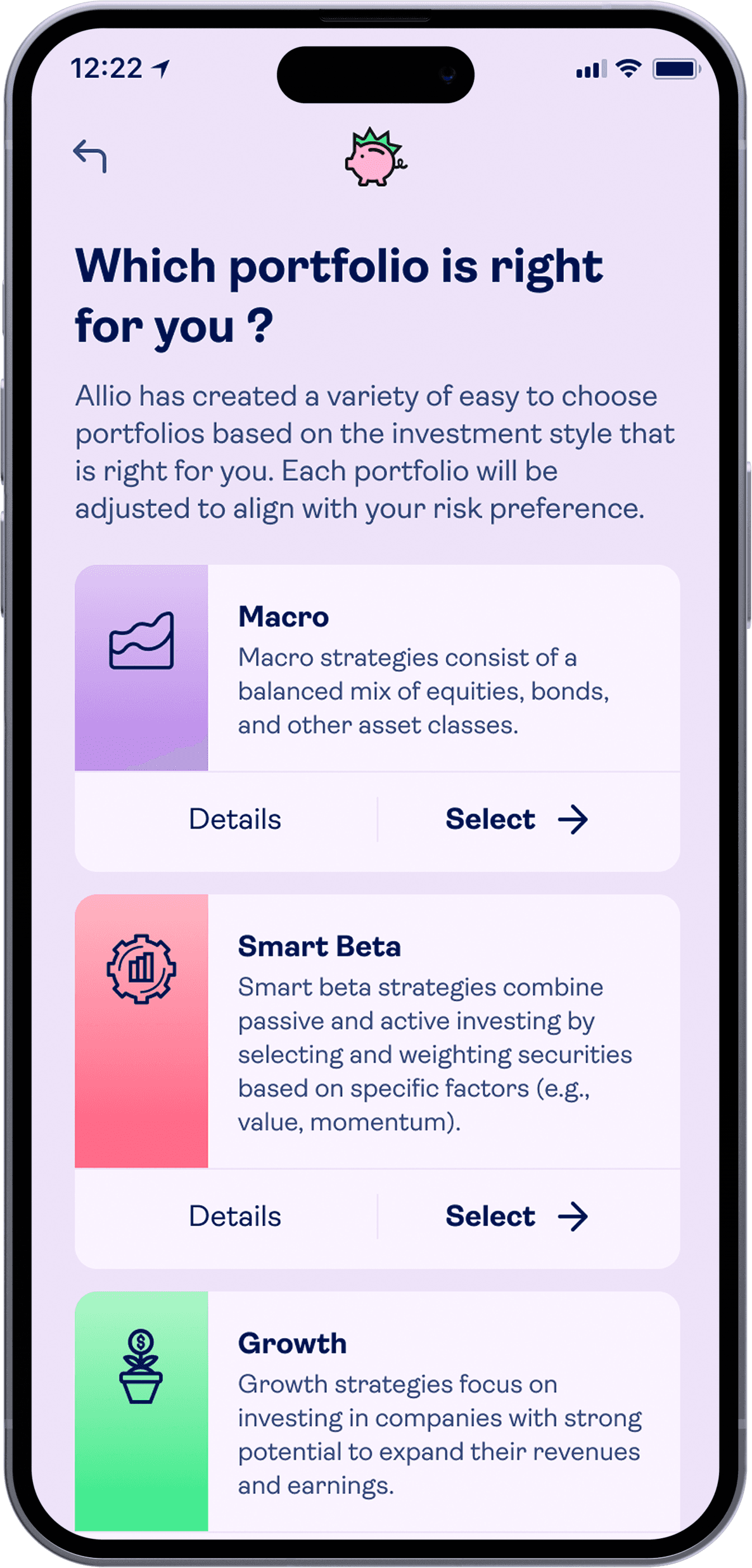

If you’re looking for an expert-guided experience that aligns with your investment strategy, select from Allio’s eight expert-crafted portfolios.

Instead of a generic 60/40 portfolio, you can choose from Macro, Smart Beta, Growth, Dividend, Value, Risk-Parity, Trend, and Disruptive Technologies—whatever aligns with your philosophy and goals.

Allio’s finance team uses a top down approach to macro investing with a focus on absolute returns and mitigating downside risk.

If you’re looking for an expert-guided experience that aligns with your investment strategy, select from Allio’s eight expert-crafted portfolios.

Instead of a generic 60/40 portfolio, you can choose from Macro, Smart Beta, Growth, Dividend, Value, Risk-Parity, Trend, and Disruptive Technologies—whatever aligns with your philosophy and goals.

If you’re looking for an expert-guided experience that aligns with your investment strategy, select from Allio’s eight expert-crafted portfolios.

Instead of a generic 60/40 portfolio, you can choose from Macro, Smart Beta, Growth, Dividend, Value, Risk-Parity, Trend, and Disruptive Technologies—whatever aligns with your philosophy and goals.

high yield portfolios

high yield portfolios

high yield portfolios

Reach your

financial goals,

effortlessly.

reach your financial goals, effortlessly.

reach your

financial goals,

effortlessly.

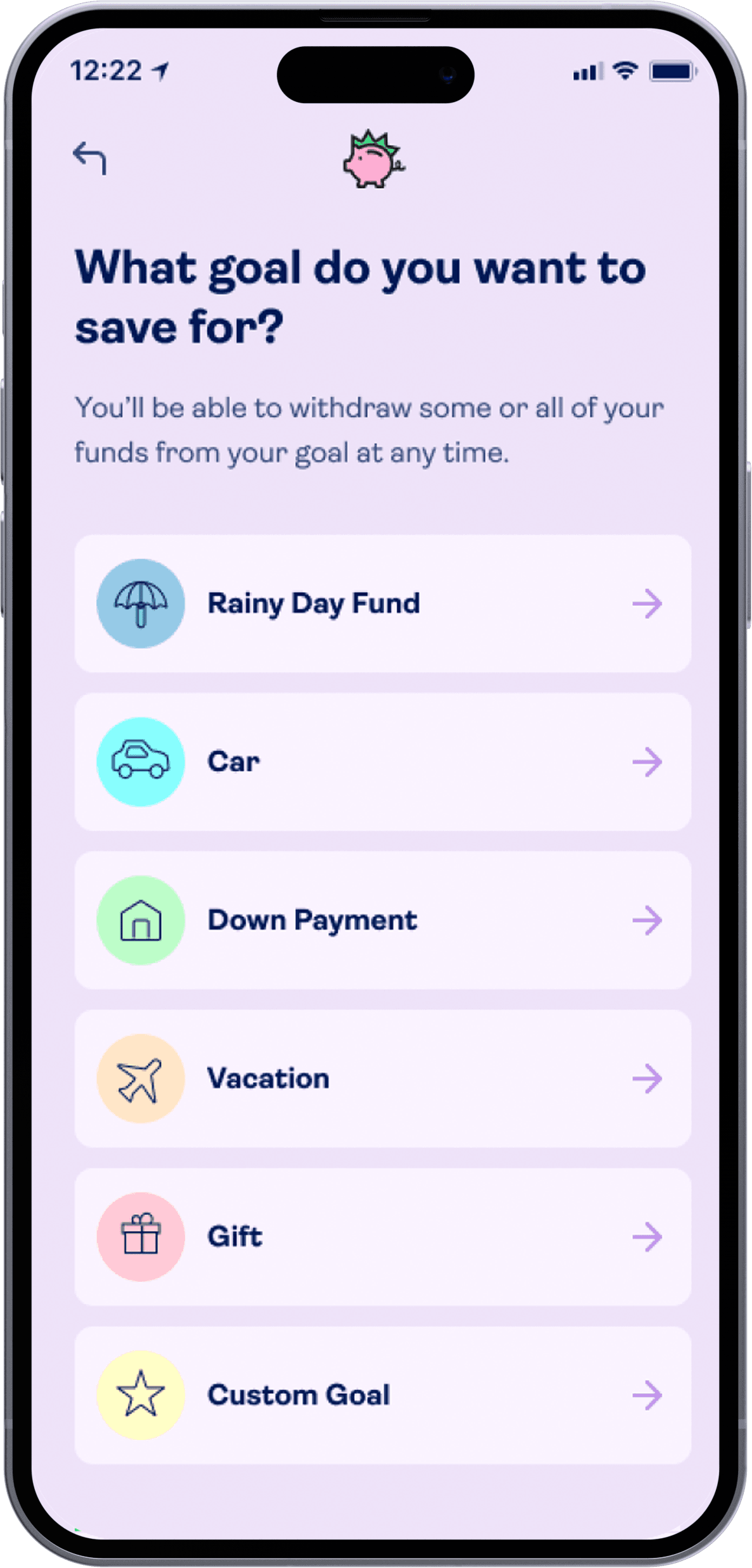

With over 5% APY, Allio’s automated high-yield portfolios help you easily reach your short-term financial goals.

When you save with Allio, we’ll automatically invest your money into Treasury Bills to help you build wealth faster than a basic savings account.

With up to 5% APY, Allio’s automated high-yield portfolios help you easily reach your short-term financial goals.

When you save with Allio, we’ll automatically invest your money into a professionally managed high-yield portfolio using investments like treasury bills to help grow your wealth more dynamically than an old fashioned savings account.

With up to 5% APY, Allio’s automated high-yield portfolios help you easily reach your short-term financial goals.

When you save with Allio, we’ll automatically invest your money into a professionally managed high-yield portfolio using investments like treasury bills to help grow your wealth more dynamically than an old fashioned savings account.

impact investing

impact investing

impact investing

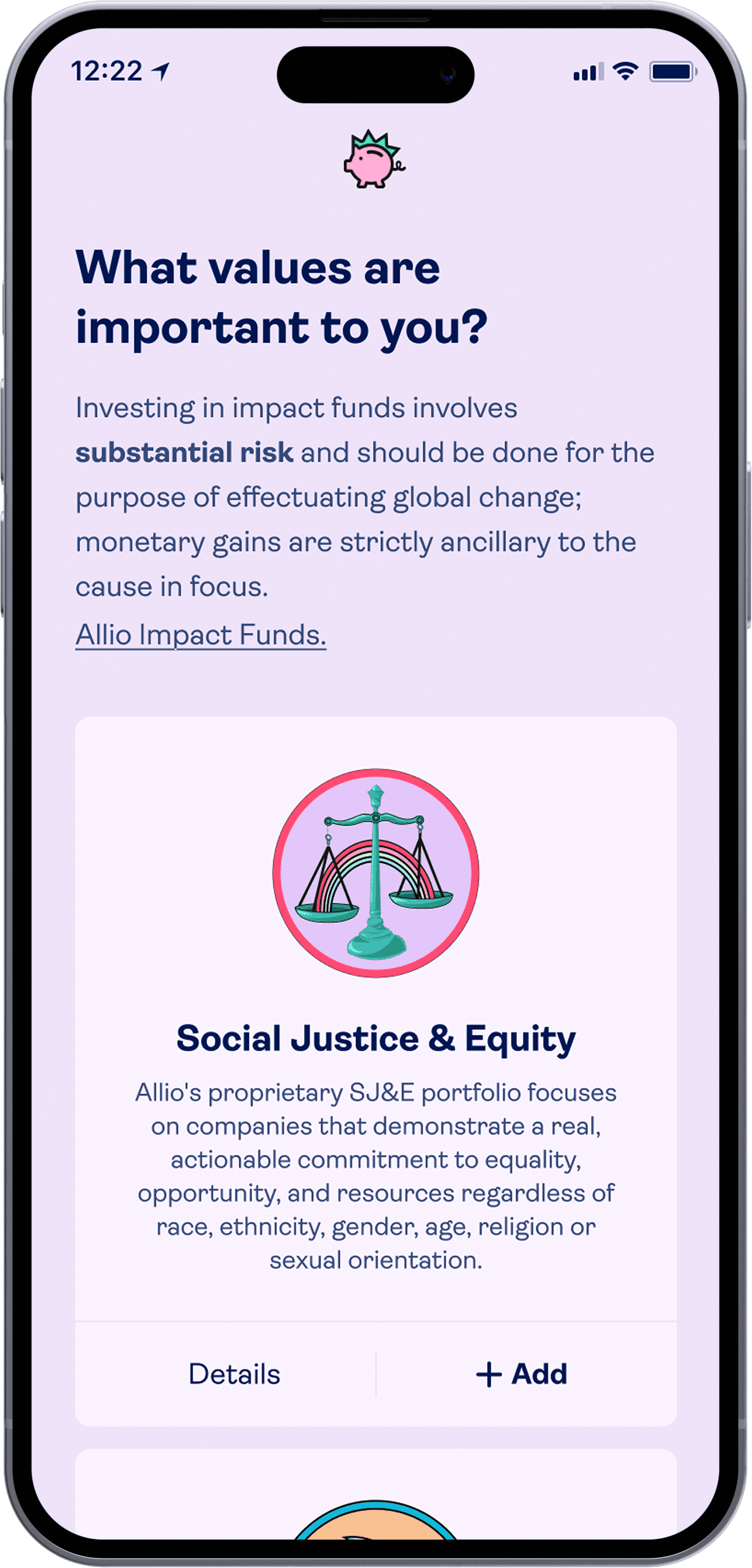

Fund what matters

most to you.

invest with your values in mind.

invest with your values in mind.

You don’t have to sacrifice your values to maximize your financial returns, which is why we’ve created proprietary impact investing baskets, so you can feel good about supporting causes you’re passionate about

With Allio, you'll be able to invest in Access to Education, Clean Energy, Social Justice & Equity, Made in America, Cancer Research, Water Stewardship, and Animal Welfare.

You don’t have to sacrifice your values to maximize your financial returns, which is why we’ve created proprietary impact investing baskets, so you can feel good about supporting causes you’re passionate about

With Allio, you'll be able to invest in Access to Education, Clean Energy, Social Justice & Equity, Made in America, Cancer Research, Water Stewardship, and Animal Welfare.

You don’t have to sacrifice your values to maximize your financial returns, which is why we’ve created proprietary impact investing baskets, so you can feel good about supporting causes you’re passionate about

With Allio, you'll be able to invest in Access to Education, Clean Energy, Social Justice & Equity, Made in America, Cancer Research, Water Stewardship, and Animal Welfare.

build wealth your way

build wealth your way

Geopolitical tensions and tighter monetary policy have produced idiosyncratic markets unlike the secular bulls of yesteryear. Navigating this complex economic climate requires a broader top down approach to building a portfolio that can be defensive, while still seeking Alpha.

Whether looking for professional help managing your portfolio or looking to learn as you do it on your own, Allio offers unrivaled personalization with next-level financial technology like real time data & execution and technical analysis provided by TradingView™ to help you establish your presence as a macro investor.

learn more

dynamic macro portfolios - coming soon

tailor your portfolio with precision.

Truly personalized investing has never been easier. With robust TradingView™ technical analysis, Allio’s Dynamic Macro Portfolios offer an unrivaled investment experience.

Customize your portfolio with the sectors, industries, strategies, and stocks of your choice. We'll take it from there—managing your custom portfolio—keeping it rebalanced and aligned with your goals.

discover

strategic portfolios

invest in expert curated portfolios.

If you’re looking for an expert-guided experience that aligns with your investment strategy, select from Allio’s eight expert-crafted portfolios.

Instead of a generic 60/40 portfolio, you can choose from Macro, Smart Beta, Growth, Dividend, Value, Risk-Parity, Trend, and Disruptive Technologies—whatever aligns with your philosophy and goals.

discover

high-yield portfolios

reach your financial goals, effortlessly.

With roughly 5% APY, Allio’s automated high-yield portfolios help you easily reach your short-term financial goals.

When you save with Allio, we’ll automatically invest your money into a professionally managed high-yield portfolio using investments like treasury bills to help grow your wealth more dynamically than an old fashioned savings account.

discover

impact investing

invest with your values in mind.

You don’t have to sacrifice your values to maximize your financial returns, which is why we’ve created proprietary impact investing baskets, so you can feel good about supporting causes you’re passionate about.

With Allio, you'll be able to invest in Access to Education, Clean Energy, Social Justice & Equity, Made in America, Cancer Research, Water Stewardship, and Animal Welfare.

discover

Securities in your account are protected up to $500,000 through Alpaca Securities, LLC, a member of the Securities Investment Protection Corporation (SIPC).

Securities in your account are protected up to $500,000 through Alpaca Securities, LLC, a member of the Securities Investment Protection Corporation (SIPC).

Securities in your account are protected up to $500,000 through Alpaca Securities, LLC, a member of the Securities Investment Protection Corporation (SIPC).

Bank Level Security. We protect your account with state-of-the-art security measures including 256-bit data encryption and multi-factor authentication.

Bank Level Security. We protect your account with state-of-the-art security measures including 256-bit data encryption and multi-factor authentication.

Bank Level Security. We protect your account with state-of-the-art security measures including 256-bit data encryption and multi-factor authentication.

As a registered investment advisor with the U.S. Securities and Exchange Commission (SEC), Allio has a fiduciary duty, which means we are obligated to act in our client's best financial interest.

As a registered investment advisor with the U.S. Securities and Exchange Commission (SEC), Allio has a fiduciary duty, which means we are obligated to act in our client's best financial interest.

As a registered investment advisor with the U.S. Securities and Exchange Commission (SEC), Allio has a fiduciary duty, which means we are obligated to act in our client's best financial interest.

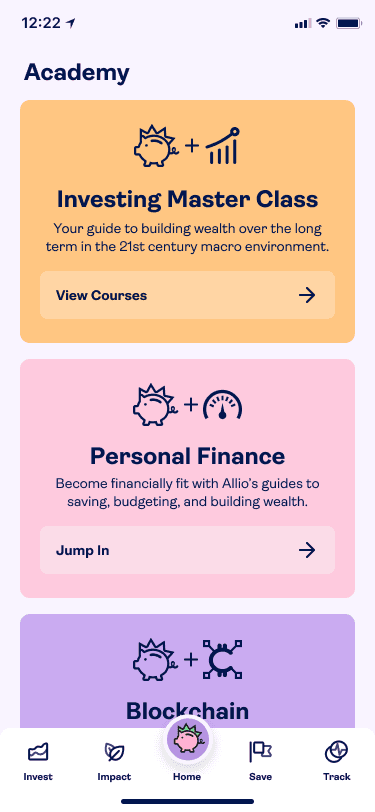

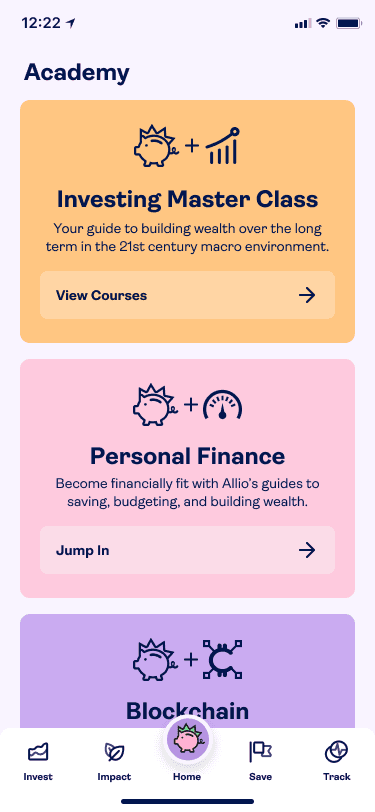

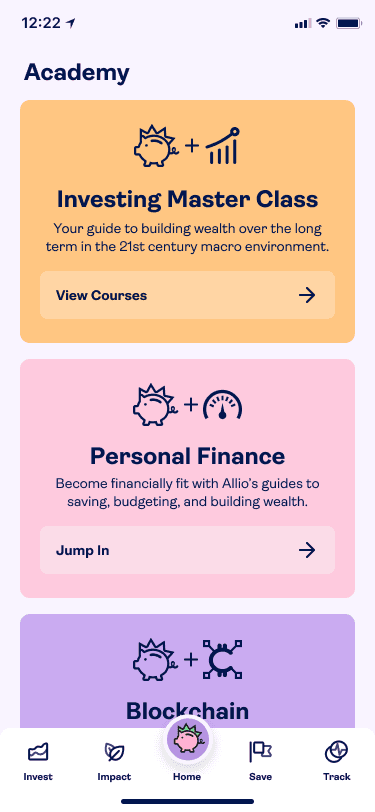

Allio

Academy

Allio

Academy

We believe in financial wellness for all,

which is why, here at Allio, we emphasize financial literacy.

Dive into some of our Allio Academy content to help you become a more informed investor.

This website is operated by Allio Advisors LLC, an SEC-registered investment adviser.

Important Disclosures: Investing involves risk, including loss of principal. Past performance does not guarantee or indicate future results. Please consider, among other important factors, your investment objectives, risk tolerance and Allio pricing before investing. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. It is not possible to invest directly in an index. Any hypothetical performance shown is for illustrative purposes only. Such results do not represent actual results and do not take into consideration economic or market factors which can impact performance. Actual clients may achieve investment results materially different from the results portrayed. Please note that a properly suggested portfolio recommendation is dependent upon current and accurate financial and risk profiles. Clients who have experienced changes to their goals, financial circumstances or investment objectives, or who wish to modify their portfolio recommendation, should promptly update their information in the Allio app. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them. Allio reserves the right to restrict or revoke any and all offers at any time.

Allio does not provide access to invest directly in Bitcoin. Bitcoin exposure is provided through ETFs, which invest in Bitcoin futures. Bitcoin has historically demonstrated high volatility. Particular investment strategies should be evaluated based on an investor’s tolerance for risk.

Allio does not provide access to invest directly in gold and other commodities. This commodity exposure is provided through ETFs that invest in commodities (i.e., gold) or in commodity futures. Investing in gold and other commodities, including through ETFs that invest in commodities or in commodity futures, is considered a high-risk investment given the speculative and volatile nature.

Compounding, generally, is the growth of principal investments due to the reinvestment of dividends without withdrawing funds from the account. Allio investment accounts do not pay interest, so the impact of compounding may be limited by the number of ETF shares an investor owns, as well as the frequency and amount of dividends paid by the ETFs in an investor’s Allio investment account. Compounding is not an investing strategy. Rather, it is a potential side effect of holding certain investments that are purchased as part of an investment strategy. The potential effect of compounding in an investor’s account does not assure positive performance of the account nor does it protect against losses. It does not take into account market volatility and fluctuations that will impact the value of any investment account.

The ETFs comprising the portfolios charge fees and expenses that will reduce a client’s return. Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. Investment policies, management fees and other information can be found in the individual ETF’s prospectus. Please read the prospectus carefully before you invest.

The effectiveness of the tax-loss harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Allio and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short- term or long-term). Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. There is a chance that trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e.g., if there are insufficient realized gains in the tax period, the use of harvested losses may be limited to a $3,000 deduction against income and distributions. Losses harvested through the strategy that are not utilized in the tax period when recognized (e.g., because of insufficient capital gains and/or significant capital loss carryforwards), generally may be carried forward to offset future capital gains, if any

Investments in securities: Not FDIC Insured • No Bank Guarantee • May Lose Value. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Allio's internet-based advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client's financial situation and do not incorporate specific investments that clients hold elsewhere. For more details, see our Form CRS, our Form ADV Part 2A, and other disclosures. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. Not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

Promotional Terms & Conditions *Allio20 sign-up bonus ($20) is exclusively for new customers who have not previously joined Allio. Offer is valid after meeting the following criteria: 1) Client must set up a new Allio account; 2) Client must fund their account with a minimum of $20; 3) Client must maintain Allio account for a minimum of 30 days. After the 30-day period concludes, the $20 sign-up bonus will be available in the Client account. Account approval is contingent on verification and approval pursuant to regulatory requirements. Allio Finance reserves the right to restrict or revoke this promotional offer at any time and without notice. All investments involve risk, including loss of principal. Investment advisory services provided by Allio Advisors LLC, an SEC-registered investment adviser.

This website is operated by Allio Advisors LLC, an SEC-registered investment adviser.

Important Disclosures: Investing involves risk, including loss of principal. Past performance does not guarantee or indicate future results. Please consider, among other important factors, your investment objectives, risk tolerance and Allio pricing before investing. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. It is not possible to invest directly in an index. Any hypothetical performance shown is for illustrative purposes only. Such results do not represent actual results and do not take into consideration economic or market factors which can impact performance. Actual clients may achieve investment results materially different from the results portrayed. Please note that a properly suggested portfolio recommendation is dependent upon current and accurate financial and risk profiles. Clients who have experienced changes to their goals, financial circumstances or investment objectives, or who wish to modify their portfolio recommendation, should promptly update their information in the Allio app. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them. Allio reserves the right to restrict or revoke any and all offers at any time.

Allio does not provide access to invest directly in Bitcoin. Bitcoin exposure is provided through ETFs, which invest in Bitcoin futures. Bitcoin has historically demonstrated high volatility. Particular investment strategies should be evaluated based on an investor’s tolerance for risk.

Allio does not provide access to invest directly in gold and other commodities. This commodity exposure is provided through ETFs that invest in commodities (i.e., gold) or in commodity futures. Investing in gold and other commodities, including through ETFs that invest in commodities or in commodity futures, is considered a high-risk investment given the speculative and volatile nature.

Compounding, generally, is the growth of principal investments due to the reinvestment of dividends without withdrawing funds from the account. Allio investment accounts do not pay interest, so the impact of compounding may be limited by the number of ETF shares an investor owns, as well as the frequency and amount of dividends paid by the ETFs in an investor’s Allio investment account. Compounding is not an investing strategy. Rather, it is a potential side effect of holding certain investments that are purchased as part of an investment strategy. The potential effect of compounding in an investor’s account does not assure positive performance of the account nor does it protect against losses. It does not take into account market volatility and fluctuations that will impact the value of any investment account.

The ETFs comprising the portfolios charge fees and expenses that will reduce a client’s return. Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. Investment policies, management fees and other information can be found in the individual ETF’s prospectus. Please read the prospectus carefully before you invest.

The effectiveness of the tax-loss harvesting strategy to reduce the tax liability of the client will depend on the client’s entire tax and investment profile, including purchases and dispositions in a client’s (or client’s spouse’s) accounts outside of Allio and type of investments (e.g., taxable or nontaxable) or holding period (e.g., short- term or long-term). Tax loss harvesting may generate a higher number of trades due to attempts to capture losses. There is a chance that trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. In addition, tax loss harvesting strategies may produce losses, which may not be offset by sufficient gains in the account and may be limited to a $3,000 deduction against income. The utilization of losses harvested through the strategy will depend upon the recognition of capital gains in the same or a future tax period, and in addition may be subject to limitations under applicable tax laws, e.g., if there are insufficient realized gains in the tax period, the use of harvested losses may be limited to a $3,000 deduction against income and distributions. Losses harvested through the strategy that are not utilized in the tax period when recognized (e.g., because of insufficient capital gains and/or significant capital loss carryforwards), generally may be carried forward to offset future capital gains, if any

Investments in securities: Not FDIC Insured • No Bank Guarantee • May Lose Value. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Allio's internet-based advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client's financial situation and do not incorporate specific investments that clients hold elsewhere. For more details, see our Form CRS, our Form ADV Part 2A, and other disclosures. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. Not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

Promotional Terms & Conditions *Allio20 sign-up bonus ($20) is exclusively for new customers who have not previously joined Allio. Offer is valid after meeting the following criteria: 1) Client must set up a new Allio account; 2) Client must fund their account with a minimum of $20; 3) Client must maintain Allio account for a minimum of 30 days. After the 30-day period concludes, the $20 sign-up bonus will be available in the Client account. Account approval is contingent on verification and approval pursuant to regulatory requirements. Allio Finance reserves the right to restrict or revoke this promotional offer at any time and without notice. All investments involve risk, including loss of principal. Investment advisory services provided by Allio Advisors LLC, an SEC-registered investment adviser.

Why most Robo Advisors are Ineffective

Optimize Your Portfolio with a Macro Investment Strategy

Diversification for Portfolio Optimization

Allio

Academy

Allio

Academy

Allio

Academy

We believe in financial wellness for all, which is why, here at Allio, we emphasize financial literacy.

Dive into some of our Allio Academy content to help you become a more informed investor.

We believe in financial wellness for all, which is why, here at Allio, we emphasize financial literacy.

Dive into some of our Allio Academy content to help you become a more informed investor.

We believe in financial wellness for all, which is why, here at Allio, we emphasize financial literacy.

Dive into some of our Allio Academy content to help you become a more informed investor.