Updated October 19, 2023

How to Survive Inflation

How to Survive Inflation

How to Survive Inflation

Mike Zaccardi, CFA, CMT

Investing Master Class

Beginner

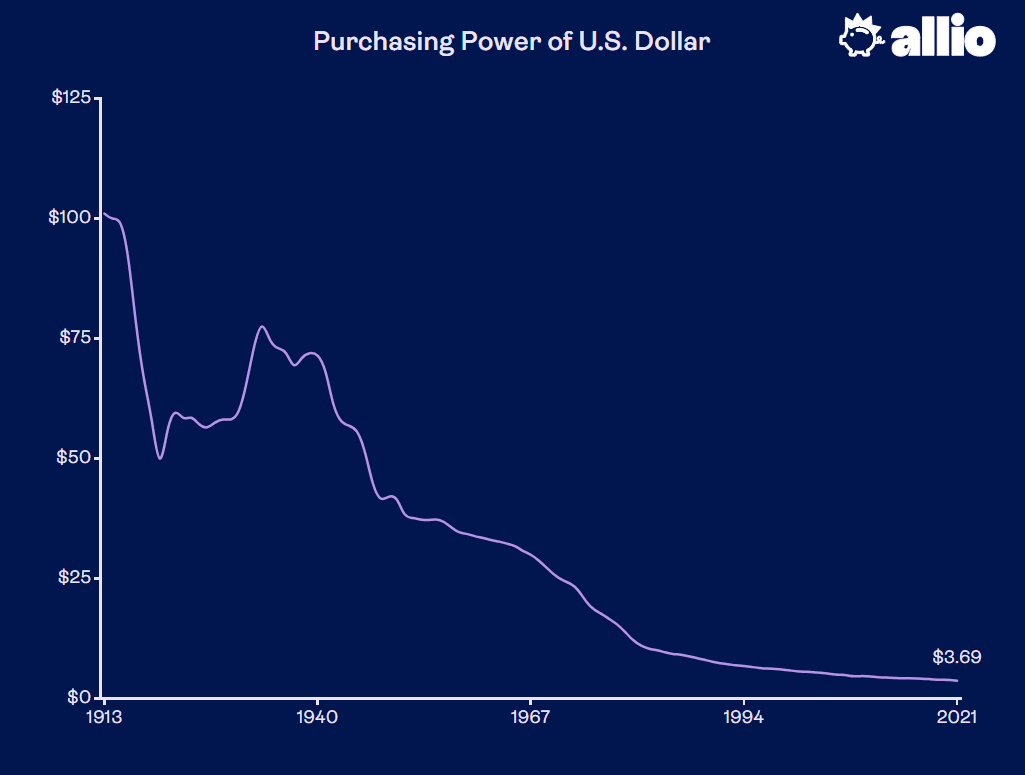

If you’ve been paying attention to the financial news at all the past few months, you’ve probably heard a lot of discussion—and maybe even a little panic—around the topic of inflation. Even if you haven’t, the chances are good you’ve felt the real effects of inflation the last time you went to the grocery store and marveled at the fact things seemed to be getting more expensive. One hundred dollars just doesn’t go as far as it used to.

Simply put, inflation is one of the most powerful forces when it comes to money, investing, and the economy—right up there with compound interest. Ignored, it has the potential to destroy wealth. But when we respect inflation and understand where it comes from, we have the opportunity to make smarter investing decisions and to position ourselves more constructively for the future.

Below, we answer some common questions about inflation so you’ll be better equipped to safeguard your money.

What is inflation?

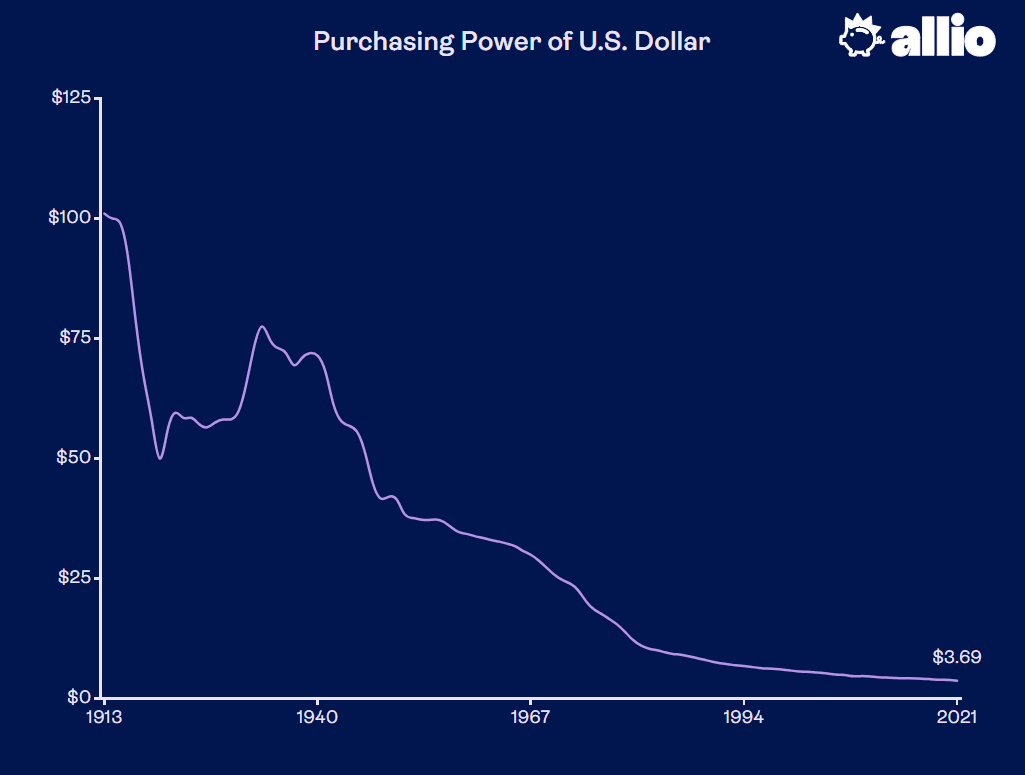

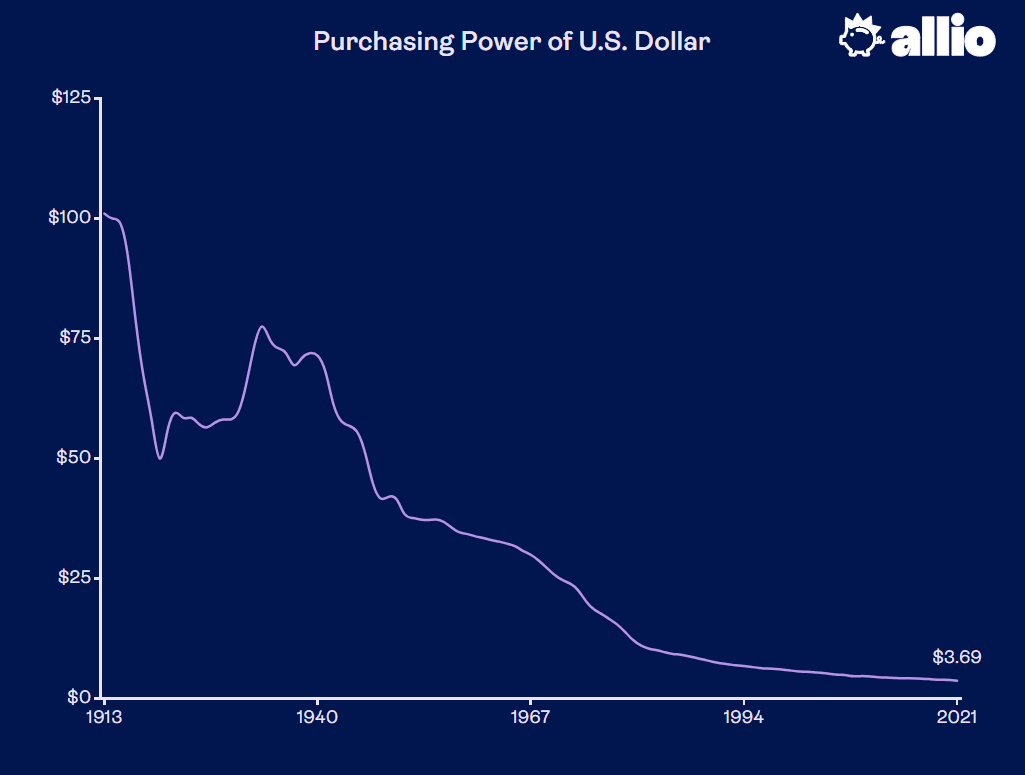

Inflation is a measure of how much the prices of consumer goods increase over time. Alternatively, it’s a measure of how much purchasing power you lose as time goes on.

In other words, it’s the force that makes a dollar today worth more than a dollar next year, and especially more than a dollar 10 or 20 years in the future. As time marches on and the prices of goods and services increase, inflation causes your money to be worth less and less.

Inflation vs Hyperinflation vs Deflation

All of that being said, it’s important to note that inflation is normal, and it’s an expected part of our economy—as long as it’s under control. Hyperinflation and deflation, on the other hand, are different stories.

Hyperinflation is a term used to describe wild, rapid, and generally out-of-control price increases, usually over a relatively short period of time. Some economists define hyperinflation specifically as an increase in prices of at least 1,000% in a single year. Unchecked, hyperinflation can be catastrophic for whole economies, as was seen in Germany in the aftermath of World War One and, more recently, in Zimbabwe in 2007 and Venezuela in 2016 through today.

Deflation, on the other hand, refers to a state in which the purchasing power of money increases as consumer prices drop. For this reason, it’s sometimes called negative inflation. While deflation might sound like a good thing in theory, it can have some pretty negative effects on an economy over time, because it usually indicates that the economy is weakening. Falling prices often lead to companies reducing their rate of production, which in turn can lead to layoffs or pay cuts, creating a feedback loop of negative growth.

How is inflation measured?

In the U.S., the primary indicator for gauging price changes is known as the Consumer Price Index (CPI).

The CPI is a measure of the average cost of a basket of goods and services across the country. If the CPI is rising month over month or year over year, the economy is experiencing inflation. If the CPI is falling month over month or year over year, the economy is experiencing deflation. (Deflation, however, has generally been a rare occurrence in U.S. history, occurring only a handful of times.)

What causes inflation?

Inflation can be caused by a number of different things, but is typically broken out into two big buckets:

Increased demand and/or decreased supply: When demand for a product or service increases faster than the supply, it causes prices to go up. This is often known as demand-pull inflation. Increase in demand can be caused by any number of factors. On the demand side, for example, access to cheap credit or rapidly rising wages encourages consumers to purchase more, shrinking supply. On the supply side, supply chain disruptions like we have seen recently can cause rapidly rising prices.

Increased cost of production: If the cost of raw materials or wages increases, then the cost of producing a product or service increases as well. In order to make money, businesses must pass on this increased cost in the form of higher prices. This is often known as cost-push inflation.

How is inflation controlled?

The Federal Reserve (otherwise known as the Fed) has a long-term annual inflation target of 2%. That’s high enough to avoid the negative effects of deflation, while being low enough it generally doesn’t disrupt the U.S. economy. Other central banks around the world typically aim for a similar annual rate of 2-3% inflation.

With this in mind, the Fed has a number of tools and strategies that it uses to try and keep inflation within its target, including:

Reducing or eliminating bond-buying programs

Increasing interest rates

Both of these tools have the effect of reducing monetary supply and cooling the economy, which serves to pump the brakes on inflation. But how effective these tactics are depend on a lot of other factors, including the root cause of inflation at any given time.

Why should savers and investors care about inflation?

There are two main reasons why everyday savers and investors should pay close attention to inflation.

First, as noted above, inflation eats away at the power of your savings. This means that if you are simply saving your money and not generating a return from it, you’re actually losing money over time.

Second, inflation lowers your real investment return. If you invest money and it earns an average return of 8% per year, but inflation over that same span of time is 6% per year, then your real rate of return is only 2% per year. And if inflation is higher than your investment return, you’ll find yourself with less buying power even though on paper it looks like you’ve made money.

So, what can you do?

It’s impossible to make blanket recommendations that’ll apply to all investors, because everyone’s financial situation is unique. That being said, investors who are worried about inflation can take a number of steps to potentially reduce the impact that inflation will have on their assets.

The first step is to think critically and strategically about how much cash you need in your portfolio. Yes, you should have a well-stocked emergency fund of cash that you know you can rely on if life were to throw something unexpected your way. But how large should your emergency fund really be? Likewise, many investors like to have a certain amount of so-called “dry powder” that they know is available if an investment opportunity arises. But should that dry powder be stored as cash, or is there a more intelligent way to keep it safe and available while still allowing it to earn returns for you?

The next step is to find ways of making your portfolio more resilient to the effects of inflation. Importantly, this doesn’t mean taking on unnecessary risk or engaging in speculation. Instead, what it means is to diversify your portfolio by incorporating other asset classes outside of the typical stocks and bonds that most of us think about when we think about investments.

Asset classes such as precious metals (e.g., gold, silver), commodities, and real estate are all playing an increasingly important role in investors’ portfolios. And in the past, these asset classes have performed reasonably well during periods of high inflation. Likewise, digital assets such as cryptocurrency may protect investors from inflation due to their limited supply in relation to fiat currencies (such as the dollar, euro, or yen).

The question then becomes: How much of your portfolio should be dedicated to these different asset classes?

Here at Allio, we take the guesswork out of the equation with expertly-designed portfolios for investors with any risk level so that you can stop worrying about the technical side of investing and focus on simply putting your money to work. Prefer more control? Our dynamic macro portfolio option puts the power in your hands. We’re not your typical finance firm. Gone are the days of exclusive, complicated investing. We're here to make your financial journey approachable, transparent, and most importantly yours. At Allio, we’re shaping the future of investing.

If you’ve been paying attention to the financial news at all the past few months, you’ve probably heard a lot of discussion—and maybe even a little panic—around the topic of inflation. Even if you haven’t, the chances are good you’ve felt the real effects of inflation the last time you went to the grocery store and marveled at the fact things seemed to be getting more expensive. One hundred dollars just doesn’t go as far as it used to.

Simply put, inflation is one of the most powerful forces when it comes to money, investing, and the economy—right up there with compound interest. Ignored, it has the potential to destroy wealth. But when we respect inflation and understand where it comes from, we have the opportunity to make smarter investing decisions and to position ourselves more constructively for the future.

Below, we answer some common questions about inflation so you’ll be better equipped to safeguard your money.

What is inflation?

Inflation is a measure of how much the prices of consumer goods increase over time. Alternatively, it’s a measure of how much purchasing power you lose as time goes on.

In other words, it’s the force that makes a dollar today worth more than a dollar next year, and especially more than a dollar 10 or 20 years in the future. As time marches on and the prices of goods and services increase, inflation causes your money to be worth less and less.

Inflation vs Hyperinflation vs Deflation

All of that being said, it’s important to note that inflation is normal, and it’s an expected part of our economy—as long as it’s under control. Hyperinflation and deflation, on the other hand, are different stories.

Hyperinflation is a term used to describe wild, rapid, and generally out-of-control price increases, usually over a relatively short period of time. Some economists define hyperinflation specifically as an increase in prices of at least 1,000% in a single year. Unchecked, hyperinflation can be catastrophic for whole economies, as was seen in Germany in the aftermath of World War One and, more recently, in Zimbabwe in 2007 and Venezuela in 2016 through today.

Deflation, on the other hand, refers to a state in which the purchasing power of money increases as consumer prices drop. For this reason, it’s sometimes called negative inflation. While deflation might sound like a good thing in theory, it can have some pretty negative effects on an economy over time, because it usually indicates that the economy is weakening. Falling prices often lead to companies reducing their rate of production, which in turn can lead to layoffs or pay cuts, creating a feedback loop of negative growth.

How is inflation measured?

In the U.S., the primary indicator for gauging price changes is known as the Consumer Price Index (CPI).

The CPI is a measure of the average cost of a basket of goods and services across the country. If the CPI is rising month over month or year over year, the economy is experiencing inflation. If the CPI is falling month over month or year over year, the economy is experiencing deflation. (Deflation, however, has generally been a rare occurrence in U.S. history, occurring only a handful of times.)

What causes inflation?

Inflation can be caused by a number of different things, but is typically broken out into two big buckets:

Increased demand and/or decreased supply: When demand for a product or service increases faster than the supply, it causes prices to go up. This is often known as demand-pull inflation. Increase in demand can be caused by any number of factors. On the demand side, for example, access to cheap credit or rapidly rising wages encourages consumers to purchase more, shrinking supply. On the supply side, supply chain disruptions like we have seen recently can cause rapidly rising prices.

Increased cost of production: If the cost of raw materials or wages increases, then the cost of producing a product or service increases as well. In order to make money, businesses must pass on this increased cost in the form of higher prices. This is often known as cost-push inflation.

How is inflation controlled?

The Federal Reserve (otherwise known as the Fed) has a long-term annual inflation target of 2%. That’s high enough to avoid the negative effects of deflation, while being low enough it generally doesn’t disrupt the U.S. economy. Other central banks around the world typically aim for a similar annual rate of 2-3% inflation.

With this in mind, the Fed has a number of tools and strategies that it uses to try and keep inflation within its target, including:

Reducing or eliminating bond-buying programs

Increasing interest rates

Both of these tools have the effect of reducing monetary supply and cooling the economy, which serves to pump the brakes on inflation. But how effective these tactics are depend on a lot of other factors, including the root cause of inflation at any given time.

Why should savers and investors care about inflation?

There are two main reasons why everyday savers and investors should pay close attention to inflation.

First, as noted above, inflation eats away at the power of your savings. This means that if you are simply saving your money and not generating a return from it, you’re actually losing money over time.

Second, inflation lowers your real investment return. If you invest money and it earns an average return of 8% per year, but inflation over that same span of time is 6% per year, then your real rate of return is only 2% per year. And if inflation is higher than your investment return, you’ll find yourself with less buying power even though on paper it looks like you’ve made money.

So, what can you do?

It’s impossible to make blanket recommendations that’ll apply to all investors, because everyone’s financial situation is unique. That being said, investors who are worried about inflation can take a number of steps to potentially reduce the impact that inflation will have on their assets.

The first step is to think critically and strategically about how much cash you need in your portfolio. Yes, you should have a well-stocked emergency fund of cash that you know you can rely on if life were to throw something unexpected your way. But how large should your emergency fund really be? Likewise, many investors like to have a certain amount of so-called “dry powder” that they know is available if an investment opportunity arises. But should that dry powder be stored as cash, or is there a more intelligent way to keep it safe and available while still allowing it to earn returns for you?

The next step is to find ways of making your portfolio more resilient to the effects of inflation. Importantly, this doesn’t mean taking on unnecessary risk or engaging in speculation. Instead, what it means is to diversify your portfolio by incorporating other asset classes outside of the typical stocks and bonds that most of us think about when we think about investments.

Asset classes such as precious metals (e.g., gold, silver), commodities, and real estate are all playing an increasingly important role in investors’ portfolios. And in the past, these asset classes have performed reasonably well during periods of high inflation. Likewise, digital assets such as cryptocurrency may protect investors from inflation due to their limited supply in relation to fiat currencies (such as the dollar, euro, or yen).

The question then becomes: How much of your portfolio should be dedicated to these different asset classes?

Here at Allio, we take the guesswork out of the equation with expertly-designed portfolios for investors with any risk level so that you can stop worrying about the technical side of investing and focus on simply putting your money to work. Prefer more control? Our dynamic macro portfolio option puts the power in your hands. We’re not your typical finance firm. Gone are the days of exclusive, complicated investing. We're here to make your financial journey approachable, transparent, and most importantly yours. At Allio, we’re shaping the future of investing.

If you’ve been paying attention to the financial news at all the past few months, you’ve probably heard a lot of discussion—and maybe even a little panic—around the topic of inflation. Even if you haven’t, the chances are good you’ve felt the real effects of inflation the last time you went to the grocery store and marveled at the fact things seemed to be getting more expensive. One hundred dollars just doesn’t go as far as it used to.

Simply put, inflation is one of the most powerful forces when it comes to money, investing, and the economy—right up there with compound interest. Ignored, it has the potential to destroy wealth. But when we respect inflation and understand where it comes from, we have the opportunity to make smarter investing decisions and to position ourselves more constructively for the future.

Below, we answer some common questions about inflation so you’ll be better equipped to safeguard your money.

What is inflation?

Inflation is a measure of how much the prices of consumer goods increase over time. Alternatively, it’s a measure of how much purchasing power you lose as time goes on.

In other words, it’s the force that makes a dollar today worth more than a dollar next year, and especially more than a dollar 10 or 20 years in the future. As time marches on and the prices of goods and services increase, inflation causes your money to be worth less and less.

Inflation vs Hyperinflation vs Deflation

All of that being said, it’s important to note that inflation is normal, and it’s an expected part of our economy—as long as it’s under control. Hyperinflation and deflation, on the other hand, are different stories.

Hyperinflation is a term used to describe wild, rapid, and generally out-of-control price increases, usually over a relatively short period of time. Some economists define hyperinflation specifically as an increase in prices of at least 1,000% in a single year. Unchecked, hyperinflation can be catastrophic for whole economies, as was seen in Germany in the aftermath of World War One and, more recently, in Zimbabwe in 2007 and Venezuela in 2016 through today.

Deflation, on the other hand, refers to a state in which the purchasing power of money increases as consumer prices drop. For this reason, it’s sometimes called negative inflation. While deflation might sound like a good thing in theory, it can have some pretty negative effects on an economy over time, because it usually indicates that the economy is weakening. Falling prices often lead to companies reducing their rate of production, which in turn can lead to layoffs or pay cuts, creating a feedback loop of negative growth.

How is inflation measured?

In the U.S., the primary indicator for gauging price changes is known as the Consumer Price Index (CPI).

The CPI is a measure of the average cost of a basket of goods and services across the country. If the CPI is rising month over month or year over year, the economy is experiencing inflation. If the CPI is falling month over month or year over year, the economy is experiencing deflation. (Deflation, however, has generally been a rare occurrence in U.S. history, occurring only a handful of times.)

What causes inflation?

Inflation can be caused by a number of different things, but is typically broken out into two big buckets:

Increased demand and/or decreased supply: When demand for a product or service increases faster than the supply, it causes prices to go up. This is often known as demand-pull inflation. Increase in demand can be caused by any number of factors. On the demand side, for example, access to cheap credit or rapidly rising wages encourages consumers to purchase more, shrinking supply. On the supply side, supply chain disruptions like we have seen recently can cause rapidly rising prices.

Increased cost of production: If the cost of raw materials or wages increases, then the cost of producing a product or service increases as well. In order to make money, businesses must pass on this increased cost in the form of higher prices. This is often known as cost-push inflation.

How is inflation controlled?

The Federal Reserve (otherwise known as the Fed) has a long-term annual inflation target of 2%. That’s high enough to avoid the negative effects of deflation, while being low enough it generally doesn’t disrupt the U.S. economy. Other central banks around the world typically aim for a similar annual rate of 2-3% inflation.

With this in mind, the Fed has a number of tools and strategies that it uses to try and keep inflation within its target, including:

Reducing or eliminating bond-buying programs

Increasing interest rates

Both of these tools have the effect of reducing monetary supply and cooling the economy, which serves to pump the brakes on inflation. But how effective these tactics are depend on a lot of other factors, including the root cause of inflation at any given time.

Why should savers and investors care about inflation?

There are two main reasons why everyday savers and investors should pay close attention to inflation.

First, as noted above, inflation eats away at the power of your savings. This means that if you are simply saving your money and not generating a return from it, you’re actually losing money over time.

Second, inflation lowers your real investment return. If you invest money and it earns an average return of 8% per year, but inflation over that same span of time is 6% per year, then your real rate of return is only 2% per year. And if inflation is higher than your investment return, you’ll find yourself with less buying power even though on paper it looks like you’ve made money.

So, what can you do?

It’s impossible to make blanket recommendations that’ll apply to all investors, because everyone’s financial situation is unique. That being said, investors who are worried about inflation can take a number of steps to potentially reduce the impact that inflation will have on their assets.

The first step is to think critically and strategically about how much cash you need in your portfolio. Yes, you should have a well-stocked emergency fund of cash that you know you can rely on if life were to throw something unexpected your way. But how large should your emergency fund really be? Likewise, many investors like to have a certain amount of so-called “dry powder” that they know is available if an investment opportunity arises. But should that dry powder be stored as cash, or is there a more intelligent way to keep it safe and available while still allowing it to earn returns for you?

The next step is to find ways of making your portfolio more resilient to the effects of inflation. Importantly, this doesn’t mean taking on unnecessary risk or engaging in speculation. Instead, what it means is to diversify your portfolio by incorporating other asset classes outside of the typical stocks and bonds that most of us think about when we think about investments.

Asset classes such as precious metals (e.g., gold, silver), commodities, and real estate are all playing an increasingly important role in investors’ portfolios. And in the past, these asset classes have performed reasonably well during periods of high inflation. Likewise, digital assets such as cryptocurrency may protect investors from inflation due to their limited supply in relation to fiat currencies (such as the dollar, euro, or yen).

The question then becomes: How much of your portfolio should be dedicated to these different asset classes?

Here at Allio, we take the guesswork out of the equation with expertly-designed portfolios for investors with any risk level so that you can stop worrying about the technical side of investing and focus on simply putting your money to work. Prefer more control? Our dynamic macro portfolio option puts the power in your hands. We’re not your typical finance firm. Gone are the days of exclusive, complicated investing. We're here to make your financial journey approachable, transparent, and most importantly yours. At Allio, we’re shaping the future of investing.

Whether you’re seeking an expert team to manage your money or looking to build your own investment portfolio with the best financial technology available, Allio can help. Head to the app store and download Allio today!

Related Articles

Mike Zaccardi, CFA, CMT

ETF Investment Guide: Your Roadmap to Building a Diverse and Profitable Portfolio

Explore the world of ETF investing with our comprehensive guide. Learn key strategies, terms, and tax considerations for successful portfolio management.

Mike Zaccardi, CFA, CMT

CAPM Formula Explained: Navigating the Relationship Between Risk and Return

Discover the power of CAPM in investment decisions. Learn the formula, calculate expected returns, and explore alternatives in modern portfolio management.

Mike Zaccardi, CFA, CMT

How To Build Wealth with Dividend Stocks: A Complete Guide to Smart Investing

Learn how to invest in dividends – our comprehensive guide covers strategies, risks, and the key to achieving stable financial returns.

Mike Zaccardi, CFA, CMT

ETF Investment Guide: Your Roadmap to Building a Diverse and Profitable Portfolio

Explore the world of ETF investing with our comprehensive guide. Learn key strategies, terms, and tax considerations for successful portfolio management.

Mike Zaccardi, CFA, CMT

CAPM Formula Explained: Navigating the Relationship Between Risk and Return

Discover the power of CAPM in investment decisions. Learn the formula, calculate expected returns, and explore alternatives in modern portfolio management.

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.