Updated October 15, 2023

Investing vs. Trading

Investing vs. Trading

Investing vs. Trading

Bill Chen, CFA

Investing Master Class

Beginner

If, when thinking of investing, your mind drifts to visions of the Las Vegas Strip—the bright lights, the high energy, and a boisterous craps table—chances are good you’re not actually thinking of investing. You’re thinking of trading.

To some people, the words “investing” and “trading” are synonymous. But the reality is investing and trading are two very different methods of engaging with the market. They involve different strategies, different mindsets, and different levels of likely success.

In what follows, we go back to the basics to define both investing and trading and answer some of the most common questions that people tend to have about each strategy.

What is investing?

Investing is the term we use to describe the act of purchasing an asset, or assets, and holding them in an investment portfolio, typically for the long term.

People usually invest for one of two reasons: Because they expect the assets they purchase will generate recurring income, or because they expect the assets, over time, will increase in value, at which point they can be sold for a profit.

There are, of course, other reasons you might choose to invest. For example, if you believe in a mission or cause, you might choose to invest because you want your money to help bring about a certain outcome—green energy, social responsibility, etc. This is commonly known as “values-based investing.”

Regardless of your reasons for investing, it’s important to understand there are a number of different strategies you might employ. Most investors will fall in one of two camps between passive and active investing.

Passive vs. Active Investing

Passive Investing

Passive investing, also referred to as “buy and hold” investing, is an investment strategy where an investor buys and holds an investment for a long period of time without making frequent trades and without trying to outperform the market.

Often, passive investors will buy an index fund or an ETF that tracks a broad market index, such as the S&P 500.

The guiding principles behind passive investing are: a. It’s difficult, if not impossible, to time the stock market, and b. The overall market tends to move higher over time

Therefore, steadily building a low-cost, well-diversified portfolio through dollar-cost averaging—and holding it for the long-term—increases the likelihood that an investor will benefit when the market does eventually move higher.

Active investing

Whereas passive investing involves buying and holding a portfolio for an extended period of time without making frequent changes to it, active investing involves making more frequent changes to the portfolio in an attempt to outperform the overall market. Even so, with active investing, the holding periods tend to be on the order of weeks and months, rather than the minutes, hours, or days indicative of trading.

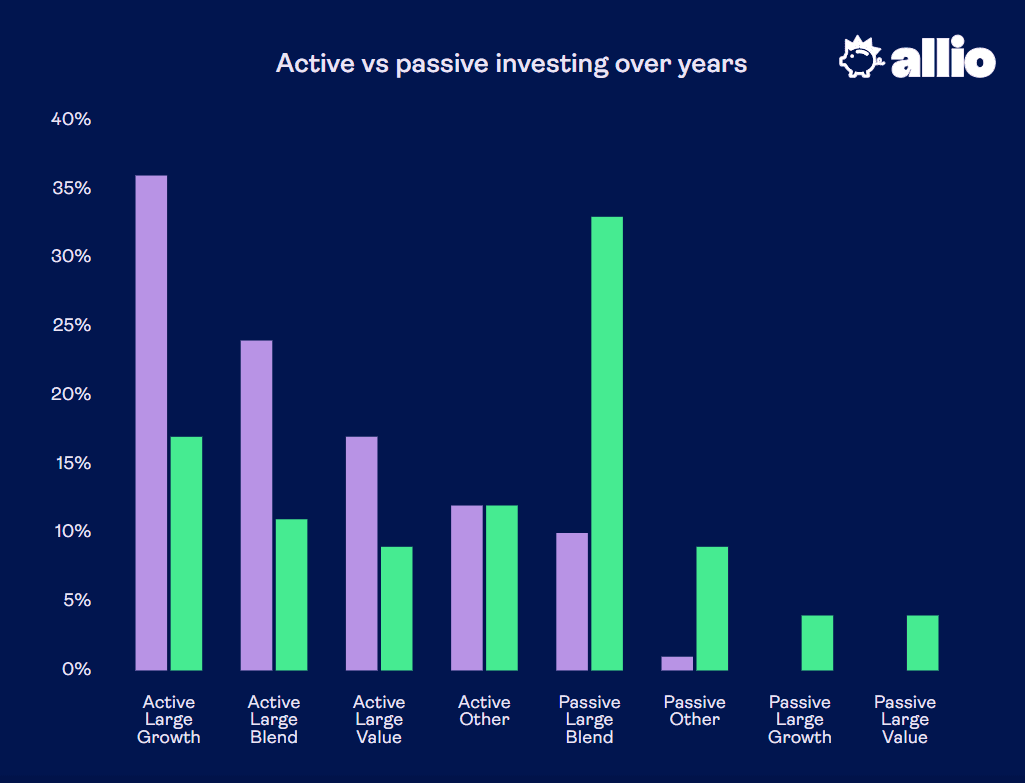

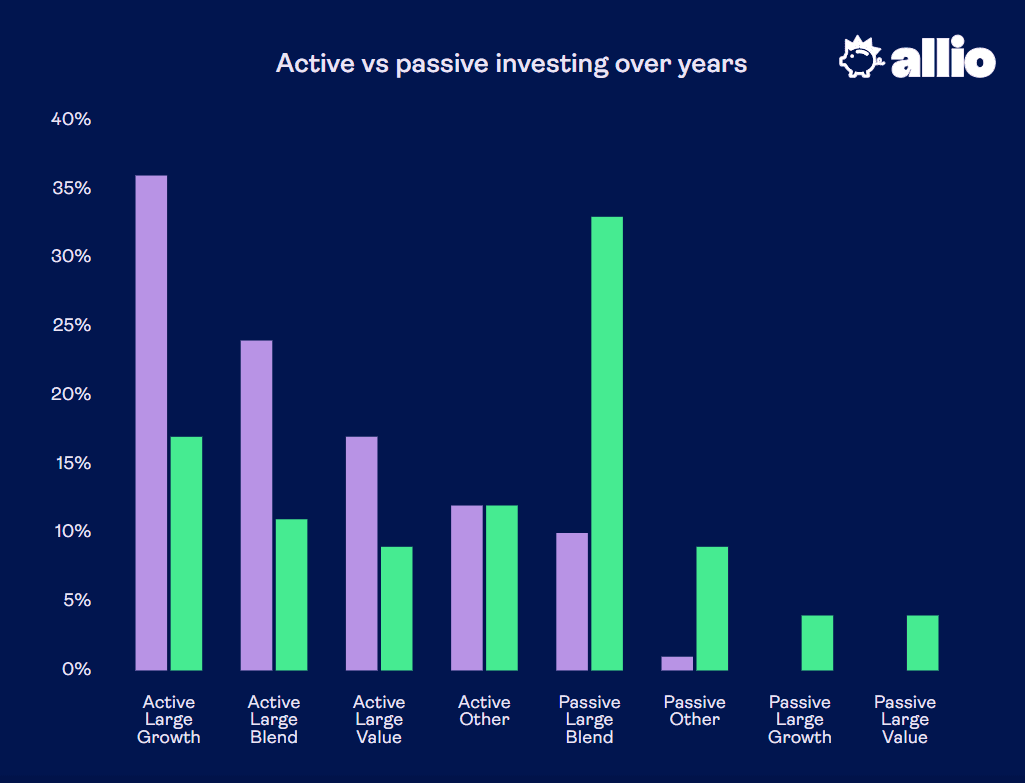

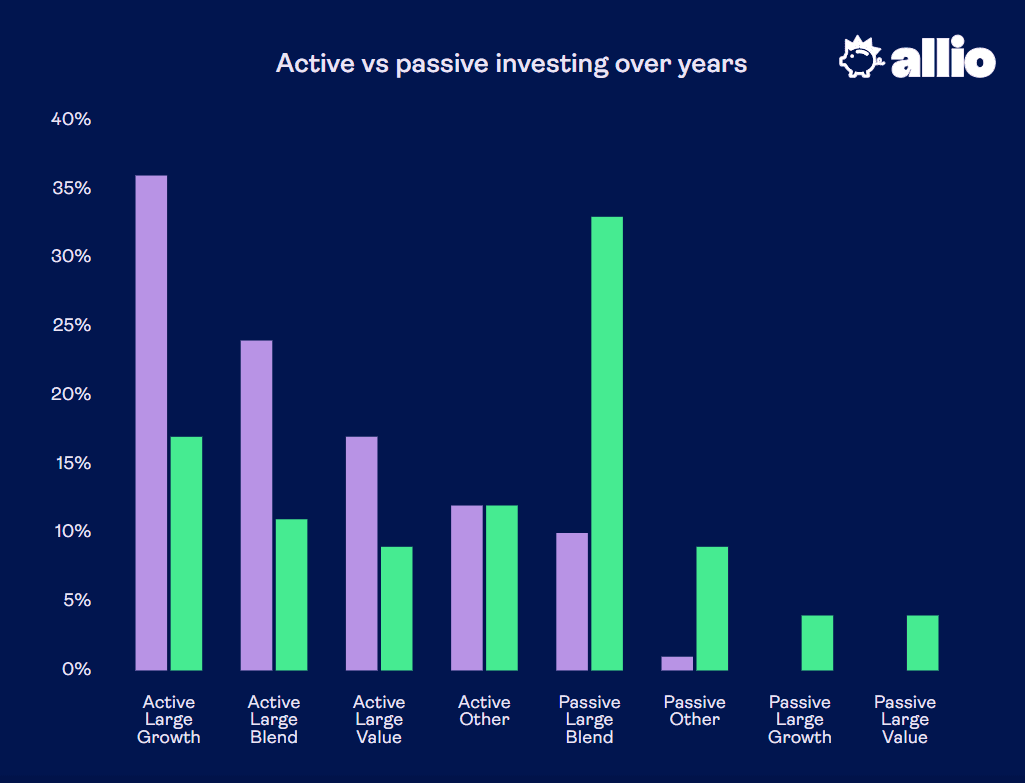

Active investing, however, isn’t easy—studies have shown that only a small percentage of active portfolio managers consistently beat their benchmarks. According to one study, only 24% of all actively-managed funds beat the returns generated by their passively managed rivals over the same period of time.

One of the main reasons active managers have a hard time outperforming is that success depends on how well an investor is able to analyze trends and preemptively position their portfolios to take advantage of price movements. Active investing also incurs increased trading costs, higher management fees, and possible tax liabilities—all of which can eat into your returns.

While active investing is different from trading (which we dive into below) the two strategies do share some similarities compared to passive investing.

Since 2018, passive investing has become dominant in the U.S. domestic equity market.

Strategic Asset Allocation: A Blend of Passive and Active Investing

There is also a third form of investing that can be considered something of a blend of both passive and active investing: Strategic asset allocation.

Strategic asset allocation is a type of portfolio strategy where an investor chooses a target allocation for different asset classes and sectors. These target allocations are typically set in response to factors such as the investor’s investment horizon, risk tolerance, and financial goals. Periodically, the portfolio is then rebalanced when it deviates from the target allocation, as might happen when a particular asset class significantly outperforms the others.

In this way, strategic asset allocation is both active and passive. It is active, because it involves making investment decisions about asset allocation beyond simply purchasing an index fund; it is passive, because it still typically involves buying and holding for the long term.

Here at Allio, we leverage strategic asset allocation in the construction of our portfolios.

Investing and trading are two very different methods of engaging with the market. They involve different strategies, different mindsets, and different levels of likely success.

What is Trading?

If you think of investing as a long-term endeavor, trading is very close to its opposite.

How so? Because traders don’t hold assets for the long term. Instead, they actively buy and sell assets with the goal of profiting from short-term price fluctuations. Their goal is to try and beat the market by making as much money as quickly as possible.

How long a trader holds his positions will depend on the style of trading he practices. The most common trading strategies include:

Scalping: The trader holds his position for very short periods of time—often, just seconds or minutes.

Day trading: The trader holds his position only during a single day’s active trading hours, with no positions held overnight.

Swing trading: The trader holds his position for a period of days to weeks, under the expectation that a larger move in the asset is about to take place.

While there are differences in these varied types of trading, all of them involve timing the market in order to take advantage of short-term price movements. Of course, as noted above, it’s very difficult to time the market.

This makes trading an inherently risky endeavor. While long-term investors have years or even decades to ride out a drop in asset prices and earn an eventual profit, traders don’t have this luxury.

It’s About Mindset

Though there’s an obvious difference in mechanics between trading and investing, we’d argue that the most important difference comes down to just one word: Mindset.

Investors are driven by a desire to build long-term, lasting wealth that they can use to achieve their various financial goals. They do this not by trying to beat the market, but by taking part in the market. If a rising tide raises all ships, and the market has over the very long term trended up, then simply taking part in the market is one of the best things that an individual can do to build wealth.

As a bonus, investors don’t need to compulsively follow market news 24/7 to feel safe and secure in their investments. While it’s always a good idea to know what the market is doing, a well-diversified portfolio should help the investor work toward their goals no matter the underlying market conditions.

Traders, on the other hand, are driven by the allure of short-term profits. While there’s nothing wrong with that, it’s a fundamentally different goal—and requires a fundamentally different mindset—compared to long-term investing. And while it’s true that some traders do make out handsomely, these tales of success are often few and far between.

In the words of our Founder, Joseph Gradante:

“Just because you see someone on the news win the lottery, doesn’t mean playing the lotto is a ticket to financial independence. It’s time people stop listening to what they hear on YouTube and start paying attention to the global macro climate and understand what it means for their financial well-being.”

Here at Allio, we provide investors with the tools they need to build lasting wealth. Round-ups and recurring investments work like a piggy bank on your phone that make it easy to passively put your money to work. Additionally, our truly-diversified, institutional quality portfolios offer exposure to non-traditional asset classes outside the typical stocks-and-bonds framework.

If, when thinking of investing, your mind drifts to visions of the Las Vegas Strip—the bright lights, the high energy, and a boisterous craps table—chances are good you’re not actually thinking of investing. You’re thinking of trading.

To some people, the words “investing” and “trading” are synonymous. But the reality is investing and trading are two very different methods of engaging with the market. They involve different strategies, different mindsets, and different levels of likely success.

In what follows, we go back to the basics to define both investing and trading and answer some of the most common questions that people tend to have about each strategy.

What is investing?

Investing is the term we use to describe the act of purchasing an asset, or assets, and holding them in an investment portfolio, typically for the long term.

People usually invest for one of two reasons: Because they expect the assets they purchase will generate recurring income, or because they expect the assets, over time, will increase in value, at which point they can be sold for a profit.

There are, of course, other reasons you might choose to invest. For example, if you believe in a mission or cause, you might choose to invest because you want your money to help bring about a certain outcome—green energy, social responsibility, etc. This is commonly known as “values-based investing.”

Regardless of your reasons for investing, it’s important to understand there are a number of different strategies you might employ. Most investors will fall in one of two camps between passive and active investing.

Passive vs. Active Investing

Passive Investing

Passive investing, also referred to as “buy and hold” investing, is an investment strategy where an investor buys and holds an investment for a long period of time without making frequent trades and without trying to outperform the market.

Often, passive investors will buy an index fund or an ETF that tracks a broad market index, such as the S&P 500.

The guiding principles behind passive investing are: a. It’s difficult, if not impossible, to time the stock market, and b. The overall market tends to move higher over time

Therefore, steadily building a low-cost, well-diversified portfolio through dollar-cost averaging—and holding it for the long-term—increases the likelihood that an investor will benefit when the market does eventually move higher.

Active investing

Whereas passive investing involves buying and holding a portfolio for an extended period of time without making frequent changes to it, active investing involves making more frequent changes to the portfolio in an attempt to outperform the overall market. Even so, with active investing, the holding periods tend to be on the order of weeks and months, rather than the minutes, hours, or days indicative of trading.

Active investing, however, isn’t easy—studies have shown that only a small percentage of active portfolio managers consistently beat their benchmarks. According to one study, only 24% of all actively-managed funds beat the returns generated by their passively managed rivals over the same period of time.

One of the main reasons active managers have a hard time outperforming is that success depends on how well an investor is able to analyze trends and preemptively position their portfolios to take advantage of price movements. Active investing also incurs increased trading costs, higher management fees, and possible tax liabilities—all of which can eat into your returns.

While active investing is different from trading (which we dive into below) the two strategies do share some similarities compared to passive investing.

Since 2018, passive investing has become dominant in the U.S. domestic equity market.

Strategic Asset Allocation: A Blend of Passive and Active Investing

There is also a third form of investing that can be considered something of a blend of both passive and active investing: Strategic asset allocation.

Strategic asset allocation is a type of portfolio strategy where an investor chooses a target allocation for different asset classes and sectors. These target allocations are typically set in response to factors such as the investor’s investment horizon, risk tolerance, and financial goals. Periodically, the portfolio is then rebalanced when it deviates from the target allocation, as might happen when a particular asset class significantly outperforms the others.

In this way, strategic asset allocation is both active and passive. It is active, because it involves making investment decisions about asset allocation beyond simply purchasing an index fund; it is passive, because it still typically involves buying and holding for the long term.

Here at Allio, we leverage strategic asset allocation in the construction of our portfolios.

Investing and trading are two very different methods of engaging with the market. They involve different strategies, different mindsets, and different levels of likely success.

What is Trading?

If you think of investing as a long-term endeavor, trading is very close to its opposite.

How so? Because traders don’t hold assets for the long term. Instead, they actively buy and sell assets with the goal of profiting from short-term price fluctuations. Their goal is to try and beat the market by making as much money as quickly as possible.

How long a trader holds his positions will depend on the style of trading he practices. The most common trading strategies include:

Scalping: The trader holds his position for very short periods of time—often, just seconds or minutes.

Day trading: The trader holds his position only during a single day’s active trading hours, with no positions held overnight.

Swing trading: The trader holds his position for a period of days to weeks, under the expectation that a larger move in the asset is about to take place.

While there are differences in these varied types of trading, all of them involve timing the market in order to take advantage of short-term price movements. Of course, as noted above, it’s very difficult to time the market.

This makes trading an inherently risky endeavor. While long-term investors have years or even decades to ride out a drop in asset prices and earn an eventual profit, traders don’t have this luxury.

It’s About Mindset

Though there’s an obvious difference in mechanics between trading and investing, we’d argue that the most important difference comes down to just one word: Mindset.

Investors are driven by a desire to build long-term, lasting wealth that they can use to achieve their various financial goals. They do this not by trying to beat the market, but by taking part in the market. If a rising tide raises all ships, and the market has over the very long term trended up, then simply taking part in the market is one of the best things that an individual can do to build wealth.

As a bonus, investors don’t need to compulsively follow market news 24/7 to feel safe and secure in their investments. While it’s always a good idea to know what the market is doing, a well-diversified portfolio should help the investor work toward their goals no matter the underlying market conditions.

Traders, on the other hand, are driven by the allure of short-term profits. While there’s nothing wrong with that, it’s a fundamentally different goal—and requires a fundamentally different mindset—compared to long-term investing. And while it’s true that some traders do make out handsomely, these tales of success are often few and far between.

In the words of our Founder, Joseph Gradante:

“Just because you see someone on the news win the lottery, doesn’t mean playing the lotto is a ticket to financial independence. It’s time people stop listening to what they hear on YouTube and start paying attention to the global macro climate and understand what it means for their financial well-being.”

Here at Allio, we provide investors with the tools they need to build lasting wealth. Round-ups and recurring investments work like a piggy bank on your phone that make it easy to passively put your money to work. Additionally, our truly-diversified, institutional quality portfolios offer exposure to non-traditional asset classes outside the typical stocks-and-bonds framework.

If, when thinking of investing, your mind drifts to visions of the Las Vegas Strip—the bright lights, the high energy, and a boisterous craps table—chances are good you’re not actually thinking of investing. You’re thinking of trading.

To some people, the words “investing” and “trading” are synonymous. But the reality is investing and trading are two very different methods of engaging with the market. They involve different strategies, different mindsets, and different levels of likely success.

In what follows, we go back to the basics to define both investing and trading and answer some of the most common questions that people tend to have about each strategy.

What is investing?

Investing is the term we use to describe the act of purchasing an asset, or assets, and holding them in an investment portfolio, typically for the long term.

People usually invest for one of two reasons: Because they expect the assets they purchase will generate recurring income, or because they expect the assets, over time, will increase in value, at which point they can be sold for a profit.

There are, of course, other reasons you might choose to invest. For example, if you believe in a mission or cause, you might choose to invest because you want your money to help bring about a certain outcome—green energy, social responsibility, etc. This is commonly known as “values-based investing.”

Regardless of your reasons for investing, it’s important to understand there are a number of different strategies you might employ. Most investors will fall in one of two camps between passive and active investing.

Passive vs. Active Investing

Passive Investing

Passive investing, also referred to as “buy and hold” investing, is an investment strategy where an investor buys and holds an investment for a long period of time without making frequent trades and without trying to outperform the market.

Often, passive investors will buy an index fund or an ETF that tracks a broad market index, such as the S&P 500.

The guiding principles behind passive investing are: a. It’s difficult, if not impossible, to time the stock market, and b. The overall market tends to move higher over time

Therefore, steadily building a low-cost, well-diversified portfolio through dollar-cost averaging—and holding it for the long-term—increases the likelihood that an investor will benefit when the market does eventually move higher.

Active investing

Whereas passive investing involves buying and holding a portfolio for an extended period of time without making frequent changes to it, active investing involves making more frequent changes to the portfolio in an attempt to outperform the overall market. Even so, with active investing, the holding periods tend to be on the order of weeks and months, rather than the minutes, hours, or days indicative of trading.

Active investing, however, isn’t easy—studies have shown that only a small percentage of active portfolio managers consistently beat their benchmarks. According to one study, only 24% of all actively-managed funds beat the returns generated by their passively managed rivals over the same period of time.

One of the main reasons active managers have a hard time outperforming is that success depends on how well an investor is able to analyze trends and preemptively position their portfolios to take advantage of price movements. Active investing also incurs increased trading costs, higher management fees, and possible tax liabilities—all of which can eat into your returns.

While active investing is different from trading (which we dive into below) the two strategies do share some similarities compared to passive investing.

Since 2018, passive investing has become dominant in the U.S. domestic equity market.

Strategic Asset Allocation: A Blend of Passive and Active Investing

There is also a third form of investing that can be considered something of a blend of both passive and active investing: Strategic asset allocation.

Strategic asset allocation is a type of portfolio strategy where an investor chooses a target allocation for different asset classes and sectors. These target allocations are typically set in response to factors such as the investor’s investment horizon, risk tolerance, and financial goals. Periodically, the portfolio is then rebalanced when it deviates from the target allocation, as might happen when a particular asset class significantly outperforms the others.

In this way, strategic asset allocation is both active and passive. It is active, because it involves making investment decisions about asset allocation beyond simply purchasing an index fund; it is passive, because it still typically involves buying and holding for the long term.

Here at Allio, we leverage strategic asset allocation in the construction of our portfolios.

Investing and trading are two very different methods of engaging with the market. They involve different strategies, different mindsets, and different levels of likely success.

What is Trading?

If you think of investing as a long-term endeavor, trading is very close to its opposite.

How so? Because traders don’t hold assets for the long term. Instead, they actively buy and sell assets with the goal of profiting from short-term price fluctuations. Their goal is to try and beat the market by making as much money as quickly as possible.

How long a trader holds his positions will depend on the style of trading he practices. The most common trading strategies include:

Scalping: The trader holds his position for very short periods of time—often, just seconds or minutes.

Day trading: The trader holds his position only during a single day’s active trading hours, with no positions held overnight.

Swing trading: The trader holds his position for a period of days to weeks, under the expectation that a larger move in the asset is about to take place.

While there are differences in these varied types of trading, all of them involve timing the market in order to take advantage of short-term price movements. Of course, as noted above, it’s very difficult to time the market.

This makes trading an inherently risky endeavor. While long-term investors have years or even decades to ride out a drop in asset prices and earn an eventual profit, traders don’t have this luxury.

It’s About Mindset

Though there’s an obvious difference in mechanics between trading and investing, we’d argue that the most important difference comes down to just one word: Mindset.

Investors are driven by a desire to build long-term, lasting wealth that they can use to achieve their various financial goals. They do this not by trying to beat the market, but by taking part in the market. If a rising tide raises all ships, and the market has over the very long term trended up, then simply taking part in the market is one of the best things that an individual can do to build wealth.

As a bonus, investors don’t need to compulsively follow market news 24/7 to feel safe and secure in their investments. While it’s always a good idea to know what the market is doing, a well-diversified portfolio should help the investor work toward their goals no matter the underlying market conditions.

Traders, on the other hand, are driven by the allure of short-term profits. While there’s nothing wrong with that, it’s a fundamentally different goal—and requires a fundamentally different mindset—compared to long-term investing. And while it’s true that some traders do make out handsomely, these tales of success are often few and far between.

In the words of our Founder, Joseph Gradante:

“Just because you see someone on the news win the lottery, doesn’t mean playing the lotto is a ticket to financial independence. It’s time people stop listening to what they hear on YouTube and start paying attention to the global macro climate and understand what it means for their financial well-being.”

Here at Allio, we provide investors with the tools they need to build lasting wealth. Round-ups and recurring investments work like a piggy bank on your phone that make it easy to passively put your money to work. Additionally, our truly-diversified, institutional quality portfolios offer exposure to non-traditional asset classes outside the typical stocks-and-bonds framework.

Whether you’re seeking an expert team to manage your money or looking to build your own portfolios with the best financial technology available, Allio can help. Head to the app store and download Allio today!

Related Articles

Mike Zaccardi, CFA, CMT

ETF Investment Guide: Your Roadmap to Building a Diverse and Profitable Portfolio

Explore the world of ETF investing with our comprehensive guide. Learn key strategies, terms, and tax considerations for successful portfolio management.

Mike Zaccardi, CFA, CMT

CAPM Formula Explained: Navigating the Relationship Between Risk and Return

Discover the power of CAPM in investment decisions. Learn the formula, calculate expected returns, and explore alternatives in modern portfolio management.

Mike Zaccardi, CFA, CMT

How To Build Wealth with Dividend Stocks: A Complete Guide to Smart Investing

Learn how to invest in dividends – our comprehensive guide covers strategies, risks, and the key to achieving stable financial returns.

Mike Zaccardi, CFA, CMT

ETF Investment Guide: Your Roadmap to Building a Diverse and Profitable Portfolio

Explore the world of ETF investing with our comprehensive guide. Learn key strategies, terms, and tax considerations for successful portfolio management.

Mike Zaccardi, CFA, CMT

CAPM Formula Explained: Navigating the Relationship Between Risk and Return

Discover the power of CAPM in investment decisions. Learn the formula, calculate expected returns, and explore alternatives in modern portfolio management.

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.