Updated October 21, 2023

Optimize Your Portfolio with a Macro Investing Strategy

Optimize Your Portfolio with a Macro Investing Strategy

Optimize Your Portfolio with a Macro Investing Strategy

Mike Zaccardi, CFA, CMT

Investing Master Class

It’s widely believed by many financial professionals that in the coming decade stocks and bonds will not enjoy the same strong returns they’ve enjoyed in the recent past. If this prediction comes to pass, it means that you, as an investor, will likely need to turn elsewhere in order to find the yield necessary to reach your financial goals.

Diversifying into alternative asset classes—such as digital assets, commodities, and real estate—is one option you can consider. But it may be possible to get even more out of your portfolio by pairing that increased diversification with a “big-picture,” or “macro” investment strategy, without having to take on any additional risk.

Here, we define what a macro investing strategy is, the different forms that it can take, and explain how it can help you strengthen and diversify your portfolio.

What is a macro strategy?

A macro strategy is an investment strategy that positions its holdings in such a way as to take advantage of large-scale economic factors and trends. Its aim is to see the proverbial “big picture,” and position the portfolio to benefit from the long-term trends already in place or from the ones likely to materialize.

In the purest sense, macro strategies are concerned with issues like interest rates, inflation, unemployment rates, gross domestic product, and other measures of national productivity. But other factors can influence a macro strategy as well, including:

Demographic Trends: Such as an aging population, population growth, and rising or shrinking middle class

Political Trends: Such as whether the election of a new political regime will lead to more or less business-friendly policies and regulations

Industry Trends: Such as sector rotations within the broad market or even the emergence or maturation of new industries like ecommerce, green energy, and big data

Technological Trends: Such as the deployment of 5G, the emergence of artificial intelligence (AI), and greater internet connectivity around the globe

A macro strategy can be domestic—focused on the macro-economic trends of a single country such as the United States—or it can be global, spanning multiple countries or regions. Because different countries experience different economic cycles, a global macro strategy can be said to offer greater diversification to your portfolio compared to a domestic macro strategy.

With all of this in mind, a macro strategy may include common assets such as stocks and bonds as well as alternative assets such as commodities, currencies, gold, and more.

Types of Macro Strategy

Macro strategies come in all shapes and sizes. In addition to following either a global or domestic playbook, macro strategies can be either systematic or discretionary. Systematic macro strategies make investment decisions based solely on the output of rules-based quantitative models, whereas discretionary macro strategies, while they might take quantitative models into account, also rely on qualitative information processed by humans.

Further, macro strategies can base their investment decisions on either fundamental or technical or sentiment analysis (or some combination of all three). And they can be designed with short-, medium-, or long-term considerations in mind.

Macro Strategy in Action

To help you understand what a macro strategy might look like in action, consider the following examples:

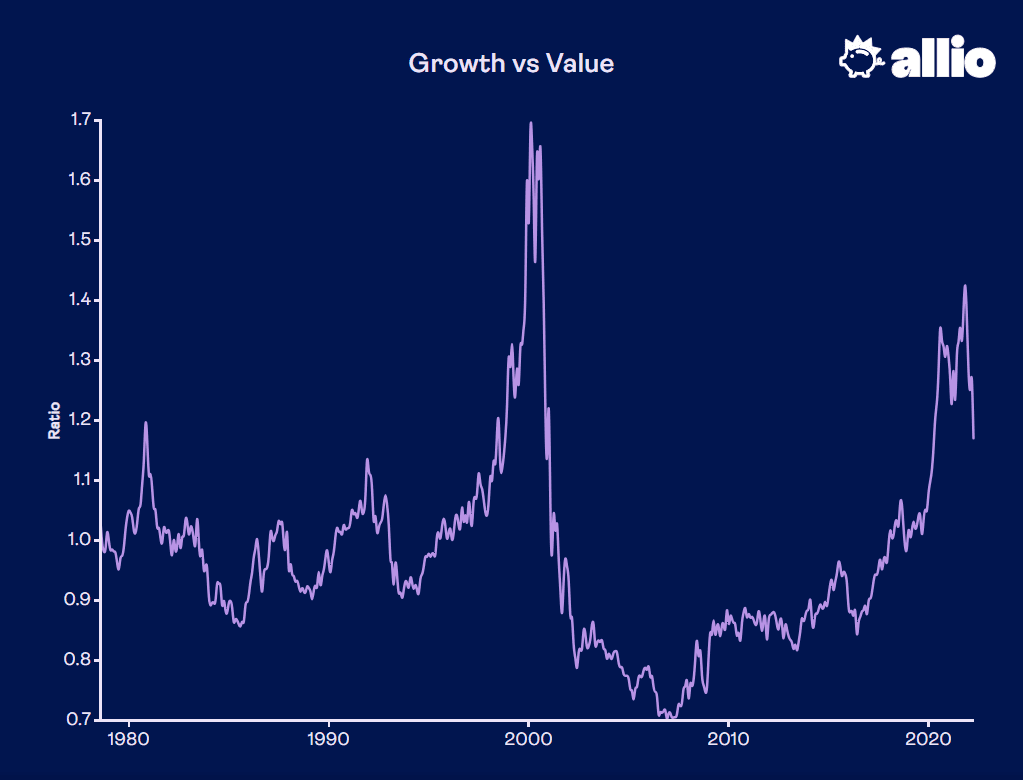

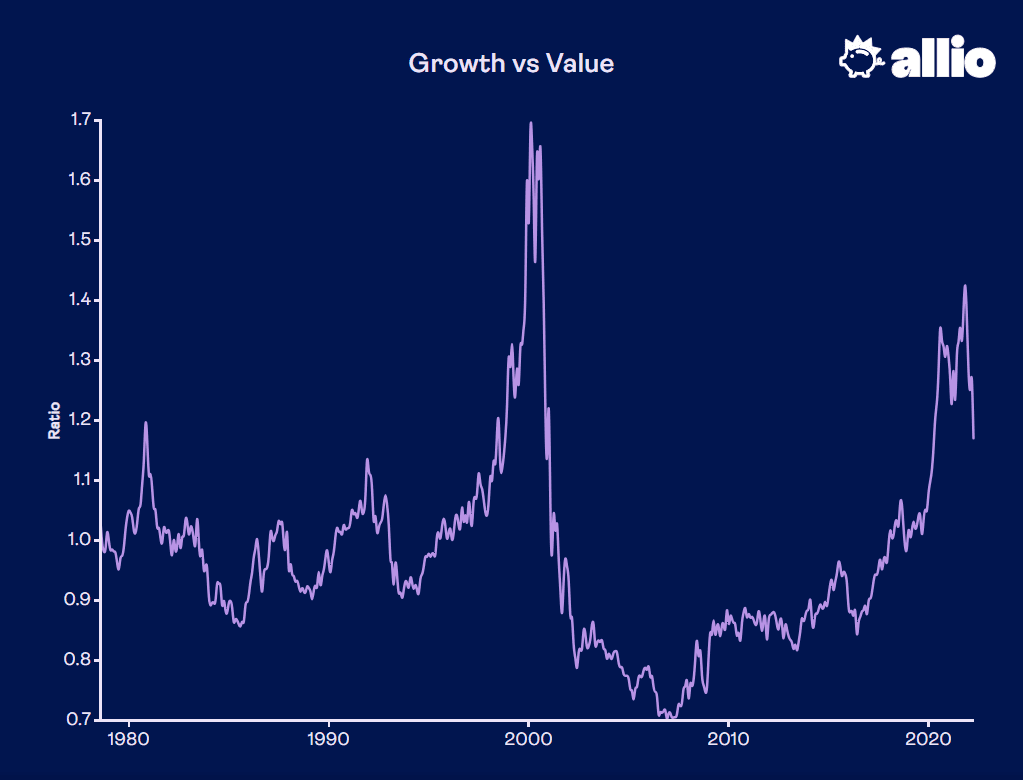

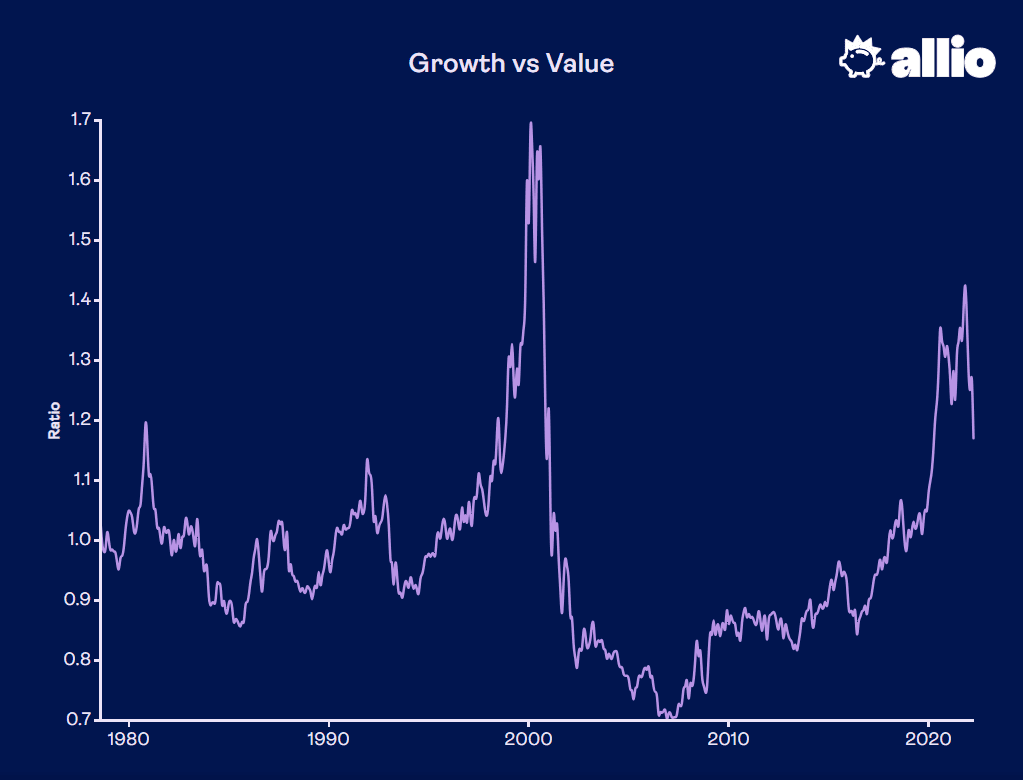

Rising Interest Rates: Growth vs. Value

When interest rates are low and are expected to stay low, growth stocks, which are shares of companies expected to grow faster than the market average, tend to perform well.

These stocks often appear to be expensive by many of the metrics that investors use to evaluate stocks, such as price to earnings ratio, but investors are willing to pay a premium for the expected growth. When interest rates begin to rise, however, it makes the future growth of these stocks worth less. This often causes investors to cycle away from growth and into less expensive stocks, called value stocks.

Thus, an investor who anticipates rising rates may preemptively position their portfolio so that they have less exposure to growth stocks and more exposure to value stocks.

Boom and Bust: Domestic vs. International Markets

Alternatively, consider the fact that countries around the globe all experience their own economic cycles. Sometimes these cycles align with each other, and sometimes they do not. By identifying which countries are entering periods of economic growth and which are entering periods of economic slowdown, it’s possible to preemptively position a portfolio in order to take advantage of these changes.

For example, an investor who believes the United States is about to enter a recession might shift a portion of her portfolio out of domestic stocks and into international markets that are on the brink of economic expansion.

Augmenting Your Portfolio with a Macro Strategy

Embracing a macro strategy in your investment approach allows you to increase your diversification, potentially decrease risk, and become anticipatory instead of reactionary to the gyrations of the market.

Unfortunately, macro investing requires a fairly deep understanding of market trends, cyclical analysis, and economic data. As such, it can be challenging for everyday investors to work a macro strategy into their investment approach. In the past, this has meant macro strategies have largely been available only to those with the resources to hire analysts and hedge funds skilled in macro analysis.

Here at Allio, we select assets for our portfolios based on an analysis of the prevailing macroeconomic conditions. As we believe US stocks and bonds are facing significant headwinds in the intermediate- to long-term, our portfolios are highly diversified and contain exposure to other asset classes such as:

Emerging markets, which may offer greater potential for growth

Commodities, which may provide a hedge against inflation

Gold, which is uncorrelated with equities and tends to perform well when equities perform poorly

Equity REITs, which benefit from rising rents and tend to do well during periods of inflation even with rising interest rates

It’s widely believed by many financial professionals that in the coming decade stocks and bonds will not enjoy the same strong returns they’ve enjoyed in the recent past. If this prediction comes to pass, it means that you, as an investor, will likely need to turn elsewhere in order to find the yield necessary to reach your financial goals.

Diversifying into alternative asset classes—such as digital assets, commodities, and real estate—is one option you can consider. But it may be possible to get even more out of your portfolio by pairing that increased diversification with a “big-picture,” or “macro” investment strategy, without having to take on any additional risk.

Here, we define what a macro investing strategy is, the different forms that it can take, and explain how it can help you strengthen and diversify your portfolio.

What is a macro strategy?

A macro strategy is an investment strategy that positions its holdings in such a way as to take advantage of large-scale economic factors and trends. Its aim is to see the proverbial “big picture,” and position the portfolio to benefit from the long-term trends already in place or from the ones likely to materialize.

In the purest sense, macro strategies are concerned with issues like interest rates, inflation, unemployment rates, gross domestic product, and other measures of national productivity. But other factors can influence a macro strategy as well, including:

Demographic Trends: Such as an aging population, population growth, and rising or shrinking middle class

Political Trends: Such as whether the election of a new political regime will lead to more or less business-friendly policies and regulations

Industry Trends: Such as sector rotations within the broad market or even the emergence or maturation of new industries like ecommerce, green energy, and big data

Technological Trends: Such as the deployment of 5G, the emergence of artificial intelligence (AI), and greater internet connectivity around the globe

A macro strategy can be domestic—focused on the macro-economic trends of a single country such as the United States—or it can be global, spanning multiple countries or regions. Because different countries experience different economic cycles, a global macro strategy can be said to offer greater diversification to your portfolio compared to a domestic macro strategy.

With all of this in mind, a macro strategy may include common assets such as stocks and bonds as well as alternative assets such as commodities, currencies, gold, and more.

Types of Macro Strategy

Macro strategies come in all shapes and sizes. In addition to following either a global or domestic playbook, macro strategies can be either systematic or discretionary. Systematic macro strategies make investment decisions based solely on the output of rules-based quantitative models, whereas discretionary macro strategies, while they might take quantitative models into account, also rely on qualitative information processed by humans.

Further, macro strategies can base their investment decisions on either fundamental or technical or sentiment analysis (or some combination of all three). And they can be designed with short-, medium-, or long-term considerations in mind.

Macro Strategy in Action

To help you understand what a macro strategy might look like in action, consider the following examples:

Rising Interest Rates: Growth vs. Value

When interest rates are low and are expected to stay low, growth stocks, which are shares of companies expected to grow faster than the market average, tend to perform well.

These stocks often appear to be expensive by many of the metrics that investors use to evaluate stocks, such as price to earnings ratio, but investors are willing to pay a premium for the expected growth. When interest rates begin to rise, however, it makes the future growth of these stocks worth less. This often causes investors to cycle away from growth and into less expensive stocks, called value stocks.

Thus, an investor who anticipates rising rates may preemptively position their portfolio so that they have less exposure to growth stocks and more exposure to value stocks.

Boom and Bust: Domestic vs. International Markets

Alternatively, consider the fact that countries around the globe all experience their own economic cycles. Sometimes these cycles align with each other, and sometimes they do not. By identifying which countries are entering periods of economic growth and which are entering periods of economic slowdown, it’s possible to preemptively position a portfolio in order to take advantage of these changes.

For example, an investor who believes the United States is about to enter a recession might shift a portion of her portfolio out of domestic stocks and into international markets that are on the brink of economic expansion.

Augmenting Your Portfolio with a Macro Strategy

Embracing a macro strategy in your investment approach allows you to increase your diversification, potentially decrease risk, and become anticipatory instead of reactionary to the gyrations of the market.

Unfortunately, macro investing requires a fairly deep understanding of market trends, cyclical analysis, and economic data. As such, it can be challenging for everyday investors to work a macro strategy into their investment approach. In the past, this has meant macro strategies have largely been available only to those with the resources to hire analysts and hedge funds skilled in macro analysis.

Here at Allio, we select assets for our portfolios based on an analysis of the prevailing macroeconomic conditions. As we believe US stocks and bonds are facing significant headwinds in the intermediate- to long-term, our portfolios are highly diversified and contain exposure to other asset classes such as:

Emerging markets, which may offer greater potential for growth

Commodities, which may provide a hedge against inflation

Gold, which is uncorrelated with equities and tends to perform well when equities perform poorly

Equity REITs, which benefit from rising rents and tend to do well during periods of inflation even with rising interest rates

It’s widely believed by many financial professionals that in the coming decade stocks and bonds will not enjoy the same strong returns they’ve enjoyed in the recent past. If this prediction comes to pass, it means that you, as an investor, will likely need to turn elsewhere in order to find the yield necessary to reach your financial goals.

Diversifying into alternative asset classes—such as digital assets, commodities, and real estate—is one option you can consider. But it may be possible to get even more out of your portfolio by pairing that increased diversification with a “big-picture,” or “macro” investment strategy, without having to take on any additional risk.

Here, we define what a macro investing strategy is, the different forms that it can take, and explain how it can help you strengthen and diversify your portfolio.

What is a macro strategy?

A macro strategy is an investment strategy that positions its holdings in such a way as to take advantage of large-scale economic factors and trends. Its aim is to see the proverbial “big picture,” and position the portfolio to benefit from the long-term trends already in place or from the ones likely to materialize.

In the purest sense, macro strategies are concerned with issues like interest rates, inflation, unemployment rates, gross domestic product, and other measures of national productivity. But other factors can influence a macro strategy as well, including:

Demographic Trends: Such as an aging population, population growth, and rising or shrinking middle class

Political Trends: Such as whether the election of a new political regime will lead to more or less business-friendly policies and regulations

Industry Trends: Such as sector rotations within the broad market or even the emergence or maturation of new industries like ecommerce, green energy, and big data

Technological Trends: Such as the deployment of 5G, the emergence of artificial intelligence (AI), and greater internet connectivity around the globe

A macro strategy can be domestic—focused on the macro-economic trends of a single country such as the United States—or it can be global, spanning multiple countries or regions. Because different countries experience different economic cycles, a global macro strategy can be said to offer greater diversification to your portfolio compared to a domestic macro strategy.

With all of this in mind, a macro strategy may include common assets such as stocks and bonds as well as alternative assets such as commodities, currencies, gold, and more.

Types of Macro Strategy

Macro strategies come in all shapes and sizes. In addition to following either a global or domestic playbook, macro strategies can be either systematic or discretionary. Systematic macro strategies make investment decisions based solely on the output of rules-based quantitative models, whereas discretionary macro strategies, while they might take quantitative models into account, also rely on qualitative information processed by humans.

Further, macro strategies can base their investment decisions on either fundamental or technical or sentiment analysis (or some combination of all three). And they can be designed with short-, medium-, or long-term considerations in mind.

Macro Strategy in Action

To help you understand what a macro strategy might look like in action, consider the following examples:

Rising Interest Rates: Growth vs. Value

When interest rates are low and are expected to stay low, growth stocks, which are shares of companies expected to grow faster than the market average, tend to perform well.

These stocks often appear to be expensive by many of the metrics that investors use to evaluate stocks, such as price to earnings ratio, but investors are willing to pay a premium for the expected growth. When interest rates begin to rise, however, it makes the future growth of these stocks worth less. This often causes investors to cycle away from growth and into less expensive stocks, called value stocks.

Thus, an investor who anticipates rising rates may preemptively position their portfolio so that they have less exposure to growth stocks and more exposure to value stocks.

Boom and Bust: Domestic vs. International Markets

Alternatively, consider the fact that countries around the globe all experience their own economic cycles. Sometimes these cycles align with each other, and sometimes they do not. By identifying which countries are entering periods of economic growth and which are entering periods of economic slowdown, it’s possible to preemptively position a portfolio in order to take advantage of these changes.

For example, an investor who believes the United States is about to enter a recession might shift a portion of her portfolio out of domestic stocks and into international markets that are on the brink of economic expansion.

Augmenting Your Portfolio with a Macro Strategy

Embracing a macro strategy in your investment approach allows you to increase your diversification, potentially decrease risk, and become anticipatory instead of reactionary to the gyrations of the market.

Unfortunately, macro investing requires a fairly deep understanding of market trends, cyclical analysis, and economic data. As such, it can be challenging for everyday investors to work a macro strategy into their investment approach. In the past, this has meant macro strategies have largely been available only to those with the resources to hire analysts and hedge funds skilled in macro analysis.

Here at Allio, we select assets for our portfolios based on an analysis of the prevailing macroeconomic conditions. As we believe US stocks and bonds are facing significant headwinds in the intermediate- to long-term, our portfolios are highly diversified and contain exposure to other asset classes such as:

Emerging markets, which may offer greater potential for growth

Commodities, which may provide a hedge against inflation

Gold, which is uncorrelated with equities and tends to perform well when equities perform poorly

Equity REITs, which benefit from rising rents and tend to do well during periods of inflation even with rising interest rates

Allio makes sophisticated macro investing simple, giving smart investors the tools to thrive in 21st century markets. Head to the app store and download Allio today!

Related Articles

Mike Zaccardi, CFA, CMT

ETF Investment Guide: Your Roadmap to Building a Diverse and Profitable Portfolio

Explore the world of ETF investing with our comprehensive guide. Learn key strategies, terms, and tax considerations for successful portfolio management.

Mike Zaccardi, CFA, CMT

CAPM Formula Explained: Navigating the Relationship Between Risk and Return

Discover the power of CAPM in investment decisions. Learn the formula, calculate expected returns, and explore alternatives in modern portfolio management.

Mike Zaccardi, CFA, CMT

How To Build Wealth with Dividend Stocks: A Complete Guide to Smart Investing

Learn how to invest in dividends – our comprehensive guide covers strategies, risks, and the key to achieving stable financial returns.

Mike Zaccardi, CFA, CMT

ETF Investment Guide: Your Roadmap to Building a Diverse and Profitable Portfolio

Explore the world of ETF investing with our comprehensive guide. Learn key strategies, terms, and tax considerations for successful portfolio management.

Mike Zaccardi, CFA, CMT

CAPM Formula Explained: Navigating the Relationship Between Risk and Return

Discover the power of CAPM in investment decisions. Learn the formula, calculate expected returns, and explore alternatives in modern portfolio management.

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.