Updated October 13, 2023

What Type of Secular Market Regime Are We In?

What Type of Secular Market Regime Are We In?

What Type of Secular Market Regime Are We In?

Raymond Micaletti, Ph.D.

Investing Master Class

Whether you’re a seasoned investor or you’re just getting started, you probably already know the market is cyclical.

These cycles are characterized by periods of growth, followed by periods of plateau or stagnation, followed by periods of decline. Eventually, this period of decline is replaced with a new period of growth, signaling the start of a brand new cycle.

But it’s also important to recognize that the market does not just move cyclically. When we zoom out, it’s possible to see underlying trends that exist despite the shorter-term market cycles we may currently be immersed in. These longer-term trends are known as secular market regimes, and they last much longer than individual market cycles.

By understanding secular market regimes and the factors that trigger them, it may be possible to position your portfolio to take advantage of these longer-term trends.

With this in mind, below we explain what, exactly, secular market regimes are, the different types of secular market regimes that exist, and provide an answer to the question of “what type of secular market regime are we in right now?”

What Is a Secular Market Regime?

The term secular market regime is used to refer to a market environment that is subject to broader economic forces and monetary policy at the national or international level. These forces influence the trajectory of the market’s long-term trendline, independent of individual market cycles. Because of this, secular market regimes typically last 10 to 20 years and span multiple market cycles.

Types of Secular Markets

Markets generally come in two main varieties: bull markets and bear markets.

A bull market is one in which asset prices have been moving higher for an extended period of time. The technical definition of a bull market requires it to have risen by at least 20% from recent lows.

A bear market, on the other hand, is one in which asset prices have been moving lower for an extended period of time. Again, the technical definition of a bear market requires it to have retreated at least 20% from recent highs.

But, according to Michael Alexander in his book Stock Cycles: Why Stocks Won’t Beat Money Markets over the Next 20 Years, secular market regimes actually come in four different varieties. He bases this theory on an analysis of the performance of the S&P 500 (and its predecessors) over the course of 200 years.

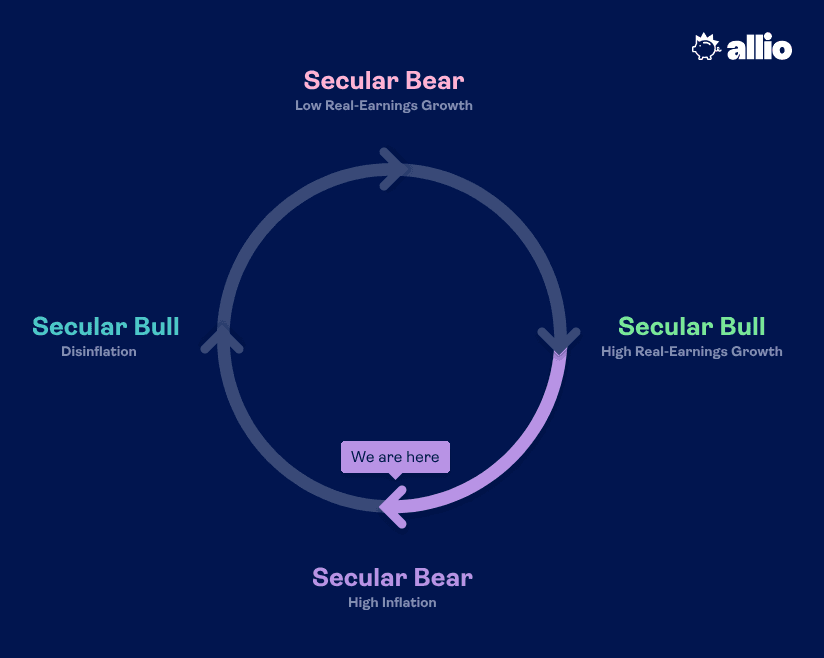

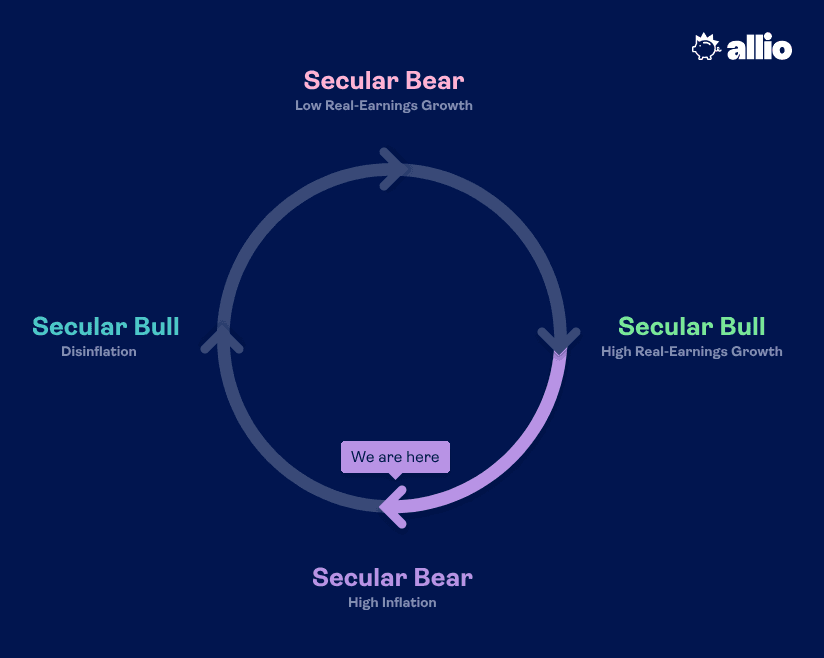

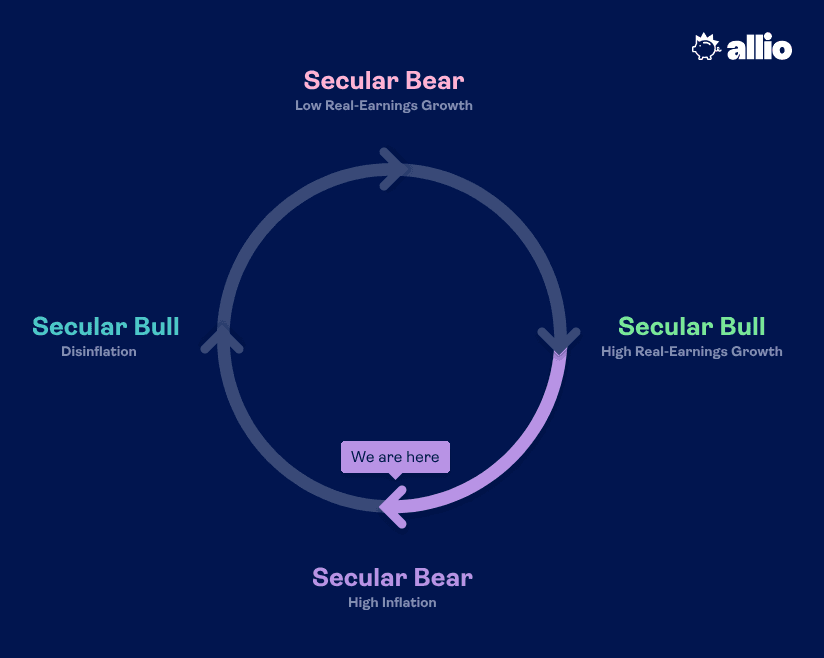

These varieties are dependent upon the underlying economic forces that are driving the bull or bear market over the long term. The traditionally-recognized types of secular market regimes are:

Secular Bull Market, driven by high real-earnings growth

Secular Bear Market, driven by high inflation

Secular Bull Market, driven by disinflation

Secular Bear Market, driven by low real-earnings growth

Generally speaking, a secular bear market driven by low real-earnings growth will lead into a secular bull market driven by high real-earnings growth. This regime will then lead into a secular bear market driven by high inflation, which will in turn give way to a secular bull market driven by disinflation. This broader cycle then repeats itself, leading back into a secular bear market driven by low real-earnings growth and the cycle begins anew.

Regardless of the driving forces, Alexander calculated that secular bull markets have historically provided an average of 12% real returns (that is, returns above inflation). Meanwhile, secular bear markets have historically provided an average real return of 0%; in other words, they tend only to keep pace with inflation.

When averaged together, we see that U.S. equities have realized a long-term annualized real return of 6%. Which is to say, over the long term, the U.S. stock market has grown by an average of 6% each year relative to inflation.

Historical Secular Market Regimes

From 1929 until today, the U.S. market has undergone eight distinct regime changes, noted in both the table and chart below:

The chart above shows the performance of the U.S. equity market since 1926. The green and blue segments represent secular bull markets, while the red and pink segments represent secular bear markets. Note that the four drivers of the secular cycles rotate in the same pattern.

As you can see from the historical data above, the typical secular market regime lasts between 10 and 20 years. The last regime, a secular bull market driven by high real-earnings growth, lasted from 2010 to 2021.

What Secular Market Regime Are We in Now?

From 2010 to 2021, U.S. equities were in a secular bull market driven by high real-earnings growth. This can be seen in the fact that between 2009 and 2020, annualized earnings growth was greater than 23% (for comparison, the long-term growth rate for earnings is about 6% per year)—and that’s despite the negative effects of the COVID-19 pandemic and global lockdown. This earnings growth was paired with low inflation and historically low interest rates.

Today, we find ourselves in a very different environment. For a number of reasons, which we’ll discuss below, we believe that we are now in the early stages of a secular bear market, driven by high inflation.

The Evidence

There are five key pieces of evidence that lead us to believe we are now experiencing a regime change into a secular bear market driven by high inflation.

Poor performance of U.S. equities

Low future equity return expectations

High inflation

Outperformance of real assets

Shifting correlations

1. Poor Performance of U.S. Equities

Since January 2022, two of the three most well-known U.S. stock indexes have officially entered bear market territory by dropping at least 20% from recent highs. At its worst, the S&P 500 lost more than 23% of its value, while the Nasdaq shed roughly 33%. Only the Dow Jones Industrial Average has avoided “technically” entering a bear market; shedding roughly 19% of its value.

2. Low Future Equity Return Expectations

Investors use a number of different metrics in order to try and predict how much the stock market will return in the future. But there is only one metric that has come to be known as the “Single Greatest Predictor of Future Stock Market Returns” due to its accuracy and correlation to future U.S. equity returns. And it’s actually rather simple—just the average investor portfolio allocation to equities.

This metric has proven itself to be impressively accurate at predicting long-term stock market returns. At the most recent U.S. equity highs, reached in December and January of 2021, this metric was forecasting negative annualized returns for the next 10 years—which is strongly suggestive of an impending secular bear market.

3. High Inflation

Meanwhile, U.S. consumers have been faced with abnormally high levels of inflation over the past 12 months. According to the most recent report released by the Bureau of Labor Statistics (BLS), inflation as measured by the consumer price index (CPI) rose by 9.1% between June 2021 and June 2022. For context, Americans have not faced inflation this high in the past 40 years.

4. Outperformance of Real Assets

Another reason for thinking we are in a secular bear market driven by high inflation is that the types of assets one would expect to outperform during such a regime—namely, commodities and commodities-related stocks (e.g., energy companies)—are precisely the ones that have been outperforming. For example, prior to its recent selloff, the energy sector was up over 60% year-to-date in 2022 (whereas as mentioned above the broad market was down over 20% at one point).

5. Shifting Correlations

Many investors believe that stocks and bonds are always negatively correlated. What this means is that when stocks fall, bonds tend to rise (and vice versa). This is why a “diversified portfolio” typically includes allocations to both stocks and bonds.

But the truth is, the two asset classes are not always negatively correlated. Historically, during secular bear markets driven by periods of high inflation (and disinflation), there is a positive correlation between stocks and bonds. We have seen a similar positive correlation since April 2020, which may serve as an early indicator of regime change.

The Forces Pushing Us in This Direction

If we are indeed entering a secular bear market driven by high inflation, it’s only natural to then ask: Why? While there are many potential forces pushing us in this direction, we believe that three of the most powerful include:

A sovereign bond bubble: Western nations, including the United States, are laden with debt and unfunded liabilities. We believe this constrains just how high the Federal Reserve can raise interest rates in order to rein in inflation, increasing the likelihood that high inflation is here to stay.

De-globalization: In the past three decades, increasing levels of globalization have translated into lower prices for countless consumer goods in the west, as businesses could easily access cheap labor in foreign countries. Unfortunately, the COVID-19 pandemic showed us just how fragile global supply chains could be. In response, many businesses have decided to “reshore” their manufacturing back to their home country. While this adds resilience to the supply chain, it typically does so at the expense of higher production costs, which feed into inflation.

De-Dollarization: The dollar has long enjoyed status as the world’s reserve currency. This means that central banks and other major financial institutions around the world have largely used U.S. dollars for international transactions. For a variety of reasons, it appears that the U.S. dollar is now being challenged for its status as the world’s reserve currency. If it changes, this would prove catastrophic for U.S. consumers, and may further exacerbate inflation.

Preparing Your Portfolio for the New Secular Regime

The good news is that a secular regime change does not need to spell disaster for your portfolio. In fact, there are steps that you can take today to give your portfolio a chance to perform despite the challenges outlined above.

For example, if U.S. equities and bonds are expected to languish while real assets are expected to outperform, it may make sense to diversify your portfolio so that it includes exposure to these real assets. Real estate (in the form of equity REITs), commodities, gold, and cryptocurrency might all help fill the performance gap left by stocks. Meanwhile, intelligent positioning within stocks to the sectors more likely to thrive during periods of high inflation may also help boost your overall performance.

Here at Allio, we understand just how powerful the global macro environment is in influencing returns. That’s why we have specifically designed our portfolios with inflation and a changing secular regime in mind. Our users have access to traditional asset classes like stocks and bonds, as well as commodities, gold, real estate, and cryptocurrency.

Whether you’re a seasoned investor or you’re just getting started, you probably already know the market is cyclical.

These cycles are characterized by periods of growth, followed by periods of plateau or stagnation, followed by periods of decline. Eventually, this period of decline is replaced with a new period of growth, signaling the start of a brand new cycle.

But it’s also important to recognize that the market does not just move cyclically. When we zoom out, it’s possible to see underlying trends that exist despite the shorter-term market cycles we may currently be immersed in. These longer-term trends are known as secular market regimes, and they last much longer than individual market cycles.

By understanding secular market regimes and the factors that trigger them, it may be possible to position your portfolio to take advantage of these longer-term trends.

With this in mind, below we explain what, exactly, secular market regimes are, the different types of secular market regimes that exist, and provide an answer to the question of “what type of secular market regime are we in right now?”

What Is a Secular Market Regime?

The term secular market regime is used to refer to a market environment that is subject to broader economic forces and monetary policy at the national or international level. These forces influence the trajectory of the market’s long-term trendline, independent of individual market cycles. Because of this, secular market regimes typically last 10 to 20 years and span multiple market cycles.

Types of Secular Markets

Markets generally come in two main varieties: bull markets and bear markets.

A bull market is one in which asset prices have been moving higher for an extended period of time. The technical definition of a bull market requires it to have risen by at least 20% from recent lows.

A bear market, on the other hand, is one in which asset prices have been moving lower for an extended period of time. Again, the technical definition of a bear market requires it to have retreated at least 20% from recent highs.

But, according to Michael Alexander in his book Stock Cycles: Why Stocks Won’t Beat Money Markets over the Next 20 Years, secular market regimes actually come in four different varieties. He bases this theory on an analysis of the performance of the S&P 500 (and its predecessors) over the course of 200 years.

These varieties are dependent upon the underlying economic forces that are driving the bull or bear market over the long term. The traditionally-recognized types of secular market regimes are:

Secular Bull Market, driven by high real-earnings growth

Secular Bear Market, driven by high inflation

Secular Bull Market, driven by disinflation

Secular Bear Market, driven by low real-earnings growth

Generally speaking, a secular bear market driven by low real-earnings growth will lead into a secular bull market driven by high real-earnings growth. This regime will then lead into a secular bear market driven by high inflation, which will in turn give way to a secular bull market driven by disinflation. This broader cycle then repeats itself, leading back into a secular bear market driven by low real-earnings growth and the cycle begins anew.

Regardless of the driving forces, Alexander calculated that secular bull markets have historically provided an average of 12% real returns (that is, returns above inflation). Meanwhile, secular bear markets have historically provided an average real return of 0%; in other words, they tend only to keep pace with inflation.

When averaged together, we see that U.S. equities have realized a long-term annualized real return of 6%. Which is to say, over the long term, the U.S. stock market has grown by an average of 6% each year relative to inflation.

Historical Secular Market Regimes

From 1929 until today, the U.S. market has undergone eight distinct regime changes, noted in both the table and chart below:

The chart above shows the performance of the U.S. equity market since 1926. The green and blue segments represent secular bull markets, while the red and pink segments represent secular bear markets. Note that the four drivers of the secular cycles rotate in the same pattern.

As you can see from the historical data above, the typical secular market regime lasts between 10 and 20 years. The last regime, a secular bull market driven by high real-earnings growth, lasted from 2010 to 2021.

What Secular Market Regime Are We in Now?

From 2010 to 2021, U.S. equities were in a secular bull market driven by high real-earnings growth. This can be seen in the fact that between 2009 and 2020, annualized earnings growth was greater than 23% (for comparison, the long-term growth rate for earnings is about 6% per year)—and that’s despite the negative effects of the COVID-19 pandemic and global lockdown. This earnings growth was paired with low inflation and historically low interest rates.

Today, we find ourselves in a very different environment. For a number of reasons, which we’ll discuss below, we believe that we are now in the early stages of a secular bear market, driven by high inflation.

The Evidence

There are five key pieces of evidence that lead us to believe we are now experiencing a regime change into a secular bear market driven by high inflation.

Poor performance of U.S. equities

Low future equity return expectations

High inflation

Outperformance of real assets

Shifting correlations

1. Poor Performance of U.S. Equities

Since January 2022, two of the three most well-known U.S. stock indexes have officially entered bear market territory by dropping at least 20% from recent highs. At its worst, the S&P 500 lost more than 23% of its value, while the Nasdaq shed roughly 33%. Only the Dow Jones Industrial Average has avoided “technically” entering a bear market; shedding roughly 19% of its value.

2. Low Future Equity Return Expectations

Investors use a number of different metrics in order to try and predict how much the stock market will return in the future. But there is only one metric that has come to be known as the “Single Greatest Predictor of Future Stock Market Returns” due to its accuracy and correlation to future U.S. equity returns. And it’s actually rather simple—just the average investor portfolio allocation to equities.

This metric has proven itself to be impressively accurate at predicting long-term stock market returns. At the most recent U.S. equity highs, reached in December and January of 2021, this metric was forecasting negative annualized returns for the next 10 years—which is strongly suggestive of an impending secular bear market.

3. High Inflation

Meanwhile, U.S. consumers have been faced with abnormally high levels of inflation over the past 12 months. According to the most recent report released by the Bureau of Labor Statistics (BLS), inflation as measured by the consumer price index (CPI) rose by 9.1% between June 2021 and June 2022. For context, Americans have not faced inflation this high in the past 40 years.

4. Outperformance of Real Assets

Another reason for thinking we are in a secular bear market driven by high inflation is that the types of assets one would expect to outperform during such a regime—namely, commodities and commodities-related stocks (e.g., energy companies)—are precisely the ones that have been outperforming. For example, prior to its recent selloff, the energy sector was up over 60% year-to-date in 2022 (whereas as mentioned above the broad market was down over 20% at one point).

5. Shifting Correlations

Many investors believe that stocks and bonds are always negatively correlated. What this means is that when stocks fall, bonds tend to rise (and vice versa). This is why a “diversified portfolio” typically includes allocations to both stocks and bonds.

But the truth is, the two asset classes are not always negatively correlated. Historically, during secular bear markets driven by periods of high inflation (and disinflation), there is a positive correlation between stocks and bonds. We have seen a similar positive correlation since April 2020, which may serve as an early indicator of regime change.

The Forces Pushing Us in This Direction

If we are indeed entering a secular bear market driven by high inflation, it’s only natural to then ask: Why? While there are many potential forces pushing us in this direction, we believe that three of the most powerful include:

A sovereign bond bubble: Western nations, including the United States, are laden with debt and unfunded liabilities. We believe this constrains just how high the Federal Reserve can raise interest rates in order to rein in inflation, increasing the likelihood that high inflation is here to stay.

De-globalization: In the past three decades, increasing levels of globalization have translated into lower prices for countless consumer goods in the west, as businesses could easily access cheap labor in foreign countries. Unfortunately, the COVID-19 pandemic showed us just how fragile global supply chains could be. In response, many businesses have decided to “reshore” their manufacturing back to their home country. While this adds resilience to the supply chain, it typically does so at the expense of higher production costs, which feed into inflation.

De-Dollarization: The dollar has long enjoyed status as the world’s reserve currency. This means that central banks and other major financial institutions around the world have largely used U.S. dollars for international transactions. For a variety of reasons, it appears that the U.S. dollar is now being challenged for its status as the world’s reserve currency. If it changes, this would prove catastrophic for U.S. consumers, and may further exacerbate inflation.

Preparing Your Portfolio for the New Secular Regime

The good news is that a secular regime change does not need to spell disaster for your portfolio. In fact, there are steps that you can take today to give your portfolio a chance to perform despite the challenges outlined above.

For example, if U.S. equities and bonds are expected to languish while real assets are expected to outperform, it may make sense to diversify your portfolio so that it includes exposure to these real assets. Real estate (in the form of equity REITs), commodities, gold, and cryptocurrency might all help fill the performance gap left by stocks. Meanwhile, intelligent positioning within stocks to the sectors more likely to thrive during periods of high inflation may also help boost your overall performance.

Here at Allio, we understand just how powerful the global macro environment is in influencing returns. That’s why we have specifically designed our portfolios with inflation and a changing secular regime in mind. Our users have access to traditional asset classes like stocks and bonds, as well as commodities, gold, real estate, and cryptocurrency.

Whether you’re a seasoned investor or you’re just getting started, you probably already know the market is cyclical.

These cycles are characterized by periods of growth, followed by periods of plateau or stagnation, followed by periods of decline. Eventually, this period of decline is replaced with a new period of growth, signaling the start of a brand new cycle.

But it’s also important to recognize that the market does not just move cyclically. When we zoom out, it’s possible to see underlying trends that exist despite the shorter-term market cycles we may currently be immersed in. These longer-term trends are known as secular market regimes, and they last much longer than individual market cycles.

By understanding secular market regimes and the factors that trigger them, it may be possible to position your portfolio to take advantage of these longer-term trends.

With this in mind, below we explain what, exactly, secular market regimes are, the different types of secular market regimes that exist, and provide an answer to the question of “what type of secular market regime are we in right now?”

What Is a Secular Market Regime?

The term secular market regime is used to refer to a market environment that is subject to broader economic forces and monetary policy at the national or international level. These forces influence the trajectory of the market’s long-term trendline, independent of individual market cycles. Because of this, secular market regimes typically last 10 to 20 years and span multiple market cycles.

Types of Secular Markets

Markets generally come in two main varieties: bull markets and bear markets.

A bull market is one in which asset prices have been moving higher for an extended period of time. The technical definition of a bull market requires it to have risen by at least 20% from recent lows.

A bear market, on the other hand, is one in which asset prices have been moving lower for an extended period of time. Again, the technical definition of a bear market requires it to have retreated at least 20% from recent highs.

But, according to Michael Alexander in his book Stock Cycles: Why Stocks Won’t Beat Money Markets over the Next 20 Years, secular market regimes actually come in four different varieties. He bases this theory on an analysis of the performance of the S&P 500 (and its predecessors) over the course of 200 years.

These varieties are dependent upon the underlying economic forces that are driving the bull or bear market over the long term. The traditionally-recognized types of secular market regimes are:

Secular Bull Market, driven by high real-earnings growth

Secular Bear Market, driven by high inflation

Secular Bull Market, driven by disinflation

Secular Bear Market, driven by low real-earnings growth

Generally speaking, a secular bear market driven by low real-earnings growth will lead into a secular bull market driven by high real-earnings growth. This regime will then lead into a secular bear market driven by high inflation, which will in turn give way to a secular bull market driven by disinflation. This broader cycle then repeats itself, leading back into a secular bear market driven by low real-earnings growth and the cycle begins anew.

Regardless of the driving forces, Alexander calculated that secular bull markets have historically provided an average of 12% real returns (that is, returns above inflation). Meanwhile, secular bear markets have historically provided an average real return of 0%; in other words, they tend only to keep pace with inflation.

When averaged together, we see that U.S. equities have realized a long-term annualized real return of 6%. Which is to say, over the long term, the U.S. stock market has grown by an average of 6% each year relative to inflation.

Historical Secular Market Regimes

From 1929 until today, the U.S. market has undergone eight distinct regime changes, noted in both the table and chart below:

The chart above shows the performance of the U.S. equity market since 1926. The green and blue segments represent secular bull markets, while the red and pink segments represent secular bear markets. Note that the four drivers of the secular cycles rotate in the same pattern.

As you can see from the historical data above, the typical secular market regime lasts between 10 and 20 years. The last regime, a secular bull market driven by high real-earnings growth, lasted from 2010 to 2021.

What Secular Market Regime Are We in Now?

From 2010 to 2021, U.S. equities were in a secular bull market driven by high real-earnings growth. This can be seen in the fact that between 2009 and 2020, annualized earnings growth was greater than 23% (for comparison, the long-term growth rate for earnings is about 6% per year)—and that’s despite the negative effects of the COVID-19 pandemic and global lockdown. This earnings growth was paired with low inflation and historically low interest rates.

Today, we find ourselves in a very different environment. For a number of reasons, which we’ll discuss below, we believe that we are now in the early stages of a secular bear market, driven by high inflation.

The Evidence

There are five key pieces of evidence that lead us to believe we are now experiencing a regime change into a secular bear market driven by high inflation.

Poor performance of U.S. equities

Low future equity return expectations

High inflation

Outperformance of real assets

Shifting correlations

1. Poor Performance of U.S. Equities

Since January 2022, two of the three most well-known U.S. stock indexes have officially entered bear market territory by dropping at least 20% from recent highs. At its worst, the S&P 500 lost more than 23% of its value, while the Nasdaq shed roughly 33%. Only the Dow Jones Industrial Average has avoided “technically” entering a bear market; shedding roughly 19% of its value.

2. Low Future Equity Return Expectations

Investors use a number of different metrics in order to try and predict how much the stock market will return in the future. But there is only one metric that has come to be known as the “Single Greatest Predictor of Future Stock Market Returns” due to its accuracy and correlation to future U.S. equity returns. And it’s actually rather simple—just the average investor portfolio allocation to equities.

This metric has proven itself to be impressively accurate at predicting long-term stock market returns. At the most recent U.S. equity highs, reached in December and January of 2021, this metric was forecasting negative annualized returns for the next 10 years—which is strongly suggestive of an impending secular bear market.

3. High Inflation

Meanwhile, U.S. consumers have been faced with abnormally high levels of inflation over the past 12 months. According to the most recent report released by the Bureau of Labor Statistics (BLS), inflation as measured by the consumer price index (CPI) rose by 9.1% between June 2021 and June 2022. For context, Americans have not faced inflation this high in the past 40 years.

4. Outperformance of Real Assets

Another reason for thinking we are in a secular bear market driven by high inflation is that the types of assets one would expect to outperform during such a regime—namely, commodities and commodities-related stocks (e.g., energy companies)—are precisely the ones that have been outperforming. For example, prior to its recent selloff, the energy sector was up over 60% year-to-date in 2022 (whereas as mentioned above the broad market was down over 20% at one point).

5. Shifting Correlations

Many investors believe that stocks and bonds are always negatively correlated. What this means is that when stocks fall, bonds tend to rise (and vice versa). This is why a “diversified portfolio” typically includes allocations to both stocks and bonds.

But the truth is, the two asset classes are not always negatively correlated. Historically, during secular bear markets driven by periods of high inflation (and disinflation), there is a positive correlation between stocks and bonds. We have seen a similar positive correlation since April 2020, which may serve as an early indicator of regime change.

The Forces Pushing Us in This Direction

If we are indeed entering a secular bear market driven by high inflation, it’s only natural to then ask: Why? While there are many potential forces pushing us in this direction, we believe that three of the most powerful include:

A sovereign bond bubble: Western nations, including the United States, are laden with debt and unfunded liabilities. We believe this constrains just how high the Federal Reserve can raise interest rates in order to rein in inflation, increasing the likelihood that high inflation is here to stay.

De-globalization: In the past three decades, increasing levels of globalization have translated into lower prices for countless consumer goods in the west, as businesses could easily access cheap labor in foreign countries. Unfortunately, the COVID-19 pandemic showed us just how fragile global supply chains could be. In response, many businesses have decided to “reshore” their manufacturing back to their home country. While this adds resilience to the supply chain, it typically does so at the expense of higher production costs, which feed into inflation.

De-Dollarization: The dollar has long enjoyed status as the world’s reserve currency. This means that central banks and other major financial institutions around the world have largely used U.S. dollars for international transactions. For a variety of reasons, it appears that the U.S. dollar is now being challenged for its status as the world’s reserve currency. If it changes, this would prove catastrophic for U.S. consumers, and may further exacerbate inflation.

Preparing Your Portfolio for the New Secular Regime

The good news is that a secular regime change does not need to spell disaster for your portfolio. In fact, there are steps that you can take today to give your portfolio a chance to perform despite the challenges outlined above.

For example, if U.S. equities and bonds are expected to languish while real assets are expected to outperform, it may make sense to diversify your portfolio so that it includes exposure to these real assets. Real estate (in the form of equity REITs), commodities, gold, and cryptocurrency might all help fill the performance gap left by stocks. Meanwhile, intelligent positioning within stocks to the sectors more likely to thrive during periods of high inflation may also help boost your overall performance.

Here at Allio, we understand just how powerful the global macro environment is in influencing returns. That’s why we have specifically designed our portfolios with inflation and a changing secular regime in mind. Our users have access to traditional asset classes like stocks and bonds, as well as commodities, gold, real estate, and cryptocurrency.

Allio makes sophisticated macro investing simple, giving smart investors the tools to thrive in 21st century markets. Head to the app store and download Allio today!

Related Articles

Mike Zaccardi, CFA, CMT

ETF Investment Guide: Your Roadmap to Building a Diverse and Profitable Portfolio

Explore the world of ETF investing with our comprehensive guide. Learn key strategies, terms, and tax considerations for successful portfolio management.

Mike Zaccardi, CFA, CMT

CAPM Formula Explained: Navigating the Relationship Between Risk and Return

Discover the power of CAPM in investment decisions. Learn the formula, calculate expected returns, and explore alternatives in modern portfolio management.

Mike Zaccardi, CFA, CMT

How To Build Wealth with Dividend Stocks: A Complete Guide to Smart Investing

Learn how to invest in dividends – our comprehensive guide covers strategies, risks, and the key to achieving stable financial returns.

Mike Zaccardi, CFA, CMT

ETF Investment Guide: Your Roadmap to Building a Diverse and Profitable Portfolio

Explore the world of ETF investing with our comprehensive guide. Learn key strategies, terms, and tax considerations for successful portfolio management.

Mike Zaccardi, CFA, CMT

CAPM Formula Explained: Navigating the Relationship Between Risk and Return

Discover the power of CAPM in investment decisions. Learn the formula, calculate expected returns, and explore alternatives in modern portfolio management.

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.