Updated October 16, 2023

Why Most Robo-Advisors Are Ineffective

Why Most Robo-Advisors Are Ineffective

Why Most Robo-Advisors Are Ineffective

Joseph Gradante, Allio CEO

Investing Master Class

Beginner

Robo-advisors rely upon automation and algorithms to provide investment management services to their clients and users. They first came into existence during the 2007-2009 Financial Crisis, and have proliferated in the years since.

The rise of robo-advisors has led to real and positive changes for millions of Americans. By automating the tedious and complicated process of portfolio construction, management, and rebalancing, robo-advisors are able to get by while charging much lower fees than traditional financial advisors. This means more people have access to tools and strategies that can help them start investing and build wealth.

While greater access to financial services is, of course, a positive thing, it comes at a cost. Namely: Simplicity. The models that guide how many robo-advisors build and manage portfolios tend to be fairly simple.

During the years since the end of the Financial Crisis—years embodied by low inflation, low interest rates, and one of the strongest equity bull markets in American history—this simplicity was fine. Robo-advisor portfolios enjoyed strong returns.

But as we enter a new, still-undefined era of financial policy, macroeconomic turmoil, and geopolitical uncertainty, this simplicity may not cut it anymore. In fact, here at Allio we believe that the traditionally popular strategies currently employed by most robo-advisors will diminish in effectiveness in this new environment.

Below is a look at the key reasons we believe this to be the case.

A Lack of Real Diversification

If you were to look at the portfolios offered by any of the major robo-advisors, you’d see that they consist mostly of just two asset classes: Stocks and bonds. The more conservative portfolios hold a higher percentage of bonds, the more aggressive portfolios hold a higher percentage of stocks. (Those that fall in between tend to skew pretty close to the popular 60/40 portfolio that consists of 60 percent stocks and 40 percent bonds.)

On the surface, it would appear that these portfolios offer adequate diversification depending on your risk tolerance as an investor. After all, stocks and bonds are what most people think of when they think about investing, and portfolios consisting of these assets have performed well for decades.

But it’s important to recognize that past performance does not necessarily translate into future returns. In fact, many financial professionals believe that, despite this history of strong performance, a portfolio consisting only of stocks and bonds is going to have a difficult time generating positive real returns in the coming decade, especially if high inflation remains “sticky.”

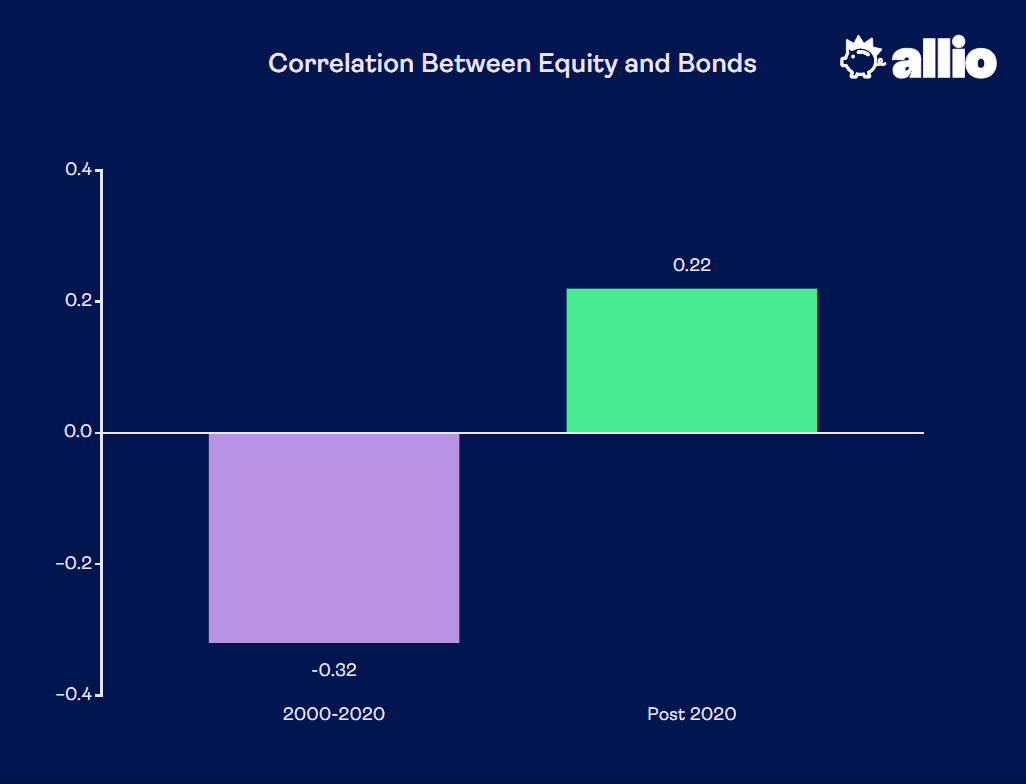

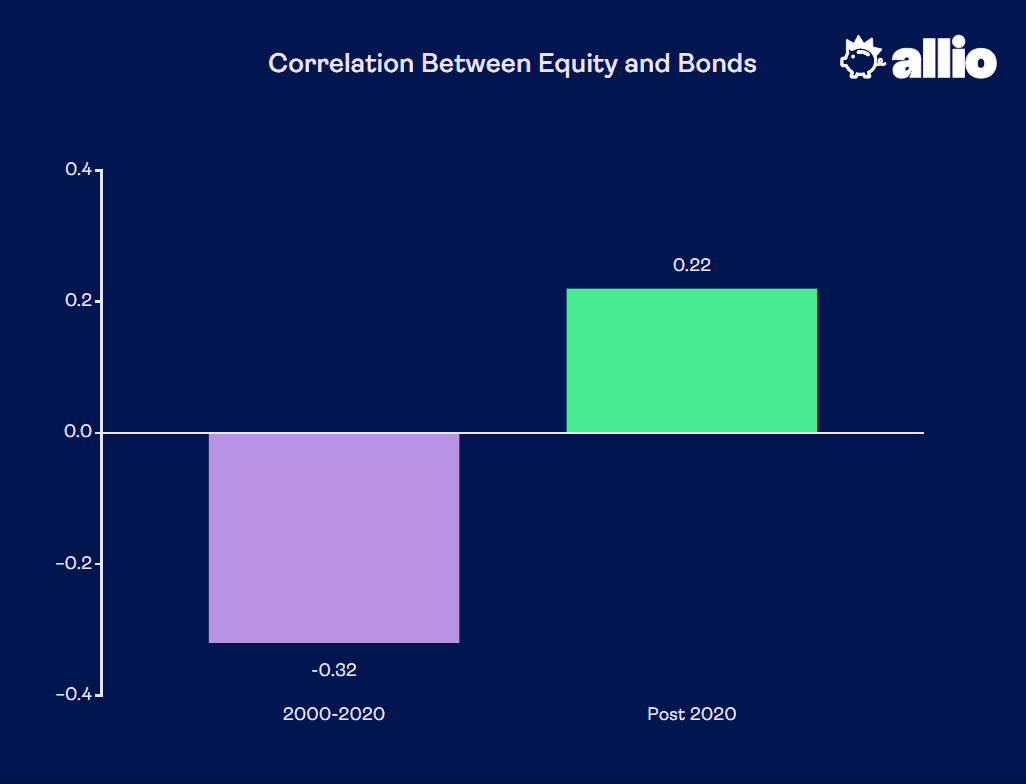

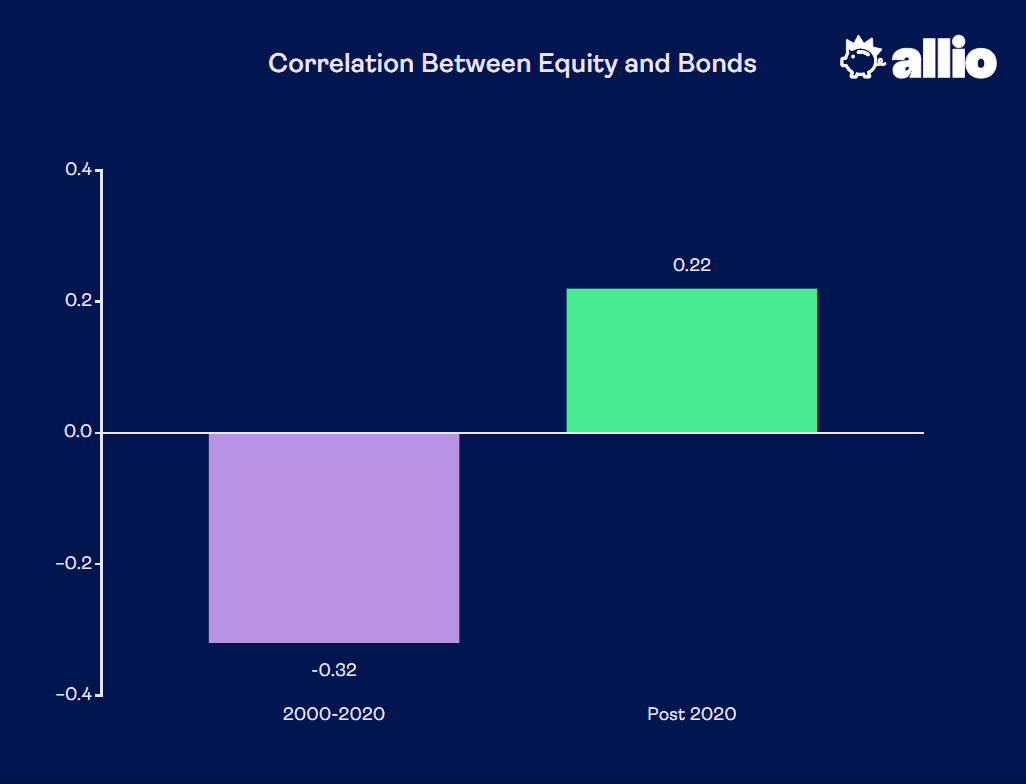

One major recent shift in market behavior relates to how stocks and bonds move with respect to one another. From 2000-2020, stocks and bonds had negative monthly correlations. That is, when stocks were up, bonds tended to be down and vice versa. This provided investors with some diversification to weather market fluctuations.

Since the bottom of the March 2020 pandemic selloff, however, the correlation between stocks and bonds has been positive. This means that when inflation gets hot, both stocks and bonds sell off; and when inflation eases, stocks and bonds both rise. Where's the diversification?

Worst of all, we believe this is a characteristic that will persist for years. U.S. stocks are priced to return perhaps as little as 1 percent annualized over the next 10 years, and bond yields are still fairly low. Hence, there's not much (sustainable) upside for either stocks or bonds if the Fed has to raise interest rates in an attempt to quell inflation. This means that a portfolio of only U.S. stocks and bonds has the very real possibility of going nowhere for the next decade.

The same might not be true for other asset classes, however. Real estate, commodities, emerging market stocks, precious metals, and digital assets offer investors additional avenues to increase diversification and generate yield—particularly during times of high inflation. The problem is that most robo-advisors do not offer comprehensive exposure to these assets. This means that investors must either open separate accounts elsewhere in order to gain exposure to these asset classes, or else capitulate to accepting a portfolio consisting only of stocks and bonds.

Here at Allio, we recognize the importance of these alternative asset classes and have constructed our portfolios in a way that allows for responsible exposure to them.

Full-scale Optimization vs Mean-Variance Optimization

Most robo-advisors leverage something called mean-variance optimization (MVO) in constructing their investment portfolios. What this means is that they seek to maximize the tradeoff between the portfolio’s expected return and its volatility.

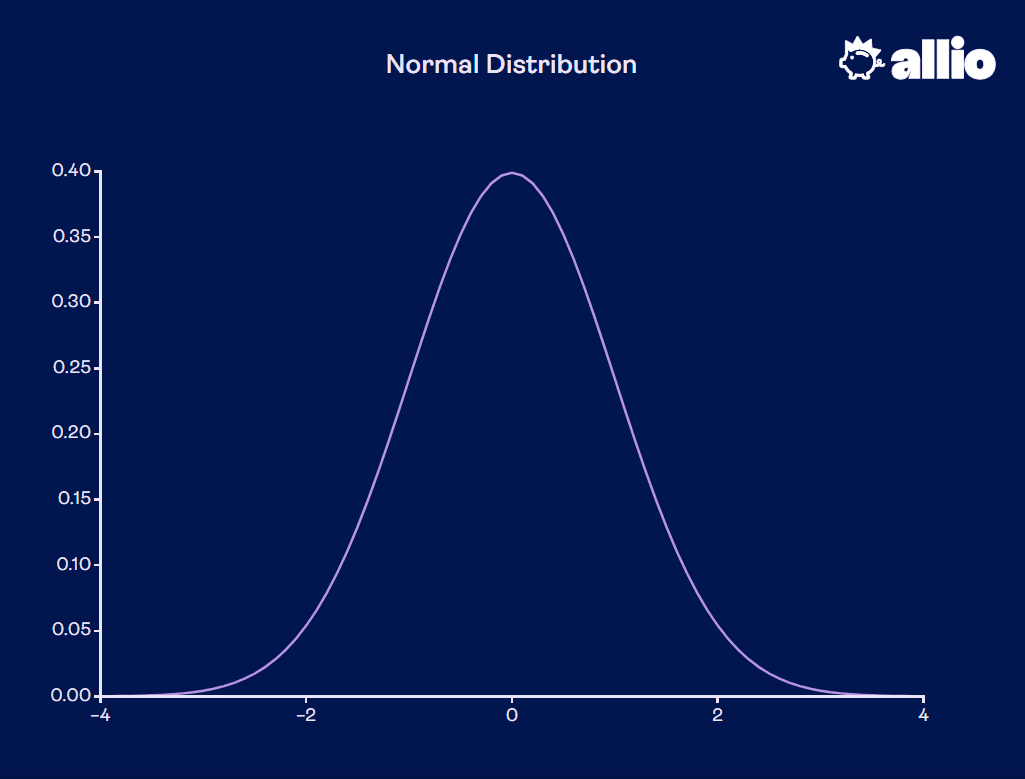

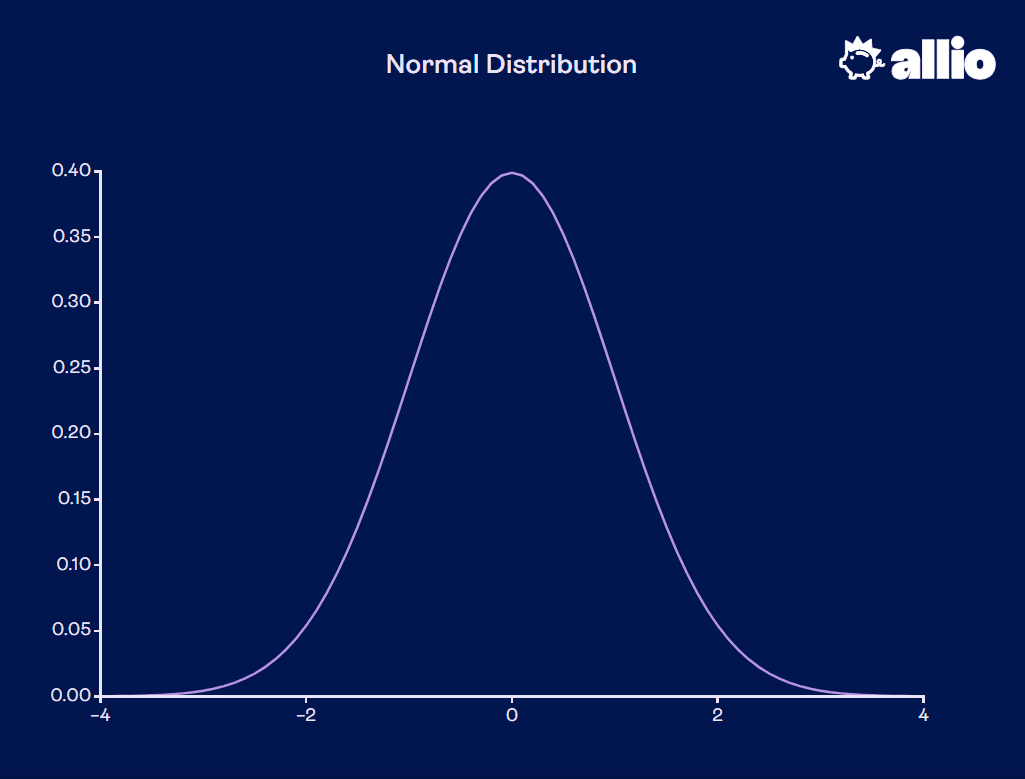

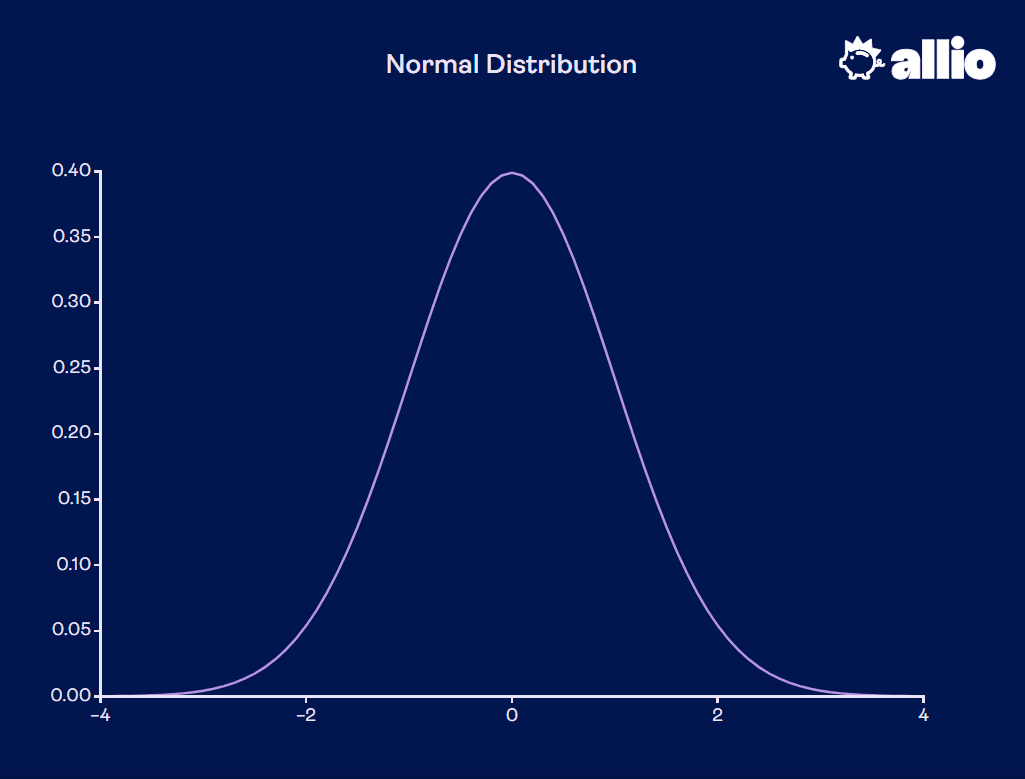

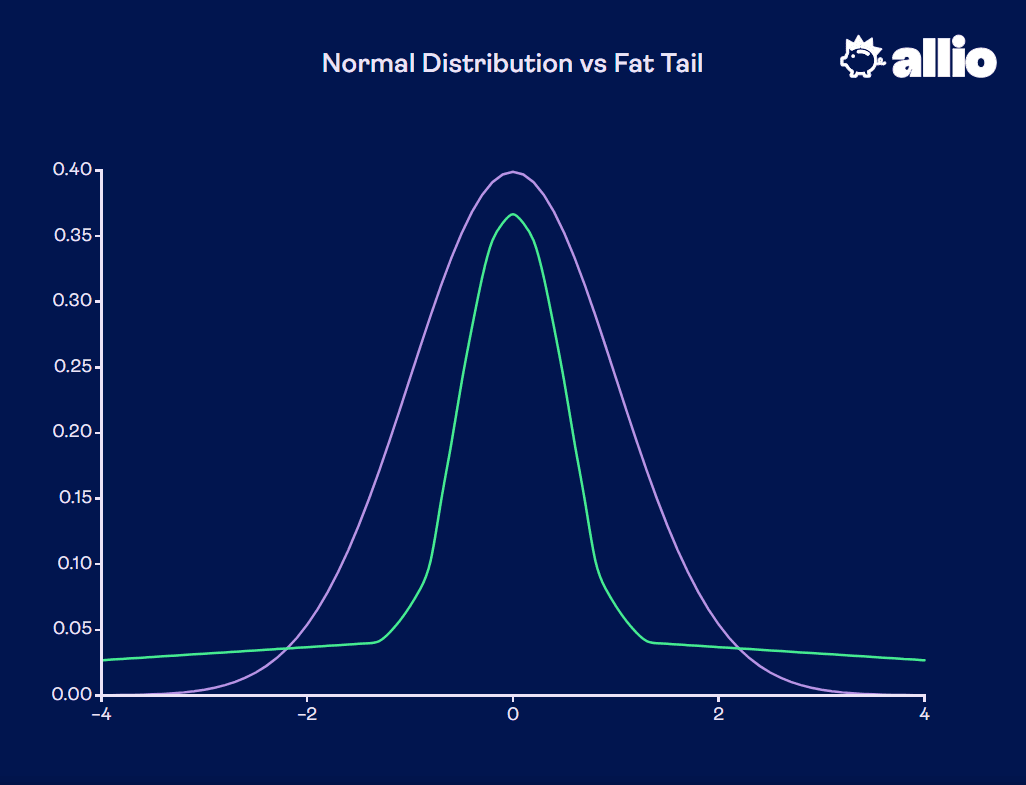

Mean-variance optimization assumes that returns are normally distributed, as you might see in a bell curve like the one below.

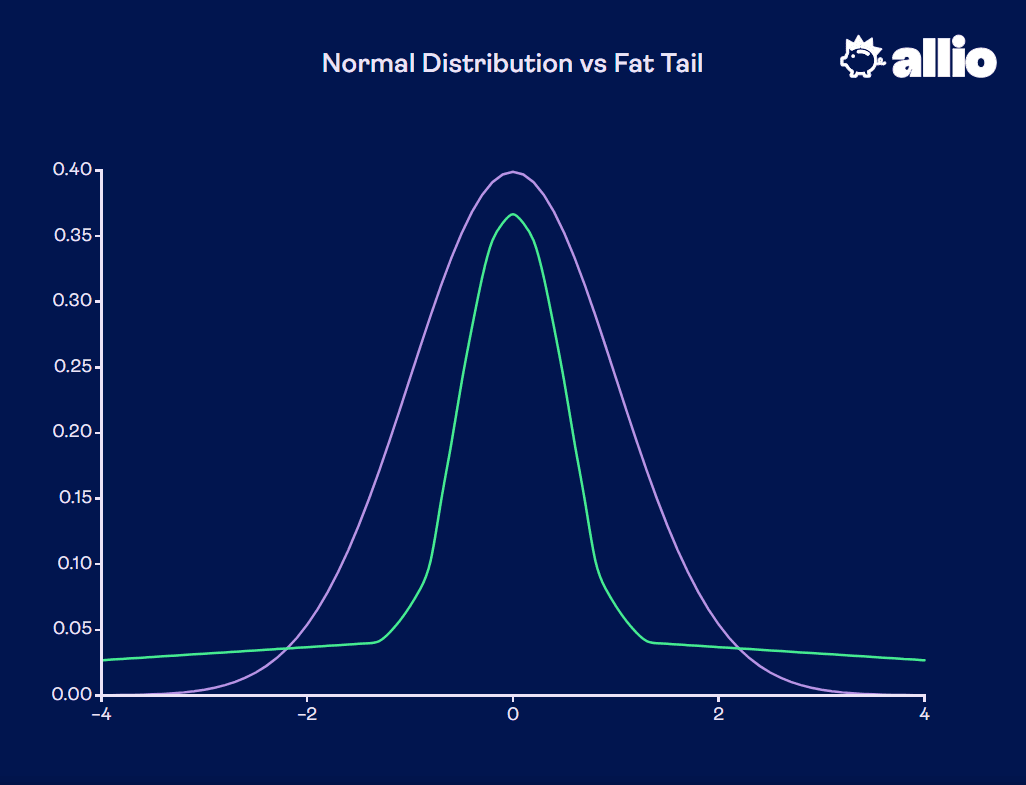

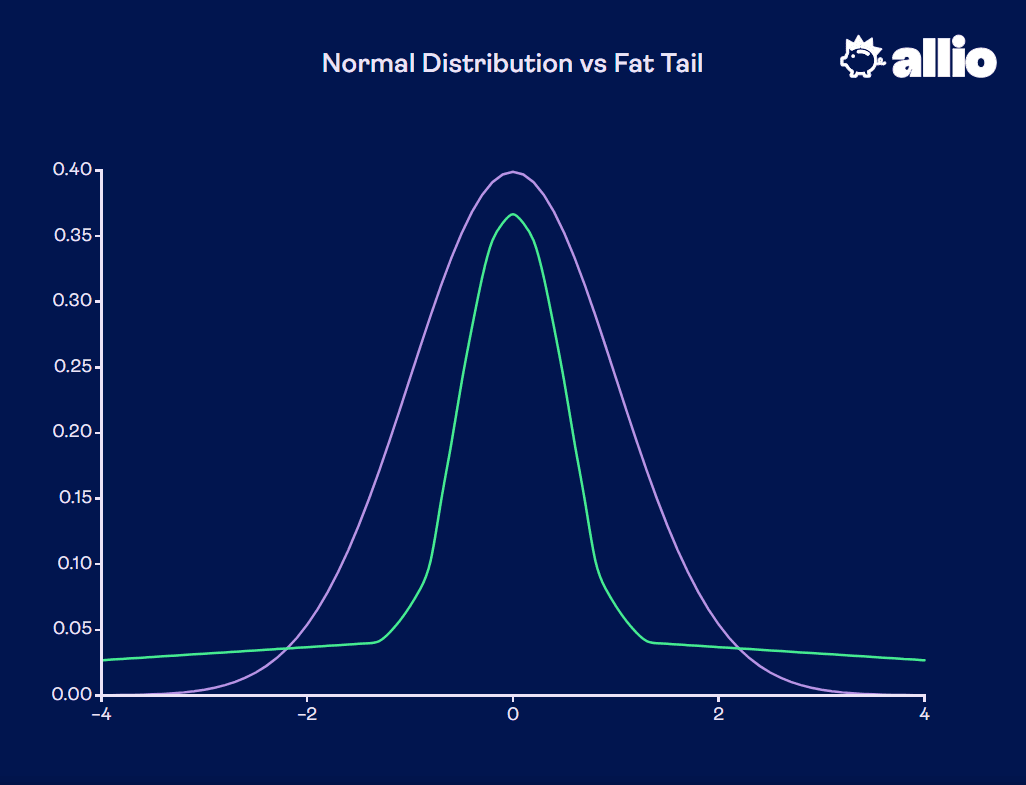

But in the world of finance, distributions of asset returns are not normal. When plotted in a chart like the one above, they have what are known as “fat tails.” That’s because there is a higher probability of large losses and large gains than a normal distribution would predict, given a certain level of volatility.

With this in mind, using mean-variance optimization to construct an investment portfolio means that an advisor either doesn’t believe that the market has fat tails—or worse, that they know but simply do not care.

Full-scale optimization (FSO), on the other hand, is a relatively recent advancement in portfolio optimization techniques. Instead of waving away the idea of fat tails, full-scale optimization embraces the entire distribution of returns in order to construct a portfolio that is typically more robust to various downside possibilities compared to portfolios constructed using mean-variance optimization.

Studies have shown that portfolios built using full-scale optimization outperform those built using mean-variance optimization a large percentage of the time.

Here at Allio, we favor full-scale optimization in the construction of our portfolios, in conjunction with a very robust and comprehensive set of simulated market scenarios.

Instead of simply using historical correlations from one long time history—where any interesting asset behavior gets washed away in the averaging process—we use correlations over many different sub-samples of our time history and generate realizations of returns that have characteristics corresponding to each of those respective sub-samples. This allows us to capture and incorporate any atypical asset behavior and generate an overall distribution of returns that has fat tails.

Additionally, we are keenly aware of the fact that asset class correlations have shifted dramatically since the day the market bottomed on March 24, 2020 during the COVID-19 selloff. We’ve taken steps to incorporate these shifts into our portfolio construction process as well.

Poor Values-Based Investing

Many modern investors would like their investment strategy to align with their personal values and beliefs. They want to invest in companies with environmentally-friendly and socially-conscious business practices, while avoiding companies that have poor track records in that regard. In recent years, this practice has been called ESG investing or values-based investing, among other names.

Some robo-advisors seeking to appeal to this new crop of environmentally- and socially-minded investors have designed “ESG portfolios.” While this sounds good in theory, once again the simplicity of how most robo-advisors operate is sub-optimal.

In order to design ESG-friendly investment portfolios en masse, most robo-advisors rely on ESG scores provided by outside, third-party agencies. These agencies evaluate companies on their environmental, social, and governance-related policies so that investors (and advisors) don’t have to do the work themselves.

Unfortunately, as ESG and values-based investing have become more popular in recent years, many companies have found ways to game the system to inflate their ESG scores—a practice known as greenwashing. The result is essentially a defanged form of values-based investing where nobody really wins.

To counter this trend, Allio has embraced values-based investing over ESG investing. By selecting which values matter most to them, clients can add to their portfolios ETFs designed to align with those particular beliefs.

There’s a Better Way

In the past decade, robo-advisors have had a real, positive impact on the finances of millions of Americans by making it easier to start investing—and at reasonable fees compared to traditional advisors. This was made easier by the fact that we were enjoying one of the longest bull markets in history.

But as we enter a post-pandemic world, we are witnessing the emergence of a new macroeconomic reality, one of rising inflation and rising interest rates—a reality that seems destined to persist for years. If so, this means the playbook most robo-advisors have relied on simply isn’t going to cut it in the coming years.

Would you like to learn more about how we’ve designed our portfolios to account for this new reality with exposure to asset classes outside the typical stocks and bonds? Maybe you’re curious about our unique approach to values-based investing that goes beyond ESG scores gamed by Wall Street to the point of farce? Or maybe you merely want to explore a better robo-advisor option?

Robo-advisors rely upon automation and algorithms to provide investment management services to their clients and users. They first came into existence during the 2007-2009 Financial Crisis, and have proliferated in the years since.

The rise of robo-advisors has led to real and positive changes for millions of Americans. By automating the tedious and complicated process of portfolio construction, management, and rebalancing, robo-advisors are able to get by while charging much lower fees than traditional financial advisors. This means more people have access to tools and strategies that can help them start investing and build wealth.

While greater access to financial services is, of course, a positive thing, it comes at a cost. Namely: Simplicity. The models that guide how many robo-advisors build and manage portfolios tend to be fairly simple.

During the years since the end of the Financial Crisis—years embodied by low inflation, low interest rates, and one of the strongest equity bull markets in American history—this simplicity was fine. Robo-advisor portfolios enjoyed strong returns.

But as we enter a new, still-undefined era of financial policy, macroeconomic turmoil, and geopolitical uncertainty, this simplicity may not cut it anymore. In fact, here at Allio we believe that the traditionally popular strategies currently employed by most robo-advisors will diminish in effectiveness in this new environment.

Below is a look at the key reasons we believe this to be the case.

A Lack of Real Diversification

If you were to look at the portfolios offered by any of the major robo-advisors, you’d see that they consist mostly of just two asset classes: Stocks and bonds. The more conservative portfolios hold a higher percentage of bonds, the more aggressive portfolios hold a higher percentage of stocks. (Those that fall in between tend to skew pretty close to the popular 60/40 portfolio that consists of 60 percent stocks and 40 percent bonds.)

On the surface, it would appear that these portfolios offer adequate diversification depending on your risk tolerance as an investor. After all, stocks and bonds are what most people think of when they think about investing, and portfolios consisting of these assets have performed well for decades.

But it’s important to recognize that past performance does not necessarily translate into future returns. In fact, many financial professionals believe that, despite this history of strong performance, a portfolio consisting only of stocks and bonds is going to have a difficult time generating positive real returns in the coming decade, especially if high inflation remains “sticky.”

One major recent shift in market behavior relates to how stocks and bonds move with respect to one another. From 2000-2020, stocks and bonds had negative monthly correlations. That is, when stocks were up, bonds tended to be down and vice versa. This provided investors with some diversification to weather market fluctuations.

Since the bottom of the March 2020 pandemic selloff, however, the correlation between stocks and bonds has been positive. This means that when inflation gets hot, both stocks and bonds sell off; and when inflation eases, stocks and bonds both rise. Where's the diversification?

Worst of all, we believe this is a characteristic that will persist for years. U.S. stocks are priced to return perhaps as little as 1 percent annualized over the next 10 years, and bond yields are still fairly low. Hence, there's not much (sustainable) upside for either stocks or bonds if the Fed has to raise interest rates in an attempt to quell inflation. This means that a portfolio of only U.S. stocks and bonds has the very real possibility of going nowhere for the next decade.

The same might not be true for other asset classes, however. Real estate, commodities, emerging market stocks, precious metals, and digital assets offer investors additional avenues to increase diversification and generate yield—particularly during times of high inflation. The problem is that most robo-advisors do not offer comprehensive exposure to these assets. This means that investors must either open separate accounts elsewhere in order to gain exposure to these asset classes, or else capitulate to accepting a portfolio consisting only of stocks and bonds.

Here at Allio, we recognize the importance of these alternative asset classes and have constructed our portfolios in a way that allows for responsible exposure to them.

Full-scale Optimization vs Mean-Variance Optimization

Most robo-advisors leverage something called mean-variance optimization (MVO) in constructing their investment portfolios. What this means is that they seek to maximize the tradeoff between the portfolio’s expected return and its volatility.

Mean-variance optimization assumes that returns are normally distributed, as you might see in a bell curve like the one below.

But in the world of finance, distributions of asset returns are not normal. When plotted in a chart like the one above, they have what are known as “fat tails.” That’s because there is a higher probability of large losses and large gains than a normal distribution would predict, given a certain level of volatility.

With this in mind, using mean-variance optimization to construct an investment portfolio means that an advisor either doesn’t believe that the market has fat tails—or worse, that they know but simply do not care.

Full-scale optimization (FSO), on the other hand, is a relatively recent advancement in portfolio optimization techniques. Instead of waving away the idea of fat tails, full-scale optimization embraces the entire distribution of returns in order to construct a portfolio that is typically more robust to various downside possibilities compared to portfolios constructed using mean-variance optimization.

Studies have shown that portfolios built using full-scale optimization outperform those built using mean-variance optimization a large percentage of the time.

Here at Allio, we favor full-scale optimization in the construction of our portfolios, in conjunction with a very robust and comprehensive set of simulated market scenarios.

Instead of simply using historical correlations from one long time history—where any interesting asset behavior gets washed away in the averaging process—we use correlations over many different sub-samples of our time history and generate realizations of returns that have characteristics corresponding to each of those respective sub-samples. This allows us to capture and incorporate any atypical asset behavior and generate an overall distribution of returns that has fat tails.

Additionally, we are keenly aware of the fact that asset class correlations have shifted dramatically since the day the market bottomed on March 24, 2020 during the COVID-19 selloff. We’ve taken steps to incorporate these shifts into our portfolio construction process as well.

Poor Values-Based Investing

Many modern investors would like their investment strategy to align with their personal values and beliefs. They want to invest in companies with environmentally-friendly and socially-conscious business practices, while avoiding companies that have poor track records in that regard. In recent years, this practice has been called ESG investing or values-based investing, among other names.

Some robo-advisors seeking to appeal to this new crop of environmentally- and socially-minded investors have designed “ESG portfolios.” While this sounds good in theory, once again the simplicity of how most robo-advisors operate is sub-optimal.

In order to design ESG-friendly investment portfolios en masse, most robo-advisors rely on ESG scores provided by outside, third-party agencies. These agencies evaluate companies on their environmental, social, and governance-related policies so that investors (and advisors) don’t have to do the work themselves.

Unfortunately, as ESG and values-based investing have become more popular in recent years, many companies have found ways to game the system to inflate their ESG scores—a practice known as greenwashing. The result is essentially a defanged form of values-based investing where nobody really wins.

To counter this trend, Allio has embraced values-based investing over ESG investing. By selecting which values matter most to them, clients can add to their portfolios ETFs designed to align with those particular beliefs.

There’s a Better Way

In the past decade, robo-advisors have had a real, positive impact on the finances of millions of Americans by making it easier to start investing—and at reasonable fees compared to traditional advisors. This was made easier by the fact that we were enjoying one of the longest bull markets in history.

But as we enter a post-pandemic world, we are witnessing the emergence of a new macroeconomic reality, one of rising inflation and rising interest rates—a reality that seems destined to persist for years. If so, this means the playbook most robo-advisors have relied on simply isn’t going to cut it in the coming years.

Would you like to learn more about how we’ve designed our portfolios to account for this new reality with exposure to asset classes outside the typical stocks and bonds? Maybe you’re curious about our unique approach to values-based investing that goes beyond ESG scores gamed by Wall Street to the point of farce? Or maybe you merely want to explore a better robo-advisor option?

Robo-advisors rely upon automation and algorithms to provide investment management services to their clients and users. They first came into existence during the 2007-2009 Financial Crisis, and have proliferated in the years since.

The rise of robo-advisors has led to real and positive changes for millions of Americans. By automating the tedious and complicated process of portfolio construction, management, and rebalancing, robo-advisors are able to get by while charging much lower fees than traditional financial advisors. This means more people have access to tools and strategies that can help them start investing and build wealth.

While greater access to financial services is, of course, a positive thing, it comes at a cost. Namely: Simplicity. The models that guide how many robo-advisors build and manage portfolios tend to be fairly simple.

During the years since the end of the Financial Crisis—years embodied by low inflation, low interest rates, and one of the strongest equity bull markets in American history—this simplicity was fine. Robo-advisor portfolios enjoyed strong returns.

But as we enter a new, still-undefined era of financial policy, macroeconomic turmoil, and geopolitical uncertainty, this simplicity may not cut it anymore. In fact, here at Allio we believe that the traditionally popular strategies currently employed by most robo-advisors will diminish in effectiveness in this new environment.

Below is a look at the key reasons we believe this to be the case.

A Lack of Real Diversification

If you were to look at the portfolios offered by any of the major robo-advisors, you’d see that they consist mostly of just two asset classes: Stocks and bonds. The more conservative portfolios hold a higher percentage of bonds, the more aggressive portfolios hold a higher percentage of stocks. (Those that fall in between tend to skew pretty close to the popular 60/40 portfolio that consists of 60 percent stocks and 40 percent bonds.)

On the surface, it would appear that these portfolios offer adequate diversification depending on your risk tolerance as an investor. After all, stocks and bonds are what most people think of when they think about investing, and portfolios consisting of these assets have performed well for decades.

But it’s important to recognize that past performance does not necessarily translate into future returns. In fact, many financial professionals believe that, despite this history of strong performance, a portfolio consisting only of stocks and bonds is going to have a difficult time generating positive real returns in the coming decade, especially if high inflation remains “sticky.”

One major recent shift in market behavior relates to how stocks and bonds move with respect to one another. From 2000-2020, stocks and bonds had negative monthly correlations. That is, when stocks were up, bonds tended to be down and vice versa. This provided investors with some diversification to weather market fluctuations.

Since the bottom of the March 2020 pandemic selloff, however, the correlation between stocks and bonds has been positive. This means that when inflation gets hot, both stocks and bonds sell off; and when inflation eases, stocks and bonds both rise. Where's the diversification?

Worst of all, we believe this is a characteristic that will persist for years. U.S. stocks are priced to return perhaps as little as 1 percent annualized over the next 10 years, and bond yields are still fairly low. Hence, there's not much (sustainable) upside for either stocks or bonds if the Fed has to raise interest rates in an attempt to quell inflation. This means that a portfolio of only U.S. stocks and bonds has the very real possibility of going nowhere for the next decade.

The same might not be true for other asset classes, however. Real estate, commodities, emerging market stocks, precious metals, and digital assets offer investors additional avenues to increase diversification and generate yield—particularly during times of high inflation. The problem is that most robo-advisors do not offer comprehensive exposure to these assets. This means that investors must either open separate accounts elsewhere in order to gain exposure to these asset classes, or else capitulate to accepting a portfolio consisting only of stocks and bonds.

Here at Allio, we recognize the importance of these alternative asset classes and have constructed our portfolios in a way that allows for responsible exposure to them.

Full-scale Optimization vs Mean-Variance Optimization

Most robo-advisors leverage something called mean-variance optimization (MVO) in constructing their investment portfolios. What this means is that they seek to maximize the tradeoff between the portfolio’s expected return and its volatility.

Mean-variance optimization assumes that returns are normally distributed, as you might see in a bell curve like the one below.

But in the world of finance, distributions of asset returns are not normal. When plotted in a chart like the one above, they have what are known as “fat tails.” That’s because there is a higher probability of large losses and large gains than a normal distribution would predict, given a certain level of volatility.

With this in mind, using mean-variance optimization to construct an investment portfolio means that an advisor either doesn’t believe that the market has fat tails—or worse, that they know but simply do not care.

Full-scale optimization (FSO), on the other hand, is a relatively recent advancement in portfolio optimization techniques. Instead of waving away the idea of fat tails, full-scale optimization embraces the entire distribution of returns in order to construct a portfolio that is typically more robust to various downside possibilities compared to portfolios constructed using mean-variance optimization.

Studies have shown that portfolios built using full-scale optimization outperform those built using mean-variance optimization a large percentage of the time.

Here at Allio, we favor full-scale optimization in the construction of our portfolios, in conjunction with a very robust and comprehensive set of simulated market scenarios.

Instead of simply using historical correlations from one long time history—where any interesting asset behavior gets washed away in the averaging process—we use correlations over many different sub-samples of our time history and generate realizations of returns that have characteristics corresponding to each of those respective sub-samples. This allows us to capture and incorporate any atypical asset behavior and generate an overall distribution of returns that has fat tails.

Additionally, we are keenly aware of the fact that asset class correlations have shifted dramatically since the day the market bottomed on March 24, 2020 during the COVID-19 selloff. We’ve taken steps to incorporate these shifts into our portfolio construction process as well.

Poor Values-Based Investing

Many modern investors would like their investment strategy to align with their personal values and beliefs. They want to invest in companies with environmentally-friendly and socially-conscious business practices, while avoiding companies that have poor track records in that regard. In recent years, this practice has been called ESG investing or values-based investing, among other names.

Some robo-advisors seeking to appeal to this new crop of environmentally- and socially-minded investors have designed “ESG portfolios.” While this sounds good in theory, once again the simplicity of how most robo-advisors operate is sub-optimal.

In order to design ESG-friendly investment portfolios en masse, most robo-advisors rely on ESG scores provided by outside, third-party agencies. These agencies evaluate companies on their environmental, social, and governance-related policies so that investors (and advisors) don’t have to do the work themselves.

Unfortunately, as ESG and values-based investing have become more popular in recent years, many companies have found ways to game the system to inflate their ESG scores—a practice known as greenwashing. The result is essentially a defanged form of values-based investing where nobody really wins.

To counter this trend, Allio has embraced values-based investing over ESG investing. By selecting which values matter most to them, clients can add to their portfolios ETFs designed to align with those particular beliefs.

There’s a Better Way

In the past decade, robo-advisors have had a real, positive impact on the finances of millions of Americans by making it easier to start investing—and at reasonable fees compared to traditional advisors. This was made easier by the fact that we were enjoying one of the longest bull markets in history.

But as we enter a post-pandemic world, we are witnessing the emergence of a new macroeconomic reality, one of rising inflation and rising interest rates—a reality that seems destined to persist for years. If so, this means the playbook most robo-advisors have relied on simply isn’t going to cut it in the coming years.

Would you like to learn more about how we’ve designed our portfolios to account for this new reality with exposure to asset classes outside the typical stocks and bonds? Maybe you’re curious about our unique approach to values-based investing that goes beyond ESG scores gamed by Wall Street to the point of farce? Or maybe you merely want to explore a better robo-advisor option?

Whether you’re seeking an expert team to manage your money or looking to build your own portfolios with the best financial technology available, Allio can help. Head to the app store and download Allio today!

Related Articles

Mike Zaccardi, CFA, CMT

ETF Investment Guide: Your Roadmap to Building a Diverse and Profitable Portfolio

Explore the world of ETF investing with our comprehensive guide. Learn key strategies, terms, and tax considerations for successful portfolio management.

Mike Zaccardi, CFA, CMT

CAPM Formula Explained: Navigating the Relationship Between Risk and Return

Discover the power of CAPM in investment decisions. Learn the formula, calculate expected returns, and explore alternatives in modern portfolio management.

Mike Zaccardi, CFA, CMT

How To Build Wealth with Dividend Stocks: A Complete Guide to Smart Investing

Learn how to invest in dividends – our comprehensive guide covers strategies, risks, and the key to achieving stable financial returns.

Mike Zaccardi, CFA, CMT

ETF Investment Guide: Your Roadmap to Building a Diverse and Profitable Portfolio

Explore the world of ETF investing with our comprehensive guide. Learn key strategies, terms, and tax considerations for successful portfolio management.

Mike Zaccardi, CFA, CMT

CAPM Formula Explained: Navigating the Relationship Between Risk and Return

Discover the power of CAPM in investment decisions. Learn the formula, calculate expected returns, and explore alternatives in modern portfolio management.

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.