Updated August 19, 2023

Mike Zaccardi, CFA, CMT

Macro Money Monitor

The home affordability landscape has changed dramatically for the worse in the last few years. For years, a lid was kept on interest rates by the Federal Reserve which promoted prospective home buyers to take on copious amounts of debt at relatively modest borrowing rates. In fact, by the end of 2021, the average 30-year fixed rate mortgage fell to record lows as calmness in the bond market, tame inflation, and the Fed’s ongoing push to prevent spikes in yields all helped the housing market.

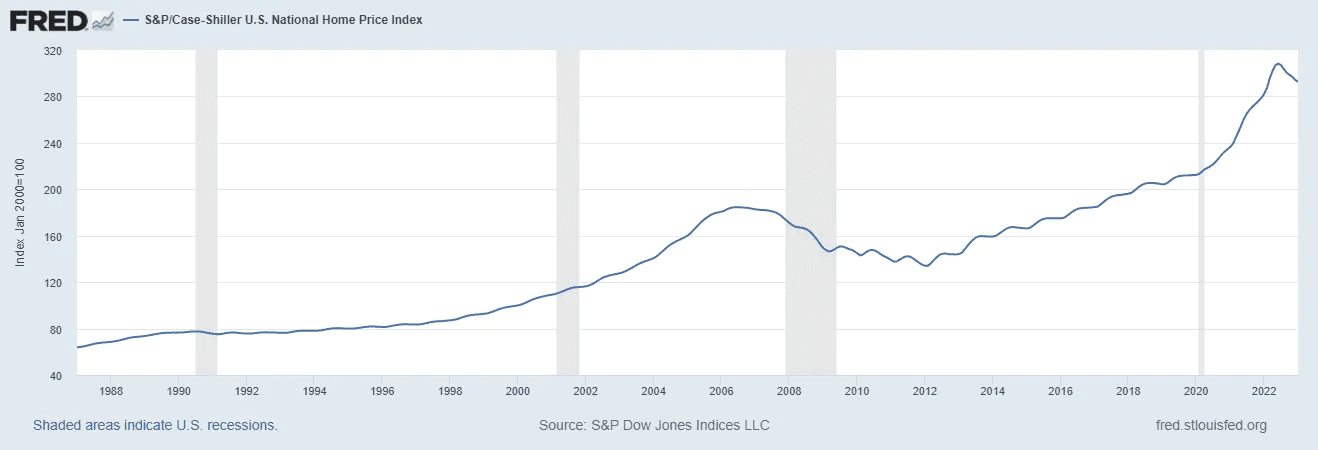

Following the pandemic, real estate prices across the country and the world spiked. There’s a key barometer that tracks home values spanning the largest metro markets. The S&P/Case-Schiller U.S. National Home Price Index surged from 213 in early 2020 to an all-time high of 308 by June 2022. In just over two years, the typical American family home gained nearly 50% in value.

S&P/Case-Shiller U.S. National Home Price Index: Near All-Time Highs

Source: St. Louis Federal Reserve

Back in 2021 and 2022 as the economy re-opened, it was commonplace for homeowners to swipe into the Zillow app to check on the latest “Zestimate” of their property. Much like meme stock mania, seeing rising prices was an instant dopamine hit. Sure enough, as the Fed began to lift interest rates during the second quarter of 2022 and beyond, house prices tumbled. They remain historically high, though, when compared to median family incomes.

The Winners and Losers

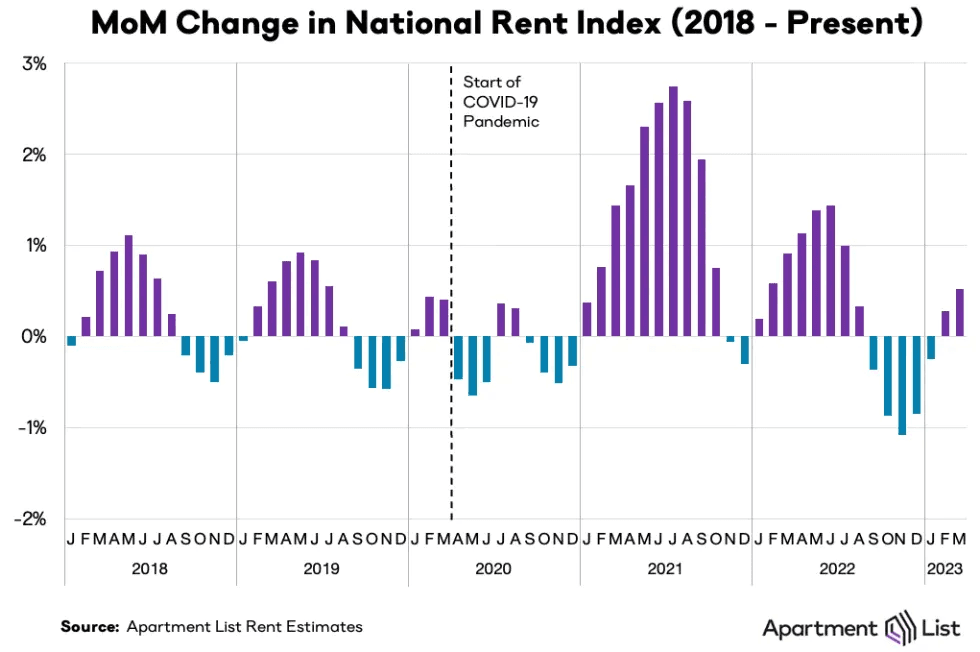

Renters and much of Gen Z were left on the sidelines from the epic housing bull market. They were faced with increasingly steep monthly payments as inflation surged to four-decade highs. According to Apartment List, 2021 and the first half of 2022 featured some of the largest monthly increases in apartment rental prices in history.

So, the world became bifurcated with the “haves” being those who locked in a mortgage rate under 4% while the “have nots” were new homeowners saddled with a high borrowing rate (who also bought near the top of the market) as well as renters forced to dole out more cash to landlords. A recent downtick in the National Rent Index is welcomed, but the damage has been done.

Apartment List National Rent Index: Record Monthly Price Climbs in 2021

Source: Apartment List

So, what’s the solution? Should young people keep renting, hoping for a sustained move lower in home values and a fall in mortgage rates? Or is it better to just bite the bullet and real estate at these high prices with borrowing rates more than double what they were in late 2021? It’s a tough call. Rising inflation, higher rates, and mercurial markets writ large make saving for home ownership harder than ever for Gen Z.

Gen Z Has Time on Their Side

At Allio, we still feel the benefits of long-term home ownership outweigh the near-term pain of shelling out such a large down payment with high interest costs, but also waiting in the short run for rates and home prices to fall might be the prudent play. Consider that if you remain in your home for, say, a decade or more, then you can spread out a chunk of those expenses over a longer timeframe.

Also, while today’s 7% mortgage rates are painful to stomach, should lower interest rates come about at any time in the years ahead, there is always the option to refinance to reduce your interest rate. Finally, time is on the side of homeowners since you gain more equity via your monthly payments as the mortgage ages.

Rent Prices: Only Going Higher

And one thing is for sure about the price of renting – it will always trend up. While there have been a few months lately that featured a drop in the Apartment List National Rent Index, longer-term data show that the cost of renting rises over time just as home prices steadily increase. You can be on the winning side of the ledger or remain a renter who bares that higher cost over the years and decades. Our view is that owning, particularly for young people who have so many years and decades ahead of them, will yield greater long-term benefits so long as you have the right plan.

Staying Put Can Help Reduce Costs

A key thing is not to move frequently as the transaction costs of real estate can be steep. While the buyer typically pays for closing costs, the seller should set aside at least 5% of the value of the property to cover items such as real estate agent & attorney fees, title costs, and other administrative expenses. Picking up and moving across the city or country every few years will harm your long-run net return on home ownership versus renting.

Is Remote Work an Option for You?

The nature of today’s job market makes it difficult to stay in one spot. Wage growth data from the Federal Reserve Bank of Atlanta prove that so-called job-switchers earn higher annual pay raises compared with job-stayers. Thus, there might be an opportunity cost to settling to remain at your current employer so that you don’t have to move. The upside for many white-collar tech workers is that remote jobs are more plentiful than ever. If you are fortunate enough to have the work-from-home option permanently, then you’re in a prime position to build wealth through homeownership.

Want a Fat Raise? Find New Work.

Source: Federal Reserve Bank of Atlanta

Gen Z: Striving to Become Homeowners

But before you snatch the keys from the real estate agent and settle into your new digs, saving for a down payment is priority one. It’s no easy task these days with the cost of living going through the roof since the onset of the pandemic and as volatility rattles the stock and bond markets alike. But Gen Z is a data-driven, ambitious group compared to other generations. They have seen the ups and downs of markets, and recognize that renting is tantamount to making property owners rich.

We find people in their 20s desire financial independence through saving right, paying off debt, and home ownership. To prove that, a poll conducted by YouGov revealed that the majority of Gen Z, 59%, view being a homeowner as a sign of financial success. Saving enough for an ample down payment is the first step.

Going About Saving for Your First Home

Building a down payment fund is easier than you might think. All you must do is set aside a reasonable percentage of your take-home pay into a low-risk investment account. For instance, if you and your spouse both have $80,000 salaries, and you devote 10% of the after-tax amount, then you’ll be stashing away about $11,000 per year into your down payment bucket. Ten percent down on a $300,000 home can be hit within three years. Moreover, once you reach 20% of equity, then you can avoid that pesky private mortgage insurance (PMI) expense.

A Disciplined Saving Mindset

You’ll want to hold that money in a low-risk investment such as a short-term Treasury exchange-traded fund (ETF), an FDIC-insured high-yield online savings account, or a prime money market fund. The advantage today is that you can finally earn some interest on cash and Treasury bills. Some young and ambitious prospective home buyers got caught up in the meme stock mania of early 2021 or the broader bull market by holding money for near-term needs in a basic stock index fund. That proved perilous as volatility soon struck and a bear market ensued in 2022.

Thus, staying disciplined with your home-buying strategy is mission-critical. And part of that strategy is shoring up your credit score. As your down payment fund swells, be sure to keep your total debt in check and never miss a credit card or auto loan payment. The higher your credit score, the better your mortgage rate will be when you go to lock it in.

Leverage the Bucketing Strategy

Hitting your down payment number can be fast-tracked by allocating windfalls from bonuses and your tax refund to that savings account as well. In personal finance parlance, this is known as the “bucketing strategy” whereby you consider different expense and savings categories on their own. Of course, you can still analyze your portfolio as a whole when assessing your overall net worth. But studies show that the bucketing method helps people hit specific financial goals sooner. You might also want to check out Allio’s “starve and stack” method for saving and investing.

Where Allio Stands

There’s a time for renting and an appropriate time to buy. Right now, waiting for rates to retreat and home values to subside could be a wise play. Between now and then, investing in yourself through education or going the extra mile at the office to score a promotion at work could set you up well for home buying success later when macro conditions turn more favorable. Long term, the safest bet is to own since land is finite and people will always need shelter.

The Bottom Line

Gen Z has hurdles to overcome if they want to become homeowners. High inflation, mortgage rates that have shot up in recent years, and volatile markets all make saving for home ownership a major challenge considering all the other costs of everyday living. Owning still beats renting over the long haul, however. There are steps and strategies Gen Z can take to build a home down payment fund so that they can get one step closer to financial independence.

Allio believes that Gen Z has the know-how and drive to become homeowners even amid so many macro challenges. Saving and investing for home ownership can be done with the help of Allio’s experienced team of hedge fund veterans.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.