Updated October 23, 2023

Bill Chen, CFA

Personal Finance

Budgeting is one of the most powerful tools available to help us reach our financial goals. That’s because it forces us to think about our goals, to understand our spending, and to reevaluate our relationship with money.

But “budgeting” doesn’t mean the same thing to everyone. There are literally dozens of budgeting strategies and philosophies, each with their own pros and cons.

With this in mind, we thought that it would be helpful to outline some of the most popular budgeting strategies from both the United States and around the world. Our hope is that one of these techniques will resonate with you and inspire you to take the first crucial steps and start saving.

1. 50/30/20 Rule

The 50/30/20 rule is a popular budgeting strategy in the United States, which became well known after Senator Elizabeth Warren featured it in her book All Your Worth: The Ultimate Lifetime Money Plan. In essence, the rule is a guideline to help you think about how you allocate your after-tax take-home pay for various uses.

According to the rule, no more than 50% of your income should be dedicated to covering your needs, which includes things like food, shelter, fuel, medications, and virtually anything else required for survival. No more than 30% of your income should be dedicated to paying for your wants, which are optional expenses like a meal at a restaurant or a new outfit. The final 20% of your income should be dedicated toward your financial goals, whether that be paying down debt or saving and investing.

The 50/30/20 rule is often lauded as being a very simple budgeting framework, because of how it dictates the way that money should be spent, and due to the fact that it builds a 20% savings rate directly into the budget. If someone using the rule determines that they are spending too much money on their needs, they’re encouraged to find ways of reducing these (typically) recurring costs. Likewise, if someone finds they’re overindulging on their wants, they’re encouraged to find a way to cut back.

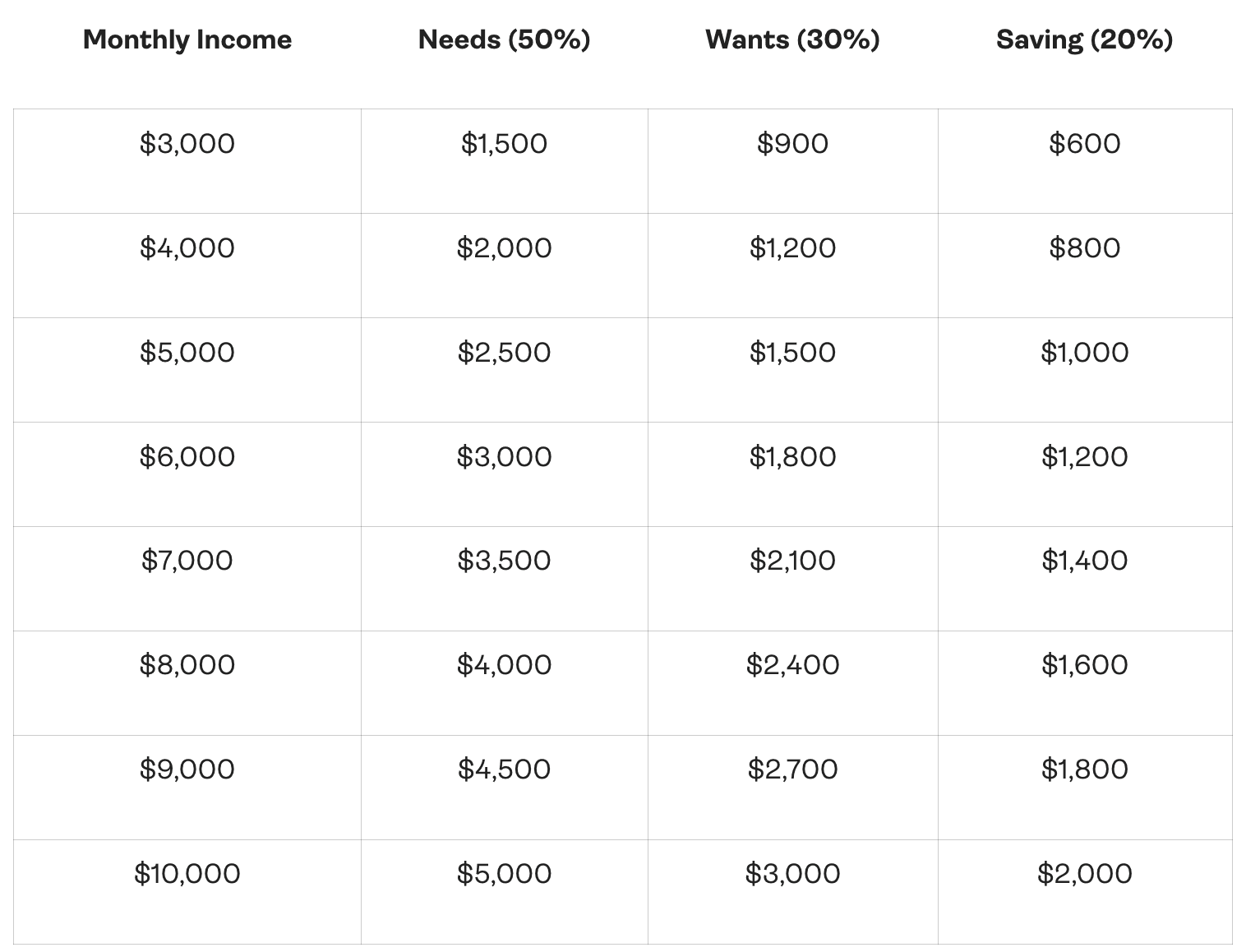

The table below shows what these percentages might look like for a range of monthly incomes. You can use it to very quickly see how much money you could dedicate to your needs, wants, and savings if you were to follow the 50/30/20 rule.

With this in mind, imagine that you fall within the $4,000 per month income bracket. If you followed the 50/30/20 rule, you would have $2,000 per month allocated to your needs, $1,200 to your wants, and $800 to your savings.

As you start tracking your expenses, you come to realize that you are actually spending an average of $2,200 per month on your needs, and $1,400 per month on your wants, leaving you with only $400 to dedicate to your savings. Armed with this information, you can now look for ways to reduce your expenses—for example, by lowering your utilities bill, moving into a cheaper apartment, cutting out unused subscriptions, etc.

2. Kakeibo

Kakeibo is a Japanese budgeting strategy that was originally popularized by Japanese housewives who were traditionally responsible for managing their household’s expenses. It works like this:

First, you determine how much money you have available to spend each month.

Next, you set yourself a monthly savings goal.

Then, you track your expenses for the month.

At the end of the month, you reflect on your performance and consider ways that you can improve in the month ahead.

Kakeibo can be an effective means of budgeting for a number of reasons. First, it forces you to sit down and think about your savings goals on a monthly basis. This makes sure that you’re always starting off each month with that goal in mind. Additionally, by breaking down long-term financial goals into smaller, monthly goals, they become less intimidating.

The way that Kakeibo treats expenses is also unique. That’s because expenses are grouped into four main categories (needs, wants, cultural expenses, and unexpected expenses). This makes it easier for you to look at your spending habits and find areas to improve and save in the month ahead.

Importantly, Kakeibo does not dictate how much money you should be spending each month on any given category of expenses. This sets it apart from the 50/30/20 rule outlined above, which sets precise percentages for each category. Instead, Kakeibo allows for flexibility. As long as you are reaching your monthly savings goal, how and where you spend the rest of your money doesn’t matter.

For example, let’s consider two individuals, each of which has a monthly income of $3,000. They each currently spend their money in exactly the same way: $1,800 per month on their needs, $1,000 per month on their wants, and $200 per month on cultural experiences—leaving no money for savings.

Now, let’s imagine that they each set a savings goal of saving $300 per month. Person A chooses to achieve this by moving into a cheaper apartment, cutting $300 per month from how much she spends on her needs. Person B, on the other hand, decides that he likes his apartment. He chooses to unsubscribe from a number of unused subscriptions, while cutting back on takeout. This allows him to cut $300 from how much he spends on his wants.

In the end, they’re both successful, even though they took different routes to get there. That’s thanks to the flexibility that Kakeibo offers.

3. Zero-Based Budgeting

Zero-based budgeting is a budgeting strategy popular in the United States and touted by many financial professionals, with perhaps the most well-known being Dave Ramsey.

The main goal of zero-based budgeting is to ensure that you give a job to every single dollar that you have at your disposal. If it’s not going to a specific purchase or expense, then it should be going toward your other financial goals like building an emergency fund, paying down your debts, or investing for the future. What it shouldn’t do is just sit there in your checking account, where you might be tempted to spend it on a purchase that you don’t really want or need.

With this in mind, to use the zero-based budgeting technique, you would sit down each month and tally your income. Next, you would subtract your known or fixed expenses—things like rent, utilities, debt servicing, etc. After that, you would allocate money specifically for your financial goals. The remainder can either be spent on things that you enjoy but don’t need or else reallocated to your savings goals.

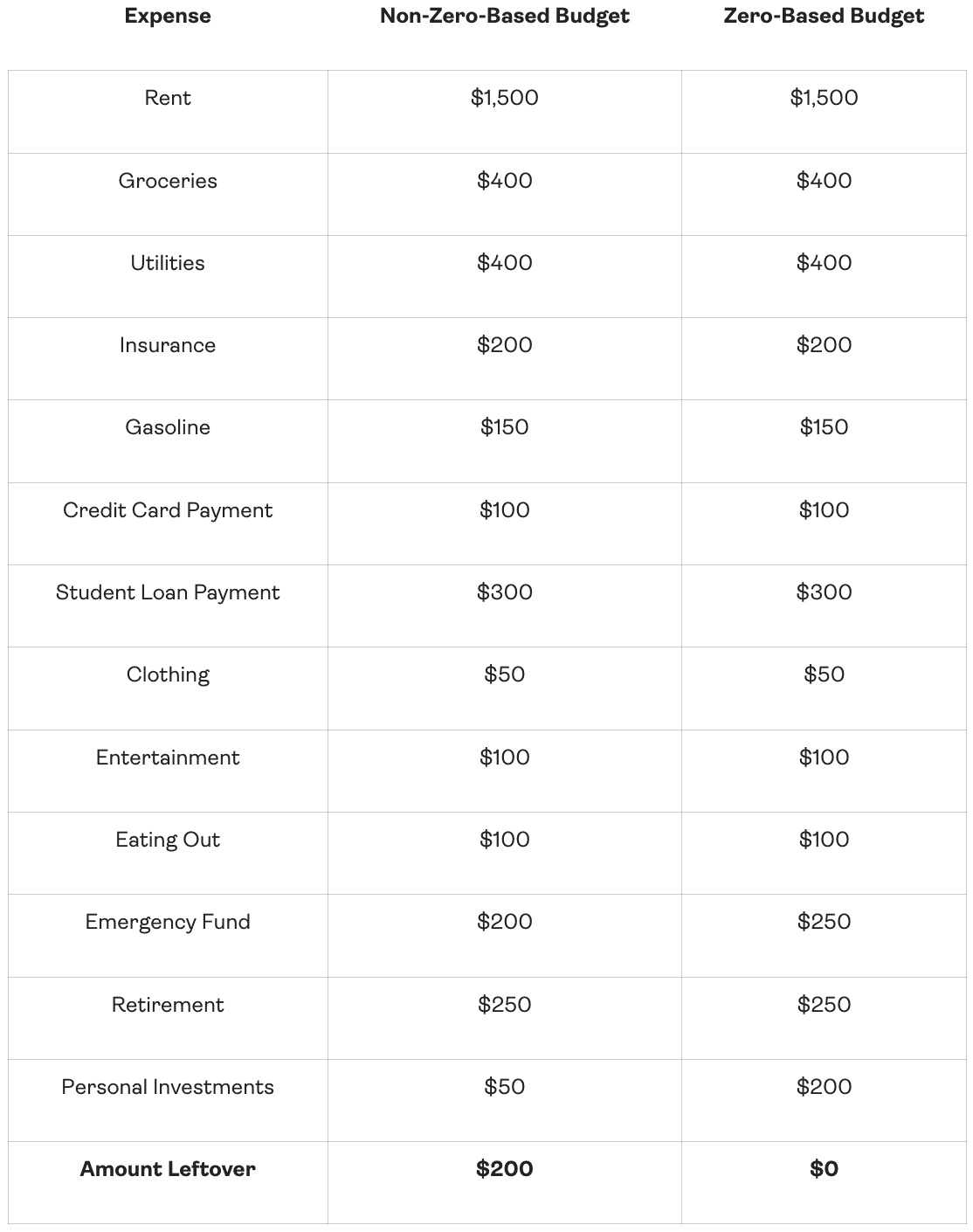

Below is a table showing both a zero-based budget and a non-zero-based budget for someone who has a monthly income of $4,000. The second column shows a budget with “unassigned funds” in need of a job to do. The third column shows a new budget with that money put to work.

As you can see, in the non-zero-based budget, there was an extra $200 each month sitting idle, without a job to do. This increases the chances of that money being spent. Instead of letting it sit idle, the zero-based budget reallocates that money toward other goals: An extra $50 per month into the person’s emergency fund, and an extra $150 per month into the person’s personal investments.

4. Paisa Vasool

Paisa vasool is a Hindi phrase that roughly translates into “value for money,” very similar to the English phrase “getting the biggest bang for your buck.” It’s all about asking yourself: Is this purchase really necessary? Is it worth the money that I am about to spend on it? With this in mind, Paisa vasool is less a budgeting strategy or saving technique than it is a general mindset that many people in India use to guide their relationship with money and spending.

Paisa vasool doesn’t discourage you from spending money on the things that you want or need. It simply encourages you to make sure that you’re actually getting your money’s worth when you do fork over your hard-earned cash. It also encourages you to think about each purchase you make, and as such inserts a little extra bit of friction that might prevent you from making a purchase that won’t actually bring value into your life.

Not sure how to decide if a purchase is worth the money? One very effective strategy is to determine how many hours it would take for you to earn the amount of money that you are about to spend. Then, you can ask yourself: “Am I willing to trade X hours of my life for this purchase?”

For example, imagine that you make $20 per hour after taxes and you are considering purchasing a $500 dress. In this scenario, you would essentially be trading 25 hours of your life for the dress. If this is a dress that you will wear just once, you might reconsider whether or not it is actually worth it; on the other hand, if it is something that you will wear dozens of times and which will bring you substantial joy each time you do wear it, you might consider it a fair trade.

Whether or not a purchase is a fair trade is a personal decision that only you can make—but it’s an important one that you should at least consider. You might surprise yourself by how many purchases you are no longer okay with once you have made the connection between your time and your money.

5. Starve & Stack

Starve and stack is a saving and budgeting strategy used around the world, especially by adherents of the FI/RE (financial independence/retire early) movement. It specifically applies to individuals or couples who have two income streams. Practitioners are encouraged to use one income stream to cover their living expenses, and to dedicate the second income stream entirely to achieving their financial goals.

Because the strategy forces an individual to severely cut back their spending (at least in relation to their income) it requires a large amount of discipline. That being said, it can be an incredibly powerful tool capable of jumpstarting your savings or investment portfolio. Even a single year under the Starve and Stack method can translate into tens of thousands of extra dollars saved and put to work where they can grow and compound over time.

For example, let’s imagine a recently married couple. One partner earns an annual salary of $75,000 per year after taxes, while the other earns $60,000. Now imagine that they want to jumpstart their savings by following the starve and stack model for five years. They do this by living off of the higher salary ($75,000 per year) while investing the lower salary.

If their investments earned an average annual return of 6%, then after five years they would have accumulated $348,850. If they kept that money invested in the market for another 35 years earning an average 6% per year, then by the time they were retirement age their portfolio would be worth $2,833,901—all without ever investing another penny.

The magic of the starve and stack method lies in its aggressive nature. By significantly cutting back on your expenses for a few years when you are younger, you empower yourself to save a significant amount of money at an early age. This gives that money much more time in the market, where it can work its magic.

Sticking to Your Budget

As you consider which budgeting strategy might work best for you, it’s also important to consider how you might stick to your budget once you get started.

Perhaps most importantly, you should make sure that you are setting yourself a realistic savings goal when you sit down to create your budget. While it’s important to choose a goal that is challenging, you also want to choose one that is achievable. Getting too aggressive with your goals and budgeting could lead to burnout, making it harder to stick with your budget over the long haul.

Beyond this, it’s important to be consistent, especially in tracking your expenses. Budgeting, at its heart, is about understanding your relationship with spending and money. By tracking your spending, you allow yourself to understand where your money goes each month. These insights will empower you to find ways to improve and make behavioral changes that enable you to stick with your budget as you work toward your various financial goals. But that only works if you are consistent; if you only track some of your expenses some of the time, you’re not allowing your budget to really work its magic.

Finally, consider leveraging technology and automation to make sticking to your budget easier. You can, for example, opt into autopay for recurring expenses, making it less likely that you will forget about an important bill and fall behind on payments. Likewise, you can automate your savings efforts by setting up a recurring transfer between your checking account and your various savings and investment accounts. The less you need to make the active decision to save, the fewer chances you give yourself to reconsider and miss your goals.

Making Your Budget Work for You

Allio is here with the tools you need to work toward your financial goals no matter how you choose to budget. Once you know how much money you have in your budget to dedicate to savings, simply set up a recurring investment to automatically transfer money into an expertly-designed, properly-diversified portfolio.

More of a spender? Turn on round-ups to automatically invest while you spend. Allio’s holistic account integration allows you to track all of your finances, while setting goals, automatically deducting a percentage of your savings towards a down payment on a home or car, an rainy day fund or whatever you decide it should be saved towards.

Whether you’re seeking an expert team to manage your money or looking to build your own portfolios with the best financial technology available, Allio can help. Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.