Updated November 2, 2023

Bill Chen, CFA

Personal Finance

The U.S. Federal Reserve remains steadfast in its mission to squash inflation. The Consumer Price Index (CPI) reveals just how much the costs of everyday life are on the rise. For much of 2022, the inflation rate hovered near four-decade highs as the economy worked through trillions of dollars of stimulus measures—both monetary and fiscal—that were shoveled into the system during and shortly after the pandemic. That was great for asset prices, like stocks and bonds in 2020 and 2021, but it meant paltry returns on your typical savings account.

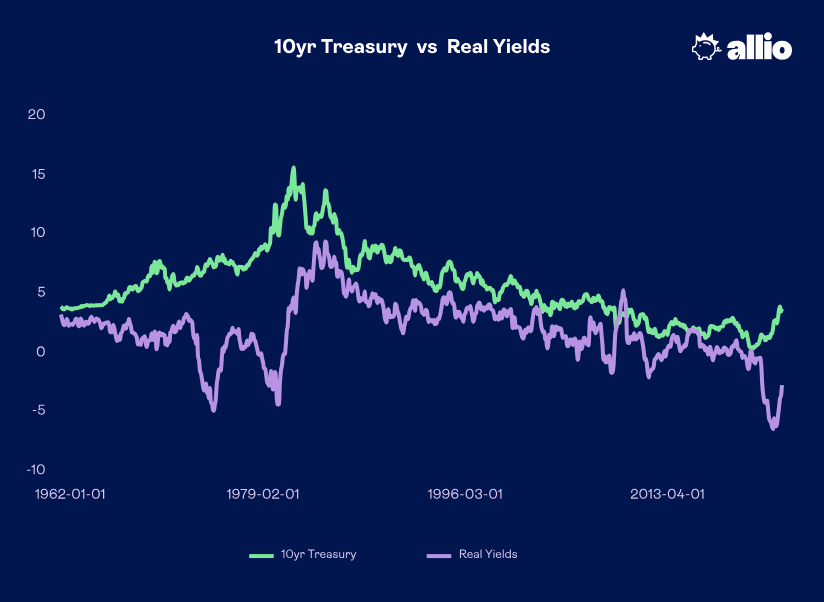

So-called “real” savings account yields, the net returns after inflation was taken into account, fell to some of the lowest levels in history. Even the benchmark U.S. 10-year Treasury rate dropped to –5% at times last year after inflation was considered. Gone were the days of earning a few percentage points above the annual CPI rate on bonds and short-term savings accounts. But are things different today? Is the era of super-low real savings account yields behind us? We don’t think so.

Real Bond Returns Still Sharply Negative

Consider that the last time the U.S. economy experienced inflation like we have seen lately, it was not a singular event. Most investors in 2023 have no idea what a sustained inflationary environment actually looks like and, more importantly, what it feels like. You have to go back to the 1970s. Talk to your parents or grandparents about how tough life was like back then. Long lines at the gas station, grocery prices that moved higher on a weekly basis, wages that were on the increase—if you managed to keep your job! The decade was fraught with recessions and bear markets.

The volatility and uneasiness of the ‘70s began with the end of a massive bull market in the late 1960s. Following the Great Depression and World War II, America was ready for a peaceful time focused on family and stability. Stocks rose sharply, seemingly year after year, in the 1950s through much of the following decade. Inflation was also generally steady. That ended once the ‘70s came about.

Annual inflation started to soar in 1971 from near 3% to a peak of 12% by early 1974—not unlike what we experienced from 2020 through mid-2022. Folks felt better, though, in the latter part of ‘74 through early 1976 when the annual rise in consumer prices retreated swiftly to just above 4%. The Fed’s policymakers likely felt a sense of accomplishment that the spike higher in CPI was transitory (to use an infamous Fed term). That was not the case. Inflation went on to make a new high by the end of the decade. It took a sharp recession induced by then Fed Chairman Paul Volcker to put the final kibosh on what was a devastating era of dwindling purchasing power of cash.

Inflation Could Rear Its Ugly Head Again

What does all that have to do with today? The parallels are there. And it could mean bad news for your savings account. Parking money even in a high-yield online bank or competitive money market mutual fund earning, say, 4% might feel like a win, but history, while rarely repeating precisely, often rhymes. Once the inflation genie is out of the bottle, it is awfully hard to get it back in. If a second round of high inflation is on the doorstep, that 4% annual savings account yield will be losing out to the effects of inflation.

What’s the solution? Is everything doom and gloom? Of course not! While it’s always prudent to stash cash in a safe account as an emergency fund or rainy day fund, we must all be sure to have the right time perspective with other buckets of our portfolios.

For money that has a time horizon of, say, a few years or more, then you should consider the appeal of a global macro portfolio that’s diversified among traditional investments like stocks and bonds, but also alternatives such as real estate, emerging market, crypto, and gold. Allio’s finance team is looking out for you by monitoring market trends and macro conditions to ensure your money is strategically aligned with the investing cards we are dealt—inflation being one of the major risks.

What we don’t want to see happen is for your savings to get slowly eroded by inflation. Unlike a steep and volatile bear market that can wipe out trillions of dollars of collective wealth in just a handful of months, inflation is that stealthy predator that gradually snatches away your money. A percentage point here, a couple there, over the course of several months or years might not seem like much as it happens, but over the long haul, purchasing power indeed declines.

A story helps to boldface the point. Think back to pre-Covid times. Suppose you went out for a nice Friday night date. Dinner, drinks, a movie or some other activity might have amounted to $70 or $80. But the memories and relationships formed through such experiences were of course worth it.

Fast forward to today, and the cost of a restaurant meal is up roughly 20% in the past three years while alcoholic beverages are higher by nearly 15%, according to CPI data. As for a movie ticket, get ready to shell out around $15 compared to under $9 back in 2017. In all, the average date night, according to the dating app Zoosk, is a smidgen away from $100. And if you need to swipe for an Uber or Lyft ride, that will cost you a whopping 45% more compared to prices in 2019. That‘s inflation.

It illustrates that today’s investors must do all they can to weather the inflationary storm. And 2023 could simply be the eye of the hurricane with another bout of rising consumer prices on the horizon if the 1970s’ playbook unfolds. Savings accounts just won’t cut the mustard if inflation runs hot.

The Bottom Line

We expect inflation to be on the mend at times in 2023. That is good news, no question. But the future is uncertain. Moreover, history proves that inflation is sometimes not a one-and-done phenomenon. If we see multiple rounds of higher CPI rate regimes, that will eat away at a savings account balance even in an era of higher short-term yields. Keeping to a strategy of investing in growth assets is needed to outpace the rise in consumer prices.

At Allio, our app is built to help young investors build an enduring portfolio to grow their net worth. Our team of experts uses carefully crafted strategies designed to help people like you. We offer a unique blend of investment options tailored to your lifestyle and financial goals. Choose one of our fully managed portfolios for hassle-free investing, handled by our team of experts. Prefer more control? Our dynamic macro portfolio option puts the power in your hands. We’re not your typical finance firm. Gone are the days of exclusive, complicated investing. We're here to make your financial journey approachable, transparent, and most importantly yours. At Allio, we’re shaping the future of investing.

Whether you’re seeking an expert team to manage your money or looking to build your own portfolios with the best financial technology available, Allio can help. Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.