Updated July 25, 2023

Raymond Micaletti, Ph.D.

Alpha

We had a rare (for 2023) divergence last week in that the S&P 500 posted a modest 0.6% gain, while the Nasdaq 100 logged a 0.9% loss. It was only the second time all year that the S&P finished up in a week that the Nasdaq finished lower.

More interesting, however, is that despite a loss of only 0.9%, the Nasdaq closed Friday 3% off its high during the week. Those highs were achieved at 1pm ET on Wednesday after a report came out that–hold the presses–AAPL was also working on AI tools. Yes, really. (It was all downhill from there for the Nasdaq the rest of the week, which suggests the market might be regaining some sanity.)

Economic data last week generally came in below expectations (including retail sales, industrial production, housing starts, building permits, existing home sales, and Philly Fed manufacturing). The Citi Economic Surprise Index, which had been moving higher in conjunction with U.S. equities, is now moving lower.

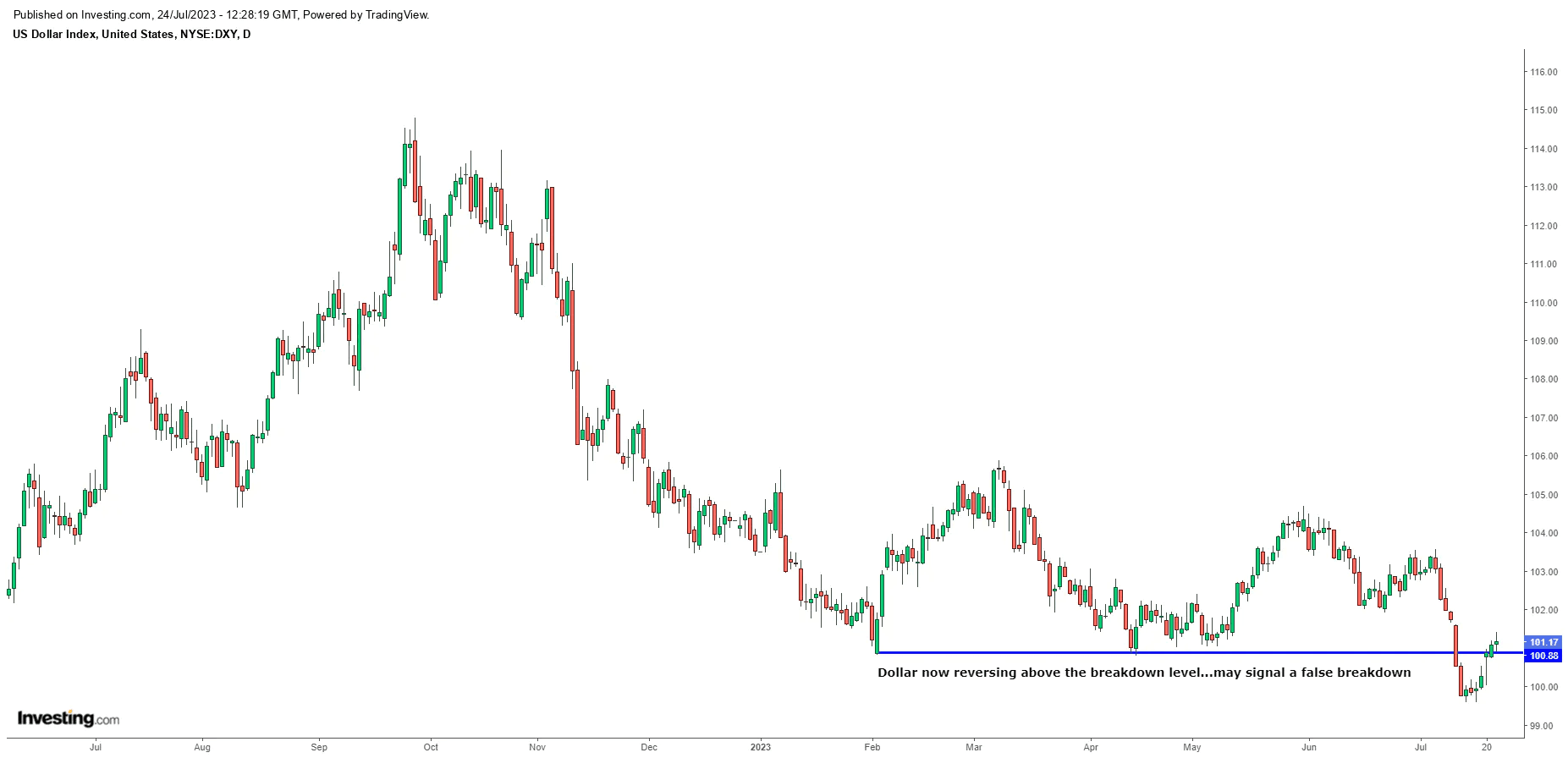

Another interesting development last week was the action in the dollar. In the days after the July 12 CPI report, the dollar fell sharply and broke below its February/April low. Having learned the hard way (many times) that markets like to catch people wrong-footed, we suggested last week that we were on the lookout for a potential false breakdown in the dollar (in which it would reverse course and rally higher catching everyone who had shorted the breakdown off-guard).

We got a mini-test of that speculation last week as the dollar rallied 1.1% right to the level in which it broke down after the CPI report. In addition, dollar relative sentiment also jumped higher, once again tip-toeing the line between bearishness and bullishness (yet still on the bearish side).

Source: Investing.com

If the dollar continues higher this week and dollar relative sentiment finally tips over into bullish territory, it will likely raise the odds of a nontrivial market pullback.

This week will present several potential landmines for equities, most notably an FOMC meeting, as well as several high profile mega-cap tech earnings reports (Microsoft, Google, Meta, and Amazon).

While we’ll delve into the bull and bear cases shortly, our sense is that if the Nasdaq rallies next week, it will be overbought at strong resistance with technical indicators sporting bearish divergences while investor positioning relevant for the Nasdaq is set to turn extremely bearish during the week. Thus, if the Nasdaq were to rally, it would likely face a rough go of it from there.

On the other hand, given the enormous rise in the Nasdaq year-to-date (and particularly the components reporting next week), this week’s earnings reports could just as easily be “sell-the-news” events.

The same is true for the FOMC meeting. It’s widely expected the Fed will raise rates a quarter of a percentage point. The Fed may then hint at a pause in rate hikes. Such a pause may already be priced into equity markets. And thus even if the Fed delivers a dovish pronouncement, we could see Smart Money selling into any rally.

As alluded to above, cross-asset positioning in growth- and liquidity-related assets will turn bearish for broad U.S. and Developed market equities during the week (the Nasdaq’s cross-asset positioning will turn the most bearish of all).

Of course, this doesn’t necessarily mean equities have to fall, and other equity relative sentiment indicators are still moderately supportive of equities (and certain sectors, regions, and countries will still sport bullish relative sentiment for weeks to come). But it’s definitely a stark change in investor positioning at the broad equity level from what we have seen the past several months.

Positioning in crude oil will also take on a more bullish turn this week after many weeks of solidly bearish positioning. On cue, energy stocks have quietly outperformed the Nasdaq so far this month by 2% while the broad commodity index is up 7%. This rise in commodities has propelled retail sentiment to levels that suggest inflationary pressures are once again rising; these pressures tend to be headwinds for equities.

Source: Investing.com

The confluence of rising inflationary pressure and a bearish turn in cross-asset equity positioning suggests the market may be hard pressed to sustain any further gains without eventually succumbing to a pullback of some sort.

With the foregoing as a backdrop, let’s examine the bull and bear cases for equities.

The Bull Case

The bull case for equities has broadened a bit from last week:

Momentum: Strong momentum rarely turns on a dime and we are downstream from several bullish technical triggers that tend to have positive effects for the next 6-12 months.

Mega-cap tech is likely a bubble: Take Nvidia. At 41x sales, it would take an investor 20 years to recover their initial investment in Nvidia if Nvidia were to grow at 20% per year for 20 years and pay out 100% in net income each year. But if Nvidia were to do that, it would then be roughly 50% of U.S. GDP (assuming 5% nominal GDP growth over the next 20 years). None of that is likely to happen and thus it’s safe to assume Nvidia is wildly overvalued. But bubbles usually get crazier than the relatively mild wackiness we have seen so far and, thus, we would not rule out mega-cap tech getting even more silly on the upside before it’s over.

Election season is around the corner: In October, dollar strength was wreaking havoc globally. Foreign delegates to the mid-October IMF meeting reportedly gave U.S. officials an earful about the economic destruction the dollar was causing. The U.S. Treasury then proceeded to systematically weaken the dollar by spending down the Treasury General Account. That mid-October IMF meeting marked the low point in global equities. In a similar vein, the Biden administration systematically (some might say, irresponsibly) drained 180 million barrels of oil from the Strategic Petroleum Reserve in an effort to lower oil prices and bring down inflation. These acts suggest the establishment will do whatever it takes to keep equity markets afloat as we head into election season. Will they be successful? Time will tell.

Peaking housing pain: According to Morgan Stanley and Goldman Sachs, we are currently experiencing peak pain, globally, in the housing market, which means the housing market will only get better from here. Stronger housing markets will be a tailwind for global growth. Notably, cross-asset relative sentiment is bullish (and set to stay bullish for weeks to come) for both the Financials and Real Estate sectors, both of which have lagged the S&P 500 dramatically this year. Thus, we may see some reversion in the coming weeks of the year-to-date relative underperformance in those sectors.

The Bear Case

The bear case keeps building:

Bearish cross-asset relative sentiment: Relative sentiment in growth- and inflation-related assets is set to turn bearish this week, and notably so for the Nasdaq

Extreme retail sentiment: Retail sentiment, which was persistently bearish through most of 2022 and into 2023, is now reaching bullish levels last seen in the midst of the bubble-like run-up in 2021. While in general standalone retail sentiment in equities is not strongly predictive of equity markets, when that sentiment is at an extreme, it pays to take notice (from a contrarian point of view).

Stretched positioning: Goldman’s “Sentiment and Positioning” indicator is at levels that suggest lower equity returns going forward.

Tech stock seasonality: August tends to see the technology sector begin a pullback that culminates in the fall before a rally into year-end.

The hype nature of the AI narrative is starting to surface: Taiwan Semiconductor on its last earnings call: “The short-term frenzy about the AI demand definitely cannot extrapolate for the long term. Neither can we predict the near future - meaning next year - how the sudden demand will continue or flatten out."Chip stocks have started to roll overGPT-4 is getting worse over time: "At least one study shows how the June version of GPT-4 is objectively worse than the version released in March on a few tasks. The team evaluated the models using a dataset of 500 problems where the models had to figure out whether a given integer was prime. In March, GPT-4 answered correctly 488 of these questions. In June, it only got 12 correct answers. From 97.6% success rate down to 2.4%"AI is NOT AI: “Current AI tools, often likened to neural networks of human brains, differ significantly in functionality. These AI systems perform statistical analysis reflexively, lacking substantial capacity for deliberate reasoning. Their learning is mostly confined to word statistics and suitable prompt responses, devoid of understanding abstract concepts or having an internal model for comprehending the world. Despite assertions that Artificial General Intelligence (AGI) will eventually be reached, we are considerably distant from this goal, and massive investment alone is unlikely to expedite this.”

Shades of the Great Financial Crisis? Credit card delinquencies and corporate bankruptcies are surging, with the former at 2008 levels and the latter coming in at the highest rate for the first half of a year since 2010.

Dollar relative sentiment once again threatening to turn bullish: This is the third time in recent months that dollar relative sentiment has been on the precipice of turning bullish. So far, it has remained bearish. But should it turn bullish, that would likely lead to higher real interest rates and a tightening of financial conditions that would presumably cause risk assets to sit up and take notice.

Our View

In the near-term, meaning over the next several weeks, we expect equity markets to be lower than current levels. Whether they move lower straightaway or whether they breathlessly extend higher first, run out of steam, and then fall sharply, is anyone’s guess.

Over the intermediate-term (i.e., the remainder of the year and into 2024), we would expect broad U.S. equity markets to reach new all-time highs for the reasons cited in the bull case above.

But over the longer-term, any new all-time highs will likely not be sustained given poor valuations, an eventual bursting of the AI bubble, and the likelihood of a resurgence in inflation.

Allio Portfolio Updates

No change to Allio’s portfolios this week.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.