Updated June 20, 2023

Raymond Micaletti, Ph.D.

Alpha

Another week, another sizable gain in equities, with the S&P 500 up 2.6% and the Nasdaq 100 up 3.8%. That brings the Nasdaq’s 4-, 5-, and 6-week gains to 9.3%, 13.2%, and 14.0%, respectively.

It was a data-heavy week with two inflation prints, a retail sales number, and an FOMC meeting.

The economic data were generally favorable—in line or better than expected. The Fed, meanwhile, held rates steady just as the market had forecasted (thanks to prior Fed jawboning). But in a surprise move, the Fed raised its assessment of how many more times (two) it will hike rates this year.

Risk assets initially sold off on that statement, but by the end of the day had shrugged it off and recouped most of their losses.

The rebound may have materialized because many economists pronounced the hiking cycle finito. Goldman’s explanation was that the market is more comfortable than the Fed that inflation will cooperate and foresees only one more rate hike at most, regardless of what the Fed’s dot plot says.

Another line of thinking that bubbled up this week was that the Fed, inevitably, will end up making a policy error–either by hiking too much or too little. Given the Fed’s (and Treasury’s) response to the bank crisis (unleashing liquidity), the market may feel the Fed will err by hiking too little, which would suggest real rates will fall and risk assets will be supported.

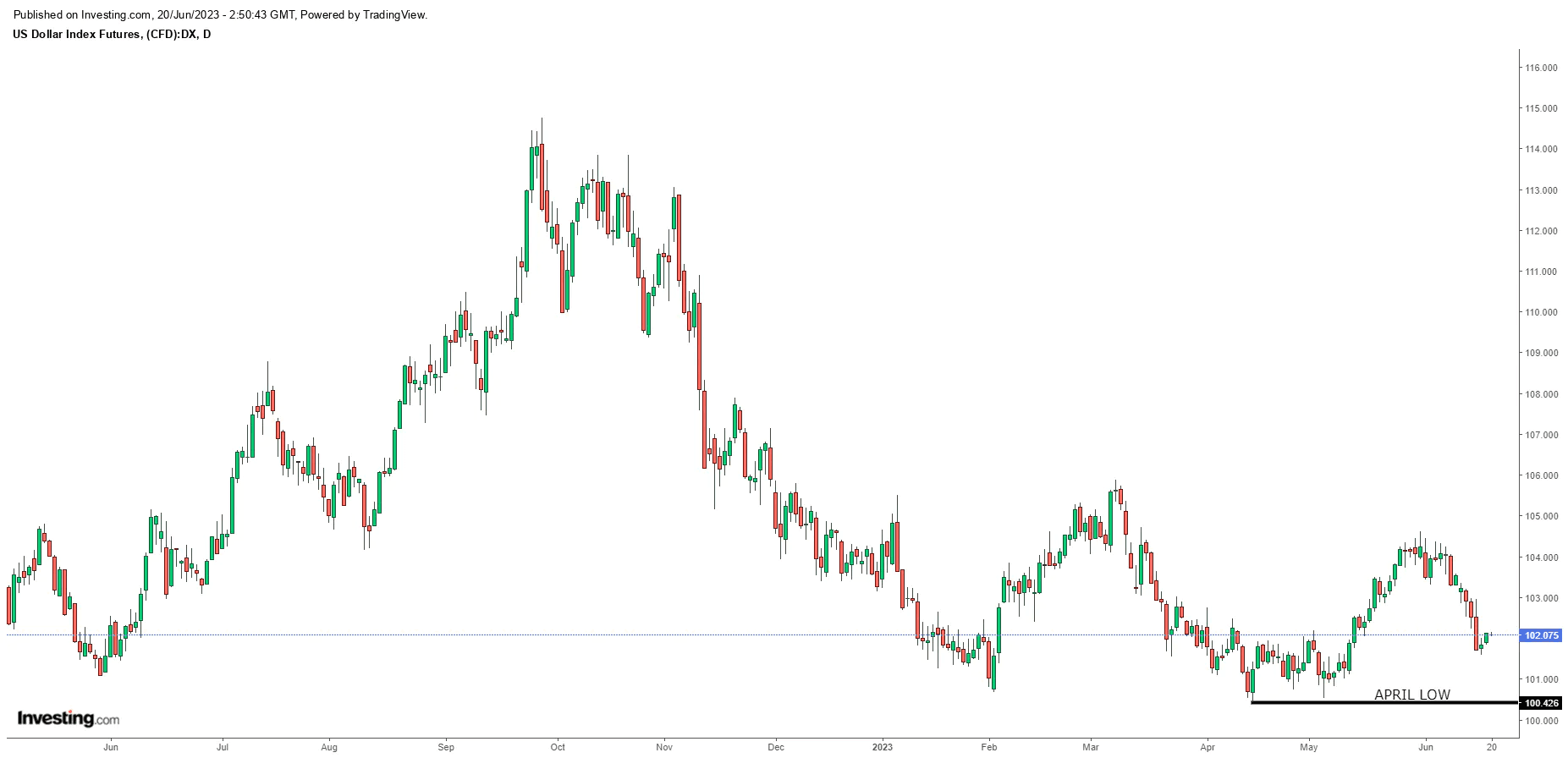

Consistent with those lines of thinking, the dollar fell 1% last week and appears to have rolled over from its recent four-week rally. Indeed, it looks as though it could challenge its April lows in the coming weeks (especially if the smart money remains bearish the dollar as they currently are).

Source: Investing.com

Gold, on the other hand, was down small, despite the dollar selloff, as real rates finished the week unchanged.

One area of the market that may be worth paying attention to is the energy complex. At the moment it is severely unloved, but several things are happening on that front.

Oil was up 2.2% last week and sentiment is recovering

The drain of the Strategic Petroleum Reserve (SPR) may be nearing its conclusion and the U.S. will be transitioning to refilling the SPR in the second half of the year.

China increased its oil quotas by 20% year-over-year despite a weak economy. One reason might be that it is ramping up its importation of crude oil and its exportation of refined oil products. Another might be that it knows the U.S. needs to refill the SPR and is looking to squeeze the U.S. economically.

The cumulative flows in energy stocks have been markedly negative (investors selling) in recent weeks–much worse than any other sector and tens of billions of dollars in net difference relative to technology stocks (which investors have been buying).

With investors nearly all-in tech stocks and shunning energy stocks, now may be the time to buy energy (just as December–when investors were shunning technology–was the time to buy tech).

On the broad market front, a battle royale is shaping up between the different investor classes, one that suggests the top might not be in (but could be approaching).

The Bull Case

The bull case has several components:

Momentum: The type of momentum we have seen isn’t easily reversed and historically has tended to foreshadow strong forward returns

Earnings: Earnings revisions have started rising

Positioning: Bank of America’s most recent Fund Managers Survey has shown that fund managers remain woefully underallocated to equities as a group. This suggests the “pain trade” remains higher. Similarly, while institutions recently have begun selling equities vigorously in the futures and options markets, they are now only at a neutral positioning. It will (likely) take several more weeks of similar selling before they become outright-bearishly positioned.

Inflation Expectations: The market’s implied inflation expectations for the end of 2024 are roughly 2.25%, much lower than economists’ forecasts. With June’s CPI (released in mid-July) set to fall sharply due to base effects (last summer was the high point for inflation), the market may be temporarily validated in its belief.

The Bear Case

The bear case mostly rests on a state of too much exuberance:

Stretched Positioning: The positioning indicators of multiple sell-side banks (e.g., Goldman, JPMorgan) have triggered upside alarms, indicating too many investors may be on one side of the boat. While these indicators don’t necessarily portend imminent weakness, they do suggest future weakness, especially if the stretched nature of the positioning persists.

Retail Sentiment: The AAII sentiment survey reached its highest difference between bulls and bears since Q4 2021. The cumulative five-day equity flows of retail investors are near their early 2022 peak (and higher than August or February). CNN’s Fear and Greed Index is at Extreme Greed levels–and higher than any reading since at least mid-2021. Peaks in this indicator have frequently coincided with interim peaks in the market.

No Fear: Activity in the options market suggests investors are in a panic about missing out on the upside (in line with the theme of everyone being on the same side of the boat).

Insiders Selling: Harvey Jones, an Nvidia board member since 1993, sold approximately 20% of his shares so far this month.

Month-End Rebalancing: According to JPMorgan, balanced mutual funds, defined pension plans, and certain global central banks/sovereign wealth funds could have up to $150 billion in equities to sell at month-end.

Our View

The textbook path for the market over the next few weeks would be a pullback in the near-term given the extremely stretched positioning and sentiment, followed by another push to new highs as investors buy the dip in an uptrend.

Whether we see that exact trajectory, however, is unclear.

Over a slightly longer horizon–4-6 weeks–we believe the market will drift higher as momentum effects and residual positioning effects dominate.

That 4-6 week horizon will take us to the next round of global central bank meetings and into the thick of Q2 earnings reports.

Further, the one relative sentiment indicator (growth and inflation relative sentiment) keeping the composite measure from being bearish looks as though its bullishness will expire in 4-5 weeks (unless institutions resume heavy relative buying, which seems unlikely).

Consequently, we could be setting up for a situation where the market has tailwinds for another 4-6 weeks (regardless of whether it pulls back in the near-term).

But after that things may get a little more difficult.

What makes the outlook cloudier than usual, however, is that:

A market top in July would clash with dozens of studies suggesting strong returns into 2024 given recent technical milestones

The market appears to be acting bubbly and it’s anyone’s guess as to when the fever might break (perhaps during Q2 earnings if mega-cap tech reports don’t match the AI hype?)

The further we get into the year the more motivation the present administration and Democratic incumbents have to keep the market elevated for the 2024 election season

The Fed appears not to be hellbent on suppressing equities anymore—possibly because of the big dropoff in tax receipts (and the subsequent ballooning of the deficit) as a result of the lack of capital gains in 2022

Several mega-cap tech stocks appear well on their way to closing gaps above or completing technical patterns that would suggest 20%-30% more upside for some of those names (as ridiculous as that might sound)

So, while our investment decisions will continue to be guided by data (and that data appears to be trending bearish with an ETA of mid-to-late July), we have a gnawing feeling that the market might confound even the most optimistic of bulls when all is said and done.

Let’s watch.

Allio Portfolio Updates

While there was no change to Allio’s core strategic portfolio this week, we did exit our tactical position in the Nasdaq 100 given the vertical nature of its rise and the vulnerability it may have to a non-trivial pullback.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.