Updated July 11, 2023

Raymond Micaletti, Ph.D.

Alpha

Equity markets sold off a bit last week, with U.S. markets being down about 1%. Notably, most indices were flat or up on the week as late as Friday afternoon, but a hearty selloff into the close erased all of the week’s progress.

Non-U.S. markets (and some equity sectors) took it on the chin a bit more–down almost 2%–purportedly on account of weak China PMIs.

We also received several pieces of jobs-related data last week and they were mixed.

On the positioning front, institutions took a break from selling equities and purchased a small amount last week (though a drop in the bucket compared to the amount they had sold in the four weeks prior). This action, however, does not change the likelihood that equity relative sentiment could turn bearish in a few weeks.

After threatening to turn bullish three weeks ago, dollar relative sentiment again took a small step back from the abyss. So long as dollar relative sentiment remains bearish, we would expect risk assets to attract interest.

Gold positioning remains neutral-ish, with perhaps a slight downward bias. Gold’s loss of momentum likely stems from a) real rates not having been favorable, b) gold having been stretched too far above its long-term moving average, and c) retail sentiment having become too bullish. But sentiment has retreated and gold has worked its way back down near its moving average (just 3% away vs. more than 10% away at its peak). Thus, if real rates start moving more favorably, gold might be able to generate some renewed upward momentum.

Positioning in crude oil and the energy sector remains staunchly bearish. That said, the energy sector is testing its 2018 highs and has quietly started to outperform tech over the past couple weeks. Given the degree to which investors have abandoned this sector in favor of tech in the first half of the year, it would not surprise if energy stocks did well (on a relative basis) over the balance of the year.

The Bull Case

The bull case is a bit narrow:

Momentum: Various studies suggest the recent bullish milestones the market has achieved are indicative of likely future strength.

Positioning: Residual equity positioning is still bullish for the next few weeks. The respective positioning of institutions and speculators is not at an extreme level (as it was last July). Thus, it’s reasonable to believe the market has room to move higher, which would then enable the institution-vs.-speculator positioning to reach extreme levels.

The fading recession? We have been hearing about an imminent recession for the past year, yet the economy has trudged along seemingly unscathed. The Atlanta Fed GDPNowcast is estimating 2.1% for Q2 and the Citi Economic Surprises Index is moving sharply higher (i.e., economic data has been coming in better than expected).Who knows, though? A recession might hit in the second half of the year. But there may also be truth to the argument that higher interest rates, when debt is so high, leads to enormous amounts of interest being paid into the economy–which is stimulatory, not contractionary.

The Bear Case

The bear case is starting to gain strength:

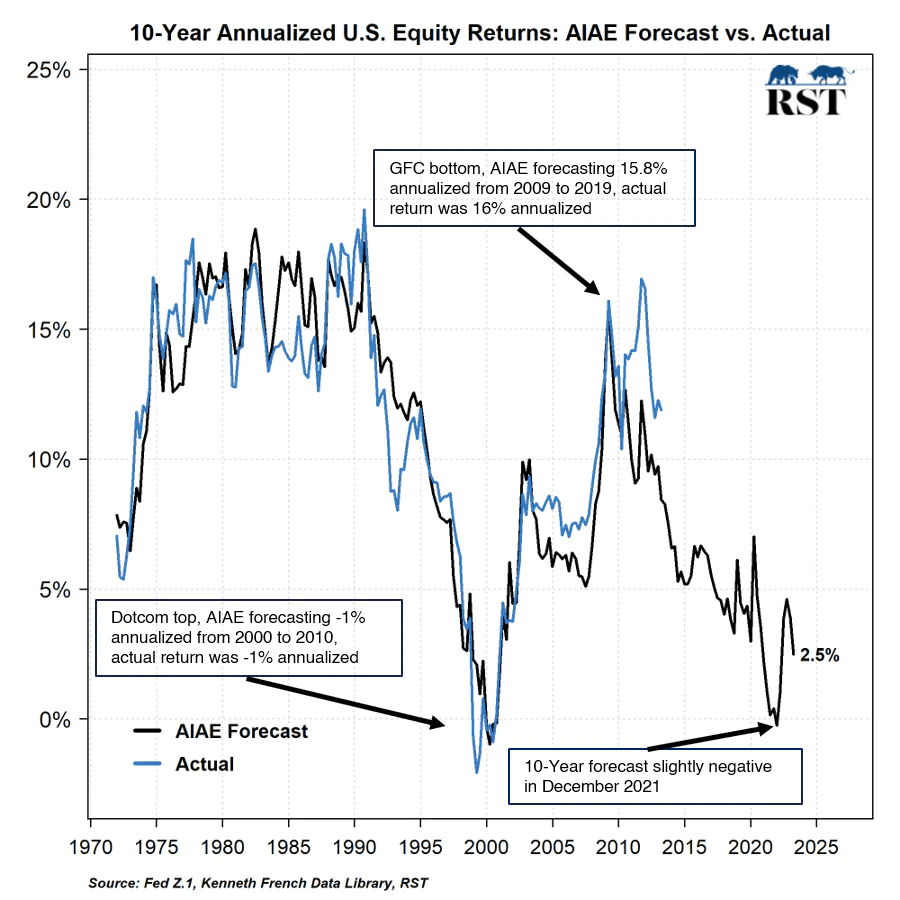

Valuations: Our preferred indicator for long-term U.S. equity returns is estimating 2.5% annualized over the next 10 years. The 10-year Treasury bond closed Friday at 4.05%. That’s -155 bps of expected annualized risk premium over the next decade. While that number reached more negative levels during the dotcom bubble (on the order of -400 to -500 bps), in recent years, -100 bps of expected risk premium has tended to see equities struggle relative to bonds.

Source: Relative Sentiment Technologies

Bearish technical divergences As equity markets made new highs in the last several weeks, various technical indicators of momentum failed to make new highs themselves. This suggests the market is “tired” and needs a breather. The fact the market couldn’t hold its gains on Friday despite strong advance-decline readings on both the NYSE and Nasdaq might be an indicator of this fatigue.

Further, when looking at charts of the ratios of the S&P 500 to the Nasdaq 100 and of the Energy sector to the Nasdaq 100, we see falling wedges, which tend to have bullish implications. We also are seeing bullish divergences on these charts–i.e., the ratios are making lower lows, while the technical indicators of momentum are not. This suggests we may see non-tech stocks start to outperform tech in the near-term.

Even supercharged bullishness comes with drawdowns: The Nasdaq 100 study we referenced last week–whereby when the Nasdaq 100 rises more than 20% above its 200-day moving average, it tends to rise another 30%+, on average, over the next 12 months–also revealed to us that in each an every instance, the Nasdaq had double-digit drawdowns during that year-ahead period. In other words, a pullback would not be the end of the world–it would be healthy and natural.

AI momentum waning: ChatGPT web traffic was down 10% in June, its first-ever drop. Meanwhile, AI valuations are at dotcom bubble levels. Which may explain why institutions have been selling the Nasdaq the last couple months (after having backed up the truck in January). The crowd has abandoned downside protection: Both the put/call ratio and the “skew,” (i.e., the ratio of downside put prices to mirror-image upside call prices) have plummeted recently. If the adage is true that the market won’t move lower when everyone is positioned for such a move, does that mean the market will move lower when no one is positioned for it?

The Fed’s balance sheet keeps shrinking: Equities (seemingly) have tended to track movements in the Fed’s balance sheet in recent years (it’s debatable whether this is causal). If the Fed’s balance sheet is a driver of equities, however, then equities will likely have to “catch down” to the Fed’s balance sheet.

Our View

The market tends not to make things easy for investors. If that tendency holds, we will likely see a sharp, scary pullback in overbought mega-cap tech stocks to penalize those late to the game.

If and when such a pullback arrives, however, is a more difficult question.

Given the selloff into Friday’s close and the modest downdraft in futures Sunday evening, it’s possible the deeper correction is already afoot.

If not, one time period that will likely see a pickup in volatility is the last week of July. That week will bring an FOMC meeting and all major mega-cap tech earnings (with the exception of Nvidia). Moreover, positioning in growth- and liquidity-related assets is also slated to turn bearish for equities that week.

Assuming we do see a respectable pullback sometime in the next several weeks, will we then get another leg higher in equities?

Various momentum studies say, “yes.” But if cross-asset positioning turns (and stays) bearish, that would likely generate headwinds for equities. Bullish momentum plus bearish relative sentiments tends to see the market drift sideways. (I.e., the upward force of trend-followers buying strength is met by the downward force of institutions selling into the rally.)

What if there’s no near-term selloff? Could equities simply continue higher from here? Yes, positioning is still residually bullish for a few more weeks. But if equities were to do so, the eventual correction, when it arrives, would likely be all the more painful.

Allio Portfolio Updates

No change this week to Allio’s portfolios.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.