Updated July 31, 2023

Adam Damko, CFA

The Piggy Bank

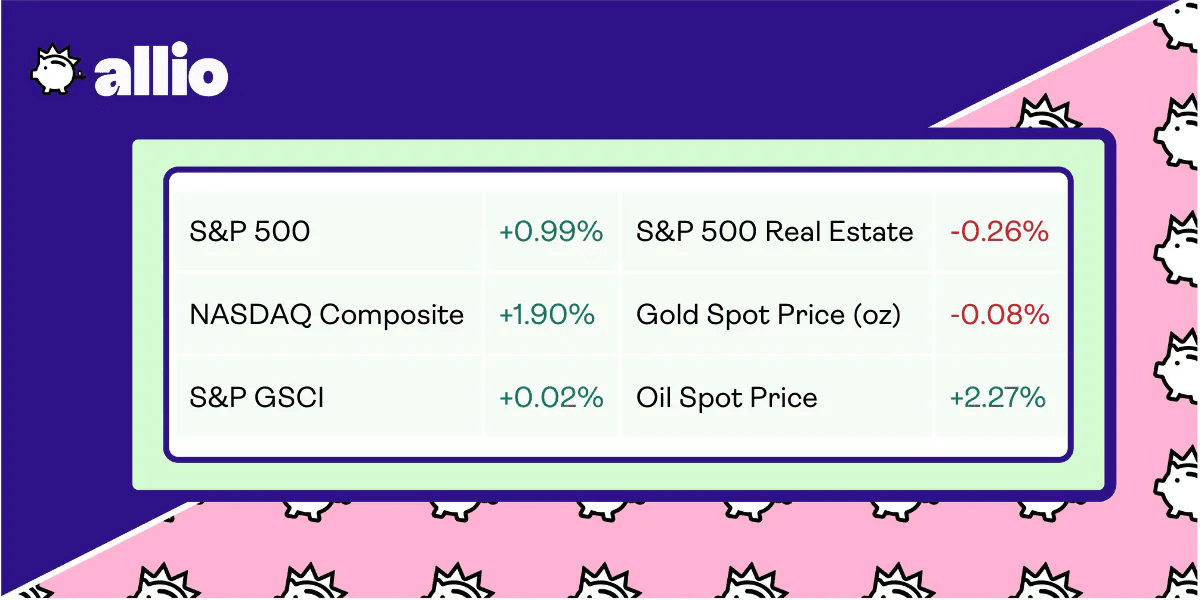

THE MARKETS

Stocks posted their third straight week of gains as the summer rally rolled on.

💼Economic News

The Federal Reserve officially approved an interest rate hike for July. The federal funds rate now sits at 5.25%-5.5%, the highest rate in 22 years. However, as the decision was largely priced in by financial markets, it did not translate to notable stock market turmoil. Investors were expecting this decision because, while inflation has moderated slightly, it still has a long way to go to reach the Fed’s goal of 2%. This is a point that the Fed Chairman Jerome Powell has highlighted before and continued to in remarks following the decision. Looking forward, he stated the central bank will continue to make decisions on a “meeting-by-meeting” basis depending on the most recently available data. If the data is good, there’s the possibility that the central bank will skip a rate hike at the next FOMC meeting in September.

👀 What to Be on the Lookout for This Week

There are a handful of economic reports coming out this week to be aware of, including:

JOLTS job openings

ISM Manufacturing PMI

Mortgage applications

Mortgage rate

Mortgage refinance index

ISM Services PMI

Jobless claims

Nonfarm productivity

Factory orders

Unemployment rate

Average hourly earnings

Nonfarm payrolls

In addition to these economic metrics, investors will also want to watch out for earnings reports from:

Cushman & Wakefield

Pfizer

Caterpillar

Starbucks

Uber

CVS

Paypal

DoorDash

Amazon

Apple

Airbnb

Booking Holdings

Dominion Energy

📰 In Other News

If you survived the past month, congratulations! You just survived the hottest month on record, according to the World Meteorological Organization. This unusual heat is being driven by anthropogenic climate change, coupled with an El Niño weather pattern. But the weather isn’t the only thing that’s been hot this summer.

Tensions between US employers and their respective unions have reached a boiling point over the past few months, with many organizations either threatening to strike or already doing so. For example, Hollywood’s two biggest unions — the SAG-AFTRA and WGA — are both on strike simultaneously. This is already creating some turmoil, with the Emmys getting pushed back, along with a few major upcoming releases. United Auto Workers, whose contract expires in September, is also threatening a strike.

Fortunately, UPS and its teamsters union of 340,000 workers were able to agree to a deal, after the company offered to install A/C in delivery vans and raise pay for drivers. With this news, the US appears to have avoided the biggest single-union strike in its history, and one with the potential to bring logistics across the country and world to a grinding halt. That should help everyone cool off just a bit.

In other “heated” news, Mastercard shut down purchases of all marijuana products this past week, which is sure to leave marijuana businesses (and consumers) hot under the collar. This move highlights the difficulties of the growing industry, as cannabis, while legal in many states, remains illegal at the federal level. Guess cash is still king after all.

Finally, in an unusual twist, tax evaders got a win last week, as the IRS announced it will end the practice of physically sending agents to your door to collect unpaid taxes. This change comes amid the tax agency’s multi-billion dollar modernization makeover. Jokes aside, when it comes to smart financial moves, paying your taxes is a tried and true best practice.

Reflects performance at market close 7/28/23

YOUR ECONOMY

📈 U.S. IPO Market Might Finally Be Turning Around

Successful IPOs

Initial public offerings (IPOs), or the first time a private company’s shares are listed for sale on a public exchange, are a longstanding pillar of the American economy. After all, where would your retirement savings be if shares of S&P 500 components like Apple, Alphabet, and Amazon weren’t for sale?

Yet, for most of the year so far, the U.S. market for IPOs has been on ice. Through the first half of 2023, newly-public companies have raised just $9.1 billion through IPOs, roughly a third below normal levels.

However, that could be set to change.

On June 15, fast-casual Mediterranean chain Cava went public and its share price increased over 100% on the first day of trading. More recently, Oddity Tech — the AI-powered owner of DTC beauty brand IL MAKIAGE — also completed a successful IPO.

One successful IPO by itself in an otherwise frigid market may be just an anomaly. But two successful IPOs fairly close together could be a signal that investors are investing with confidence again — by extension, a sign of a strong economy.

The Icy IPO Market

During 2020 and 2021, interest rates sat at record lows. In this type of economic environment, investors had no problem buying up shares of high-growth startups promising huge returns, even if these companies had yet to post a profit.

However, as the Federal Reserve began to raise interest rates, startups with high growth but low profits became less attractive to investors. The result of this economic shift has been an ice-cold IPO market for most of 2023.

After a volatile past few months, however, things are finally starting to look more stable. The U.S. job market has remained strong, inflation has subsided, and U.S. stocks are nearing 52-week highs.

As a result, it looks like investors are finally getting a bit more comfortable speculating on high-growth companies.

Upcoming IPOs

Following the success of Cava and Oddity Tech, more large private companies may make plans to go public in the coming months. A few major contenders include:

Arm: A British chip designer that could fetch a valuation of more than $50 billion.

Klaviyo: An already-profitable marketing automation platform valued at $9.5 billion in 2021.

Turo: A sharing economy car rental platform valued close to $3 billion.

Birkenstock: A German shoe manufacturer valued at more than $7 billion.

Instacart: A food delivery platform valued at roughly $12 billion, with plans to go public in 2021, since put on hold.

Notably, not all companies are feeling fully confident about the current market conditions. For example, payment processing platform Stripe, social media platform Reddit, and digital advertising firm Aleph Group have all stated they will likely wait until 2024 at the earliest to consider going public.

It’s important to remember shares of newly public companies tend to be volatile and investing in them is inherently risky. As a potential investment, each new IPO must be analyzed based on its own merits and each individual investor’s risk tolerance. But as an overarching sign of the economy’s health, a coming IPO pop would appear positive.

😨 PTO Panic: Layoff Fears Keep Americans Glued to Their Desks

Vacation? In This Economy?

Is America the land of the free or the land of the fatigued?

As a society, Americans have typically been known for a work-life balance that largely favors the former. However, according to a recent study by online learning platform ELVTR, things have really started to tip out of balance this summer.

ELVTR’s study found that 57% of US workers are scaling back their summer vacation plans, with 37% of workers taking less time off and 20% skipping their vacation altogether. Experts are attributing this phenomenon to two main factors.

First is — and stop us if you’ve heard this one before — sky-high inflation. Over the past two years, even workers fortunate enough to get a raise have seen their real earnings decline, thanks to surging prices. With most household budgets stretched thin, fewer families feel comfortable taking extra time off of work.

Second, today’s workers collectively have less bargaining power now than they did in 2021 and 2022. In the wake of the pandemic, workers had lots of bargaining power as companies struggled to restaff their workforces. But, now that many companies are fully restaffed, the balance of power has shifted back in favor of corporations.

Layoff Fears

An additional reason Americans might be feeling less confident taking time off is the fear of being laid off.

Widespread layoffs have run rampant through the economy over the last year. As of July 25th, 885 companies have laid off over 221,000 workers so far in 2023. Granted, these layoffs have been largely confined to the tech sector. But even so, it feels as if every week features a new headline highlighting more layoffs.

The prevalence of layoffs throughout the economy, coupled with a soaring cost of living, may be leading many Americans to avoid the risk of taking time off of work, even just for a day or two.

Fighting Burnout

Even when employees do manage to carve out time for their vacation, many still end up bringing their work with them. In the same survey, 68% of workers reported packing their work laptops in their luggage, in order to circle back on emails and follow up with colleagues.

In general, people tend to overwork themselves because they’re worried about losing their job, letting down their colleagues, or falling behind in their careers. Ironically, this is often why many employees find themselves spread too thin and ultimately quit, citing burnout.

Burnout is one of the most commonly cited reasons workers quit their job, and is usually the result of being overworked. However, having employees quit unexpectedly is a worst-case scenario for many companies, since they lose out on any time and money spent on training.

The pressure many employees feel to work as hard as possible might provide a short-term benefit for companies. But, if it continues to result in employees quitting, it’s likely a long-term net negative. So it’s important to remember taking time off isn’t just acceptable. In the long run, it’s necessary. So be sure to set aside some time this summer to take some time out of the office — and leave your work laptop in it.

POCKET CHANGE

Gen X is feeling the financial pressure to care for both kids as well as aging parents. For this reason, the so-called “sandwich generation” is falling behind on retirement planning.

New research shows worker motivation peaks around age sixty. This means that as many as 150 million jobs could shift to older workers by the end of the decade.

Activities across the US are starting — and ending — earlier. Cinemas are canceling midnight showings for matinees, and more kitchens are closing at 8 PM. Remote and hybrid workers with the flexibility to start their afternoon festivities early are fueling the shift.

The Hollywood strike could be a massive boon for the creator economy. As traditional studios are forced to enter a holding pattern, platforms like Instagram, YouTube, TikTok, and Twitch could see an engagement boost.

Spotify raised the price of its ad-free premium plan by $1 to $10.99 per month. Existing customers will be given a one-month grace period before the new price goes into effect.

Ready to build wealth on autopilot? Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.