Updated May 8, 2023

Bill Chen, CFA

The Piggy Bank

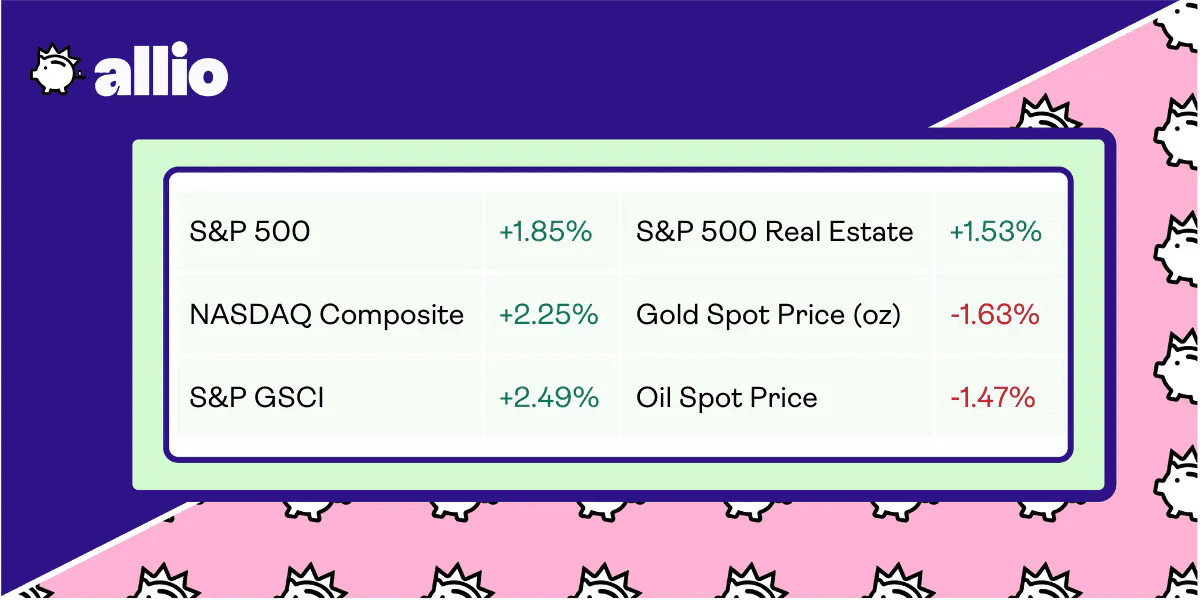

THE MARKETS

📈 Despite a strong Friday performance with most equity indices up nearly 2%, U.S. stocks finished the week down 1%, dragged lower by banks (-10%) and energy companies (-6%).

The Nasdaq 100 was a lone bright spot, finishing the week up small, as the market digested a Federal Reserve rate hike, (stellar) Apple earnings, and the monthly non-farm payrolls report.

💼Economic News

Fed Chair Jerome Powell and the Federal Reserve raised interest rates once again last week, by the 25-basis-points widely expected by Wall Street. This marks the 10th consecutive raise and brings the federal funds target rate to 5.00-5.25%.

The federal funds rate makes it more expensive for both consumers and businesses to borrow money. This means that interest rates will continue to increase for things like mortgages, car loans, and credit cards.

Over the past year, the Fed has raised rates aggressively in an effort to tame inflation. Experts expect the most recent hike to be the last for the foreseeable future. However, the Fed emphasized its policy is “data-dependent” — meaning the future outlook could easily change depending on next week’s inflation report.

👀 What to Be on the Lookout for This Week

This Wednesday, the closely-watched inflation rate will be released for April. After hitting a peak of 9.1% in June 2022, inflation has been on a 9-month downward spiral, hitting 5% in March. Investors will be eager to see if this trend continues next week.

In addition to that release, this week will be another busy one for earnings, with reports coming from:

KKR

Airbnb

Electronic Arts

Allbirds

Rivian

ZipRecuiter

Beyond Meat

The New York Times

Walt Disney

Yeti

Krispy Kreme

📰 In Other News

Airbnb makeover: As Americans gear up for what’s expected to be a record summer of travel, Airbnb has some long-awaited good news. The massive lodging company announced a flurry of updates addressing customer feedback, including:

Airbnb Rooms: A new feature allowing guests to book individual rooms at select properties for lower rates.

Fewer chores: Listings with unreasonable lists of chores will be removed from the app.

Transparent pricing: No more surprise cleaning fees. All costs will be reflected in the initially quoted price.

Congressional trading ban: It’s always nice to see American politicians agreeing on an issue for a change. Representatives Alexandria Ocasio-Cortez and Matt Gaetz introduced a bill to ban congresspeople and their spouses from trading stocks.

Screenwriter strike: If the next season of your favorite TV show has a few major plot holes, it might be because the Writer’s Guild of America is on strike. 11,000 screenwriters are striking for the first time since 2007 in pursuit of better working conditions and higher wages.

ChatGPT’s influence: Since the AI industry moves at the speed of light — or of CPUs, at least — there were plenty of updates this past week. For one thing, IBM announced it will pause hiring for nearly 8,000 roles it believes it can replace with AI. Also, ChatGPT can apparently help students put together study guides. This puts EdTech companies like Chegg on red alert. Chegg’s management already warned investors that ChatGPT is hurting its growth.

Reflects performance at market close 5/5/23

YOUR ECONOMY

🫠 Are “Bare Minimum Mondays” a Bad Idea?

Sayonara, Scaries

If you find yourself overcome with the Sunday Scaries as the weekend draws to a close, TikTok is offering a cure. A recent trend has taken the video-sharing platform by storm. “Bare Minimum Mondays” have been put forth as a way to fight back against the dreaded feeling of returning to work on Monday.

The idea of Bare Minimum Mondays is to, well, do the bare minimum on Monday. Instead of hitting the ground running, proponents suggest you prioritize self-care and mental health over productivity on the first day of the work week.

For example, one TikToker reportedly keeps the first two hours of her Monday morning free to help ease back into her working routine. She also only schedules three tasks for the entire day. By cutting herself some slack on Monday, she says she actually winds up being more productive.

Employees Disengage

Bare Minimum Monday joins last year’s “Quiet Quitting” as yet another TikTok trend in which younger generations fight for a better work-life balance. Quiet Quitting also described only fulfilling baseline duties at your job and refusing to go above and beyond.

It’s easy to chalk both of theseTikTok trends up to younger employees being lazy or shirking responsibilities. But, in reality, these trends speak more to the weight many among the younger generations assign to self-care, fighting burnout, and a balanced lifestyle not dominated by their careers. They starkly contrast the “hustle culture” prevalent across the workforce, encouraging all employees to work as hard as possible, regardless of their role or goals.

Trends like Bare Minimum Monday are a sign younger employees are feeling less engaged in the workforce — but they’re not the only one. There’s also hard data to support this. One study found that just 31% of workers born after 1989 feel “engaged” at work. And according to a Gallup poll, the disengagement grew worse during the pandemic. Employee engagement dipped by 4% from 2020 to 2022.

Balanced Mondays Are Better

While Bare Minimum Monday might seem like an attractive trend for burnt-out workers to embrace, most experts recommend a more balanced approach. In a labor market marred by widespread layoffs and other cost-cutting measures, disengaging can put your career in a precarious position. Even for those who work remotely, most managers can tell who is committed to their job and who isn’t.

Instead of Bare Minimum Monday, the move might be to shoot for a “Balanced Monday” instead. A way to accomplish this is to approach Monday not with a bare minimum mindset, but a slow and steady one. Even though you’re back at work, it doesn’t mean that you need to show up at 6 AM and knock out every item on your Weekly To-Do List in a single day. Instead, use the day to complete a few high-priority tasks and set yourself up for success through the rest of the week.

After all, if work-life balance is the goal, moving from one extreme to the other will still leave you off-kilter.

🧸 How Kids Can Spark Relocation Plans

Moving on Up

According to Zillow’s Quarterly Survey of Homeowner Intentions and Preferences, households with 2 or more children are three times more likely to sell their house and move in the next three years than households with no children.

The story that this data tells seems clear. When you’re young and single, there usually aren’t as many boxes your living situation must check. Most people generally just try to find the most comfortable living space within their budget.

However, with each new life step, more variables must be considered. Move in with a significant other, and you’ll need to factor their living preferences into the decision. For example, if they love the city and you love the suburbs, you’ll need to come to a compromise. Once you start having kids, the dynamic will change again. And, as your family grows, you must make decisions based on what’s best for everyone, not just yourself.

Post-Pandemic Push

Zillow’s survey showed that, as of March 2023, 35% of households with two or more children had plans to sell their house and move in the next three years. For families with just one child, this percentage dropped to 18%. Finally, just 11% of families with no children had plans to move.

Another interesting takeaway from this survey is that family-related moves have been on the rise since the pandemic. In the first quarter of 2021, only 26% of families cited growing family size as a reason for their move. But, by the first few months of 2023, this percentage had jumped to 42%.

Will I Need To Move?

You’ll likely view this data differently depending on where you are at in the family-building process.

If you have growing children, you might have already experienced a few family-related moves firsthand. Even if you have yet to settle down and start building a family, it could still be worth anticipating a family-related move at some point in your future. But this doesn’t mean you need to up and move across the country to a three-bedroom home in the name of future-planning. In fact, big picture, family-related moves are some of the easiest to execute. You might not even need to move out of your town.

When your family is growing, the biggest needs typically include a larger home, as well as access to schools, daycare, and other child-related amenities. According to Zillow’s survey, most of these needs can usually be met by moving locally. 84% of homeowners who were considering moving planned to move within an hour of their current home. Fortunately, moving locally tends to be a much simpler operation. It’s easier and less expensive than moving across states. And, particularly important when considering children’s needs, it allows everyone to keep their existing relationships and routines in place.

Of course, all of this is just data. Just because a survey says that most families move once they have children, it doesn’t mean you’ll need to. At the end of the day, you know best how to meet your family’s needs and ensure everyone under whichever roof you choose is comfortable, happy, and safe.

POCKET CHANGE

Job growth popped in April, defying expectations. The U.S. added 253,000 jobs during the month, pushing the unemployment rate down back down to a 54 year-low of 3.4%.

Many major brands are letting customers opt-out of Mother’s Day marketing emails. By doing so, companies like Levi’s, Canva, and DoorDash could start a trend of empathy-led marketing.

A “hi” text from an unknown number may be from a scammer trying to “pig butcher” you. “Pig butchering” is a ploy in which scammers build a relationship with unsuspecting victims before convincing them to invest their life savings.

Geoffrey Hinton, known as the Godfather of AI, left his role at Google. He plans to warn society about the potential threat posed by artificial intelligence.

Roughly 43% of people nearing retirement age do not know exactly how much they’ll receive monthly from Social Security. This could pose a budgetary problem for the many Americans who plan on funding their retirement at least in part through the program.

A new study concluded ChatGPT has better bedside manner than most doctors. When it comes to offering diagnoses, doctors tend to be brief, while ChatGPT’s longer responses exhibit more empathy.

Ready to build wealth on autopilot? Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.