Updated July 17, 2023

Adam Damko, CFA

The Piggy Bank

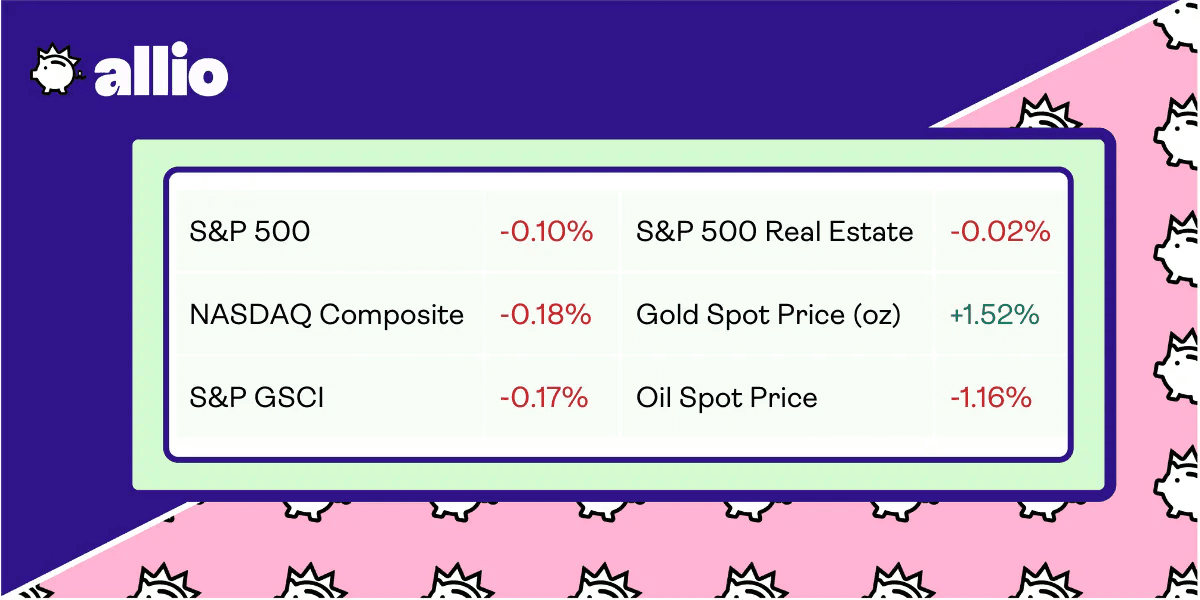

THE MARKETS

📈 Equities markets bounced back this week, notching gains of 2.5% on the back of cooling inflation as earnings season moves to the fore.

💼Economic News

The latest inflation data was released this week. Be sure to check out our detailed analysis below.

In other notable news, US consumer sentiment soared in July and hit its highest point in roughly two years. In addition to the latest positive inflation data, consumers may be feeling better about the softening labor market, a strong start to Q2 earnings, and receding fears regarding the Federal Reserve’s ongoing rate hike campaign. Recessionary concerns still cast a dark cloud for consumers and investors, but the wind may be blowing in the right direction to avoid a storm.

👀 What to Be on the Lookout for This Week

Looking ahead, there are a handful of economic updates to keep an eye out for this week, including:

Retail sales

Industrial production

Housing market index

Building permits

30-year fixed-rate mortgage

Unemployment claims

Existing home sales

Additionally, Q2 earnings reports are starting to ramp up. In particular, next week will feature reports from several prominent financial companies including:

Tuesday: Bank of America, Bank of NY Mellon, Charles Schwab, Morgan Stanley, Lockheed Martin

Wednesday: Ally Financial, Goldman Sachs, Netflix

Thursday: Capital One, United Airlines, American Airlines

Friday: American Express

📰 In Other News

SAG-AFTRA, the union representing Hollywood performers, followed in the footsteps of the Writers Guild of America by going on strike. This is the first time in more than sixty years that both groups have gone on a strike simultaneously. While it may ultimately lead to better working conditions for America’s entertainers, it will probably also lead to a lot less quality content in the immediate future. Fortunately, there are still 34 seasons of The Simpsons to binge.

Protection from generative AI’s game-changing content capabilities is a big part of what’s driving these contentious contract negotiations. But that’s not the biggest AI-related news story this week. Following months of record-breaking growth and inescapable buzz, OpenAI’s ChatGPT has finally hit some serious road bumps.

First, OpenAI was sued by a trio of writers, including comedian Sarah Silverman. The group accused the AI company of knowingly training ChatGPT on illegally-obtained works of the authors’ books. Also, ChatGPT has come under investigation by the FTC. On Thursday, the FTC issued a civil subpoena to investigate whether OpenAI “engaged in unfair or deceptive practices relating to risks of harm to consumers, including reputational harm.” In other words, does the infamously inaccurate ChatGPT actually harm users by making false statements? The answer may not be a simple one. But it’s a question some pretty powerful people are asking.

OpenAI is not the only powerhouse under regulatory fire. Bank of America was recently hit with a $250 million fine. The Consumer Financial Protection Bureau accused the megabank of illegally opening accounts for consumers without their knowledge, double-charging customers for overdraft fees, and withholding credit card rewards. Bank of America will be forced to repay $100 million to customers and will also have to pay an additional $150 million in fines. This news will surely fuel the Biden administration's crackdown on “junk fees.”

Finally, things aren’t just heating up for America’s second-largest bank — they’re heating up for America in general. The US is currently experiencing a serious heat wave, with the past month seeing the hottest week on record. Approximately 73 million Americans live in areas that will see dangerous heat in the coming weeks. This has led to diminished production in the agricultural sector and concerns of power outages in the energy space.

Reflects performance at market close 7/14/23

INFLATION UPDATE

😎 June’s Inflation Data Marks a Year of Consecutive Cooling

12 in a Row

The rate of inflation — or the rate at which prices increase over time — slowed to just 3% in June, marking the 12th consecutive month of decreases. This represents a 1% decrease from May’s 4% inflation reading, as well as the smallest yearly increase since March 2021.

The decrease in inflation was mainly driven by decreases in the cost of energy. Fuel oil, gasoline, and utility gas service fell 36.6%, 26.5%, and 18.6%, respectively. Inflation also slowed for new vehicles by 4.1%, food by 5.7%, and shelter by 7.8%.

The Context

June’s inflation data represents the lowest annual rate in more than two years. Notably, around this time last year, inflation was sitting at a 40-year high of close to 9%.

At that time, the Federal Reserve, America’s central bank, found itself in a precarious situation. The Fed needed to slow the rate of inflation by raising interest rates, but had to avoid raising rates too quickly and throwing the US into recession.

To do so, the Fed has spent the past year raising interest rates at the fastest clip in decades. But with the latest release, it seems the Fed may be close to achieving its goal. Inflation is now within striking distance of the Fed’s 2% target rate.

But the work might not be done. Core inflation, which excludes food and energy prices, still came in at 4.8% for June. Since food and energy prices are notoriously volatile, this is the metric that central bank policymakers most frequently reference. With the rate still running well above the Fed’s 2% target rate, it’s clear we are not out of the woods just yet.

Looking Forward

While it’s never possible to predict the Fed’s moves with 100% accuracy, most economists expect the central bank to raise interest rates again in July after pausing in June.

The Fed held off on a rate hike in June so it could measure the economic impact of its aggressive hiking campaign over the past year. While experts expect a rate hike in July, the pullback in prices for June should give the Fed more confidence to hold rates steady for the rest of the year.

Looking forward, economists expect inflation over the next year to hover around 3.4%. Again, nothing is ever certain and this could change at any moment. But, for now, Americans can breathe a sigh of relief as it appears that the days of dramatic price hikes may be behind us.

YOUR ECONOMY

🥫 “Center Store” Prices Soar

Nonperishable Food Prices Peak

Planning on throwing a summer BBQ in the next few months? Good news! The prices of staple foods like produce, fresh meats, and eggs have largely cooled from their instance 2022 levels.

But bad news: this might not mean your grocery bill is any lower than before. That’s because the price of “center store” goods — or goods commonly found in the middle aisles of the grocery store — are now surging.

Overall, food price increases have slowed down, rising just 5.8% in May. This number is still high, but it’s a significant improvement from the 13.5% price spikes of last August.

However, the price of center store food did not improve significantly from that highwater mark, remaining up 12% in May. This essentially includes all foods that won’t immediately go bad such as potato chips, mayo, and applesauce. For the week ended May 27, prices for these three nonperishables were up 17%, 23%, and 22% year-over-year, respectively, according to the market-research firm, NielsenIQ.

Pricing Power Struggle

Across America, a pricing power struggle is playing out between retailers like Walmart, Kroger, or Albertsons and producers of consumer packaged goods such as General Mills, Kellogg’s, or Procter & Gamble.

The price of food you buy at the grocery store is influenced by both of these parties. Food producers make different types of foods and sell them to grocery stores, who typically mark the food up slightly higher before selling it to consumers.

Over the past few months, consumer packaged goods companies have been keeping prices elevated, claiming they are still experiencing higher prices further up the supply chain and thus must increase prices at the product level. They cite the rising costs of labor, transportation, and raw materials as an excuse for their price hikes. Meanwhile, most food producers are apprehensive about lowering prices too quickly in order to protect their margins.

However, companies like Walmart know customers come to them in search of rock-bottom prices. Eager to extend low prices to customers again, major retailers are now pushing back against the price increases from producers. The result is a pricing power struggle between some of America’s biggest companies.

Customer Pushback

Despite the heavyweights involved in the brewing battle, ultimately, the market is determined by customers.

In this case, consumers have been pushing back against rising prices by opting for cheaper versions of packaged goods. For example, Target’s chief food and beverage officer stated the retailer’s in-house brands are growing nearly twice as fast as national brands. Executives at Walmart issued a similar statement and mentioned that center aisle goods are where consumers are most likely to opt for in-house brands.

Due to this pushback, food companies have finally started reining in price increases. They’ve even begun offering more discounts, a practice largely put on hold during the pandemic.

All of this is a positive sign that, while prices of center aisle goods remain high, they will likely start to ease in the coming months.

🙎 Three Ways to Beat the Singles Tax

What Is the Singles Tax?

Roughly 93% of adults acknowledge it is more expensive to be single when compared to having a significant other, according to a report from Forbes Advisor. This phenomenon can be traced to the so-called singles tax.

In today’s pricey world, hitching up with a significant other can be a serious game-changer for your finances. For example, instead of renting alone, you can split the cost of a one-bedroom apartment, which can cost as much as $1,625 in states like California. In theory, this alone can save you more than $800 each month or nearly $10,000 per year. Couples also save money by splitting the bill when it comes to groceries, household supplies, nights out, vacations, and much more.

While single people may have more freedom when it comes to living their preferred lifestyle, couples appear to have an edge when it comes to their finances.

Beating the Tax

If you’re still flying solo, there are a few ways you can tip the scales back in your favor.

First, consider buying in bulk. If there’s a local Sam’s Club, BJ’s, or Costco near you, it may be worth working the cost of a membership into your budget. And, even if there are no wholesalers, you can still bulk-buy goods from places like Target and Walmart. Since you’re only responsible for feeding one person — yourself — buying in bulk doesn’t necessarily apply to groceries. But you can always stock up on supplies like laundry detergent, paper towels, canned goods, and other non-perishables. Buying in bulk almost always results in a higher bill at the register, but a lower cost per unit.

Another way to keep your costs down is to consider budget billing for your utilities. Budget billing is when you’re charged a set amount per month for your utilities. This way, you’ll never risk going over budget on your bill, as you can always plan on being charged a predetermined amount. This is a great saving hack for single people, since you only have to factor your own comfort level into your utilities usage. In other words, you don’t have to worry about your significant other getting too hot or cold around the house.

Finally, place an extra emphasis on your largest monthly expenses. Most often, your largest expenses are rent, insurance, and a car payment. Negotiating lower payments for any of these three expenses can have an outsized impact on your budget. For example, if you can save up and buy a used car instead of taking on a monthly car payment you can save your monthly budget roughly $716 per month — the average cost for a new car payment. This will have a much bigger impact on your budget than clipping coupons on the grocery store.

The Single Advantage

Couples may have a slight advantage over single people when it comes to saving money on certain expenses. But there are also plenty of financial advantages to being single.

For example, you can choose to live wherever you want, never have to worry about spending on others, and have complete freedom to go anywhere and do anything you’d like. For couples, all of these decisions will usually require a discussion of some sort — or, at least, they certainly should.

At the end of your day, be sure to base your financial plan on your preferred lifestyle, not vice versa. Sure, you might be able to save money on rent if you had a partner. But it’s rarely a good idea to make major life decisions just to save a buck.

POCKET CHANGE

Roughly 36% of Gen Z and millennials report to having a friend that leads them to overspend. To halt raking up debt and prevent lifestyle creep many have admit to dumping their spendy friends.

The nationwide supply of electric vehicles has surged 350% this year. The 92-day supply is roughly twice the industry average and shows EVs are sitting on lots longer than intended.

India is set to become the world’s second-largest economy by 2075, per Goldman Sachs. A growing population, investment in technology, and rising worker productivity could help it dethrone the US for the world’s #2 spot.

The price of sriracha is surging due to a shortage of the chili peppers used to make the sauce. This shortage is the result of a climate change-induced “megadrought” in America’s southwest.

The cost of a stamp rose three cents, the third price hike in the past 12 months. This is the shortest time span between price hikes in the postal service’s history.

Bed, Bath, & Beyond canceled the auction for its Buy Buy Baby business. But baby retailer Dream On Me agreed to buy the company’s intellectual property for $15.5 million.

Ready to build wealth on autopilot? Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.