Updated May 20, 2023

Bill Chen, CFA

The Piggy Bank

THE MARKETS

📈 U.S. stocks finished the week roughly unchanged as they grappled with cooling inflation, rising jobless claims, and plummeting consumer sentiment.

💼Economic News

The Consumer Price Index for April showed inflation hit 4.9% last month. Read our Inflation Update below for more details on what that means.

Additionally, the US government is continuing toward the debt ceiling, or the point where it would no longer be able to pay its debt obligations. Discussions to raise the debt ceiling have stalled so far. If a negotiation isn’t reached, it could have a major impact on the lives of millions of Americans, and the global economy at large.

Historically, politicians have always been able to find a way to raise the debt ceiling – even if a deal isn’t reached until the 11th hour.

👀 What to Be on the Lookout for This Week

There are plenty of economic updates to be on the lookout for this week, including retail sales, industrial production, business inventories, building permits, and housing starts.

Additionally, investors will get an update on the number of existing home sales in the US during April. In March, existing home sales dipped 2.4% from February, which could be due to stubbornly high housing prices. A weekly update to the 30-year fixed-rate mortgage will also be released, which currently sits at 6.48%.

As far as earnings, a number of notable companies will report this week, including:

United Insurance

Monday.com

Home Depot

Target

TJX Companies

Walmart

Alibaba

Deere & Company

📰 In Other News

Disney World Reverses Changes: Over the past few months, one thing has become clear for Disney World executives: you don’t mess with resort guests. To cut costs, Disney World eliminated long-time perks like dining passes and early park hours. It also started requiring guests to make a reservation in addition to buying a ticket. In the wake of backlash, Disney World reversed all three of these policies this week. The change will go into effect in January 2024.

Alphabet’s AI: As usual, no week passes without major updates in the world of generative AI, an industry that moves faster than the speed of the algorithms themselves. And this week marked a big one: Google announced it’s opening up its AI chatbot Bard to the public. In its presentation, the search giant highlighted how Bard will be implemented in Google Search to help navigate people toward the information they need.

Interestingly, in a product demo, Bard’s results were listed above all other search queries. This raises an interesting question: Is Google in the process of disrupting its own core product, internet search? With the rate at which AI innovation is moving, we might learn this answer within months, or weeks, or maybe even later today.

Elon Musk Gives Up “Head Twit” Title: Elon Musk tweeted he’s stepping down as Twitter’s CEO but will stay on as executive chair and CTO. The replacement is NBCUniversal’s former head of advertising, Linda Yaccarino.

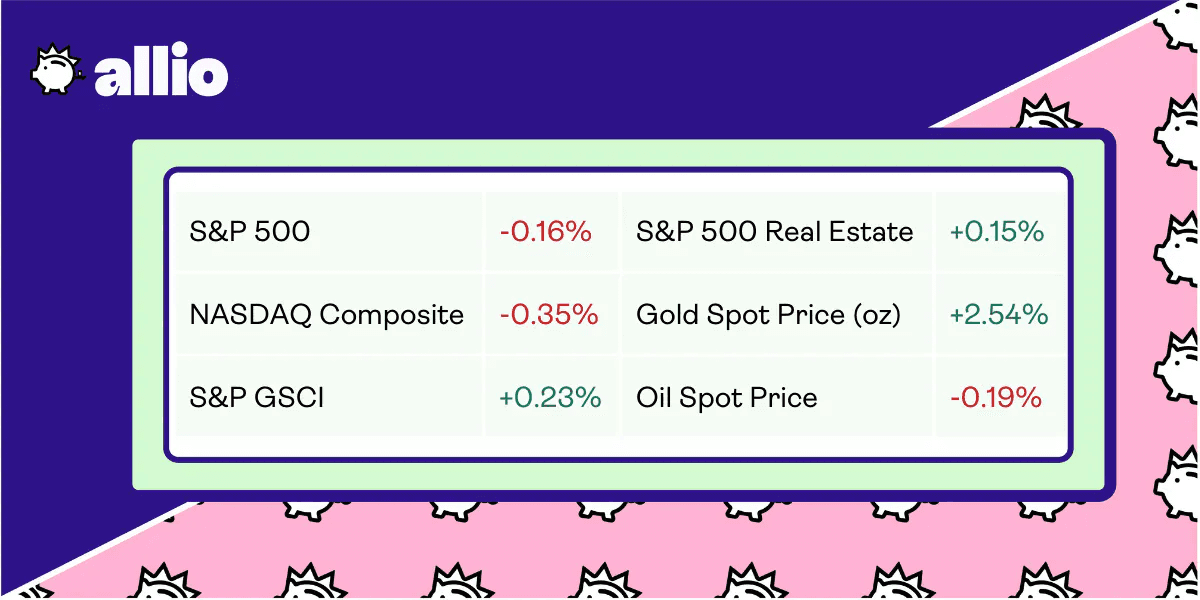

Reflects performance at market close 5/12/23

INFLATION UPDATE

🧊 Inflation Cools, Continuing 10-Month Streak

Inflation Cools

The Consumer Price Index, a closely-watched inflation metric, is in for April. The result? Inflation continued its downward trajectory, hitting 4.9% in April 2023. This marked the lowest inflation rate seen in two years and a significant improvement from last summer, when inflation peaked at 9.1%. Since that peak, inflation has decreased every month.

This report marks a win for American families after struggling under the weight of higher costs for much of the past year. It’s also a sign that the Federal Reserve's decision to increase interest rates at a rapid pace has been working.

While this report showed good news overall, it doesn’t mean that the issue of high inflation is resolved. The Fed has historically set a target inflation rate of 2%. At 4.9%, inflation may be lower than the high rate Americans have grown accustomed to, but it is still more than double the ideal rate.

Many experts agree one main reason for this decrease is that supply chains have naturally cleared up in the post-pandemic economy. The same is true for energy prices, which have cooled since Russia’s initial invasion of Ukraine. But there are surely many factors at the root of the slowing inflation.

Breaking Down Inflation

An inflation rate of 4.9% means that, on average, prices today are 4.9% higher than they were a year ago.

The major price changes driving the lower rate are airline tickets, new cars, and groceries, particularly eggs. All of those categories decreased in price in April, helping to pull inflation down.

However, gas and rent climbed significantly, counteracting those price decreases to a degree.

Here’s a quick breakdown of other price changes from the report:

Food prices: +7.7%

Energy: -5.1%

Gasoline: -12.2%

Fuel Oil: -20.2%

Used Cars: -6.6%

Remember that, while this data is important to know, these figures are merely national averages. How these price changes impact you specifically will depend on different factors, such as your location and spending habits.

Looking Forward

For now, it looks like inflation is continuing to trend in the right direction. For consumers, the bottom line is prices should hopefully no longer be spiking in a frenzy the same way they did in 2021 and 2022.

That said, if you’re not getting a 4.9% raise this year, you’re technically getting a pay decrease. This is because the cost of living is rising around you, decreasing the purchasing power of your income.

Additionally, the Fed’s main strategy for fighting inflation has been to raise interest rates. While the rate hikes may have helped cool inflation, they have also made it more expensive to borrow money, meaning you can expect to pay much more in interest when applying for a mortgage or auto loan.

The fall to 4.9% is a significant, if small step in the right direction. But consumers, companies, and Fed officials alike will hope the 10-month streak is only the beginning.

YOUR ECONOMY

💵 Americans Find Themselves Strapped for Cash

Savings Slump

During the pandemic, the US personal savings rate jumped to a high of 34%. In other words, Americans were tucking away over a third of their disposable income. But since then, this number has plummeted to under 5% — and 10% of those surveyed have no savings at all.This dramatic savings slump is likely fueled by a turn in the economy as hundreds of thousands of Americans found themselves laid off this year in the tech sector alone. On top of that, months of sky-high inflation have increased the cost of living significantly, leaving people with less disposable income to save for the future.

Living on the Edge

The fact that Americans aren’t saving enough is already fairly bad news. When you consider that both home and auto repossessions are on the rise, the economic picture grows even bleaker.

In March, more than 36,000 properties entered foreclosure. This figure was up 20% from February and 10% from a year ago. That was also the 23rd straight month of increasing foreclosures. Auto loan delinquencies, or the number of people paying their car loan late, are also on the rise.

With the average savings rate declining, foreclosures and repossessions up, and inflation still sitting more than twice the Federal Reserve’s target rate, many Americans may feel like they have their backs up against the wall.

How to Protect Yourself

If you find yourself struggling to meet your mortgage payment, there are still some residual pandemic-era assistance programs that you can take advantage of. In particular, you can explore the Homeowners Assistance Fund, which is designed to help homeowners impacted by the pandemic catch up on their housing expenses.

To help you find your financial footing, your best bet might be to secure another form of income. In the era of side hustles and the gig economy, it’s easier than ever now to do so, sometimes without even leaving your home. So be sure to consider exploring remote or work from home opportunities, which can typically be implemented more simply on top of your existing schedule. As many aspects of life become more difficult, a little ease is more than welcome.

And if you're looking for a way to passively save, make sure to activate Allio's round ups feature, which helps you set money aside every time you make a purchase.

✈️ Biden Admin Squares off Against Airlines

New Regulations

The Biden administration is giving America’s airlines two options: tighten down on last-minute flight cancellations, or loosen the purse strings.New regulations proposed by the administration would require airlines to cover all expenses related to a flight delay or cancellation, so long as the air travel companies were at fault for the disruptions. Expenses would include hotel rooms, meals, and taxi rides, in addition to the cost of refunding the ticket.As it stands, many larger airlines will already pay for meals or hotel stays in such circumstances. However, these new rules would make compensating all travel disruption expenses a requirement for all airlines. Before enacting these new rules, the Biden administration will first need to clearly define what is considered to be a “controllable cancellation and delay.”The announcement comes in the wake of a rocky winter travel season for air travel companies, particularly Southwest Airlines. During the 2022 holiday season, Southwest canceled tens of thousands of flights, leaving Americans stranded across the country. The incident is being investigated by the Biden Admin to determine if the airline scheduled an unrealistic amount of flights, which would be considered an “unfair and deceptive practice.”

Fighting for Travelers

Having your flight canceled at the last minute can be an incredibly frustrating experience for flyers. At the very least, it means you’ll have to spend hours in an airport. And in the worst case scenarios it means you’ll miss important events like a wedding, funeral, or holiday.Of course, there’s not much airlines can do when flights are canceled due to weather. After all, it’s not safe to fly in hazardous conditions and the airline shouldn’t be penalized for factors far from its control. But when flights are canceled due to easily avoidable scenarios, such as understaffing, passengers have every right to be frustrated.Currently, most airlines do not offer cash compensation for airline-caused delays or cancellations. Some will extend food and hotel vouchers, but many simply rebook you on another flight. While this is better than nothing, it doesn’t change the fact that a flight cancellation seriously inconveniences travelers and may force them to cover many unexpected costs out-of-pocket.

Greater Transparency

The Biden administration isn’t satisfied with simply making airlines cough up hotel and food money either.

The Transportation Department also announced development of an online dashboard allowing travelers to easily check an airline’s refund and cancellation policy. This way, travelers can avoid flying with airlines at which they know they won’t be refunded in the case of delay or cancellation. By making these policies more readily transparent, the administration is hoping airlines might take it upon themselves to offer better service.

President Biden is clearly making it a top priority to help protect Americans as they take to the skies. For travelers, the timing is ideal, as this summer is projected to be one of the busiest in recent years. If airlines aren’t careful over the coming months, it will only add more fuel to the engine to pass these new regulations.

POCKET CHANGE

Swifties are fueling a spending boom. Shaking off the pandemic era, Taylor Swift fans are spending big to be a part of the singers Eras Tour.

The Writer’s Guild of America instituted its first strike of the streaming era in pursuit of higher pay and better conditions. This strike has already delayed the release of shows like Stranger Things, Severance, Marvel’s superhero movie Blade, and many more.

El Niño is expected to occur this year between late summer and early fall. This irregular weather phenomenon could worsen the drought in the central US and lead to even higher food prices.

Amazon is offering online shoppers $10 to pick up orders from Whole Foods, Amazon Fresh, or Kohl’s locations. This move comes as the eCommerce giant attempts to cut delivery costs.

Planet Fitness is offering free summer memberships to all teens aged 14 to 19. This offer is part of the discount gym’s goal to improve the physical and mental health of America’s youth.

Ready to build wealth on autopilot? Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.