Updated August 7, 2023

Adam Damko, CFA

The Piggy Bank

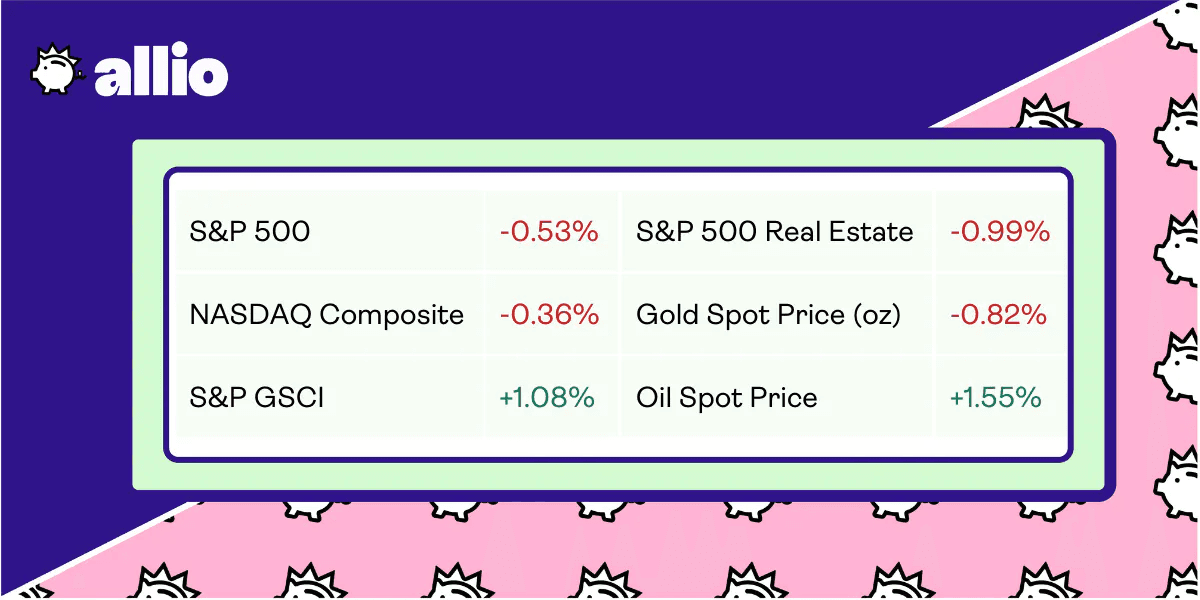

THE MARKETS

📈 Equity markets tumbled this week, down 2% on profit-taking, a weaker labor market, and disappointing Apple earnings.

💼Economic News

According to the Bureau of Labor Statistics, the US added 187,000 new jobs in July – mainly in the health care, social assistance, and financial services industries. This was enough to help the unemployment rate dip down to 3.5% from 3.6% in June.

The latest jobs report, coupled with June’s 3% inflation report, shows that the US economy is still holding strong even in the face of one of the more hawkish Federal Reserves that we’ve seen in recent decades.

👀 What to Be on the Lookout for This Week

This week, the closely-watched rate of inflation will be released. Last month, inflation slowed to just 3%, the lowest reading since March 2021. Core inflation — which excludes food and energy prices — will also be released. It clocked in at 4.8% in June.

Other than that, be sure to watch out for:

Monday: Used car prices

Tuesday: NFIB Small Business Optimism Index, US trade deficit

Wednesday: Mortgage refinances, application, 30-year fixed-rate

Thursday: Inflation

Friday: Producer price inflation

Additionally, be on the lookout for these companies releasing earnings:

Monday: Palantir, Beyond Meat, Lucid Group

Tuesday; Eli Lilly, UPS, and Twilio.

Wednesday: Disney, Plug Power, and Roblox

Thursday: Krispy Kreme, Six Flags

Friday: Spectrum Brands, Nauticus Robotics

📰 In Other News

Missed credit card payment? The United States Government just got a ding to its credit for the first time in over a decade, as Fitch Ratings downgraded the US from an “AAA” to an “AA+”.

The ratings agency cited the “growing debt burden” as well as “political dysfunction” in Washington for the decision. In particular, the ratings agency was concerned over Washington’s continued last-second decisions to address the debt ceiling. These failures to agree until the last second shows an “erosion of governance”, according to the ratings agency. This downgrade is unlikely to challenge the US government’s role as one of the world’s most reliable lenders…but it could be a wake-up call for members of Congress.

In more Congressional news, outrage over hospital billing practices is stirring up change from Congress, state legislatures, and the Biden administration. In particular, these groups want are passing legislation to crack down on dishonest billing practices like site-neutral payment policies and "facility fees".

Site-neutral payments are an issue within Medicare, where the program pays different amounts for the same services based on where those services are performed. This leads to some patients paying higher-than-necessary prices. Meanwhile, facility fees are hidden fees that hospitals tack on for services provided to commercially insured patients in clinics they own.

The healthcare market is incredibly complex and any changes will likely take months, if not years, to materialize. But, this news is a step in the right direction over reducing hidden fees and making healthcare more affordable.

Finally, extreme heat across the country is leading to higher gas prices. This is because major oil refineries can’t operate at full capacity in triple-digit temperatures. The result is a decrease in the nation’s gas supply and higher prices. Ironically, even one of the industries most responsible for climate change isn’t immune to the effects of climate change.

The national average for a regular gallon of gas is currently $3.83, up 30 cents over the past month.

Reflects performance at market close 8/4/23

YOUR ECONOMY

💕 Marital Finances: The Fine Line Between Privacy & Transparency

Married vs. Unmarried Finances

Being single has its perks — including complete control over purchase decisions. After all, you might think, it really shouldn’t be anyone else’s business how much money you’re making, spending, or investing for the future. But, once you have a partner, it is.

Although you will retain some autonomy over your expenditures, entering a relationship brings about a shift in dynamics, particularly if you and your partner decide to live together. Your partner might begin to question certain aspects of your life, like how much money you have saved, what level of debt you have, and what your financial goals for the future are. The answers to these questions will play a huge role in building the foundation of your relationship.

Then, if you get married, everything changes again. Even if you and your partner decide to sign a prenuptial agreement, once you get married, financial transparency is crucial. In healthy marriages, spouses typically stay on the same page when it comes to money. That said, even though you lose a little bit of monetary freedom, sharing finances with a partner has long-term economic advantages.

According to data from the Federal Reserve Bank of St. Louis, married couples tend to be four times as wealthy as unmarried partners who live together. The reason? Unmarried couples may be less willing to combine their finances, which results in married partners enjoying more financial benefits compared to their unmarried counterparts.

Setting Spending Limits

Talking about money with your significant other can be a bit awkward. Unfortunately, this can cause many couples to avoid having money conversations at all. Instead of avoiding the topic, the key is to find the perfect balance between privacy and transparency. One way that many financial experts recommend achieving this is to set a spending limit.

A spending limit is simply a set dollar amount for individual purchases that neither partner can cross without asking the other. For example, if you set a spending limit of $100, neither partner can spend over $100 without checking in with the other first.

The spending limit that works best for you is going to depend on both your and your partner’s income. To find your sweet spot, one strategy is for both of you to write down your preferred spending limits, and then pick the middle point.

Shifting Your Limit

When establishing your spending limit, it is essential to remind each other that it may evolve over time, in tandem with the changes in your expenses as you and your spouse navigate your marital journey together.

For example, when you’re younger and don’t have kids yet, you might be comfortable with your partner spending up to $750 without consulting you. But, once you have kids, you’ll have to factor all of their expenses into your budget as well and your spending limit will likely dip.

A spending limit will help both you and your partner understand exactly how much you can spend without feeling guilty. And you’ll both know the exact moment you should check in before swiping your card.

In that sense, a spending limit is like taking a bright highlighter to that highly-important fine line between financial independence and transparency.

👩🎓 Is College Worth the Cost?

Rising College Costs

It’s no secret the cost of college has gone through the roof over the past 20 years.

In the past two decades, the price of tuition and fees at a private university has jumped 134%. The price of an out-of-state public university is up 141%. The price of an in-state public university is up 175%. As of 2023, attending an in-state school will run you an average of $11,541. For private schools, that average balloons to $44,433.

To help keep up with the cost of college, students have increasingly relied on loans to fund their education. Accordingly, the average federal student loan balance has more than doubled since 2007.

With all this in mind: Is receiving a college degree still worth the rapidly rising cost?

Breaking Down the Costs

Before answering that question, it’s important to note, not all college degrees are created equal.

For example, if you plan to obtain a bachelor’s degree in marketing, and pursue a career as a marketing manager, you can expect to earn a median salary of $135,000 upon graduation. But if you obtain a bachelor’s degree in, say, athletic training, you can only expect to earn a starting salary of $39,500.

From there, the answer to whether or not college is worth it will depend on the ratio between how much you’re paying for your degree compared to how it will improve your earning potential throughout the course of your life.

For example, if you attend a more affordable in-state public school that costs just $11,000 per year, your degree will likely pay off over the course of your life, even if you major in a field with lower earning potential. But, if you attend a private school where tuition will cost closer to $40,000, consider whether your future earnings will be high enough to repay the cost of the education.

This isn’t to say that certain areas of study are better than others. But it could be well worth ensuring your degree will offer tangible benefits on par with its cost.

Still Worth It?

By some estimates, college graduates can expect to earn $1.2 million more than high school graduates over the course of their lifetime. On the whole, they also spend less time unemployed.

Thanks to the increase in earning potential, it’s safe to say the cost of college can still be worth it in the long run. But it’s still important to balance the costs and make sure you’re not overpaying for your degree. It's also worth considering vocational or trade schools, which can have a high ROI based on what you choose to specialize in.

If you’re contemplating pursuing an advanced degree, it might also be worth completing a Free Application for Federal Student Aid (FAFSA) form. The amount of student aid you receive will likely be a big factor in your decision to attend.

In the past, getting a college degree was seen as a golden ticket to a well-paying job. Today, it’s more like a bicycle: it’ll help you get there faster, but you’ll still have to pedal yourself. So make sure you don’t shell out for the 27-speed if the single-speed will get you there too.

POCKET CHANGE

Walmart is adding in-store advertising as it looks to add more revenue streams. The ads will be featured on screens in self-checkout lines, on the store’s radio, and at demo stations.

Amazon is delivering more packages in one day or less after overhauling its delivery network. To achieve this, the Everything Store is incorporating same-day delivery sites that only stock popular items.

Scientists at UC Riverside revealed a new avocado. This new breed, called Luna, is similar to the Hass avocado, but easier to harvest and smoother tasting.

Theme parks are going above and beyond to keep guests cool amid triple-digit temperatures. Some creative methods include tree-lined paths, extended park hours, and even water balloon fights.

Last year, roughly 18% of couples hosted a destination wedding. Some of the most popular destinations include Mexico, Europe, Costa Rica, and the Caribbean.

Ready to build wealth on autopilot? Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.