Updated June 5, 2023

Bill Chen, CFA

The Piggy Bank

THE MARKETS

📈 Equity markets finished the week roughly 2% higher across the board, as “animal spirits” ran wild and non-tech stocks decided to join the AI rally.

💼Economic News

After finally finishing negotiations and passing in the House, the Senate came to an agreement on a new bill late Thursday night to extend the debt ceiling. Though it came down to the wire, the US will avoid falling into default, which could have had major economic consequences across the country and world.

The Senate had a busy week, as they also voted to repeal President Joe Biden’s student loan forgiveness plan. If you were counting on this $20,000 loan forgiveness plan, don’t hang your head just yet. It’s largely expected the White House will veto this bill and the House of Representatives won’t have the votes to override the veto. However, it still faces a challenge in the Supreme Court. A ruling is expected later this month.

Also in the past week, a new report suggested that inflation might be being caused deliberately by corporate greed — a concept known as “greedflation.” In other words, some companies might be increasing prices and simply blaming inflation, even if their costs aren’t actually increasing. Although it’s difficult to prove, the fact that the S&P 500’s average earnings-per-share beat analyst expectations in Q1 by 4.5% is a sign companies might be padding their bottom lines.

👀 What to Be on the Lookout for This Week

This week, be sure to watch for the release of the IBD/TIPP Economic Optimism Index, which measures the outlook for the US economy. Regrettably, this index has been pessimistic — or clocking in a reading below 50 — for the past 21 months. It fell to 41.6 in May, a low since November.

Other reports releasing next week include:

US trade gap

30-year fixed-rate mortgage

Jobless claims

Factory goods orders

Also, be on the lookout next week for these earnings reports:

Gitlab

Sprinklr

JM Smucker

Thor Industries

Dave and Busters

Campbell Soup

GameStop

Rent the Runway

Docusign

Vail Resorts

📰 In Other News

Disney’s live-action remake of The Little Mermaid was released over Memorial Day Weekend and brought in $117.5 million—enough to rank fifth all-time for Memorial Day Weekend releases. But, even more importantly, “The Little Mermaid’s” success has kicked off a larger debate — are movie theaters officially “back”?

With plenty of blockbuster releases to look forward to this summer, the next few months will mark a make or break moment for an industry that’s still feeling the shockwaves from the pandemic.

Despite the shortened week, Amazon still managed to make headlines twice this past week. First, the tech giant was ordered to pay a combined $30 million to the FTC in order to settle two data privacy lawsuits. The larger of the two claimed Amazon violated the Children's Online Privacy Protection act by illegally retaining children’s voice and geolocation data via Alexa and Ring. Later in the week, the Everything Store hit the news cycle again when its workers staged a walkout to protest the company’s climate impact and return-to-office mandate.

In non-Amazon-related news, many of America’s most prominent CEOs returned to China this past week, now that the country is open again for the first time in three years. Visitors included Tesla’s Elon Musk, JP Morgan’s Jamie Dimon, and Starbuck’s Laxman Narasimhan.

Since China is the world’s second-largest economy, serving the market is a necessity for many blue-chip companies. While these CEOs were looking to curry favor, the Chinese business environment remains rife with geopolitical tensions and uncertainty.

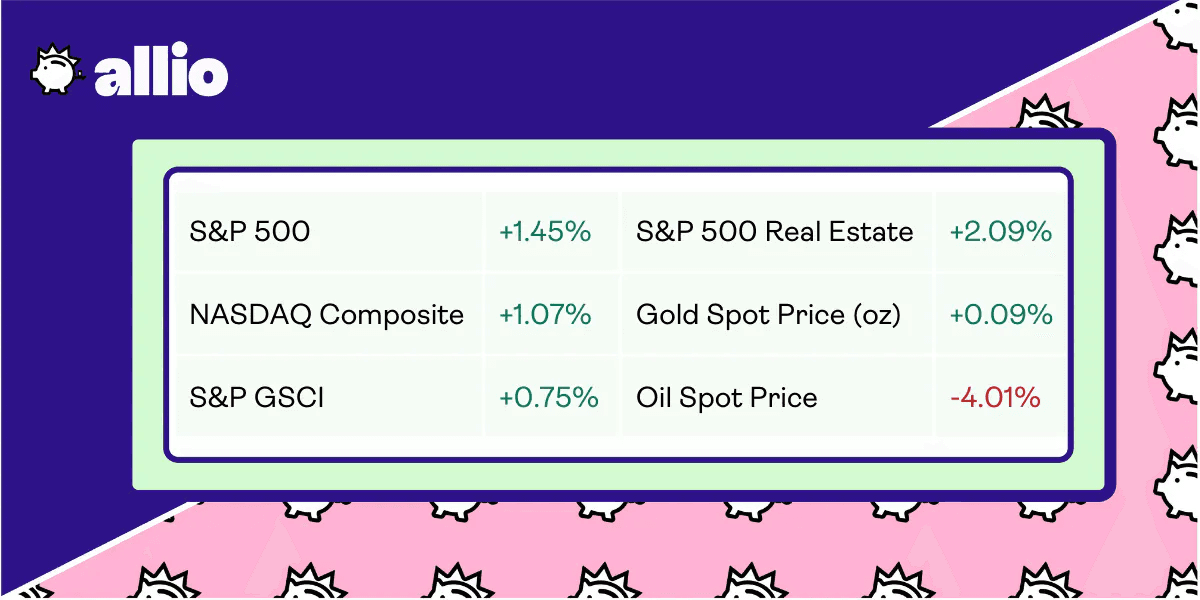

Reflects performance at market close 6/2/23

YOUR ECONOMY

🤑 5 Crucial Negotiating Tips

(Almost) Everything Is Negotiable

They say everything in life is negotiable. Now, this doesn’t mean that you can cruise the aisles of your grocery store and demand a cheaper price for your eggs. (As lovely as spending less than $4 per dozen may sound.)

But, for some larger purchases, haggling is not only acceptable. It’s expected.

For certain expenses like the interest rate on your mortgage, a little negotiation can instantly save you thousands of dollars — if it’s done properly.

How To Haggle

Before you decide to start haggling, make sure you’re speaking with someone who has the authority to change prices. The manager of a furniture store? Perfect. The person checking you out at Walmart? Not so much. If the person you’re speaking with legally can’t help you, you may well go hunt a snipe.

From there, the first step is to simply ask for a discount or upgrade. It might sound obvious, but it’s a crucial step because it opens the floor for the negotiation. You’d also be surprised how much you might get simply by asking. As they say, closed mouths don’t get fed.

If simply asking doesn’t work, try to swap something of value. One of the most reliable things to offer small businesses in particular is a promise you will return in the future. Or, for a discount, you’ll buy more right now.

Another strategy is to team up with a partner to run a “good cop, bad cop” routine. To make this work, one partner will plead with the other to make a purchase, while the other stands firm stating it’s too expensive. If you’re within earshot of a manager, they may rush over to see if they can sweeten the deal.

On that note, you’ll also want to be strategic with your timing. Remember, most sales reps work on monthly sales quotas. If you show up ready to buy later in a month, you’re more likely to get a deal.

As a final step, explaining your reason for buying to the sales rep can help humanize you in their eyes and increase the chances they’ll go out of their way to help you. For example, maybe you’re a broke college student trying to buy your dad a Father’s Day gift, or a single mother looking to book a surprise trip for the kids.

What To Haggle?

In general, the larger a purchase, the more flexibility you’ll have to negotiate. For example, a few common large expenses you can typically negotiate include your mortgage rate, medical bills, hotel room, car, furniture, or mattress. Another rule of thumb is, if the purchase requires a sales representative from the company, you have a green light to start negotiating.

You can also set yourself up for success by researching your purchase beforehand, making a plan, and rehearsing a few times before showing up to the dealer. This will probably prove more effective than winging it on the spot.

Finally, remember negotiation is a skill. And, just like all skills, your negotiating prowess will need to be honed and fine-tuned over time. You might have to spend some time and hard work. But you can make up for it with the money you stand to save in the long run.

🍔 The Curious Case of American Appetites

Conflicting Headwinds

While the pandemic may be over, uncertainty is still very much on the menu for restaurant operators this summer.

It’s a tricky time to forecast food sales heading into the warmer months. Will it be a huge summer for sales as restaurants ride the travel boom? Or will consumers pull back spending in the face of rising costs?

Restaurateurs are essentially evenly split on the issue.

According to data from Datassential, roughly 50% of restaurant operators expect higher sales or improved traffic over the next few months. These expectations are mainly attributed to the summer travel season, which is projected to be stronger than last year. As a general rule, more people traveling tends to correlate to more people eating out.

On the other hand, persistent inflation has driven up the costs of everything from gas and groceries. This has many Americans feeling more budget conscious than ever. When asked, roughly one-third of Americans claimed they plan on dining out less over the coming months.

So it’s safe to say that this summer’s restaurant sales will be a mystery dish.

Three Case Studies

To get an idea of how foot traffic is trending, let’s look to sales at three restaurant chains: Sweetgreen, Chipotle, and Shake Shack.

Interestingly, all three restaurant chains have experienced slowing foot traffic post-Memorial Day. All three of these chains are relatively cheaper than most sit-down dining experiences, which could be a worrying sign for restaurant operators preparing for the summer.

So why is foot traffic is down, even with pandemic restrictions lifted and pent-up demand in full flux? Those three restaurants cited general economic uncertainty, return to office trends, and fewer visits from lower-income customers. Again, this largely points to the fact that Americans are opting to spend less on eating out.

Summer Sales?

While the uncertainty may mean a headache for restaurants, on the bright side, it may actually play in diners’ favor.

Under normal circumstances, restaurants usually don’t need to offer any type of deal or discount to lure in potential customers over the summer. In fact, summer demand is typically so strong, it might even lead to price increases.

However, if sales are projected to be lackluster, restaurants will be more inclined to offer deals and promotions. In fact, restaurants that did offer deals during Q1 noticed an 8% bump in traffic compared to last year. This is a sign that Americans still want to eat out — they may just need a little incentive to do so.

With that said, keep your eye on restaurant promos over the next few months. There’s a chance your next night out might not be as expensive as you expect it to be.

POCKET CHANGE

Housing prices are back on the incline, thanks to steep competition and low supply. In March, home prices increased by 0.4% compared to February.

Streamers are removing content as a way to avoid residual payments and licensing fees. Consumers can expect this trend to continue as Wall Street increases expectations for streaming companies.

The number of Americans living paycheck-to-paycheck is higher among six-figure earners than any other demographic. The figure jumped to 49%, up 7% from last year. Overall, 61% of Americans are living check to check.

The average cost of a US wedding in 2023 is up $1,000 from last year. It now sits at $29,000. This increase is likely the result of consistently-high inflation, as well as pent-up nuptial demand from the pandemic.

Today’s adults are taking longer to reach key financial milestones. Adults are now likely to reach financial independence by age 25, compared to 21 for adults in the 1980s.

Ready to build wealth on autopilot? Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.