Updated May 22, 2023

Bill Chen, CFA

The Piggy Bank

THE MARKETS

📈 U.S. stocks finished the week sharply higher, with the broad market up 1.7% and the Nasdaq 100 up 3.5%, as tech dominance continues.

💼Economic News

One of the biggest topics dominating headlines this past week is the US debt ceiling. According to Treasury Secretary Janet Yellen, the US could run out of cash to cover its debt obligations as early as June. Despite this rapidly approaching deadline, US lawmakers have still not reached an agreement on this potentially catastrophic issue.

President Biden has warned that, if they can’t reach an agreement, the US will likely experience a recession, severe stock market selloff, and a hit to the US dollar.

However, despite all this uncertainty, markets have still remained relatively stable, which could be a sign that investors expect a compromise to be reached at the 11th hour, as has been the case in the past.

👀 What to Be on the Lookout for This Week

Looking ahead, this week will be a busy week when it comes to both corporate earnings and economic releases.

On the earnings side, Zoom and Nvidia will offer earnings reports that will likely be heavily focused on generative artificial intelligence. Zoom recently announced partnerships with both Microsoft and Google’s AI companies of choice: OpenAI and Anthropic. Meanwhile, Nvidia’s share price has more than doubled this year off demand for its chips driven by AI’s momentum.

These companies are also reporting:

AutoZone

Lowe’s

Dick’s Sporting Goods

Intuit

Costco

Workday

Best Buy

On the economics side, investors will get plenty of insight from the Federal Reserve, with speeches expected from St. Louis’s Jim Bullard, Dallas’s Lorie Logan, and Boston’s Susan Collins. The FOMC meeting minutes will also be released, giving investors greater insight as to the Fed’s thinking regarding future rate hikes.

Other expected economic reports include:

New home sales

Jobless claims

US GDP growth rate

Trade deficit

Personal income

Personal spending

Durable goods orders

30-year fixed mortgage rate

📰 In Other News

US taxpayers can finally begin to sigh in relief as the IRS is officially testing a direct file service to allow Americans to easily report their income to Uncle Sam. The IRS will pilot the system in 2024 thanks to a stipulation in the Inflation Reduction Act which allotted $15 million to develop the system.

In related news, Intuit-owned TurboTax recently agreed to pay a settlement of $141 million. The nation’s most popular tax-filing software was accused of using deceptive marketing practice to steer low-income Americans away from free tax-filing services.

Speaking of legal issues, there are quite a few ongoing legal spats across the country:

Montana banned TikTok. Montana Governor Greg Gianforte announced that he was banning the popular video-sharing app, TikTok, throughout the state, effective in January 2024. The ban was contested almost immediately by a group of TikTokers who claimed that it violates their First Amendment Rights.

Disney canceled plans for its Florida campus. The media conglomerate will no longer build an office complex in Florida that would have reportedly brought 2,000 jobs to the state. The company cited “changing business conditions” for the decision, in an apparent reference to its ongoing legal feud with Florida Governor Ron DeSantis.

The Supreme Court backed social media. In two major rulings, the US Supreme Court continued to back Section 230 which protects social media companies from being liable for what users post on their platform.

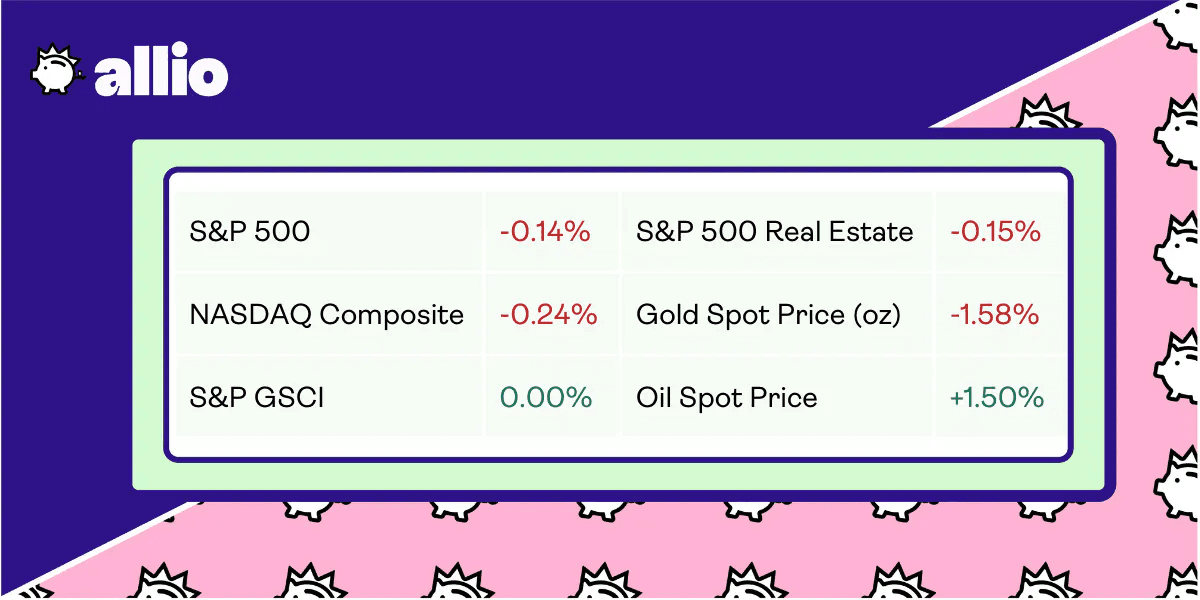

Reflects performance at market close 5/19/23

YOUR ECONOMY

🏫 School of Tok: Money Edition

Trending on TikTok

Conventional norms may say it’s rude to share information about your money situation or ask other people about theirs. But TikTok norms say sharing financial info is beneficial for everyone involved.

In a new trend called #paydayroutine, TikTokers have been sharing anything and everything about their finances. This involves spilling the exact amount you receive in each paycheck, as well as breaking down exactly how you spend it.

So far, the hashtag has racked up a collective 53 million views.

How Does It Work?

In their 60-second video, users start by sharing the exact sum they receive from their employer each payday. Then, they describe their spending routine: how exactly they plan on allocating the money, including rent, utility, credit card payments, travel expenses, food, retirement, and more, complete with dollar amounts.

There are two main benefits to participating in this trend.

As a viewer, you can get an idea of other people’s spending habits and how much their bills are. This is especially helpful if you track down the #paydayroutines of people who are in your income bracket. This will give you a direct comparison of how your spending and savings stack up.

Comparing with others can also help you answer important questions like, “Am I spending too much on my car insurance?” or, “Should I be making an effort to save more?”

The other main benefit of this trend is that, as a participant, you can crowd-source feedback about how your spending habits look. Plus, if you establish and share your goals with TikTok, you may be able to build a network of people to hold you accountable to reaching them.

Money experts say that having someone to hold you accountable is highly important to healthy finances. In fact, it taps into a phenomenon known as behavioral finance.

What’s Behavioral Finance?

Sharing your financial habits and goals with others is kind of like bringing a buddy to the gym. Your friend can help keep you motivated to hit the gym and reach your goals, even when you don’t feel like going. Plus, watching someone else push themselves to succeed can inspire you to do the same.

This doesn’t necessarily mean you need to download TikTok today, share all of your private info, and start taking advice from random people as the gospel truth. But it’s worth considering the benefits of opening up more about your income and financial goals to close friends or family members. Doing so can help you achieve the same goal of the #paydayroutine trend. Namely, providing you with context about your finances and helping you reach the goals you set for yourself.

Since people rarely have the opportunity to talk openly about money, your loved ones may be eager to share their own financial info with you. They may even have some taboo questions of their own.

🚙 Car Commitment: Americans Are Holding Onto Vehicles Longer

Getting Older

The average age of a car in the US just rose to 12.5 years; the highest year-over-year increase seen since the Great Recession.

Is this a testament to the durability of modern vehicles? A sign Americans are nostalgic for older models and rejecting newer car designs? Maybe. But more likely, Americans’ decision to hold onto cars longer is being driven by financial necessity.

In fact, there are three major economic factors currently encouraging Americans to keep driving the same vehicle.

Three Factors

During the pandemic, there were widespread disruptions to supply chains around the world. This caused a delay in the production of new cars, limiting the supply of vehicles and, in turn, pushing would-be buyers of new cars into the used car market.

In 2021, the average price of used cars started to spike dramatically as people rushed to swap their rides. Although the pandemic is now in the rearview, Americans are still dealing with its impact.

On top of that, the past two years have been riddled with some of the highest inflation since the 1980s. With the prices of groceries, gas, and rent rising, Americans have less money left over to splurge on a new set of wheels.

So why don’t people just finance a new car to make it more affordable? Well, many drivers are still doing just that. But the cost of borrowing money to finance a car is also getting more expensive. Since March 2021, the Federal Reserve has increased interest rates ten times, making it significantly more expensive to finance a car.

Today, prime borrowers, or those with a credit score of 661 to 780, can expect to pay 7.83% for a used car loan. Meanwhile, subprime borrowers, or those with a credit score of 601 to 660, can expect to pay 12.08% for a car loan. If your credit score is lower than 601, your expected interest rate skyrockets even farther.

No New Rides

According to Cox Automotive, the average listed price of a used car was $26,799 in April. The average price of a new car was $48,275.

If you’re on the hunt for a new ride, it might be wise to take a detour and stay put in the one you’ve got for a while longer. You’ll likely end up getting a better deal if you can wait at least a few more months. You also want to do your best to avoid making a decision that will hinder you for years, like signing an auto loan that charges you 10% or more in interest.

If you absolutely need a car, it may be wise to buy as much of it as possible in cash to avoid financing. Plus, you should consider trying to secure funding from an outside lender, which would likely offer better rates than the car dealership.

With any luck, car prices will start to ease as supply chains continue to return to normal and we can get back to blue skies and the open road.

Psst... Did you know Allio can help you save for a financial goal - like buying a car? Find out how.

POCKET CHANGE

Pickleball courts are popping up at malls across America, filling a void left by recent retail closures. Since 2019, the number of people playing pickleball has increased by 159%.

Helion Energy just signed a deal to provide Microsoft with nuclear energy by 2028. If successful, the energy company would become the first commercial fusion energy supplier.

Google announced two new AI solutions geared towards the biotech and pharmaceutical industries. These solutions should help make it cheaper and easier to bring new medicines to market.

Taco Bell filed a petition with the US Patent and Trademark Office to cancel the “Taco Tuesday” trademark. The coveted trademark is currently owned by competitor Taco John’s.

Home Depot reported earnings below analyst expectations as consumer spending slowed down. The retailer benefited massively from the pandemic-induced stay-at-home lifestyle over the past few years.

Ready to build wealth on autopilot? Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.