Updated January 29, 2024

Adam Damko, CFA

The Piggy Bank

THE MARKETS

📈 Real Estate Deals Decelerate as Investors Pull Back Amid Rising Interest Rates and Record Home Prices

💼 Economic News

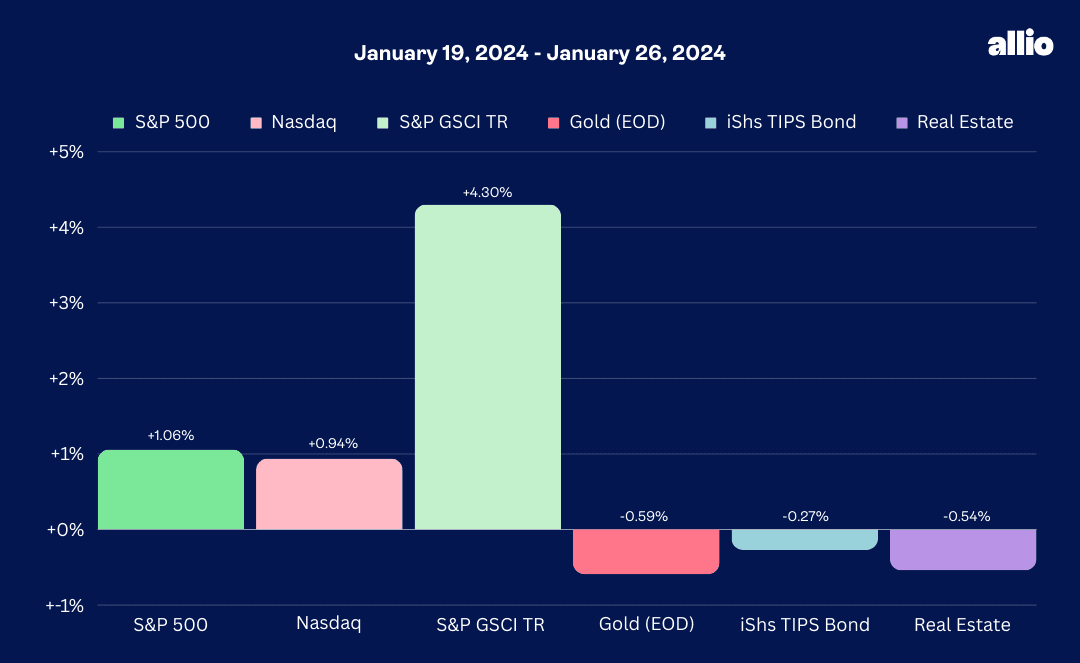

More Good Inflation News. For months, the word “inflation” has struck fear into the hearts of investors, as recent years saw the purchasing power of the dollar decrease at the fastest pace in decades. But according to the latest Personal Consumption Expenditures index release, the worst of these fears may well be behind us. In December, core PCE hit 2.6%, marking the first time that this inflation measure fell below 3% since March 2021.

Core PCE, which excludes food and energy categories which tend to be more volatile than others, is the Fed’s preferred measure of inflation, meaning it tends to carry the most weight in the Fed’s interest rate policy decisions. In general, the Fed shoots for around 2% annual inflation. So, with this release, America’s central bank is closer to its goal than it has been in years. That could potentially give the Fed the confidence needed to begin cutting the federal funds rate down from its current decades-high.

👀 What to Be on the Lookout for This Week

Here are the main economic announcements to look out for:

Monday: Franklin Resources

Tuesday: Microsoft, Alphabet, AMD, UPS, Starbucks, General Motors, Pfizer, Starbucks

Wednesday: Mastercard, Qualcomm, Boeing, Novo Nordisk, Metlife, ADP, Shell, Honeywell

Thursday: Apple, Amazon, Meta Platforms

Friday: ExxonMobil, Chevron, AbbVie

Additionally, here are the biggest earnings reports to keep an eye on:

Monday: Dallas Fed Manufacturing Index

Tuesday: Case Shiller Home Price Index, JOLTS Job Openings

Wednesday: 30-Year Mortgage Rate, ADP Employment Change, Fed Interest Rate Decision

Thursday: Initial Jobless Claims, ISM Manufacturing PMI

Friday: Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings, Factory Orders

📰 In Other News

Real Estate Deals Slow. Investors are starting to reel in their real estate purchases, according to new data from Parcl Labs, a real estate data and analytics firm.

Back in 2022, businesses acquired around 802,000 homes. But this number dropped to just 570,000 in 2023. The pullback is likely due to higher interest rates and record home prices, both of which can reduce investors’ returns and make real estate a less attractive asset.

MIT’s Reassuring Findings. If you’ve been concerned about AI stealing your job, you might want to read MIT’s recent study. There’s a good chance it’ll help you sleep better at night.

The research from MIT’s Computer Science and Artificial Intelligence Lab concluded that replacing human workers with AI simply isn’t economically viable for most industries. In other words, while AI might be able to do your job, it probably can’t do it for significantly less money than you can. With these findings, the supposed AI takeover will likely be more gradual than previously thought.

Temu’s Surprising Target Market. Chinese eCommerce site Temu is known for offering heavy discounts on products. The platform debuted in the US in late 2022 and quickly became one of the most downloaded apps. Being an online marketplace, many experts assumed that Temu was primarily popular with younger shoppers, similar to TikTok Shop and Shein. However, that may not be the case.

According to Temu’s sales data, the Chicago research firm Attain determined that Gen Xers and baby boomers are the demographics most likely to use Temu. According to the data, shoppers 59 and older made an average of 5.6 transactions, compared to shoppers 18 to 26 who made an average of just 2.6 transactions.

The FTC’s AI Investigation. The Federal Trade Commission (FTC) is launching an investigation into AI leaders like Microsoft, Alphabet, OpenAI, and Amazon. The competition regulator will be looking into the cloud and AI partnerships between these tech goliaths, searching for anti-competitive practices.

YOUR ECONOMY

📲 Social Media Drives Gen Z’s Money Habits?

Growing up Social

As the first generation to grow up with the internet and social media, it should come as little surprise that members of Generation Z — born between 1997 and 2012 — lean heavily on social media for financial guidance, per a new report by Federal Reserve Bank of Kansas City.

If someone a baby boomer needs financial advice, they’re likely to schedule an appointment with a financial advisor. And if they owe money to a friend, they’ll probably repay them using cash or a check. In contrast, many members of Gen Z are comfortable seeking financial advice on platforms like TikTok. And when they need to repay someone, they prefer peer-to-peer payment apps, like Venmo or Cash App.

There’s nothing inherently wrong with these new money habits. But given their prevalence, it’s important to be aware of the risks associated with fintech apps. Relying solely on financial advice from crowdsourced platforms can also pose its own set of challenges.

Social Media & Money

Over the past decade, payment apps like Venmo and Cash App have grown in popularity as they offer a convenient way to send money between friends. In addition to transfers, these apps often include a social media feature that allows users to share information about their transactions, including amounts and reasons for the payment. Although it is possible to disable this feature, many have grown accustomed to viewing their own transaction history, as well as the spending habits of others.

According to the Kansas City Fed’s data, younger generations are much more likely to use money-sending apps than their parents. Roughly 85% of people between the ages of 18 and 44 reported using payment apps, compared to 38% for those aged 60 and over.

In the same study, many younger consumers reported using social media as their go-to source for financial information. While scrolling through their feeds on TikTok, YouTube, or Instagram, they would receive advice from financial influencers — or “fin-fluencers” — they follow.

Words of Caution

On the one hand, it may be a net positive that money is so front-of-mind for younger generations. U.S. schools have faced criticism for failing to properly prepare Americans for the financial responsibilities of adulthood. The ability to learn how to invest on YouTube — and to actually invest from your phone — is not just more convenient, but may be creating a more financially literate population.

However, there are several drawbacks, and it's important to be aware of their respective risks. For example, many members of Gen Z are inclined to treat Venmo or Cash App like a bank account. Although they provide instant access to money, it's important to understand that these apps don't offer the same consumer protections as bank accounts. Many users have money automatically added to payment apps through reloads, but these funds, once stored, don't offer the same security as a bank account. If a financial institution is not insured by the Federal Deposit Insurance Corporation (FDIC), recovering funds stored on the app is unlikely if the company were to go under. That’s not the case with traditional bank accounts insured by the FDIC.

Additionally, having money in a payment app is particularly risky considering the threat posed by scammers and hackers. In fact, the Federal Trade Commission (FTC) estimates that roughly $164 million was lost through payment apps in 2022. Because of this, experts advise users to turn on two-factor identification or require a password to access the app. This simple step saves a lot of stress, especially if the phone is lost or stolen.

Finally, while social media influencers can be a useful source of information — especially considering personal finance isn’t commonly taught in schools — it's important to always double-check the information you receive online to ensure its accuracy. Truthfully, this applies to all economic information or financial advice, regardless of its source. However, it’s particularly true when the barrier to entry isn’t a degree in finance or professional certification, but simply setting your camera to selfie view and pressing record.

🤔 Looking for a New Job? Wait a Few Months

America’s Restless Workforce

The youngest working generation, Gen Z, is known for a willingness to share almost every aspect of their lives, be it with friends, family, or followers on social media. Their personal finances are no exception.

Many Americans likely had “find a new job” on their list of New Year’s resolutions. A LinkedIn poll of 1,000 US professionals found that nearly 85% were interested in switching jobs this year. For younger workers, this percentage is even higher. A whopping 90% of Gen Z and 92% of millennials are considering a job change this year.

This general feeling of restlessness may be due in large part to inflation. Many employees have watched their pay raises be eclipsed by rising prices over the past few years. But the tricky economic landscape is just one of a long list of reasons to continue the job hunt.

Another factor might simply be FOMO, or fear of missing out. Many workers observed colleagues receiving hefty pay pumps after switching jobs over the past year. Data from the Federal Reserve Bank of Atlanta showed that people who switched jobs back in August 2022 were able to secure an average pay bump of 8.4%, compared to the 5.6% average pay raise for those who remained in their jobs during that time frame. Although the average wage growth rate dipped in 2023, the difference in earnings may be enough for some employees to emphasize the advantages of considering new career opportunities.

But a lot has changed in the year and a half since then. As 2023 continued, the pay bump workers got for switching jobs shrank even further. Now, when looking into the current conditions in the job market, experts suggest it may be best to consider postponing the job hunt until later in 2024.

The State of Today’s Job Market

American employees have enjoyed an historically tight job market over the past few years.

In other words, for much of 2023, unemployment hovered near a half-century low, leaving a higher demand among companies for new hires than there were workers to fill them. As of November 2023, the Bureau of Labor Statistics estimated that there were 8.8 million unfulfilled job openings — about a million more than pre-pandemic levels. The fact that there were more job openings than available workers left job seekers with plenty of power at the negotiation table.

However, the pendulum has since swung back in favor of employers. Although the job market remains fairly tight for hourly workers, demand for white-collar jobs in fields like finance, marketing, and software development has slid below pre-pandemic levels, according to Indeed. With many workers now competing to fill fewer job openings, employers are the ones with more leverage in negotiations. As a result, today’s employers can afford to offer less generous salaries and perks than in recent years.

The Patient Bird Gets the Worm?

Nevertheless, today’s job hunters shouldn’t despair. For one thing, the labor market is still strong. And, while job seekers may not be able to land a significant pay increase, they’ll still have a good shot at finding a job, should they need one.

Additionally, it's important to remember that the labor market tends to grow and contract along with the economy. Over the past year, economic growth has slowed down in response to the Federal Reserve raising interest rates. But this trend is widely expected to change in 2024. Many economists expect the Federal Reserve to start cutting interest rates at some point this year. Right now, markets are pricing in a 40% chance that the Fed will cut rates before March 20.

Once the Fed begins to cut rates, it will lower the cost of borrowing, which typically spurs business investment and expansion. When the economy expands, the demand for workers tends to increase, which means the pendulum may be poised to start swinging once again.

POCKET CHANGE

Buy Now, Pay Later bills from the holiday season are coming due. With credit card debt at a record high, many US consumers are acutely feeling the weight of these payments.

63% of Americans ranked their current financial situation as “good” in a new Axios survey. And 85% felt they could change their finances for the better this year.

People are starting to share details about getting fired online, breaking the job loss stigma. For some, this openness is empowering.

American CEOs are growing weary of return-to-work mandates. Only 6 out of 158 US CEOs say they’ll prioritize bringing workers back to the office full-time this year, as hybrid work becomes the new norm.

The Federal Highway Administration is phasing out funny messages on highway signs. The FAA said these messages "adversely affect respect for the sign."

Head to the app store and download Allio today to start building wealth your way!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.