Updated July 24, 2023

Adam Damko, CFA

The Piggy Bank

THE MARKETS

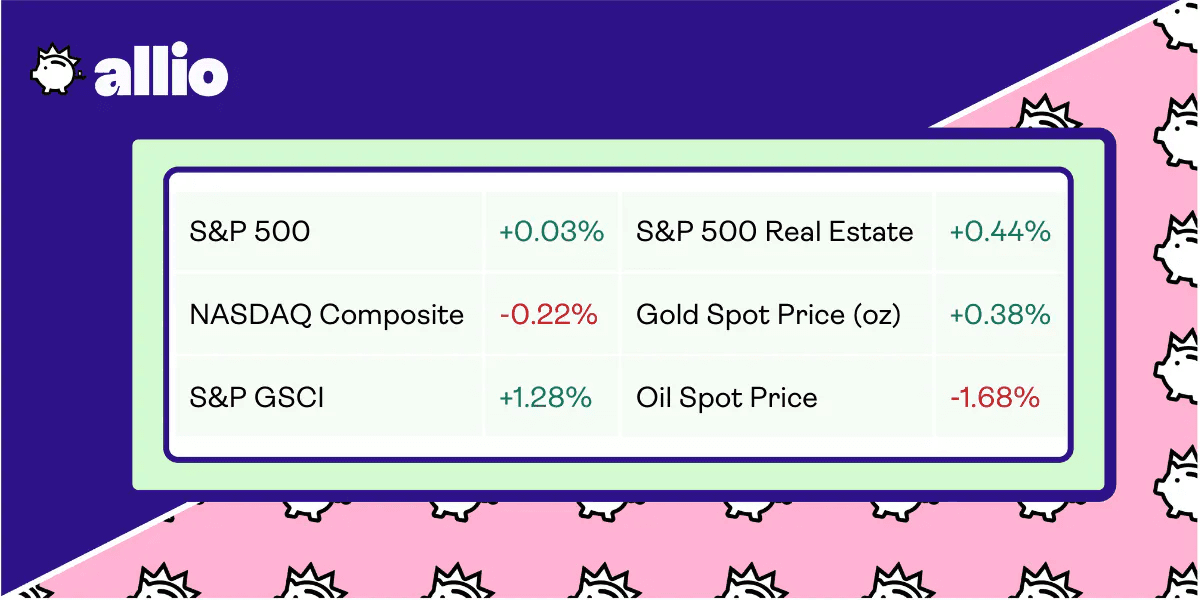

📈 Equity markets were mixed this week as the broad market rose half-a-percent while the Nasdaq 100 fell 1%.

💼Economic News

The latest data show that just 1% of all homes in the US changed hands during the first half of 2023, the lowest percentage in a decade. This means that, for those in the market for a new home, you have roughly one-third fewer houses to choose from than in years past. Since many homeowners locked in ultra-low mortgages during the pandemic, they’re hesitant to move and risk taking on a higher mortgage.

On top of that, home prices reached an all-time high in May after rising 0.7% month-over-month. Experts are surprised housing demand remains so strong, even as the Federal Reserve has increased interest rates at the fastest pace in decades.

👀 What to Be on the Lookout for This Week

This week will also be a busy one for earnings, with the following companies schedule to report:

Domino’s Pizza

Microsoft

Alphabet

3M

Raytheon

Meta Platforms

Coca-Cola

Boeing

Hilton

Honeywell

CBRE

Ford

Chevron

Exxon Mobil

Procter & Gamble

📰 In Other News

After years in the pipeline, it took the Federal Reserve’s instant payment system a lot longer than an instant to arrive. But now, FedNow is here. The Fed’s new system will let banks and credit unions instantly transfer money for customers 24/7, 365. And 35 financial institutions have already adopted it, including two of America’s biggest: Wells Fargo and JPMorgan Chase.

The other major story of the week was a slew of blockbuster earnings reports. And, like any great story, there were unmistakable winners and losers. Among the former, Netflix stood out. After posting a subscriber loss for the first time in company history last year, Netflix reportedly added 5.9 million subscribers in the second quarter. This is a sign that its plan to crackdown on password sharing is paying off. Adding fuel to the fire, Netflix plans to eliminate its ad-supported free tier. Plus, with plans to expand its budding gaming sector, the reigning video streaming giant might soon add “game” to its title.

On the other hand, AT&T, Verizon, and other legacy media providers did not have such a hot week. A Wall Street Journal report revealed these companies are responsible for an extensive network of 2,000 unused cables across the US. These cables are encased in lead, which could be toxic and is in some areas at risk of seeping into the groundwater. Leaving the cables in the ground isn’t exactly an option. But it could cost about $60 billion to completely remove them all.

Additionally, for those who love to travel overseas, it might be time to celebrate — or make a few more bookings. Following in the footsteps of its rivals, United Airlines upped the number of international flights it offers in the wake of surging consumer demand. So, the next time you want to fly internationally, you might not need to trek to a major airport and sit through three layovers just to get there.

Reflects performance at market close 7/21/23

YOUR ECONOMY

🔄 Debt Déjà Vu: Student Loan Payments Return

Return of Monthly Payments

After roughly three years of serenity, a rude awakening is coming for millions of Americans with student loan debt: the return of monthly payments.

Outstanding student loans will resume collecting interest in September, with payments set to restart in October. According to the Consumer Financial Protection Bureau, roughly 20% of borrowers will likely struggle to make their payments.

By this point, student loan payments have been in forbearance for nearly three years. During this time, interest has not accrued on outstanding balances and borrowers have not had to make any payments. The unexpected pandemic-era relief helped roughly 37 million borrowers save approximately $195 billion since April 2022, according to the Federal Reserve Bank of New York.

But the payment restart could be conversely difficult. During the same period when student loan payments were paused, inflation in the US hit historic levels. For most of 2022, inflation was well over 6% causing the income of a typical household to decrease by roughly 1% from December 2021 to December 2022.

How Much Do Americans Owe?

When it comes to student loans, the typical borrower pays between $210 and $314 monthly — or around $2,500 to $3,750 annually — to service their debt. This is, of course, just an average; some borrowers pay less, while others pay much more.

Meanwhile, for borrowers that make close to the US median income, paying $210 to $314 per month will essentially equate to a 4% to 5% cut in pay.

The return of student loan payments could have a disproportionately steep impact on borrowers when compared to other bills. Making a steep payment each month to service your student loan debt hinders your ability to invest this money or save it for significant life goals like buying a home.

On top of that, for borrowers who owe a significant sum, the prospect of repaying loans in full can feel hopeless, as interest growth could drag the repayment process out for many years.

Prepping Your Budget

The silver lining is that the Biden administration has placed a safety rail in place for borrowers. Namely, the White House says borrowers won’t be considered delinquent or placed in default for missing payments during the first year after the pause ends. This means that missing a student loan payment is unlikely to hurt your credit score or show up on your credit report.

That said, this safety rail does not mean you should start skipping your student loan payments. In fact, the more you’re able to pay off now before the interest resumes, the less you’ll have to pay in the long run. But it may be able to help you sleep easier knowing that missing a payment or two won’t have life-altering consequences.

Fortunately, there is still a full month to prepare before student loans start collecting interest in September. And there are two months before October, when payments resume. If money's tight, instead of trying to repay your loans by squeezing money from your existing budget, money experts recommend picking up a side hustle to help generate extra income for your student loans. You may have to work a little harder, but you’ll be able to sleep more soundly.

🚨 Breaking Down the New 401(k) Catch-Up Contribution Rules

What Are Catch-Up Contributions?

A catch-up contribution is a tax law that allows those aged 50 or older to contribute more money to their retirement account than people under 50. Typically, near-retirees can contribute an additional $7,500 to Roth accounts, as well as 401(k) plans.

However, moving forward, those who earned $145,000 or more in the previous year will only be allowed to make catch-up contributions to a Roth plan, not a company-sponsored 401(k). If you are relying mainly on a 401(k) to fund your retirement, this update could throw a significant wrench in your plans.

This rule change is set to take effect January 1st, 2024. It could imply that some high-earning Americans may have to pay more in taxes.

Losing a Tax Break

Under the previous rules, near-retirees making catch-up contributions to 401(k) plans enjoyed two advantages. For one thing, they got to invest money and have it compound to help fund retirement. But, on top of that, they enjoyed the added benefit of delaying their tax payments until a later date — and possibly even paying less in taxes overall.

Since the funds for a 401(k) are pulled directly from your paycheck, the money isn’t taxed until you withdraw it during retirement. Typically, by the time you are retired, you’ll have a lower income, meaning you’re in a lower tax bracket and ultimately owe less in taxes.

For example, if someone paid a tax rate of 35%, they could save $2,625 on their tax bill when making a catch-up contribution of $7,500 to their 401(k). Put another way, this person could simultaneously reduce their tax bill while also investing money for retirement.

However, under the new rules, this tax trick is moot, since near-retirees will have to pay taxes upfront during high-earning years, as opposed to in lower-earning retirement years.

Adjusting Your Retirement Planning

Notably, these recent changes from Congress will not apply to Individual Retirement Accounts, or IRAs, which are usually offered by third-party providers instead of your employer. As of 2023, if you’re 50 or older, you can still contribute catch-up contributions of up to $1,000, in addition to the $6,500 annual limit.

Additionally, not all companies offer Roth retirement accounts to their employees. If you fall into the demographic that might be impacted by this rule change, it may be worth inquiring with your company’s HR team about how your account will be impacted.

All things considered, this rule change will only impact those 50 and up who earn over $145,000 — a relatively small demographic. However, even if this rule change doesn’t apply to you, it can still pay to follow along with the national conversation surrounding financial legislation. Changes like this one are a reminder that tax and investment laws are constantly in flux. By following along and making the necessary changes along the way, you’ll be able to better set yourself up for a financially successful future.

Looking to level-up your financial literacy when it comes to retirement planning? We'd suggest checking out our Guide to IRAs and our 401(k) Explainer.

POCKET CHANGE

Chipotle announced plans to open two new locations each in Kuwait and Dubai. The fast casual chain signed its first franchise partner, the Kuwait-based Alshaya Group, to facilitate its Middle Eastern expansion.

Goldman Sachs cut the odds of the US entering a recession in the next 12 months from 25% to 20%. Analysts attribute this positive outlook to better-than-expected economic data, including lower inflation.

The average American eats roughly one-third less ice cream per year than in the 1980s. Today’s consumer appears to prefer smaller, premium pints with a wider variety of flavors.

The Biden administration is developing a program to rank consumer gadgets on their cybersecurity prowess. Starting as early as next year, gadgets that meet certain requirements will bear a “US Cyber Trust Mark” shield.

Roughly 15% of restaurants have added extra fees to customer bills this year as costs for labor, food, and rent surge. Diners have taken to social media to express frustration with these additional surcharges.

Ready to build wealth on autopilot? Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.