Updated March 21, 2023

Raymond Micaletti, Ph.D.

Alpha

We experienced another manic and action-packed ride in markets last week. Regional banks suffered a 15% loss–on the heels of a 17% loss the prior week–and were the continued focal point of a market seemingly one bad headline away from panicking.

The week started on a positive note last Sunday when the FDIC stepped in and backstopped uninsured depositors at SVB and SBNY. The market initially breathed a sigh of relief. Equity futures rallied on the news. But the good vibes didn’t last long.

By 11pm Sunday, futures had topped and proceeded to fall 4% (high to low) by the next morning. Though they recovered to finish flat by the end of the day, it was clear that the FDIC’s actions would not be enough to stop the burgeoning crisis.

On Tuesday, we got the latest CPI report, which was largely in line with expectations. The biggest component of the month-over-month increase was shelter, which is a lagged value and likely much higher than real-time shelter inflation. Thus, the market largely ignored the slightly hot core CPI number and rallied throughout the day.

But again, the rally didn’t stick. Banking worries persisted.

By midweek, both Credit Suisse and First Republic were in need of extraordinary assistance. And they received it. The Swiss National Bank said it would provide a credit lifeline of up to $54 billion for Credit Suisse, while JPMorgan and other too-big-to-fail U.S. banks cobbled together $30 billion to shore up First Republic’s deposit base.

And once more the market responded favorably. At first. But by Friday, both banks were again on the verge of collapse.

Treasury Secretary, Janet Yellen, didn’t seem to help matters Thursday when asked in front of Congress whether the FDIC’s backstop would extend to uninsured depositors at institutions other than SVB and SBNY. She responded by saying that uninsured depositors at other banks would be backstopped only if their banks were systemically important.

Her comment set a negative tone for Friday’s trading where First Republic–which on Thursday had risen from $20 to $40 on the news that JPMorgan and other too-big-to-fail banks were infusing it with $30 billion in deposits–fell back below $20 in after-hours trading on Friday evening.

Throughout the week, Fed fund futures oscillated wildly–pinging back and forth between forecasting the Fed would hold rates steady or raise them by 25 basis points. Meanwhile, the Fed’s balance sheet ballooned by $300 billion as distressed banks made use of the Fed’s discount window to go on a borrowing spree. This balance sheet increase ended up negating more than half the Fed’s quantitative tightening of the past year.

Friday’s rout in regional banks and the likelihood Credit Suisse and First Republic wouldn’t survive past Sunday, gave the market a “Lehman weekend” feeling.

The consensus was that central banks and governments would need to do something over the weekend to restore confidence in the global banking system, lest we suffer a catastrophic cascade of bank failures.

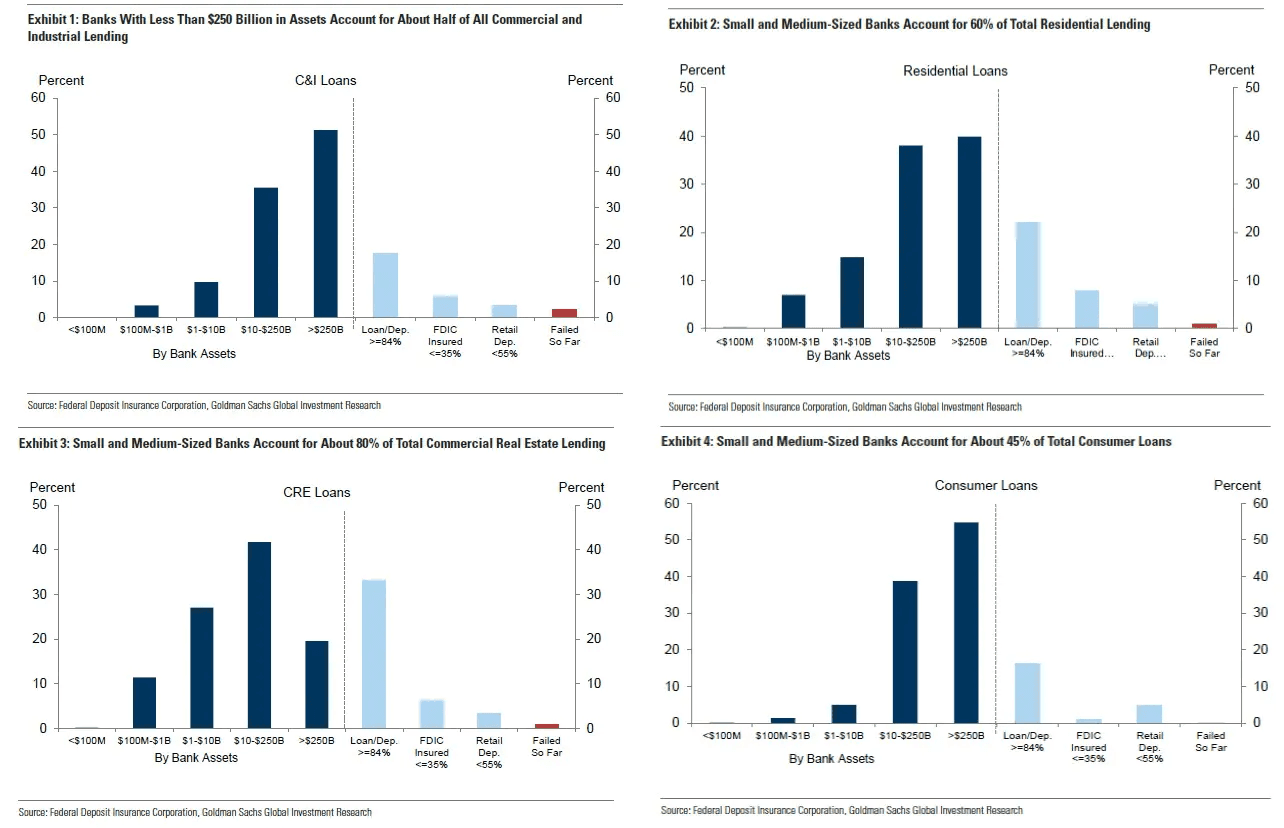

As small- and mid-sized banks supply 50% of commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending, allowing these banks to fail would likely usher in the next Great Depression. Hence, the consensus that authorities would need to act.

Despite all this seeming horror, however, the S&P 500 finished the week up 1.5%.

The S&P’s performance paled in comparison, however, to the Nasdaq 100’s 5.8% gain, gold’s 5.6% gain, and bitcoin’s 35%(!) gain. No doubt these assets were anticipating some concerted action by authorities to stem the crisis.

At the time of publication, UBS has agreed to buy Credit Suisse, seemingly taking that concern off the table. And the Federal Reserve has announced currency “swap lines” with five other central banks for the purpose of supplying dollars to the global financial system.

The First Republic situation, however, has not yet been dealt with, despite rumors of Warren Buffett’s potential involvement.

As a result, all eyes will be on the Fed this week as it announces its latest policy decision Wednesday afternoon.

The market is currently expecting the Fed to hike by 25 basis points. If that expectation survives Monday’s trading, it’s virtually assured the Fed will follow through with a 25 basis point hike.

Notably, while retail and hedge funds were selling, institutions were buying (as of the week ending March 10).

Add to these points, the fact the Fed’s balance sheet has expanded, swap lines have been put in place, and Warren Buffett may swoop in to save the day with regional banks.

Lastly, it seems inconceivable that the Fed, Treasury, and White House would stand by and let a banking collapse turn into the next Great Depression or even allow it to flirt with that level of calamity.

The Bear Case

The bear case rests on the Fed continuing to be a comedy of errors–either by continuing to maintain its hawkish stance because it feels it’s thisclose to stamping out inflation or by providing liquidity and kind words that are ultimately deemed not enough by the market.

Our View

While it would have been nice to have the latest Commitments of Traders Report (from this past week) to see what investors were doing in the wake of the latest developments, alas, the CFTC is still one week behind in its reporting.

Nevertheless, bitcoin, gold, the dollar, short-term rates, and the Nasdaq are all behaving as though a tsunami of liquidity is right around the corner.

The S&P 500 had ample opportunities to fall last week, even selling off substantially on multiple mornings, only to see that weakness largely or completely erased by that day’s close.

It is often said that retail investors trade emotionally during the early part of the day, while institutional investors trade methodically over the latter part of the day. If so, that suggests retail investors continued to panic last week, while institutional investors continued to accumulate.

The two weeks after March options expiration tend to be seasonally weak, consequently, we could see some near-term weakness in equity markets.

But, provided the Fed gets its messaging and actions right in the coming days, we would expect equities to generally trend higher over the coming weeks given the excessive bearishness and potential for a positive catalyst for the banks (as the alternative to a positive catalyst–i.e., doing nothing and watching the economy crater–seems to be the surest path to the gallows for central bankers and politicians).

Of course, if the Fed botches its communications this week, well, then, call your mother!

We also reiterate our belief that gold is well positioned to benefit regardless of what happens in equities. If equities rise on newly-injected liquidity, gold should do well. If equities fall because of the ongoing bank crisis, gold should continue to receive safe-haven flows. (Note: notwithstanding the fact gold has gone vertical the last two weeks and is ripe for a breather.)

This win-win situation is a friendly reminder that we’re in a secular bear market driven by high inflation and gold is historically one of the best performing assets in such a regime. Don’t miss out on its secular appeal.

At Allio, gold is one of our largest allocations across all of our portfolios, as we expect it to be a high-performing asset for the duration of this secular regime.

Further, hedge funds have extreme short positions–at levels that coincided with interim market bottoms several times in 2022.

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.