Updated May 1, 2023

Raymond Micaletti, Ph.D.

Alpha

The broad equity market gained 0.60% last week led by the Nasdaq 100’s 2% gain (on the back of well received mega-cap tech earnings). It marks the 7th straight week (ever since Silicon Valley Bank’s collapse) without a meaningful pullback in the broad equity market.

Microsoft finished the week up 7.5%, Meta clocked in with a 12.8% gain, and Google rose 2.2%. Amazon, despite an initial 12% surge after reporting earnings Thursday post-market, was the lone loser of the big-tech companies that reported earnings last week, falling 1.4%.

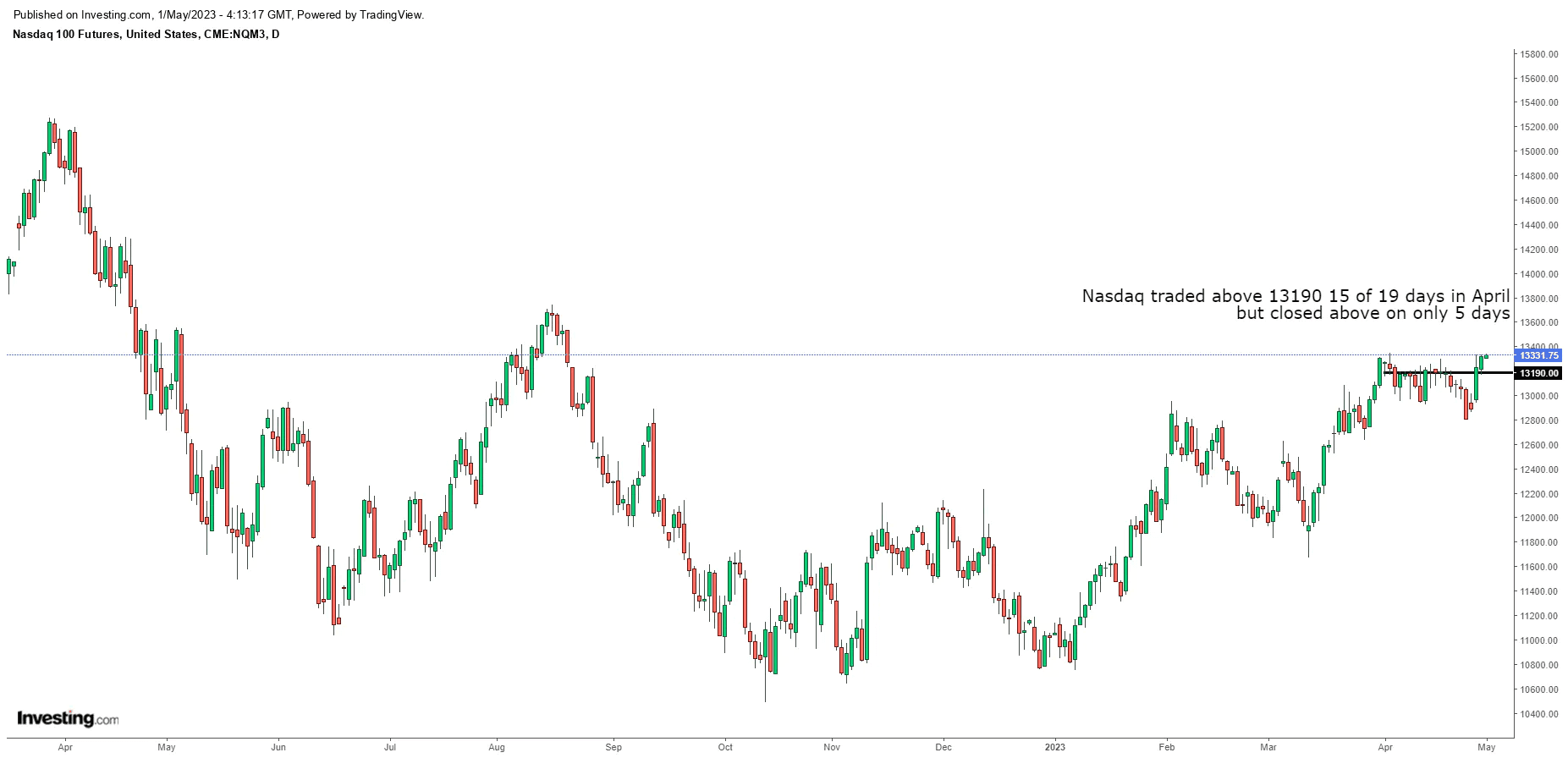

The generally favorable response to tech earnings lifted the Nasdaq 100 futures above what had seemingly become impenetrable resistance at 13190–a level the June contract crossed 15 of the 19 trading days in April, but closed above only five times. It closed Friday at 13320–its highest close since August.

Source: Investing.com

This week we’ll get the Fed’s latest policy statement on Wednesday, Apple’s earnings on Thursday, and the non-farm payroll report on Friday (along with other jobs data on Tuesday (JOLTS), Wednesday (ADP), and Thursday (initial claims)).

With respect to the Fed, the market is pricing in an 85% chance of a 25 basis-point rate hike—a hike the market feels will be the Fed’s last of this hiking cycle. Where the market and the Fed tend to differ is that the market believes the Fed will begin cutting rates this year, while the Fed has repeatedly insisted it will not.

How the market responds to the Fed on Wednesday may set the trading tone for the next couple weeks. Since the middle of last year, any time the S&P 500 has been above 4000, the Fed has amped up its hawkish rhetoric. We’re now bumping up against 4200 on the S&P; will the Fed’s pattern continue?

On the one hand, inflation is still elevated and global financial conditions are easing (thanks to the Bank of Japan’s quantitative easing and the Fed’s recent injections of liquidity to stem the bank crisis). These factors would argue for the Fed to remain hawkish.

On the other hand, if the Fed still hopes to engineer a soft landing, almost certainly it would need a stable and/or rising equity market to pull it off. With the fallout from the recent bank crisis still unknown, the Fed may opt to go easy on equities.

In any event, with equities overbought at resistance, a near-term pullback would almost be expected. But near-term pullbacks aside, what can we expect over the next several weeks?

The Bull Case

The bull case can be summed up in three bullet points:

Positioning—according to Nomura’s flows guru, Charlie McElligott, “max pain” remains higher, as many investors continue to be underweight a rising market and particularly underweight tech stocks. Further, in the futures and options markets last week, institutions continued to buy while speculators and retail continued to sell.

Market behavior—according to Credit Suisse, “Bear market rallies in general do not go more than 3% above their 200-day moving average (circa 4083 on the S&P 500) for more than 3 weeks. We are 4.4% above the 200-day moving average and have been above for 26 trading days.”

Earnings beats—according to Goldman, “So far 1Q is shaping up to actually be a bit better than usual. In addition to strong results from mega-cap Tech, we have also seen a better-than-feared if not outright strong earnings from the banks, airplane manufacturers, industrials more broadly, the airlines (for the most part), and even toy makers.”

The Bear Case

The bear case rests on the following:

Extremely narrow breadth—despite multiple breadth thrusts having triggered earlier in the year, recent breadth has been paltry. As ZeroHedge sums it up: “the entire market is propped up by - quite literally - a handful of stocks; in fact virtually all of the 2023 gains are thanks to a handful of tech, and mostly AI stocks. This means that the market has never been more fragile and susceptible to a crash, as all of the recent upside is thanks not to a diversified rally but upside in a few giga-cap techs. And while 2021 showed that such narrow rallies can steamroll all bears for a long, long time, 2022 taught us just how painful it is when these narrow rallies reverse, leading to brutal declines across the tech sector.”

Poor valuations—expected 10-year annualized nominal U.S. equity returns (3.1%) are below the 10-year Treasury yield (3.45%). From current levels, both are likely to underperform inflation over the next decade. Or in words of Goldman’s Tony Pasquariello, “On the topic of valuation, here it should be noted that once you take out the tech bubble and the COVID bonanza from the data set, we’re currently looking at near 50-year highs in the PE ratio of S&P.”

The bull case is near-fantasy—as Pasquariello further notes, “can you imagine if we exit 13 years of interest rates pinned at zero, plus roll off billions in bond holdings, and the penalty is a 15% equity pullback from all-time highs at a 18 multiple? it would be the most elegant dismount of all time.” What’s the likelihood of the stars aligning like that?

Our View

We continue to hold the view that equities likely have higher to go in the near-term before the downtrend resumes. That said, the investor positioning that has underpinned the rally off the October low is not as bullish as it was just a few months ago.

Our measures of equity and dollar relative sentiment, while currently still supportive for equities, are both inching closer to levels that would likely result in market headwinds. A bearish turn for either is not imminent, but it’s conceivable one or both could turn unfavorable sometime later in May.

The fact both are within a stone’s throw of turning bearish would seem to jibe with a scenario in which the market squeezes higher relatively soon, forcing speculators and retail investors to cover their shorts. Institutions would likely sell into any such rally and finally turn bearish again after nearly a year of being bullish (i.e., from late June onward).

If that were to happen, we would expect a concurrent bullish shift in the narrative to help lure retail investors back into the market. Let’s see what happens.

Allio Portfolio Updates

No change to our portfolios last week, which from a strategic standpoint continue to favor gold, commodities, and energy stocks, and from a tactical perspective favor the Nasdaq 100.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.