Updated October 18, 2023

Bill Chen, CFA

Personal Finance

When it comes to building wealth, the sooner you are able to start saving and investing—and the more money you’re able to put to work—the better off you’ll be. That’s because the longer your money is in the market, the more time it has to compound and grow.

There are a lot of different savings strategies that you can leverage to bolster your efforts, especially when you’re first getting started. One extremely effective strategy that you can use to jumpstart your financial journey is known as the Starve and Stack method.

Below, we take a look at what Starve and Stack is and walk through some examples that show its power in action.

What is Starve and Stack?

Starve and Stack is a saving strategy that was originally created and popularized by Nick Vail, a financial advisor and money blogger. It’s since become very popular amongst the FIRE (Financial Independence/Retire Early) crowd.

The strategy only works for those who have two income streams, such as a married couple where both partners work or an individual who has a full-time job as well as a side hustle. It works like this:

Instead of depending on both income streams to cover your living expenses, you live off of just one income (this is where the “starve” part comes in) and use the other income to save and invest (this is the “stack”).

So, a married couple where both partners work would essentially live off of one person’s income while using the other person’s income to work toward their shared financial goals. For a single person with two jobs, it works exactly the same way.

What makes Starve and Stack so effective is the fact that it allows you to rapidly build a nest egg and put that money to work. In this way, you’re front-loading your efforts so that compound interest has as much time as possible to work its magic.

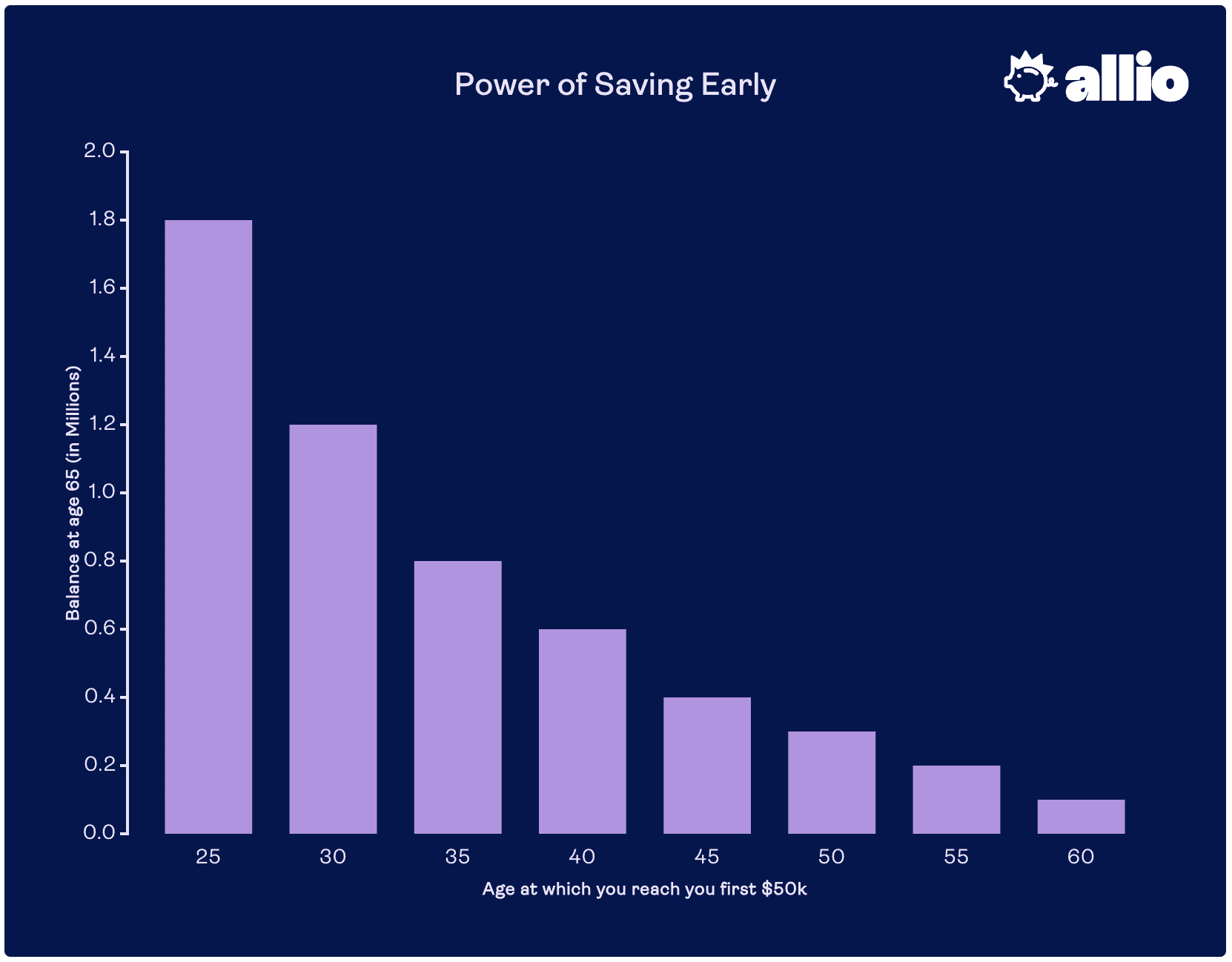

According to a study by Business Insider, having saved $50k at age 25 vs age 60 results in a whopping difference of $1.65 million by retirement.

Starve & Stack in Action

The easiest way to really understand the power of the Starve and Stack method is to walk through a few examples. In Example A, we see an individual who uses the Starve and Stack method to get a jumpstart on their savings; in Example B, we see someone save a more “traditional” way.

Example A: Starve and Stack

Let’s imagine that Person A is 25 years old. She has a full-time job where she makes $50,000 per year after taxes, and a side hustle where she brings in an additional $30,000 per year after taxes.

Instead of using her extra money to upgrade her car or get a bigger apartment, Person A decides that she’ll live off of the income from her full-time job and use the money from her side hustle to start investing.

If person A invests a total of $30,000 for 5 years and earns an average 6% return on her investments, then by the time she is 30 she will have socked away just under $175,000 in her investment account. At that point, she decides that she’s going to stop investing so aggressively so that she can focus on some of her other financial goals, like saving up a down payment on her home.

Even if she never invests another penny, if she leaves that money invested and earns the same 6% rate of return until she retires at 67, she’d have a total of $1.6 million. That’s not a bad return for just 5 years of scrimping and saving!

Example B: Slow and Steady

Person B is also 25 years old. He makes the same amount of money as Person A—$50,000 from his full-time job and an additional $30,000 from his side hustle. But instead of using his side hustle money to fund his savings, Person B uses it to fund his lifestyle. At the end of the day, Person B has just $6,000 per year to invest.

So, from the age of 25 all the way up to the age of 67, Person B invests $500 each and every month. The good news is that after all those years, Person B also ends up being a millionaire: His portfolio is worth $1,135,080!

The Verdict

Unfortunately, Person B had to invest a lot more money than Person A to get there, and in the end he still had less to show for it. Over the course of 42 years (from the age of 25 to 67), Person B invested a total of $252,000. Person A, on the other hand invested just $150,000 over the course of just 5 years—and ended up with $465,000 more than Person B.

That’s thanks to the power of compound interest. By investing more money earlier, Person A was able to take advantage of the greatest asset she had: Time. By giving her money more time in the market, she gave her nest egg the opportunity to grow as much as possible.

Of course, not everyone has $30,000 to invest every year like Person A. And it is also worth noting that Person B wasn’t wrong for investing in the way that he did. Different people have different budgets, different life goals, different investment horizons, etc.—and only the individual can decide how much to save and invest.

Here at Allio, we provide our clients with the tools that they need to invest regardless of their budget or investment strategy. Whether you want to make a one-time lump sum investment so that your money has as much time in the market as possible, set up recurring investments that let you dollar-cost average into your position, or opt into round-ups that help you grow your investment account as you spend, we’ve got the options you need.

Whether you’re seeking an expert team to manage your money or looking to build your own portfolios with the best financial technology available, Allio can help. Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.