Updated July 10, 2023

Adam Damko, CFA

The Piggy Bank

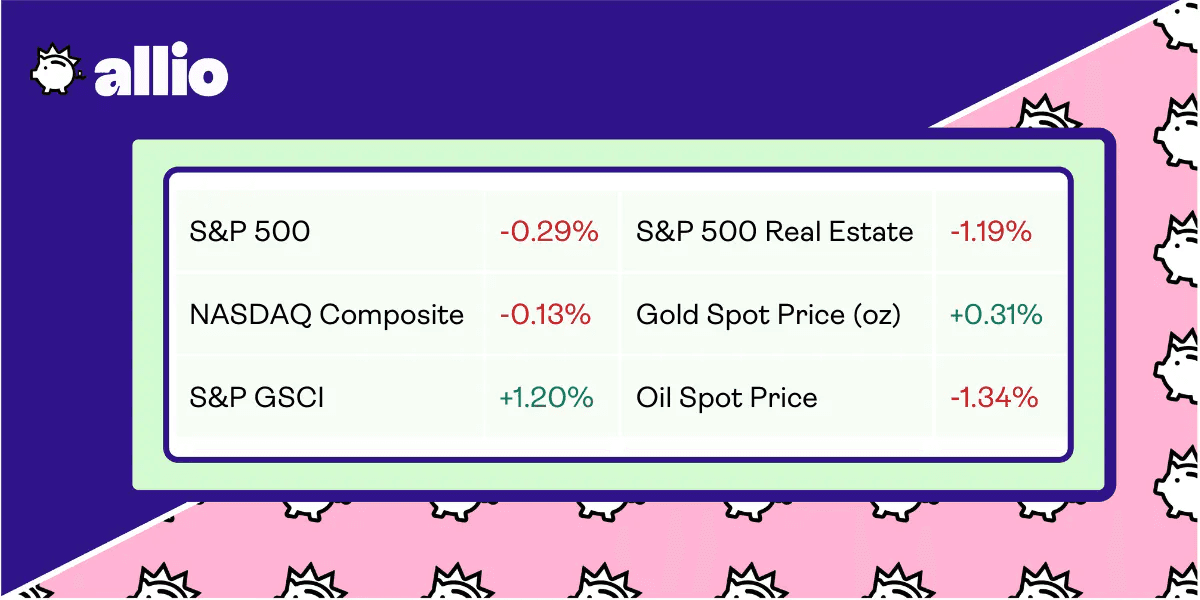

THE MARKETS

📈 Equity markets fell 1% this holiday-shortened week as they digested several pieces of jobs-related data

💼Economic News

Sales of new vehicles in the US have risen by 13% so far through the first half of the year. This comes as a surprise to industry experts, as buyers have not been deterred by higher interest rates or inflationary pricing pressure. Most experts are attributing the higher sales numbers to pent-up demand from shoppers sidelined for almost three years thanks to pandemic-related vehicle shortages.

This type of “resilient demand” has been seen in other sectors of the economy as well, including groceries and travel. In general, most economic experts have been expecting to see a slowdown in spending as prices rise. But, for most sectors, spending has continued as normal and in some cases even accelerated.

👀 What to Be on the Lookout for This Week

This week will feature the updated inflation rate for the month of June. In May, inflation slowed for the 11th consecutive month, reaching just 4%. This represents a dramatic decrease from last June, when inflation was sitting at 9.1%. That said, while inflation has decreased dramatically, it’s still double the Fed’s 2% target rate.

Other major economic releases to look out for next week include:

The NFIB business optimism index

Producer price inflation

Import prices

Export prices

US government budget statement

When it comes to earning releases for next week, be on the lookout for:

WD-40

Pepsi

Progressive

Delta

BlackRock

JPMorgan

Citi

📰 In Other News

This past week, Meta introduced Threads, a new social media app designed to let users share text and have public conversations virtually. If that idea sounds familiar, it’s because that’s exactly what Twitter does. Threads will join Meta Platform’s portfolio of social media companies, which includes Instagram, WhatsApp, and, of course, Facebook.

Meta has a long history of borrowing ideas from other companies, with a few examples including Instagram’s Snapchat-like Stories feature and TikTok-adjacent Reels. Elon Musk’s decision to make Twitter’s code open-source might have proved a little too juicy for Meta Platforms to pass up — and it appears to have paid off. Over just a few days, Threads has already racked up 70 million users. However, Twitter has already threatened legal action over the alleged “copycat” app.

Outside the social media sphere, BlackRock refiled paperwork to launch a Bitcoin ETF. BlackRock’s CEO, Larry Fink, has done a significant about-face when it comes to his opinion on Bitcoin. Just a year or two ago, he wanted nothing to do with the cryptocurrency. But, upon the release of this ETF, Fink went on record saying Bitcoin could “revolutionize” finance.

Finally, things are heating up in the gig economy world, as GrubHub, UberEats, and DoorDash all sued New York City this past week over its new wage law. This new law will establish a pay rate for app-based delivery workers requiring them to earn a set minimum wage. The delivery companies claim this will result in higher prices for consumers as well as reduced flexibility for workers.

Reflects performance at market close 7/723

YOUR ECONOMY

🎓 The State of Student Loan Forgiveness

The Supreme Court’s Decision

At the end of June, the Supreme Court officially overturned President Joe Biden’s plan to forgive up to $20,000 in student loan debt by a vote of 6 to 3.

In the wake of this decision, millions of borrowers counting on forgiveness will once again be responsible for repaying their entire student loan balance.

Student loans will start accruing interest again in September and payments are set to restart in October. For those with student loan debt, this means that you have roughly two months to create a financial plan for your loans before they start racking up interest again.

Looking Forward

For the past few years, Americans with student loan debt have remained in a state of limbo.

Monthly payments have been suspended since the onset of the pandemic. At the same time, President Biden has been pushing to forgive student loan debt entirely — a campaign promise he has been trying to deliver since his election in 2021.

For the record, President Biden has stated he still plans on attempting to pass a student loan forgiveness plan using an alternative path. However, any new legal route will likely take an extended period of time, and will surely face further scrutiny from the opposition. With that said, experts don’t recommend counting on any new plan to succeed just yet.

With all that said, many Americans who have grown accustomed to not making student loan payments could be in for a rude awakening once October comes. For now, borrowers will have to once again budget for monthly student loan debt payments.

Establishing a Payment Plan

For those worried about being unable to make student loan payments, the Biden administration announced a 12-month “on-ramp” transitionary period. This period will put guardrails in place to protect borrowers and is designed to help people get used to making payments again. During this period, missed payments will not hurt your credit score or be sent to collections agencies.

Since it’s been nearly three years since most Americans have had to worry about paying student loans, it may be worth a refresher on the steps you’ll need to take to do so. The first step for all borrowers is to simply log on to your lender’s portal and get up-to-date on your account. When doing so, be sure to review key info like your total outstanding balance, current interest rate, monthly payment, and debt term. From there, re-evaluate your monthly budget to determine if it can absorb your upcoming student loan payment or if changes need to be made.

As a general rule of thumb, experts recommend committing to a higher monthly payment, if your budget allows it. Doing so will help you to pay off your loans more quickly while saving money over the long run due to interest payments. Finally, if you're seriously concerned about your ability to repay loans, you can also inquire with your student-loan servicer about any forbearance programs available.

There’s no way to sugarcoat it. For 43 million Americans, the prospect of making student loan payments again is, at best, not ideal. However, as long as you have a proper plan in place, you may be able to avoid an improper impact on your budget.

☀️ The Latest Economic Boom Has Some Southern Charm

Remote Workers Migrate South

The silver lining of the pandemic is that it ushered in a new era of remote work. The quick rise in work-from-home mandates allowed workers to break free from geographical shackles when creating their ideal work-life balance.

With this newfound freedom, remote workers have been flocking away from crowded city centers in favor of other parts of the country. And, based on recent data released by the IRS, a clear top choice for relocating workers has emerged: America’s Southeast.

Over the past two years, states like Florida, Texas, Georgia, the Carolinas, and Tennessee have experienced a surge in popularity. As a result, for the first time since the 1990s, these states are contributing more to the national GDP than the Northeast. The economic center of gravity in the US appears to be shifting south.

Economic Impact

In 2020 and 2021, an estimated $100 billion in new income flowed into the Southeast, according to data from the IRS. At the same time, $60 billion bled out of the Northeast.

Notably, this trend of relocating to the south hasn’t been limited to remote workers. Many major corporations have also been uprooting their headquarters from pricier cities in order to find a new home in the South. If employees aren’t working full-time in an office, it doesn’t make sense for some companies to keep paying a lease in pricey cities like New York or San Francisco. Instead, corporations can move to more affordable, tax-friendly cities like Jacksonville, Atlanta, Fort Worth, or any number of growing southern metros.

This relocation of major companies has helped the Southeast become an economic powerhouse for new job growth. In fact, the region has accounted for more than 66% of all job growth since early 2020. It is also home to 10 of the 15 fastest-growing cities in America.

3 Benefits of the Southeast

When deciding on where to move, there are three main benefits of the Southeast catching remote workers’ eyes.

For one thing, most southern states tend to have lower tax rates. If you’re making six figures living in a high-tax city like Los Angeles, you could save tens of thousands in taxes just by moving out of state. Or, to put it another way, you could give yourself a raise of tens of thousands of dollars just by relocating.

Compounding these financial benefits, the region by and large has a more affordable cost of living than major metros in the Northeast or on the West Coast. This means that, in addition to reducing your tax bill, a move south could cut down your grocery bills, too.

Finally, the South also has the allure of warm weather, cheaper coastline property, and looser regulations in general. If you’re a remote worker looking for a change of pace or an investor looking for an opportunity, the Southeast may well be the region to watch.

POCKET CHANGE

Apple cut production of its Vision Pro headset due to manufacturing issues. The iPhone owner originally wanted to ship 1 million units in 2024. It has since revised this forecast to 400,000.

The rise of AI technology spurred a fresh wave of investment and acquisitions. Billions are being poured into AI startups as companies scramble to establish themselves.

Only 28% of millennials and Gen Z don’t rely on their parents for financial assistance. Younger generations are having an increasingly hard time becoming financially independent.

Most Americans believe they need $1.27 million to retire comfortably. However, the average American only has $89,300 in retirement savings.

76% of workers ages 20 to 29 say they don’t want to work remotely full-time. As a result, the number of coworking spaces is growing rapidly across the country, expanding into amenities as diverse as Airstreams, abandoned candy factories, and yurts.

Ready to build wealth on autopilot? Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.