Updated October 7, 2023

Mike Zaccardi, CFA, CMT

Personal Finance

Want to know the secret to building long-term wealth? Well, there's no secret per se, but one key investing principle is like the magic dust to becoming financially independent.

Compounding, or the investment returns on your investment returns, is said to be the eighth wonder of the world, at least according to Einstein. So, there might be something to this money concept, and if you want to hit your financial goals sooner rather than later, you need to know the key features and possible pitfalls that come with harnessing this great power.

What is Compounding?

Compounding is a phenomenon whereby your portfolio’s earnings are reinvested over time, allowing them to generate additional returns. It’s important to recognize that once you’ve set up your portfolio and allocation, there are two components of the overall balance: your contributions (what you invested at the onset and then periodically in the future) and your earnings (what you’ve earned in the market through gains on stocks and funds or the interest received from bonds).

Compounding happens slowly if you have your money parked in short-term savings like Treasury bills and with more speed (and volatility) when invested in the stock market. Your investments compound across all time periods, too, but you won’t see the big impact until years or even decades down the road. Time is your friend when looking to harness the power of compounding; your initial investments have the potential to grow exponentially faster compared to if you had withdrawn and spent your earnings along the journey.

Unlocking Long-Term Wealth Through Compounding

Ask someone who has been investing for a few years and they will probably tell you that it’s good and all, but it is not a get-rich-overnight kind of thing – even in strong market environments. But let us also task you with this: Approach a retiree, say a parent or grandparent, and prod them on how investing has worked out for them over their lifetimes. They will likely urge you to get started investing today.

Here’s what we mean: Suppose one of your elders stashed away $10,000 in the US stock market in 1980. That is more than four decades of compounding at play. In that time, the actual compounded yearly return in the market has been 11.3%. Over 43 years, what do you think the account value has grown to? Write it down. We’ll give you a minute.

Is your number seven figures? $1.06 million to be precise is what that starting $10k swelled to – all from doing nothing as an investor and just allowing compounding to work its magic (again, it’s not really magic, it’s just math!).

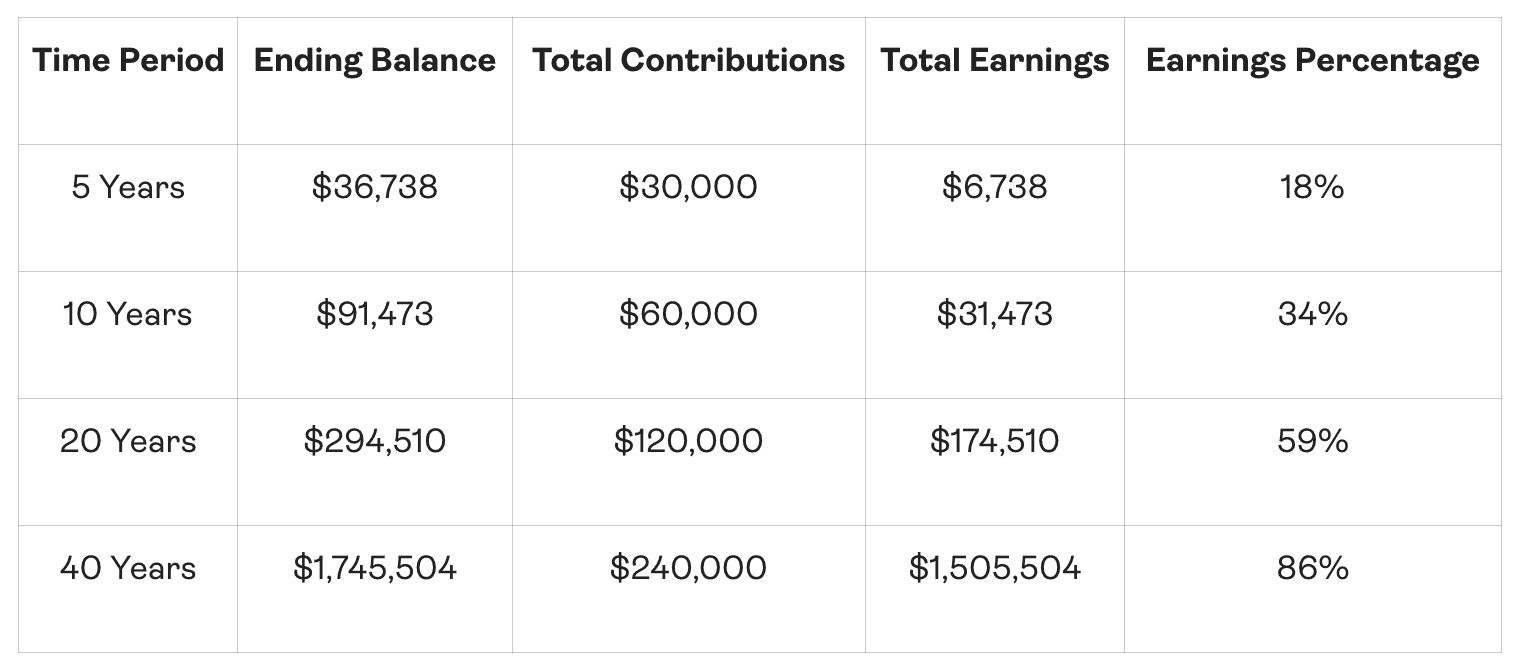

But maybe you don’t have a $10k stack lying around. Perhaps you just recently began a full-time job and are eager to put your money to work for you. If you save $500 each month for your retirement and earn a reasonable 8% return on average for 40 years, here is what you can expect compounding to deliver you: $1.745 million. Check out what your portfolio balance would look like through the decades:

Of course, stock market returns will be volatile and there will be taxes and small investment fees to pay along the way, but you get the picture. Compounding investment returns can have a dramatic impact on your net worth over time; check out the column on the far right – as years go by, the portion of your account balance that comes from market gains (your earnings contribution) starts out low but then amasses to be almost the entire portfolio. You can play with Allio’s Retirement Calculator for yourself.

Another takeaway from the illustration is that time is your best friend as a long-term investor. The earlier you get in the game, the more you can benefit from compounding. Go back and ask that older relative, and they will underscore the importance of making it a habit to invest as soon as possible.

What is Simple Interest? Is It Different Than Compound Returns?

Compound interest is like the less sexy version of compounding stock market returns. Similar to how an investment account can grow exponentially, cash sitting in a savings account generates interest. That interest is then deposited back into your account periodically (usually monthly), and that interest earns interest on itself. You can often build wealth faster by saving via short-term Treasury Bills compared to common savings and checking accounts at the big banks – check out Allio’s high-yield portfolio to learn more.

Savings accounts usually feature a stated interest rate that will change over time. That differs from stock market returns which can vary significantly from year to year.

Distinguishing Compound Interest from Simple Interest

The key to unlocking compounding’s power is to do all you can to avoid withdrawing from your investment account or savings account. If you cash out your earnings and interest, then you're pretty much just getting what’s known as “simple” interest. When earning simple interest, your interest does not earn interest. That’s good news if you are borrowing money and paying back a lender, but it’s a lousy deal when saving and investing. Mortgages and student loans often feature simple interest, so that makes paying off your debt easier.

Knowing the “Rule of 72”

Finance nerds like our portfolio managers at Allio commonly employ the rule of 72 when projecting returns. This heuristic is used to quickly estimate how long it takes an investment to double, assuming compounding returns. For instance, let’s take the example from earlier. Recall that an 8% return was figured. Simply divide 72 by 8. The resulting number approximates the number of years needed to double the initial investment. So, after year 9, a $10,000 investment would have doubled to $20,000. Tack on another 9 years, and you would have a cool $40k.

The Bottom Line

Compounding is an individual investor’s superpower. The sooner you get it working for you by investing for the long term, the faster you can reach your financial milestones. You can grow your money effortlessly and set your wealth on autopilot using Allio’s automated portfolios no matter what your money goal is. Our macro strategies and Allio’s high-yield portfolios can enable your investments to compound, propelling you toward financial freedom.

Our expert-level macro investing strategies are used by people just like you. Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.