Updated February 12, 2024

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

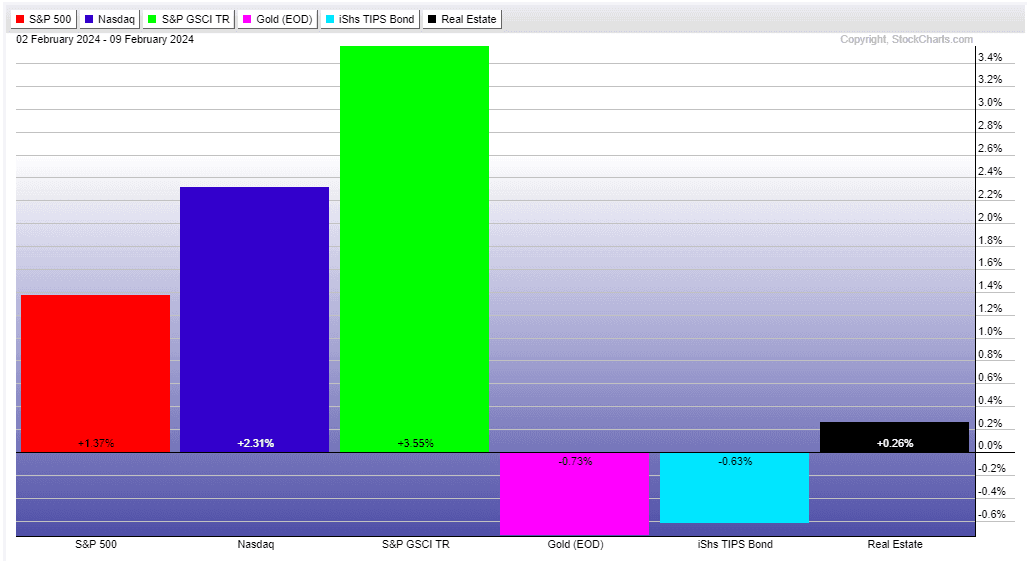

The S&P rose 1.4% last week, finishing above the psychologically important 5,000 level for the first time. Maybe more impressive, the SPX is now higher in 14 of the last 15 weeks – a feat only achieved once before in 1972. The AI-fueled bull market continues to take Wall Street by storm. Indeed, the tech-heavy Nasdaq Composite outperformed, up 2.3% during the data-light and earnings-heavy week. Bullish action was seen under the surface, too. The Russell 2000 small-cap index jumped 2.5% as it rose above the 2000 mark (a key round number we highlighted last week). Better breadth was seen in emerging markets with the Vanguard FTSE Emerging Markets Index ETF (VWO) climbing by 2.5%, helped by a recovery in the Chinese stock market.

Sector-wise, Information Technology, unsurprisingly, led the way with a 2.8% gain. Only Consumer Discretionary and Health Care outperformed the S&P 500. There was relative weakness in the defensive Consumer Staples and Utilities sectors – seen by technicians as a healthy development in bull markets as investors flee low-risk sectors for more risk-on spaces. Real Estate managed to end the week in the black despite interest rates being on the rise. The aggregate bond market index fell 0.8% as markets price in better economic growth prospects. The TIPS ETF fell just 0.6%.

All’s quiet on the commodities front as gold hovers around the $2050 per ounce level and oil wobbles in the low to mid-$70s per barrel on WTI. Gasoline futures, however, ended last week at their highest weekly settle since early Q4. A mild winter has taken its toll on natural gas as it plunged to a fresh low dating back to September 2020. Finally, that box of chocolates might cost you a bit more this year – cocoa futures have doubled in the last month just in time for Valentine’s Day.

For the year, the S&P 500 is up 5.4% and the Nasdaq Composite is higher by 6.5%.

A Quiet Week of Momentum-Led Stock Market Gains, Bond Yields Creep Higher

Source: Stockcharts.com

The Look Ahead

There was a lull on the economic calendar last week, but the data train now gains steam during the heart of February. Monday is quiet as usual (maybe much needed after the Super Bowl), with just the monthly Treasury budget statement to be released in the afternoon, and that should feature little fanfare. Tuesday morning will be critical, though.

First, the NFIB Small Business Optimism Index for January hits the tape early in the morning – that's a fascinating report to delve into the current sentiment and forward outlook of small business owners writ large. It ticked up to the highest level in five months in December as the vibes continued to mend. We’ll keep our eyes on how firm owners see inflation – it was cited as the top concern in the previous report. Another key question asked in the survey that impacts markets is how much firms plan to raise wages in the short run. That sets the stage for the January CPI report due out later in the morning.

Wall Street expects a 0.3% consumer price rise (Core) for last month, bringing the year-on-year Core rate down to 3.7% from 3.9% as of the end of 2023. Headline inflation is seen as having ticked higher by just 0.2%. Since the last CPI report, rate traders have virtually nixed the chance of a March Fed rate cut. Valentine’s Day is a light data session, so the focus will be on corporate earnings reports and everybody’s special someone. But it’s back to economic business on Thursday with weekly jobless claims (which continue to run at generally low levels despite many corporate layoff headlines). Empire Manufacturing plunged to –43.7 in January, the lowest reading since May 2020, and another weak –20 print is expected for the New York region – it will be important to watch the Input Prices subcomponent for further clues on inflation as well as New Orders which took a drastic turn lower last month.

Import prices on Thursday morning will also offer inflation information, but the Retail Sales report for January will be the highlight. Economists forecast a spending dip to have taken place last month amid some harsh weather conditions across the Eastern third of the US. Card spending data from BofA suggests a retail sales decline from stout numbers in December, though the Core Control group may rise 0.2%. Another macro bellwether report, Industrial Production, hits before the opening bell on Thursday, and the consensus calls for nearly unchanged levels in January compared to December. Business Inventories and housing market data round out the busy week. Six FOMC members, including four voters, speak from mid-day Monday to Friday afternoon. Lastly, hedge fund 13F filings will pour in on Wednesday.

Key Inflation Readings, Inflation Data, and Another Busy Schedule of Fed Speak

Source: BofA Global Research

Earnings Reports This Week

Two-thirds of the S&P 500 have reported Q4 results. The EPS beat rate is 75%, but that’s merely near the 5-year average. Sixty-five percent of companies have topped revenue estimates while the year-over-year blended EPS growth rate has increased to 2.9% for last quarter – firming up what should be the second consecutive quarter of higher per-share profits compared to year-ago levels. Still, Factset reports that guidance has been less than stellar with 52 SPX companies issuing negative outlooks compared to just 21 firms serving up positive EPS guidance.

As we get deeper into the reporting season, more small and mid-sized companies as well as foreign firms report. But major US large caps continue to provide Q4 numbers and 2024 outlooks. Arista Networks (ANET) stands out on Monday before Coca-Cola (KO), Shopify (SHOP) and Marriott (MAR) are the headliners Tuesday morning. Later that day, Airbnb (ABNB), MGM Resorts (MGM), Zillow (Z), and Robinhood (HOOD) provide varied views on the state of the consumer.

CME Group (CME) and Kraft Heinz (KHC) are two of the bigger names reporting Wednesday before the bell while Cisco (CSCO) and Occidental Petroleum (OXY) post that evening. Embattled John Deere (DE) in the Industrials sector will be one to watch Thursday along with automaker Stellantis (STLA). A chip name, Applied Materials (AMAT), reports Thursday after the close along with Coinbase (COIN) and DraftKings (DKNG). Friday is light.

Industrial and Consumer Companies Take Center Stage This Week

Source: Wall Street Horizon

Topic of the Week: Shades of 2013-14, Sentiment Lifts Along with Stock Prices

We’ve talked about the pickup in some soft economic data recently. Weak regional manufacturing reports notwithstanding, both the University of Michigan Surveys of Consumers and The Conference Board’s Consumer Confidence report for January, at long last, show ebbing vibes. A still-strong labor market (though significantly looser compared to 12 months ago), cooling inflation, and rising real wages take time to trickle into the collective psyche, but households are now feeling more upbeat.

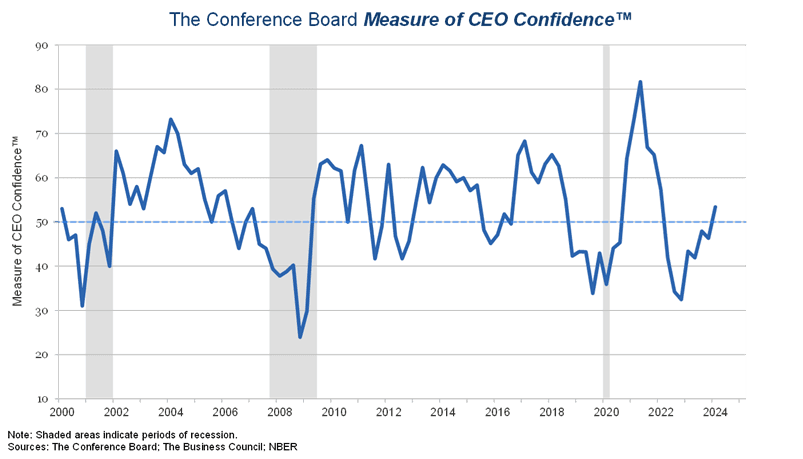

Last week, another arrow was placed into the positive-sentiment quiver. The Conference Board reported that CEO confidence turned positive for the first time in two years. The measure was sharply negative heading into 2023 – at lows not seen since the Great Recession. That came after an all-time high right around the stock market peak at the turn of 2021 into 2022. Higher interest rates, stubborn inflation, and fears of a significant downturn in consumer demand were clearly top of mind just a year ago.

Hope From the C Suite

Today, the tables have turned in a bullish way. Now above the key 50 level, CEOs cited better current conditions, and 36% of respondents expect the broad economy to improve over the next six months, up from just 19% in last quarter’s survey. The percentage of executives expecting worse economic conditions plunged from 47% in Q4 last year to 27% this quarter.

CEO Confidence Rebounds Amid Improved Macro Conditions

Source: The Conference Board

Soft Employment Outlook, Muted Capex Plans

It wasn’t exactly a gangbuster report all around, though. Just 35% of CEOs expect to expand their workforce over the next year, down slightly from the previous quarter, while nearly one in four forecasts employment reductions. Capital spending plans also appear tepid as political uncertainty was cited as the greatest US challenge facing businesses this year at home. Abroad, the spread of ongoing wars as well as deglobalization and US-China tensions are seen as the biggest risks.

The CEO Confidence survey appears as a highly representative look at where things stand at the macro level today. While there is always a degree of uncertainty, the near to intermediate-term perspectives are rather robust. Inflation is falling, growth remains healthy, companies are producing record EPS, and AI’s allure has penetrated most parts of Wall Street and Main Street.

Healthy Vital Signs Among Businesses and Consumers As 2024 Presses On

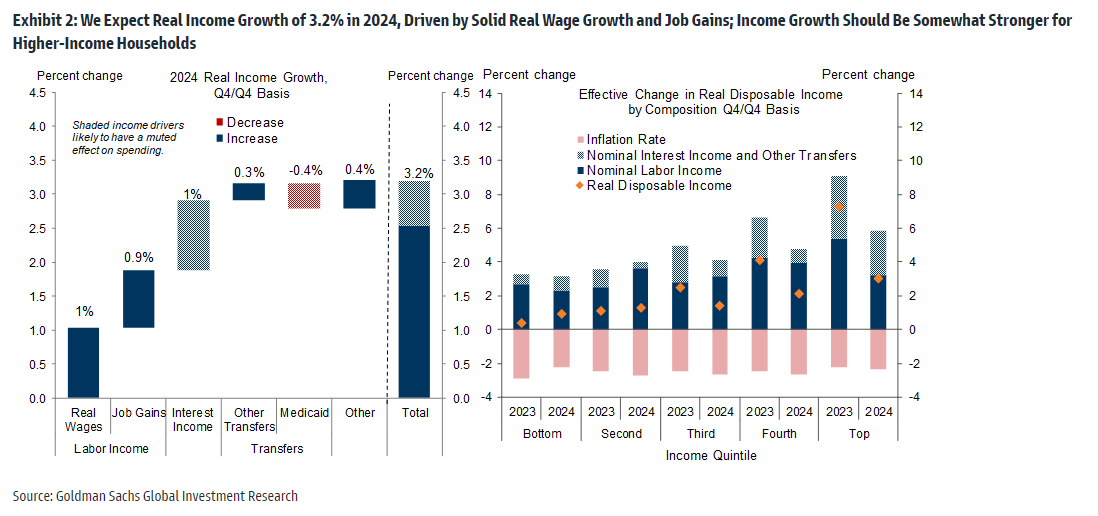

What’s more, tight corporate bond spreads suggest low risks of a significant uptick in bankruptcies and consumer balance sheets are solid despite widely reported record-high credit card debt. There remains excess savings from the pandemic just as real income growth hums along, potentially topping 3% in 2024 if analysts at Goldman Sachs are correct.

Goldman: Inflation-Adjusted Income Growth This Year

Source: Goldman Sachs Investment Research

Is it a Bull Trap? Going Back in Time to 2013-2014.

Does it feel like a bull market to you? Are you confident that stock prices will continue up, up, and away? There’s an aura of doubt in the marketplace. Just take a look at the average sellside strategist’s year-end 2024 price target for the S&P 500. Charlie Bilello reports that it's just 4861 – that is 3.3% below where the index settled last week. It has the feel of a decade ago.

In 2013, the S&P 500 returned 32.4% in what was a low-volatility climb with just a few mini-corrections on the order of 3% to 5% (there hasn’t been a pullback of more than 2% in the last 70 trading days, by the way). What made folks skeptical back then was that US stocks were finally rising through their 2007 highs – the fear was that new highs would not be sustained. Thus, cash was on the sidelines waiting for a significant pullback. There wound up being no dip to buy. The S&P 500 rallied into early 2015 before sputtering through Q1 of the following election year.

There’s Always Something to Worry About

Along the way, fears of another European banking contagion, slowing growth in China, and the Fed’s infamous tapering of QE, among other worries, would come and go. All the while, equities climbed said walls of worry. There are certainly parallels to today. The SPX is through its early 2022 high and there are a handful of negative catalysts, some of which were cited in the CEO Confidence survey.

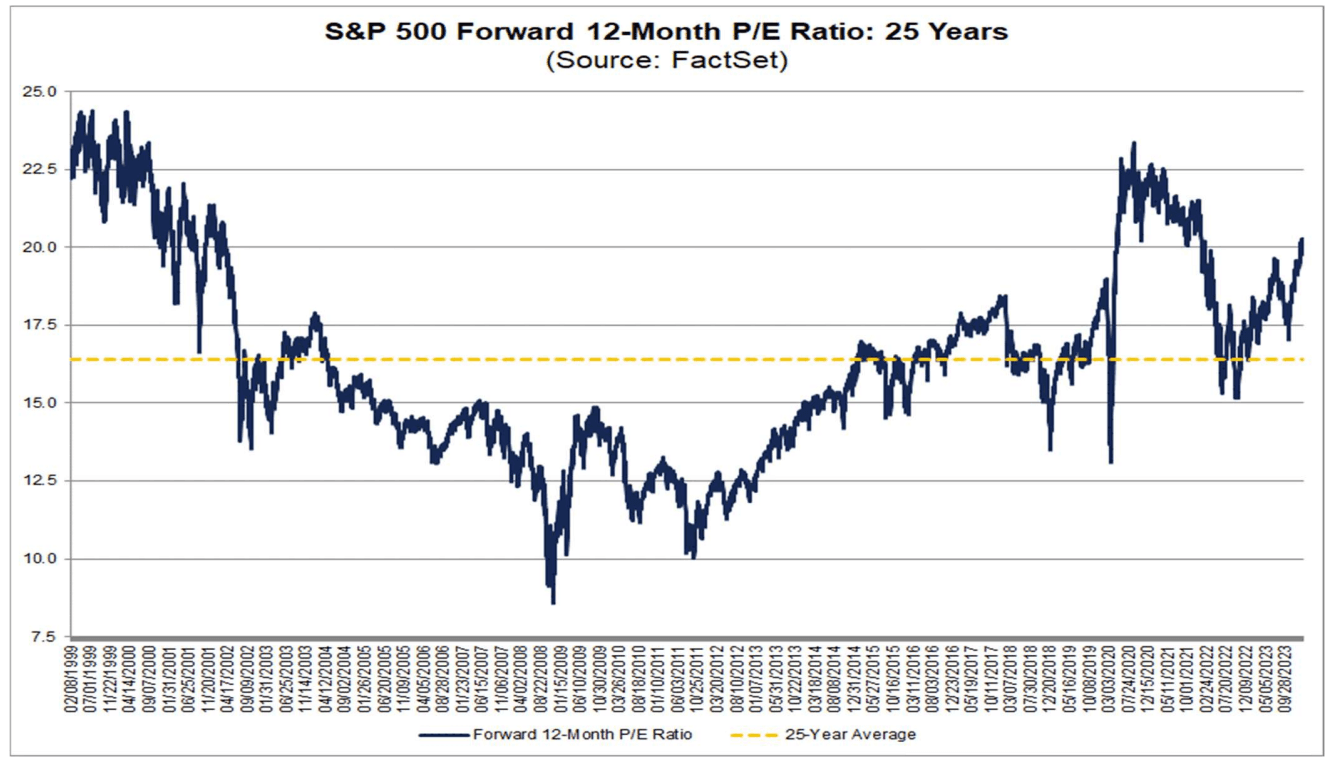

But US Large-Cap Valuations Are Worse Now

One difference today is that valuations are significantly richer than 10 years ago. For the first time in two years, domestic large caps trade north of 20 times forward earnings estimates – they were under 15 times earnings this time in 2014, coming off a dirt-cheap P/E of 10 in October 2011. Of course, today’s valuation is at least partly explained by larger weights in growth-focused sectors and companies (primarily the Magnificent Seven names along with GLP-1 drugmaker Eli Lilly (LLY) and Broadcom (AVGO), a major semiconductor company).

S&P 500 P/E Since 1999: Back Above 20x

Source: Factset

The Bottom Line

Despite more tepid earnings guidance, CEOs are generally more upbeat today, which backs up sanguine consumer survey gauges lately. It comes as stock prices continue to soar to all-time highs, albeit with many macro strategists doubting the move. Equities remain more focused on the growth trajectory and less so on what the Fed may or may not do in the short term, all while corporations produce solid earnings. We’ll get more gauges on both the inflation and demand fronts this week with CPI, Retail Sales, and PPI.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.