Updated December 18, 2023

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

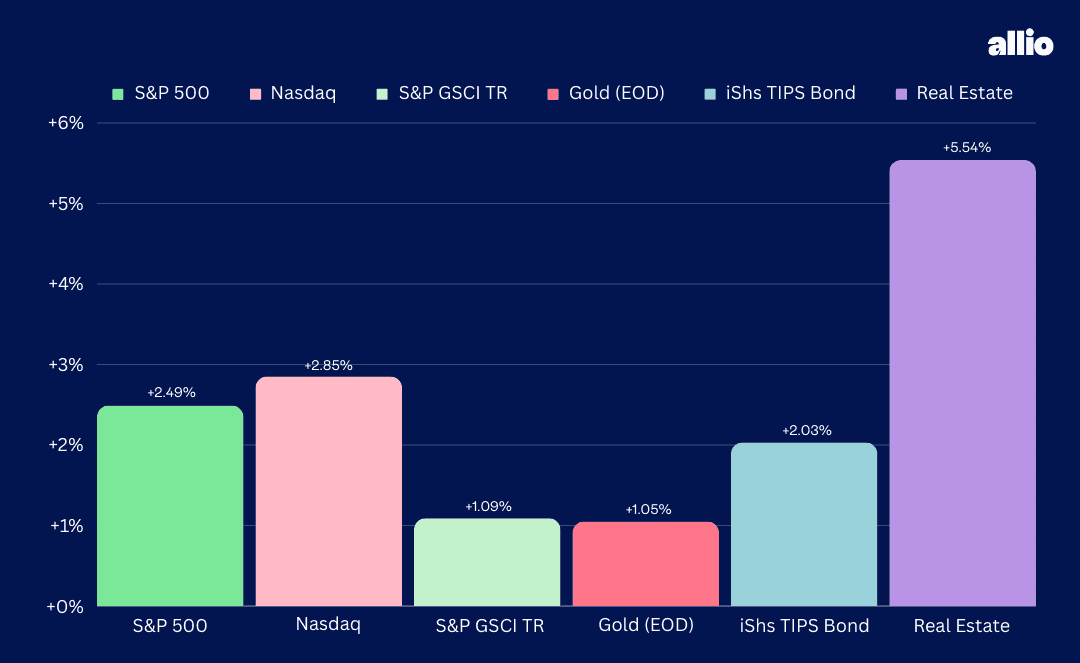

Make it a “Magnificent Seven” weekly winning streak. The S&P 500 rallied another 2.5% to close at its best level since January 2022 as the bulls’ charge into the holidays continues. The advance marks the SPX’s longest string of weekly climbs since October 2017. The Nasdaq Composite outperformed with strength in the more commonly known “Magnificent Seven,” comprised of US mega caps.

Information Technology was not the top sector, though. Risk-on cyclicals, including Real Estate, Materials, and Industrials carried the torch last week. Each of those sectors climbed more than 3%. Heavy bond buying resulted in a full quarter-point drop in the 10-year Treasury yield, lifting rate-sensitive niches of the equity space. The beaten-down regional bank area rose more than 8% as fears of a recession ease. A set of sanguine inflation data was encouraging news for investors and consumers – the TIPS bond ETF rallied 2%.

Speculators were even scooping up commodity stocks. The aggregate commodity index inched up 1% with a comparable gain for gold. The precious metal climbed back above the $2000 mark.

For the year, the S&P 500 is up 22.9% and the Nasdaq is higher by 54.5%.

December 8, 2023 - December 15, 2023

The Look Ahead

Economic data has been mixed lately. Labor market indicators look decent, and certainly are not pointing to an imminent recession. Holiday spending trends are tracking well with Christmas just one week away. Inflation, meanwhile, has been working in the Fed’s favor.

Following this morning’s NAHB Housing Market Index reading for December, Housing Starts data hits Tuesday in the premarket along with Building Permits figures for November. Housing data will be particularly interesting this week given some hints of increased transaction activity in the real estate market and mortgage rates back under 7%, a 9-month low. Also on Tuesdays, the Fed’s Raphael Bostic will speak on the U.S. economy and its outlook at 12:30 p.m.

Lower borrowing rates and easing gas prices should provide a modest boost to The Conference Board’s December Consumer Confidence survey, which crosses the wires Wednesday at 10 a.m. ET. Recall the sharp rebound in the University of Michigan Consumer Sentiment report earlier this month. Still, Existing Home Sales are expected to drop modestly from October’s total as inventories remain very slim across the country.

Thursday and Friday will be busy on the macro front, just as traders take off for the long holiday weekend. Initial Jobless Claims have been steady, and those numbers will come out at the same time as a third look at the Q3 GDP report on Thursday, including personal consumption Core PCE data. Soft PPI data last week should imply a tame update on the Fed’s favored inflation barometer. Later that morning, a 20th consecutive monthly decline in the Leading Economic Index (LEI) is expected to be reported - that is at least one recession yellow flag.

Friday is packed with market-moving news. Personal Income and Spending data for November comes out before the bell, and November PCE data could rattle stock and bond market futures along with the Durable Goods report, which is expected to snap back after an October dip. A final look at UMich for November shouldn’t hold many surprises while New Home Sales for last month are expected to have risen sequentially.

This Week's Data Deck: Housing Data, Consumer Confidence, Q3 GDP & PCE, LEI, Personal Income and Spending, and Durable Goods

Source: BofA Global Research

Earnings Reports This Week

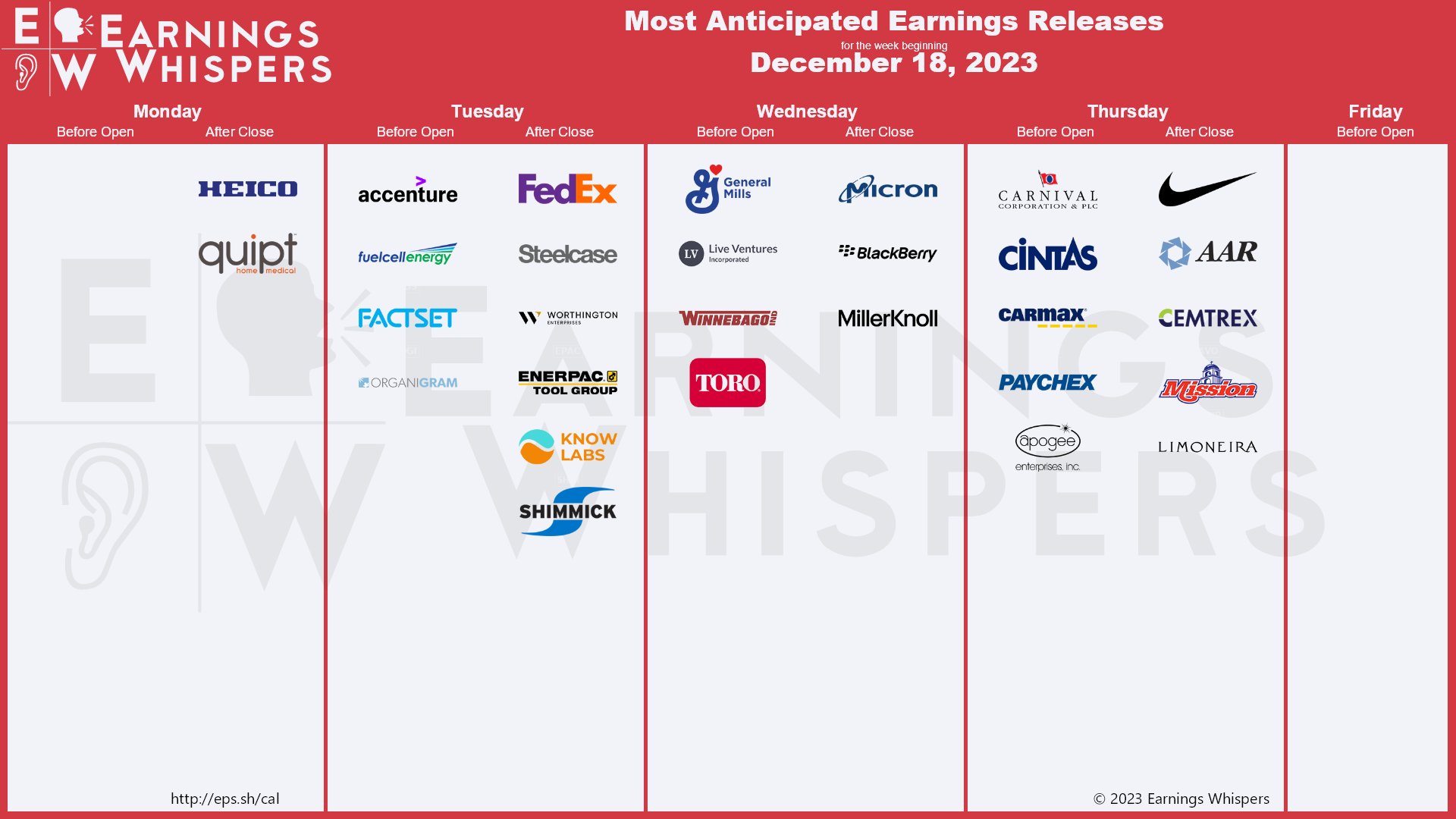

A handful of multinational companies report quarterly results this week. FedEx (FDX), a key bellwether for the domestic economy, has delivered massive gains for shareholders since its October low near $225 – the transportation company posts numbers Tuesday night.

Wednesday morning offers a glimpse into the state of staples. After hints of 2024 deflation on Costco’s (COST) Q3 earnings call, we’ll keep our eye on top-line trends from General Mills (GIS). Chips are then in focus that afternoon when Micron (MU) posts its Q1 figures.

Ahead of the Christmas weekend, two consumer names report Thursday. Carnival (CCL) and Nike (NKE) may shed light on discretionary spending trends as well as insights from NKE on the goings on in China.

FedEx, General Mills, Micron, Carnival, and Nike Are the Headliners

Source: Earnings Whispers

Topic of the Week: Dissension in the Ranks?

Amid so many key economic reports and readings on the health of the consumer last week, Wednesday’s FOMC decision and Chair Powell’s press conference captured the spotlight - and some criticism. It was just a few weeks ago when the Fed Chief said the Committee was not considering rate cuts. Then, in an apparent significant change of thinking, Powell pointed to easing monetary policy last week.

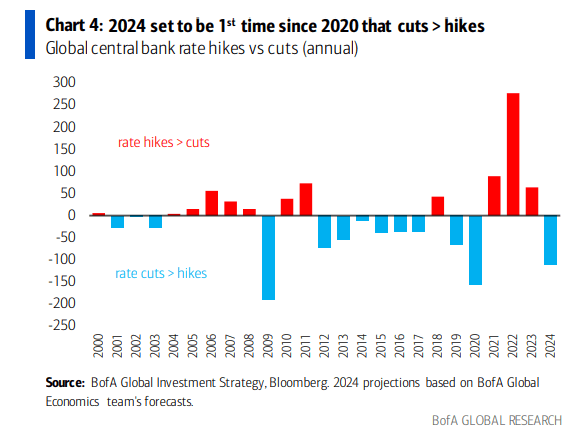

As it stands, the Committee’s dot plots pencil in three cuts by the end of 2024. Making the situation all the more eyebrow-raising is that Fed governor Chris Waller told The Wall Street Journal, before the December Fed meeting, that cuts may indeed be on the horizon, assuming inflation continues to move in the right direction.

The Comeback Kids

Stocks naturally rallied as dovish language began to seep into the Fed’s tone, continuing a near-vertical rally off the late October low in the S&P 500. Bond yields have cratered from near 5% on the 10-year note to 3.9%. Risk-on areas like US small caps, ARKK stocks, and the beaten-down REIT space have all surged. For context, the Russell 2000’s rally has been so intense that the small-cap index went from a 52-week low to a 52-week high in 33 trading days, the fastest such bullish reversal in its history.

A Dovish Fed, Really?

There were concerns, among the bulls, that Powell would ‘talk down’ the markets in the presser last Wednesday, but that did not happen. His Q&A session was widely seen as dovish, detailing the possibility of a soft landing and easing monetary conditions over the next 12 months. The SPX jumped 1.4% on Fed Day, with just about all slices of the global equity market outperforming the Magnificent Seven stocks. Dissention in the Fed ranks came on Friday, however.

Fed’s Williams Tries to Talk Down Rate-Cut Hopes

In an interview with CNBC on Friday morning last week, the New York Fed President, sometimes seen as second in command on the FOMC, made it clear that the central bank isn’t “really talking about rate cuts right now.” Stocks and bonds took his hawkish comments in stride. Small caps gave back about 1% to close out the week while large caps and the Treasury yield curve were about unchanged. Then on Sunday, Bloomberg reported that Austan Goolsbee, seen as a Fed dove, said it was still too early to declare victory over inflation.

These crosscurrents make investors and macro strategists curious, if not concerned, about what’s happening at the Fed – some members appear focused on squashing inflation while others are turning their focus to possible growth risks.

All of this sets up an intriguing 2024. The December Fed meeting was clearly the pivot the bulls have been pining for, given a sharp easing in the dot-plot forecasts, but it remains to be seen how high and for how long the Fed will keep its policy rate in significantly restrictive territory.

2024: The Year of Cuts?

The market let its voice be heard. Rate traders are now screaming for a slew of eases over the ensuing 12 months. Fed Funds futures priced in upwards of 6 full quarter-point cuts through December 18, 2024, late last week, though that figure retreated modestly following Williams’ CNBC interview. By the time the dust settled Friday, 130 basis points of easing is now the expectation. Of course, the Fed Funds futures market is a hedging market, so that figure is often biased lower.

Global Central Banks Expected to Slash Policy Rates Next Year

Source: BofA Global Research

Allocation Decisions

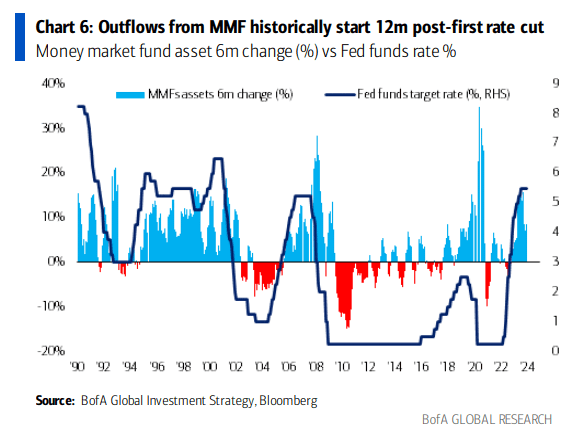

Investors will soon have to decide what to do with their collective cash hoard. $6 trillion of assets are parked in money market funds, easily a record (albeit not as impressive historically when compared to, say, the S&P 500’s market cap). You and I can earn about 5.25% APY in the Allio high-yield portfolio, but this time next year, that rate could be a full point lower, perhaps with a 3-handle. Will investors flee the safety of money markets and re-allocate to stocks? Will they extend duration via swapping cash for bond funds? Will lower borrowing rates spark a housing resurgence? These are all unknowns and questions Wall Street strategists will grapple with.

All Eyes on MMF Flows

Source: BofA Global Research

Can the Consumer Keep Up?

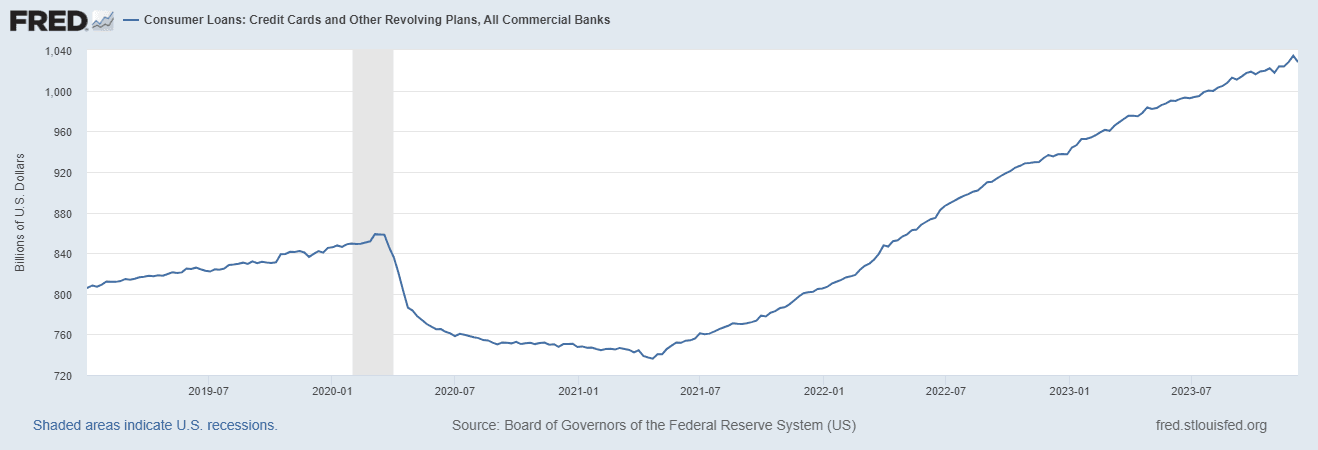

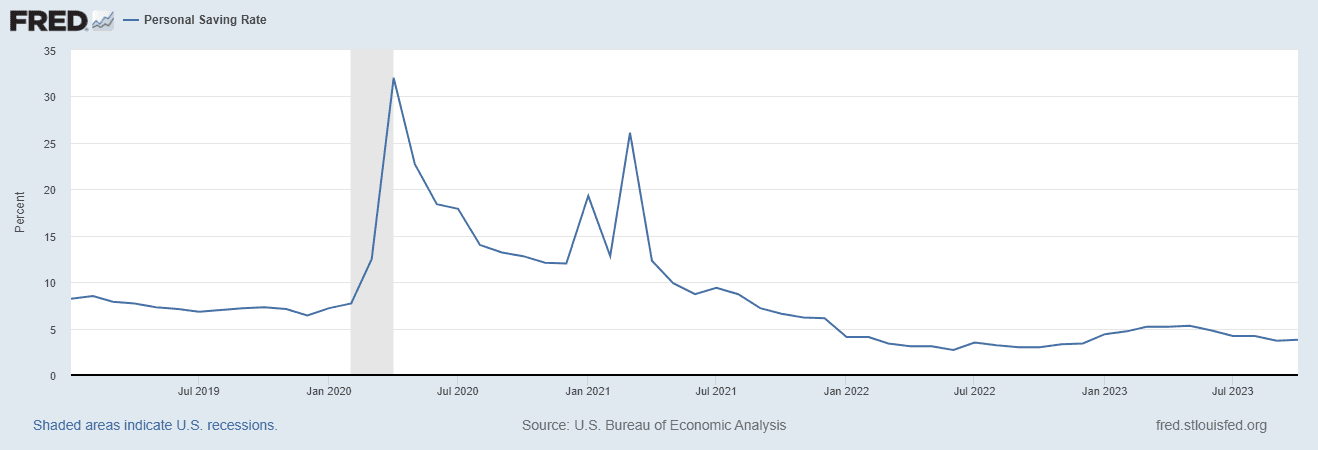

There is another scenario, however. What if we begin to see cracks in the jobs market? One of the fastest Fed-tightening campaigns in history may still lead to a rocky landing. If the unemployment rate were to tick up above 4%, a portion of that cash on the sidelines may not re-enter financial markets at all. Consider that credit card debt and other revolving consumer loan balances are up 40% since April 2021 and the US Personal Saving Rate hovers under 4%. Families may have to tap investment accounts if economic conditions turn south.

US Consumer Borrowing Surges Since Q2 2021, Fueling the Spending Boom

Source: St. Louis Federal Reserve

US Personal Saving Rate – Under 4% As Incomes Struggle to Keep Pace with Inflation

Source: St. Louis Federal Reserve

Moreover, J.P. Morgan’s Marko Kolanovic points out that 80% of excess savings from the COVID era are depleted. By mid-2024, according to Kolanovic, it’s likely that only the top 1% of income earners will be better off compared to before the pandemic.

Excess Savings Drying Up

Source: J.P. Morgan, Daily Chartbook

Don’t Lose Sight of Risk Management

Why are we pointing out the potential problems amid all-time highs in the Dow and the S&P 500’s best mark in 23 months? When the animal spirits of greed run high on Wall Street, we must look out for what may be lurking just under the surface – it's all part of being prudent managers of risk when it comes to global macro investing. At the same time, it feels great to end the year on a flourish, something we pointed out was a real possibility during the August through late October correction. Equities are indeed priced for a sanguine 2024 considering that the SPX is now close to 20 times next year’s EPS forecast.

November CPI, PPI, Retail Sales Delight Investors

Additionally, the data last week was pretty darn good. Away from the Fed noise, November CPI verified about in line with expectations – and the numbers would have been even better had it not been for a surprising, and likely transitory, rise in used car prices. Stocks jumped on Tuesday after that key inflation data.

Prices at the wholesale level were exceptionally soft, so much so that November PPI may have impacted some of the Fed members’ thoughts on the inflation outlook. Then on Thursday, jobless claims came in very low, underscoring some firmness in the employment landscape and November Retail Sales confirmed robust consumer spending at the start of the holiday shopping season.

The Bottom Line

The bulls have been running strong on Wall Street lately (quite literally). With conflicting chatter apparent at the Fed, uncertainty as to how much easing will take place in 2024 was taken in stride by traders last week. The S&P 500’s seventh straight weekly climb and fresh all-time highs on the Dow come alongside an increase in sentiment and more aggressive positioning. We continue to be on the hunt for what could go wrong while enjoying this late-year rally across asset classes.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.