Updated March 4, 2024

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

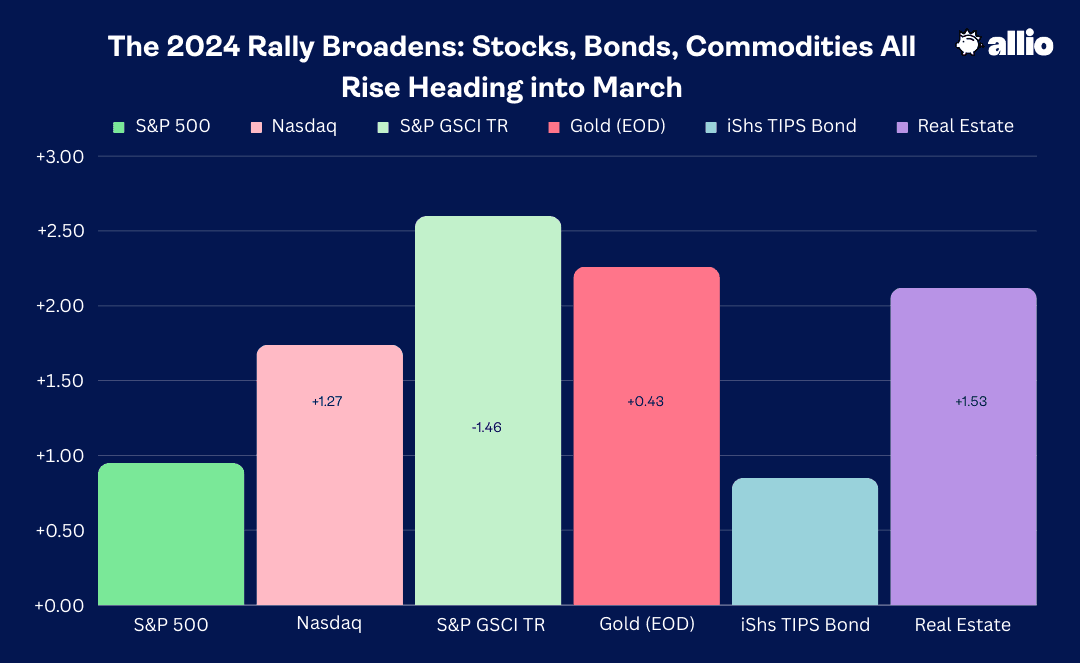

The S&P 500 is now up 16 of the past 18 weeks with the index higher by more than 25% off its October 2023 low. The rally has broadened out lately, with large-cap stocks from sectors away from the tech space notching fresh all-time highs. Still, to end February and kickoff March, the Information Technology sector led the way with a 2.7% climb last week, but a diversified mix of other areas also outperformed. Real Estate, which had been among the year’s worst-performing spots, jumped more than 2% and Consumer Discretionary gained about the same despite some concerns about a slowdown in retail spending. Healthcare, Consumer Staples, and Utilities were the notable laggards during the week – those generally defensive sectors further assert that there’s a risk-on sentiment permeating markets.

The Nasdaq Composite, at long last, eclipsed its late 2021 high just above 16,200 to close at a new all-time high on Friday, driven higher by another monster week for shares of NVIDIA (NVDA) and other semiconductor stocks. Tesla (TSLA) also lit up trading screens with a 5.6% weekly jump.

Elsewhere, it was a rare strong week across the commodity complex. Soft economic data to start March sent Treasury yields lower, putting a bid to oil and gold. The prompt month of WTI is now smack-dab at $80 per barrel – the highest in about four months. Gold, meanwhile, quietly settled at an all-time high on Friday, narrowly surpassing its $2093 previous peak from late last year. Lower real yields are seen as a boon for commodities despite the US Dollar Index continuing to meander around the 104 level.

As for bonds, the 10-year Treasury yield had hit 4.35% on February 23, but the last print on Friday was under 4.2% - the lowest rate since immediately before the January CPI report hit the tape on February 13. In all, the aggregate bond index clawed back 0.5% to make it back-to-back weekly gains.

For the year, the S&P 500 is up 7.7% and the Nasdaq Composite is higher by 8.4%.

Source: Stockcharts.com

The Look Ahead

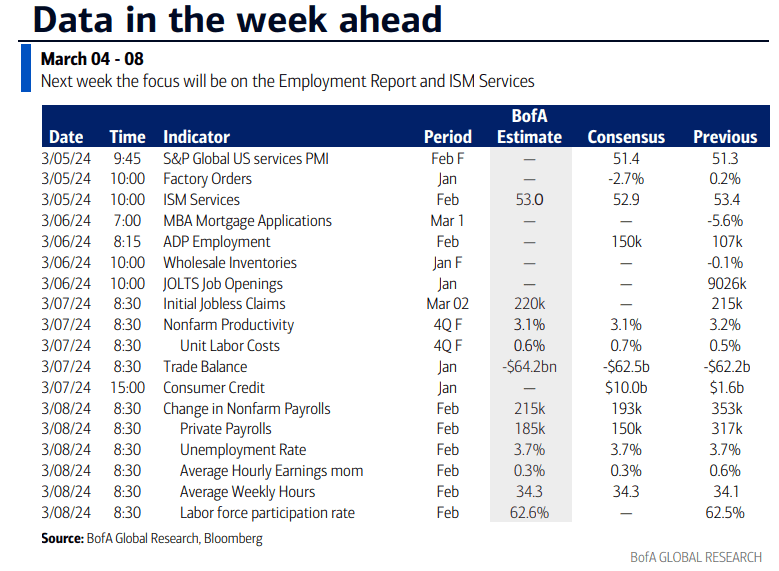

Following an uneasy month of economic data but generally strong corporate profit results, the focus shifts back to the employment picture this week. Before the jobs numbers come in, though, we’ll get updates on the services slice of the domestic economy.

First up is a February final read on the S&P Global US Services PMI gauge – it's expected to remain above the key 50 level (the demarcation line between expansion and contraction). Shortly after that on Tuesday, Factory Orders are forecast to have dropped notably in January, but this is a dated report, so more attention will be paid to the timelier February ISM Services PMI number at 10 a.m. ET. That survey came in strong in January, notching its best levels since September last year, and another solid print is the consensus. Macro pundits will pay close attention to the index’s subcomponents, including the all-important Prices Paid number. Last week, the ISM Manufacturing report revealed a drop in Prices Paid, New Orders, and Employment, which helped send bond yields lower and stocks to new highs.

Labor market indicators will light up screens starting on Wednesday morning. At 8:15 a.m. ET, ADP’s private payrolls figures will be released, and economists expect a solid 150k gain, which would be an increase from January’s soft +107k number. Then at 10 a.m., the January Job Openings and Labor Turnover Survey (JOLTS) will offer fresh clues on hirings, firings, and quits. Weekly Jobless Claims data comes Thursday at the usual time – it continues to be crickets as initial claims remains in a sweet spot for economic growth. At the same time that’s released, we will get a final update on Q4 Nonfarm Productivity and Unit Labor Costs – any further inklings of improved productivity would be welcome news as far as the Federal Reserve is concerned.

Friday morning will be all about the employment picture in February. The Nonfarm Payrolls report hits before the bell, and the consensus forecast shows a solid, though sequentially lower, 193k jobs gain. Private sector payrolls are seen increasing by 150k with an unemployment rate holding serve at 3.7%. We’ll be watching both average hourly earnings data as well as average weekly hours worked for clues on wage inflation (more to come on that later). February data will be key throughout this month since the broad narrative out there is that this past January featured wonky seasonal adjustments and effects from outlier weather patterns. So stay tuned.

In terms of Fed Speak, the Fed’s Harker kicks things off Monday morning with a speech on the economic impact of higher education, but Chair Powell’s testimony before the Senate Banking Committee on Wednesday and Thursday at 10 a.m. may be most important. The Fed’s Beige Book will be released on Wednesday afternoon, too.

Services PMIs, Powell’s Testimony, and Employment Data Are the Highlights

Source: BofA Global Research

Earnings Reports This Week

The Q4 reporting period isn’t in the books quite yet. While 97% of S&P 500 companies have posted profit results, with a decent, though not stellar, 73% bottom-line beat rate, a handful of bellwether firms will provide numbers this week. Additionally, a few major industry conferences could shed light on segments of the economy: the Morgan Stanley Technology, Media, and Telecom Conference and TD Cowen Health Care Conference will feature updates from executives which could be market-moving events.

On the earnings slate, Tuesday’s headliner will be Target (TGT) and NIO (NIO) in the premarket. Following Walmart’s (WMT) powerhouse Q4 report and stock split, expectations might be ratcheted up for the Minnesota-based retailer. Tuesday evening will be active – CrowdStrike (CWRD), one of the major winning stocks over the past year, issues quarterly numbers while Ross Stores (ROST) and Nordstrom (JWN) from the Consumer Discretionary sector report. On Wednesday, JD.com’s (JD) results could impact the China trade while Abercrombie & Fitch’s (ANF) meteoric share-price rise will be put to the test as that retailer issues profit numbers in the pre-market. Foot Locker (FL), Campbell Soup (CPB), and Victoria’s Secret (VSCO) are other consumer-related firms reporting mid-week. On that theme, Thursday is all about the consumer as Kroger (KR), Big Lots (BIG), Burlington (BURL), American Eagle Outfitters (AEO), and BJ’s Wholesale (BJ) put out Q4 results.

The focus then shifts back to A.I. on Thursday afternoon when Broadcom (AVGO) numbers hit the tape. Costco (COST) and Marvell (MRVL) will likely impact both the Consumer Staples and Information Technology sectors late in the week.

Retail Earnings Keep Rolling In, Eyes on the Consumer

Source: Earnings Whispers

Topic of the Week: The Inflation Debate Heats Up

Mentioned earlier, this month’s employment and inflation data will be particularly important for future Fed policy. The FOMC meets on the 19th and 20th, but no significant decisions are expected. Recall it was just a handful of weeks ago when traders were on the fence about whether the first rate ease would be announced at this month’s Fed gathering. Hot January CPI and PPI readings put the kybosh on that notion. In fact, heading into the year, the Fed Funds futures market suggested that upwards of 150 basis points of cuts could have happened in 2024, contingent upon a material slowdown in the economy and inflation gauges eventually coming home to the Fed’s 2% target.

Higher For Longer, Bullish for Stocks?

The disinflation trajectory hasn’t played out as the macro doves hoped. But for investors, it’s sort of like “Who cares?” Maybe more surprising than the dramatic drop-off in the number of expected Fed rate cuts is that stocks, including longer-duration slices of the market, have shot higher. In February alone, the S&P 500, Nasdaq, and Russell 2000 each registered gains of more than 5%, all while expectations for the first cut were pushed out to June at the earliest. What’s more, the yield on the 10-year Treasury note climbed a quarter point. It has the feel of a classic “reflation” trade in some respects.

It goes to show that weighing macro gauges is one thing, but predicting markets is a whole other challenge. Even ultra-risk-on and speculative areas such as biotech stocks and, of course, cryptocurrency have been on fire. Bitcoin posted its best monthly gain since December 2020 in February, climbing nearly 50%.

Recalcitrant Inflation Keeps the Fed on Watch

Still, the reality is that lofty short-term rates may be here to stay since a variety of factors point to stubbornly high inflation. Torsten Sløk put out an eyebrow-raising set of charts and macro assertions on Friday. The Chief Economist at Apollo Global made the case that there will be all of zero Fed rate cuts in 2024. He highlighted that the US economy is in fact not shooting for any kind of landing, but may be reaccelerating. Slok so much as pointed an indirect finger at the Fed, suggesting that the FOMC’s December pivot might have sparked an inadvertent macro tailwind.

Though January’s PCE inflation data was a sigh of relief to investors, as it came right on consensus estimates, and as the ISM Manufacturing survey for February surprised to the weak side, certain measures of inflation could be turning higher in the short run. The labor market remains somewhat tight (kind of ‘good, not great’) and wage growth is stuck at a high level, between 4% and 5%.

Average Hourly Earnings Growth Remains Well Above Pre-Pandemic Levels

Source: Torsten Sløk, Apollo Global

Eye on Small Businesses

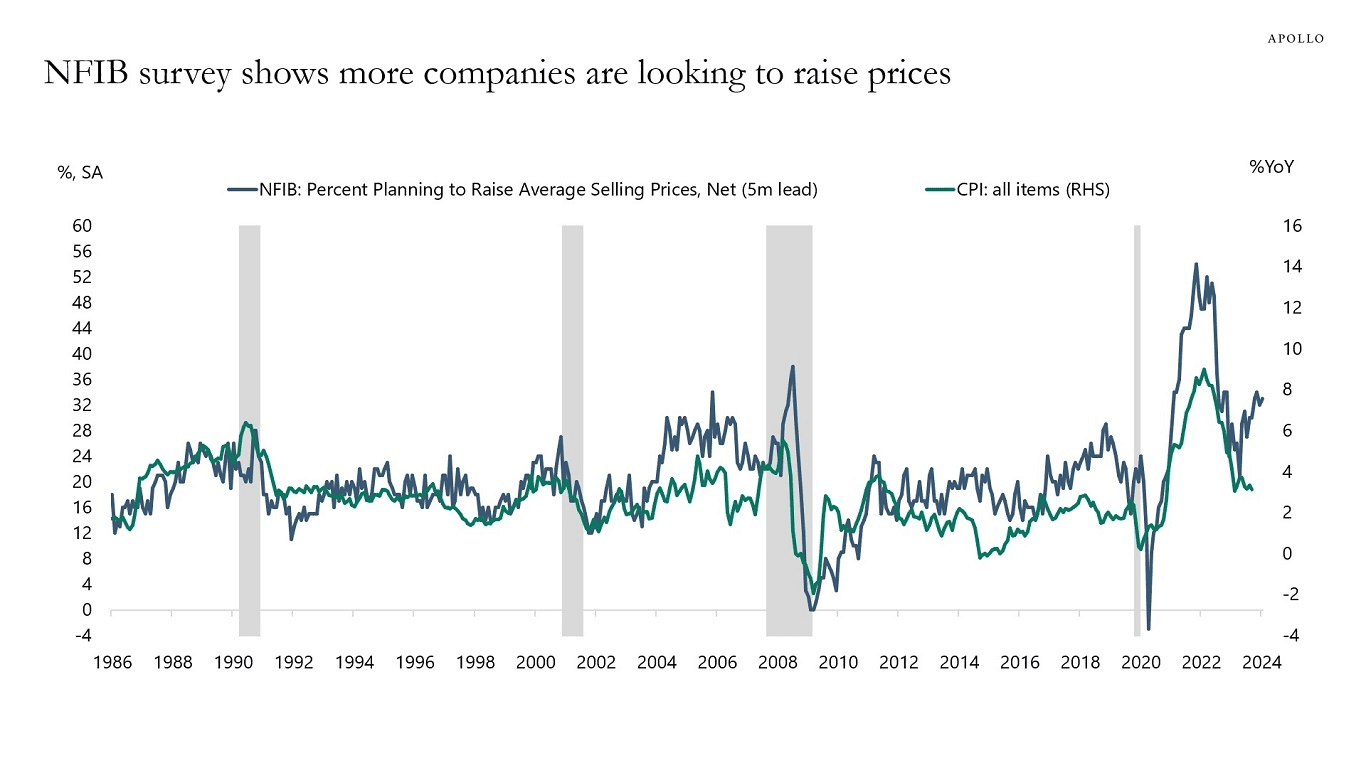

Another concern is that, according to the most recent NFIB Small Business Survey, an increasing number of firms plan to raise prices and workers’ wages – often a harbinger of stronger inflation ahead. And despite a steep fall off in rent price gains in the last several quarters, asking rents in certain cities could be inflecting upward, which would eventually cause the CPI and PCE to trough before getting to the magical 2% figure.

Small Businesses Plan to Hike Prices, an Inflation Bellwether

Source: Torsten Sløk, Apollo Global

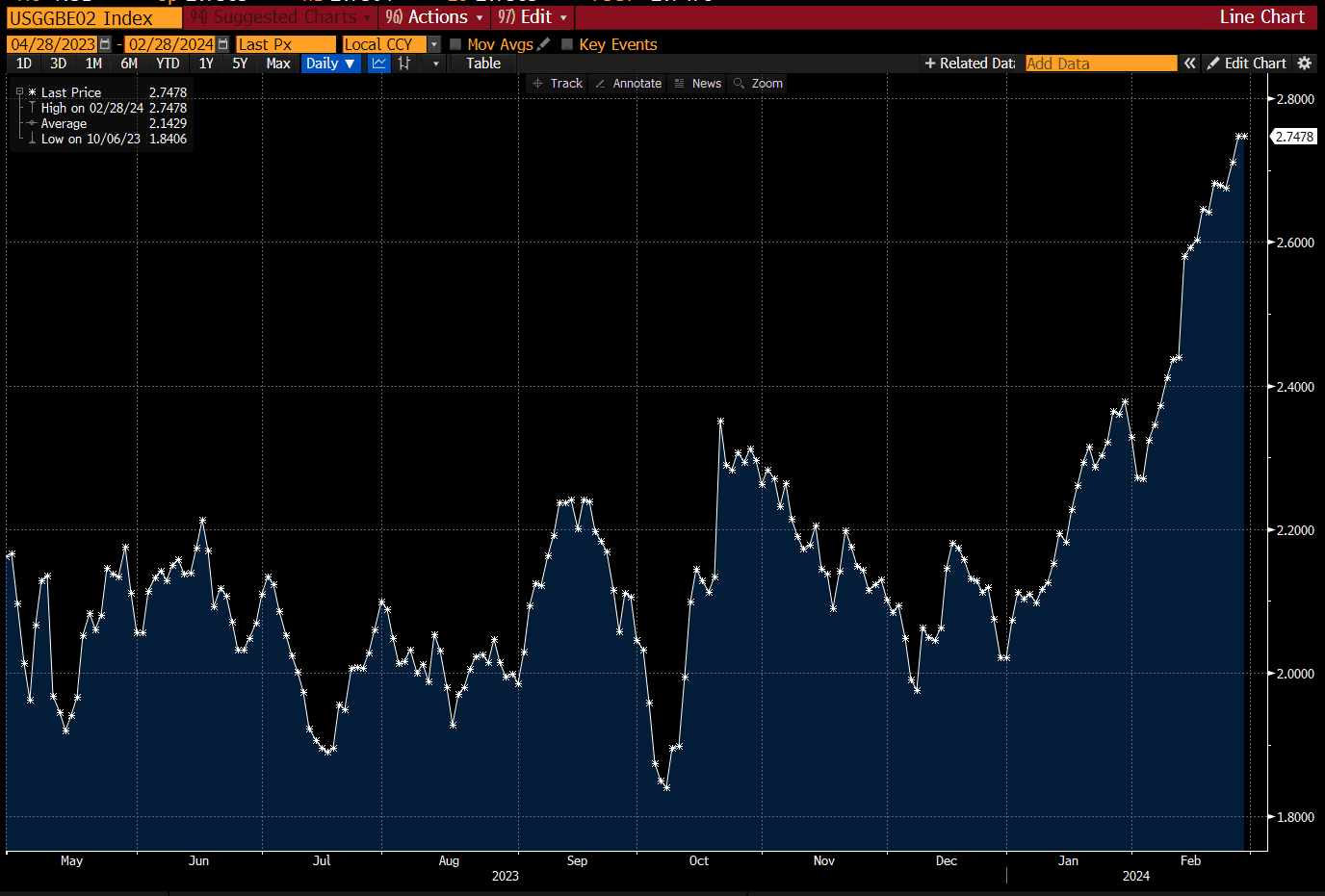

Bond Traders Agree – Inflation, High Fed Rates Are Not Going Away Soon

Price action also makes the case that short-run inflation may hang too high. Last week, the 2-year breakeven inflation rate, the yield difference between near-dated inflation-protected securities and comparable-term Treasuries, approached 2.8% - the highest level in almost a year. For perspective, the 2-year breakeven rate was barely above 2.0% at the start of 2024.

2-Year Breakeven Inflation Jumps above 2.7%

Source: Lisa Abramowicz, Bloomberg

Growth Trends on Track

On the growth front, the latest Atlanta Fed GDPnow number underscores that the economy is humming right along. At 2.1%, the inflation-adjusted expansion rate is much cooler compared to the second half of last year, but if the number verifies, that is hardly a bumpy landing. The Atlanta Fed’s model and the Blue Chip consensus are homing in on 2%, so there is some confidence that modest real growth is taking place, and we’ll know a whole lot more by the end of this week once the full slate of employment data feeds in.

Solid Real GDP Growth Expected in Q1

Source: Atlanta Fed GDPnow

The Bottom Line

The path toward 2% inflation remains uncertain. A host of indicators portend hot consumer price trends, potentially pressuring the Fed to put off its first rate cut for later in the year, with some even suggesting that if we stay on the current macro trajectory, then no cuts at all could take place in 2024. And what might the stock and bond market reaction be if hikes are put back on the table? A lot will unfold over the next few weeks.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.