Updated February 26, 2024

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

Stocks rose to another round of fresh record highs in a data-light week. NVIDIA’s (NVDA) earnings report Wednesday night was the clear standout, helping to lift both the Nasdaq Composite and the S&P 500 to their best respective sessions in a year. It was also the largest single-day market cap gain for a company in history, surpassing Meta Platforms’ (META) monster post-earnings move earlier in the Q4 reporting season. All told, the S&P 500 rose 1.7% and the Nasdaq Composite lifted 1.4%. The holiday-shortened week also featured strength among foreign stocks, including new all-time closing highs for Germany’s Xetra Dax Index and Japan’s Nikkei 225 Index. Domestic small and mid-cap stocks struggled, though, with the Russell 2000 ending last week down by 0.9%.

Sector-wise, it was the defensive Consumer Staples niche that performed best, up more than 2%, aided by a very strong earnings report from Walmart (WMT) last Tuesday morning. Risk-on and value-oriented areas like Materials, Industrials, and Financials outperformed the SPX while Energy and Real Estate lagged, though all 11 S&P 500 groups were positive. For all the fanfare around NVDA, Information Technology and Communication Services underperformed last week.

In the bond market, the yield on the US 10-year Treasury note crept up to its highest level since late November 2023 amid a weak Treasury auction on Thursday afternoon and continued Fed rhetoric suggesting no rate cuts happening anytime soon. Still, the 10-year rate dropped nearly 7 basis points on Friday to settle at 4.26%, leading to a modest rate drop for the week. Hence, both the aggregate bond index and the TIPS ETF sported small gains. It was a mixed bag in the commodities space with gold catching a bid from both the rise in bond prices and a falling US Dollar Index (DXY), but oil got slammed on Friday, posting a 2.7% decline – its worst session since early January as the global energy supply/demand balance continues to run bearish. Overall, the commodity index gave back 1.3%.

For the year, the S&P 500 is up 6.7% and the Nasdaq Composite is higher by 6.6%.

Stocks Steamroll Higher, Defensives & Cyclicals Lead as NVDA Snatches the Spotlight

Source: Stockcharts.com

The Look Ahead

February told a cautionary tale on the macro front. Both the CPI and PPI reports were to the hot side, causing Wall Street strategists to rethink their rate-cut forecasts. Goldman Sachs, among the most aggressive forecasters, succumbed to the reality that the FOMC will likely wait until mid-year to begin easing its policy rate. We’ll get more clues on both the inflation front and the growth side of the economic ledger this week as we finish off February and begin the final month of Q1.

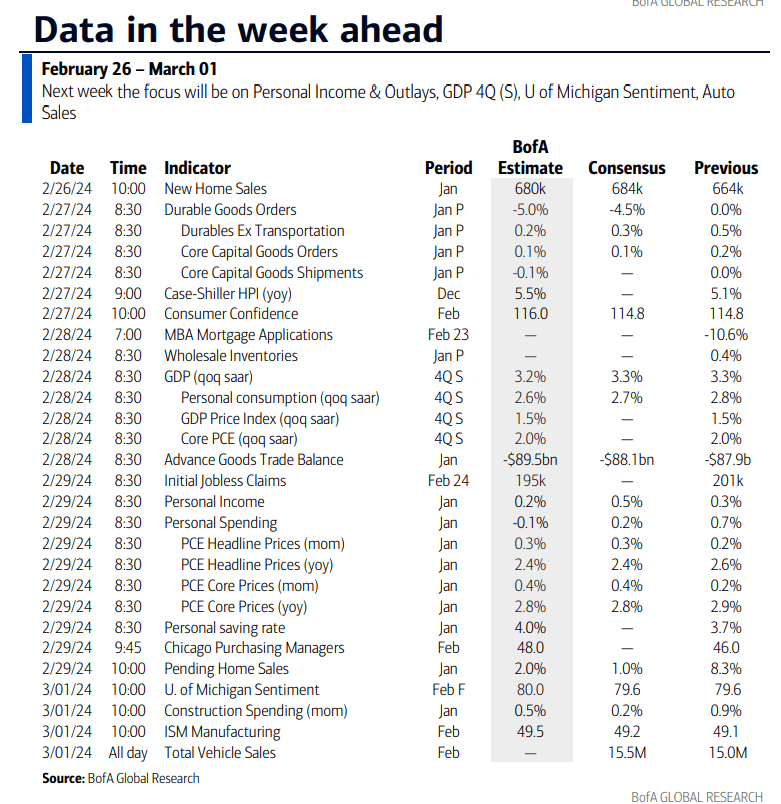

New Homes Sales is the highlight on Monday. The previous read for December showed the largest month-on-month climb since November 2022, but rising mortgage rates, now back above 7%, could cool off purchase activity as we approach the home-buying season. The macro action really gets going on Tuesday with a trio of key reports. First, a preliminary look at January Durable Goods Orders crosses the wires at 8:30 a.m. ET, and economists expect a sharp decline from December, though Durables Ex Transportation and Core Capital Goods Orders are forecast to have risen slightly from the previous month. Then comes a dated December update of the S&P Case-Shiller Home Price Index which BofA believes will reveal a 5.5% year-over-year rise in domestic home values. Finally, the Conference Board’s Consumer Confidence number for February hits the tape at 10 a.m. ET. Recall last month that the index notched a two-year high on improving views of current conditions and declining pessimism looking ahead. An even higher figure is the consensus forecast for this month.

On Wednesday, the major economic data point comes from the second update to Q4 GDP figures. No major revelations are expected, but it will likely underscore that the domestic economy expanded at a fast clip as 2023 finished. Perhaps the most important numbers to look at will be the consumption and price data for insights into the inflation situation. Leap Day, February 29, is another busy one for macro-onlookers – we'll get Initial Jobless Claims before the bell along with the all-important January Personal Consumption Expenditure (PCE) data, something the Fed monitors closely. The consensus calls for a 0.3% monthly jump in Headline PCE while Core PCE is seen having increased by a stubbornly high 0.4%. That’s much too hot for the Fed to begin cutting in March. Still, if we see Headline PCE yoy drop to 2.4% while Core inflation dips to 2.8%, then it will suggest that inflation’s broader trajectory is not too far from where Chair Powell and the FOMC want it.

The first of March will not feature a jobs report – that comes on Friday morning next week. A final view of the University of Michigan Surveys of Consumers, January Construction Spending data, and the ISM Manufacturing report all come at 10 a.m. ET on March 1. We’ll be on the lookout for more upbeat consumer sentiment numbers but also a continued sub-50, contractionary, ISM Manufacturing survey. On the Fed circuit, several voting members have speaking engagements from mid-day Wednesday through Friday afternoon.

Q4 GDP Updates, PCE Inflation, Consumer Sentiment Data, and the ISM Manufacturing Report Are the Highlights

Source: BofA Global Research

Earnings Reports This Week

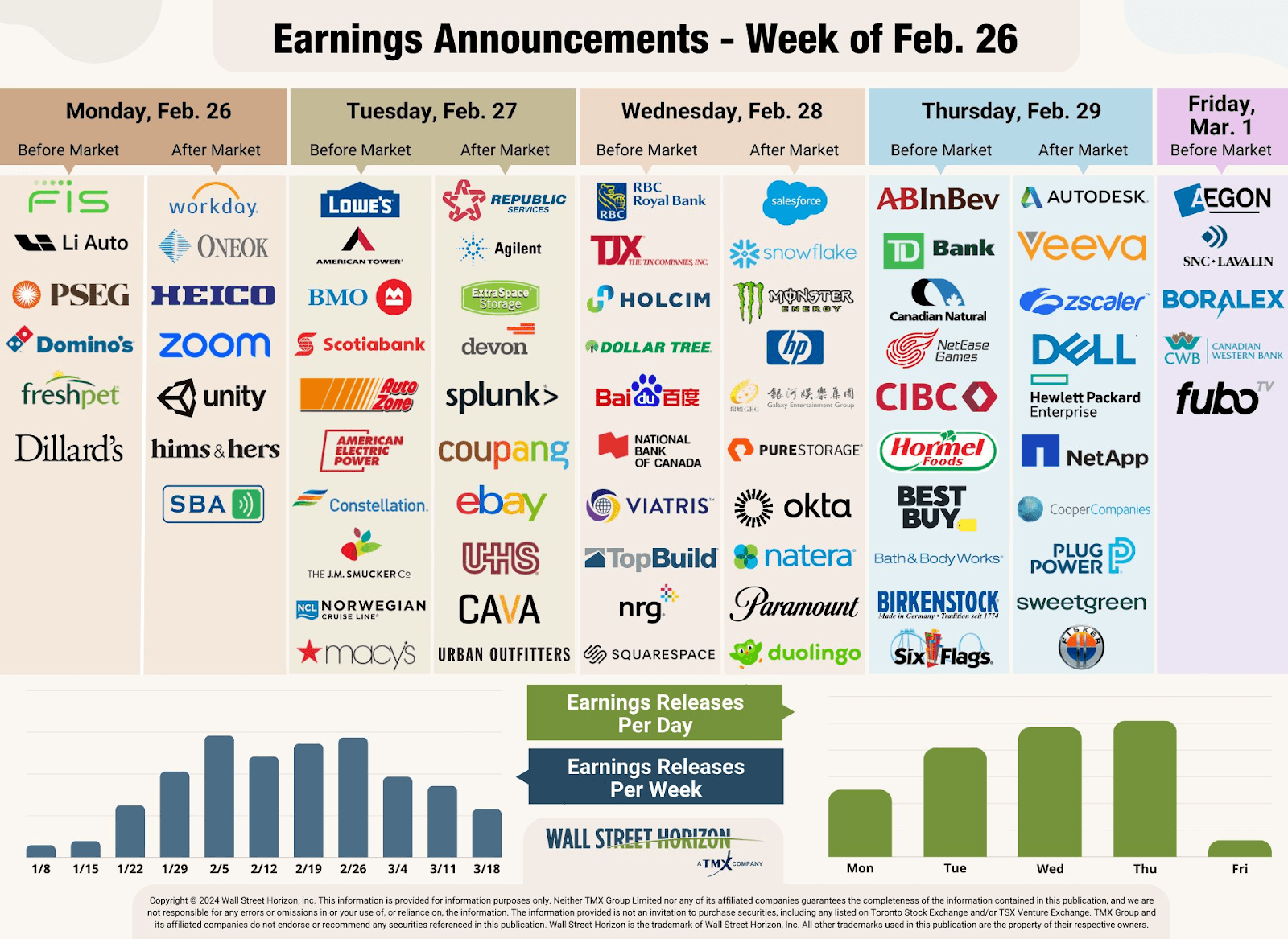

Most of the S&P 500 has reported Q4 results, and the collective beat rate was about in-line with recent averages. Aggregate earnings have come in better than expected, too, but the gain compared to analyst forecasts was less stellar versus previous quarters. This week, consumer and retail companies are again in focus after WMT’s and Home Depot’s (HD) fourth-quarter numbers last week.

Lowe’s (LOW) is among the standouts – the home improvement store posts earnings Tuesday morning along with AutoZone (AZO) and Macy’s (M). A major winner in the last year, Republic Services (RSG) in the trash business delivers earnings Tuesday night as does eBay (EBAY), CAVA (CAVA), and Urban Outfitters (URBN). TJX Companies (TJX), Dollar Tree (DLTR), and Baidu (BIDU) are more consumer-related firms issuing results Wednesday before the bell. Tech takes the stage that evening, though, with Dow component Salesforce (CRM) reporting as well as Snowflake (SNOW). Best Buy (BBY) and recent-IPO Birkenstock (BIRK) posts profit numbers Thursday morning with Zscaler (ZS) and Dell (DELL) reporting after the close.

Retail and Tech Companies Are the Headliners as Q4 Earnings Season Winds Down

Source: Wall Street Horizon

Topic of the Week: AI Euphoria & Momentum Carrying the Torch at Home, Recessions and Bull Markets Abroad

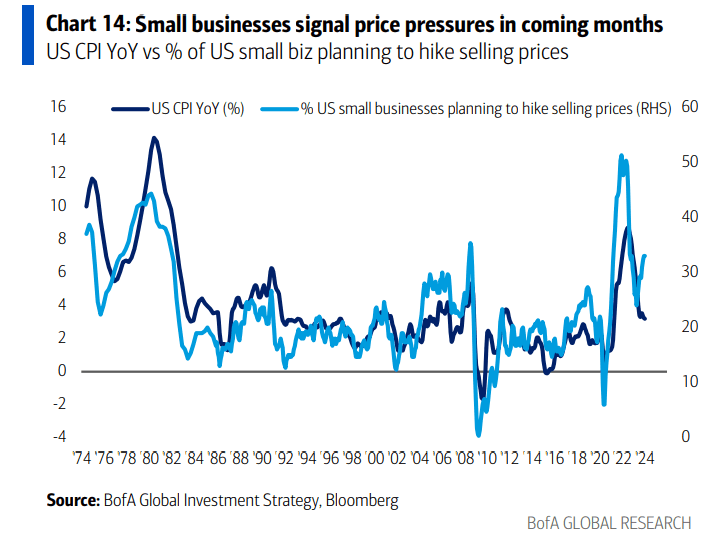

Last week, we discussed that inflation remains a concern for the FOMC. It’s a different type of inflation, though. Recall it was precisely two years ago when oil prices began to take off following Russia’s invasion of Ukraine. The US economy was grappling with ongoing supply chain issues from the pandemic just as consumers’ “revenge travel” took off. There were major factors that would culminate in Headline CPI printing a four-decade high of 9.1% by the following June.

Today looks much different. Oil prices are stagnant in the mid-$70s while natural gas flirts with its lowest levels since the middle of the 1990s. Consumer spending, while gangbuster last year, appears to be easing if the January Retail Sales report and some recent card-spending data trends are accurate. Supply chains are a non-issue and wage growth is normalizing.

The Inflation Battle Wages On...Probably into the Summer

But that last percentage point of inflation is proving to be tough to control. There was some debate among economists toward the end of 2023 whether getting PCE from 3% to 2% would be easy or a challenge, but risks are mounting that strength in pockets of the domestic economy may keep inflation just a bit too high.

Small Businesses Plan on Increasing Selling Prices, Pressuring Inflation to the Upside

Source: BofA Global Research

Perhaps we can look just to NVDA’s earnings report last week as a sign that enterprise investment is humming along just fine. The chip designer reported yet another blowout set of results as AI mania takes a leg higher. While the Fed supposedly disregards the stock market, a boom in the usually cyclical semiconductor industry could buck the disinflationary trend seen since the summer of 2022.

The Employment Market Remains Firm Enough

Recalcitrant inflation is also the result of a labor market that remains somewhat tight. Initial Jobless Claims show no leading signs of a growth slowdown, and while real wage gains were tempered in January, so long as we don’t see a meaningful uptick in the unemployment rate, Chair Powell is unlikely to announce a drop in the Fed’s policy rate before the summer.

Deep Cuts Less Likely Per Option-Implied Rates

Source: Goldman Sachs

It’s even conceivable that this 5.25% to 5.50% target range could persist for the balance of 2024. Bear in mind that the CME’s FedWatch Tool, using Fed Funds futures, is really just an average of a handful of possible outcomes, and the implied future rates are generally biased toward cuts due to the ever-present risk of an unforeseen negative shock to economic growth.

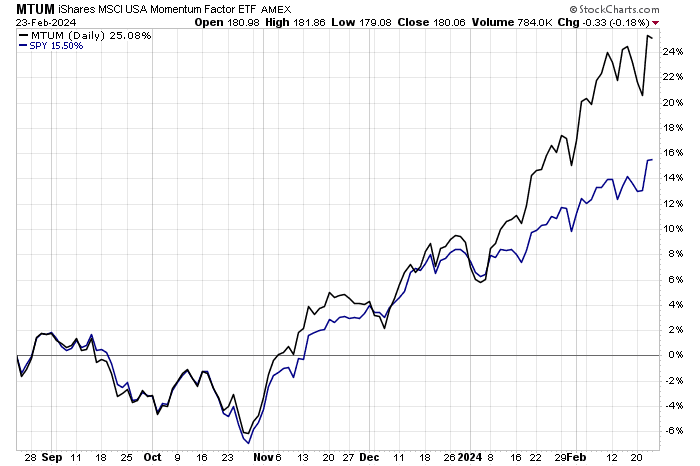

Momentum Begets Momentum

For investors, it could mean more of the same. The longer the first rate ease is delayed, the more fuel there is for mega-cap tech and momentum to dominate. The iShares MSCI USA Momentum Factor ETF (MTUM) has soared since the start of the year, easily outperforming even the S&P 500’s solid YTD gain.

MTUM Momentum Factor ETF Jumps, Outpacing the S&P 500 in 2024

Source: Stockcharts.com

US Factor Performances: Momentum Top of the Stack YTD

Source: WisdomTree Funds

Its largest holdings are NVDA, META, Broadcom (AVGO), and drugmaker Eli Lilly (LLY). Each of those stocks is now among the top 10 most valuable companies in the world. All the while, the Russell 2000 Index sputters around technical resistance as each bump-up in yields weighs on the rate-sensitive small-cap space.

Don’t Wait for the Recession - Look Around to Find It

You see, after years of economic conditions and market dynamics that seemed to turn on a dime, investors now face what could be a prolonged period of “more of the same.” The momentum factor, which had been out of favor for three years, might stick around as a winner as macro strategists debate if and when a macro slowdown shows itself.

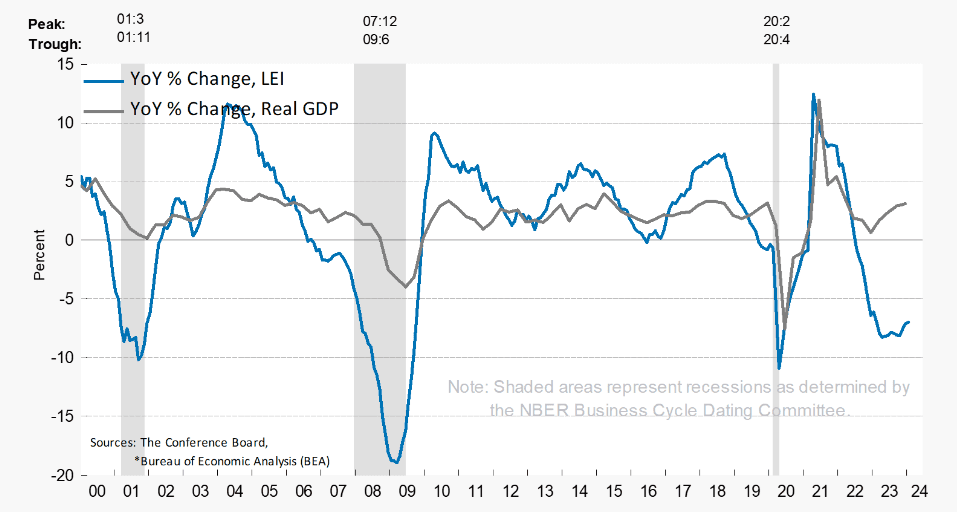

Each passing month’s set of economic data points refutes the calls for a hard economic landing despite all of the historical indicators (inverted yield curve, negative money supply trends, dreadful Leading Economic Index (LEI) numbers, to name a few) suggesting that a recession should come about.

The LEI Fell Again in January, Its 23rd Consecutive Monthly Drop

Source: The Conference Board

Technical Recessions Strike the UK and Japan, Germany Probably in Recession

We are a free market economy, however, so the economic cycle will eventually play itself out. For now, the revolution that is investment in AI has likely lifted our economy enough so that we’ve avoided an NBER recession this go around. America is home to the best profit generators in the world, and economies lacking those growth engines have indeed suffered.

Just take a look overseas – the UK slipped into recession at the end of last year, Japan lost its crown as the world’s third-largest economy after falling into recession in Q4, and the German economy shrank in 2023. In fact, there was quite the bumpy landing, just not in the US.

Stocks Discount the News

As I like to say, we must take off our economist hats and don our investor hats. While recessions are being flagged left and right in certain nations, stocks are climbing. I mentioned earlier that the Dax and Nikkei are both at fresh highs, but even beaten-down Chinese stocks are up nine sessions running – their longest winning streak in six years. As economic forecasters stand by, waiting for growth to get dinged at home, global macro investment opportunities have presented themselves.

The Bottom Line

NVDA was no doubt the standout last week, but there are broader trends investors should pay attention to. We’ll get important economic updates this week while price action under the market’s surface suggests that some themes may endure. As AI shines at home, global markets have shrugged off recessionary headlines.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.