Updated September 12, 2023

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

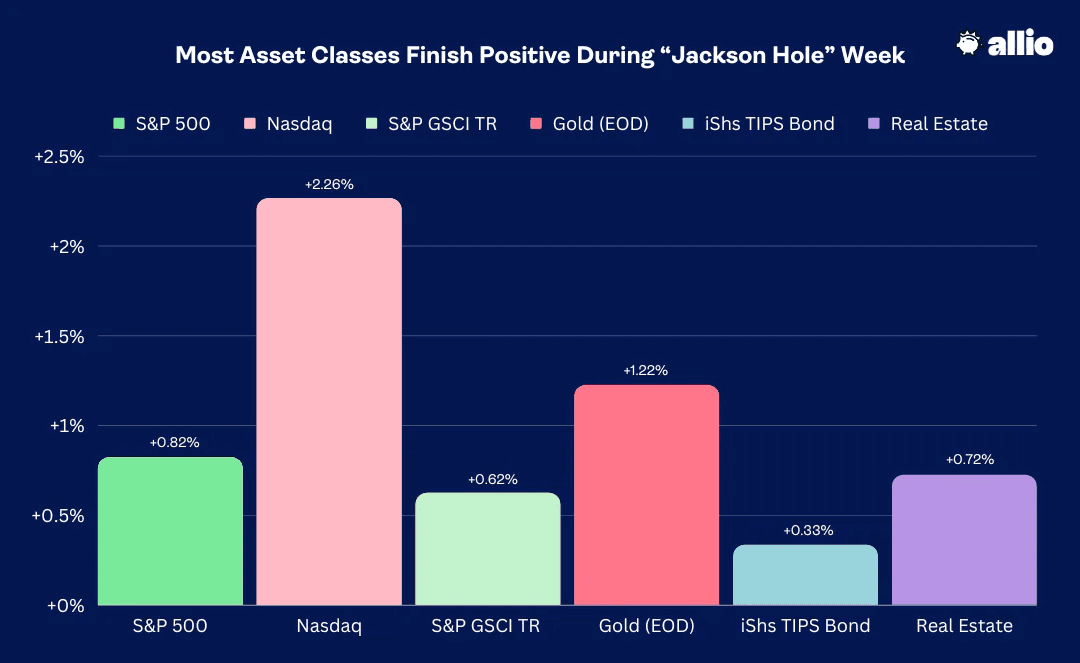

Last week, stocks snapped their 3-week losing streak with the S&P 500 clawing back some of its August losses. Domestic large caps were up less than a percent last week while the Nasdaq Composite rose more than 2%. With the Information Technology and Consumer Discretionary areas being the only sectors outpacing the SPX, the value style and small caps were underperformers. Real Estate managed to finish in the black, however, returning 0.7%, helped by a retreat in interest rates. The closely watched TIPS market outperformed the broader fixed-income space.

On the commodities front, gold also finished in the black, ending a 3-week losing streak of its own – buyers appear ready to scoop up the precious metal on approaches of $1900. Lastly, commodities writ large were bought up and are actually not far from multi-month highs despite a US Dollar Index that has gained significant ground since mid-July. On that note, the dollar was up nearly 1% again last week.

August 18, 2023 - August 25, 2023

The Look Ahead

It’s a big week of economic data as many Wall Street analysts and traders soak up a final week of summer fun away from their desks. No rest for the weary, we will get a June update on national home values with Tuesday’s Case-Schiller Home Price Index before the July Job Openings and Labor Turnover Survey (JOLTS) along with the Conference Board’s August glimpse at Consumer Confidence at 10 a.m. ET.

Wednesday features more employment and housing data – August ADP Employment arrives first, then July Pending Home Sales crosses the wires at 10 a.m. In between, a second read on Q2 GDP hits the tape. More key data the Fed monitors comes on Thursday with the July Personal Income and Spending figures.

Finally, it will not be a quiet finish ahead of the 3-day weekend; August’s Employment Report and ISM Manufacturing data will be a look into the growth situation as the often-volatile month of September gets underway.

We’ll get earnings reports from a handful of retailers, such as Best Buy (BBY), Dollar General (DG), and lululemon (LULU) as well as names from other areas: CrowdStrike (CRWD), Salesforce (CRM), Okta (OKTA), UBS (UBS), and Broadcom (AVGO).

Retail, CrowdStrike, Salesforce, Broadcom Earnings on Tap

Source: Earnings Whispers

Jackson Hole Debrief: A New Star Was Not Born

Fed Chair Jay Powell reminded market watchers that the FOMC’s job is never easy. The world’s most accomplished economists and PhDs often gather in a stuffy room and struggle to get it right when it comes to determining what monetary policy actions to take.

“We are navigating by the stars under cloudy skies,” said Powell during his much longer missive to the media compared to 2022’s 8-minute stern and “painful” message. Recall August of last year – the S&P 500 had just rallied significantly off its mid-June low as the CPI rate eased from its June 40-year high. Indeed, bond yields trended lower ahead of the Jackson Hole Economic Symposium back then, but the Fed Chairman had eyes on setting the economy back on track in terms of price stability.

Assessing Powell’s Message

Jay sought to inflict damage to economic growth in an effort to accelerate the move lower in the inflation rate. He and the rest of the FOMC were willing to cause economic hardship on working families to accomplish that key part of the Fed’s dual mandate. Jump ahead a year, and we are talking about an immaculate disinflation, soft landing, and goldilocks outcome.

The unemployment rate is near five-decade lows at 3.5% while Headline CPI hovers just above 3%, not too far above the Fed’s 2% goal. Many pundits asserted that Powell, during his address from the foothills of the Grand Teton Mountains, would tip-toe around a victory lap. That did not exactly play out, but he was certainly more measured in his words and tone last Friday versus a year earlier.

Rising Chance of Another Hike

Powell’s balanced message contained something for the bulls and bears, hawks and doves. Ultimately, the market scored it to the hawkish side of the monetary ledger, evidenced by a rise in Fed Funds futures pricing for a September or November rate hike. There are now better than 50:50 odds of a final quarter-point increase, something I have been watching closely over recent weeks. Stocks took it in stride and rallied into the close on Friday.

Perhaps more impactful to long-duration assets and savers alike is that there’s only 0.75 percentage point of cuts priced into the futures curve in 2024. Now, historically when the Fed issues its final rate hike in a cycle, the first cut happens about six months later – and the market is banking on that trend to continue. Still, the mantra of “higher for longer” continues to take on new meaning, and we could be looking at a Fed Funds target rate north of 4% for many quarters ahead.

Growth and Inflation: A Complicated Relationship

Driving the tighter policy is an economy that just won’t give up. The much talked about Atlanta Fed GDPnow model spits out third-quarter real economic growth of 5.9% as we head into a big week of data, including a jobs report. What we find fascinating is that one longstanding precept that is purported to assist monetary policy decision-makers, the Philips Curve, is not working as it once did.

Strong Consumer Spending Data Lifts Q3 GDP Growth Model

Source: Atlanta Federal Reserve

The Phillips Curve illustrates a perceived inverse relationship between the unemployment rate and the inflation rate. It suggests that when unemployment is low, inflation tends to be high, and when unemployment is high, inflation tends to be low. The idea behind the Phillips Curve is that as the jobs market tightens (low unemployment), workers gain more bargaining power, leading to increased wage demands, which in turn can result in increased costs for firms. To cover these higher costs, companies may raise prices, leading to higher inflation.

Eyeing a Productivity Boost

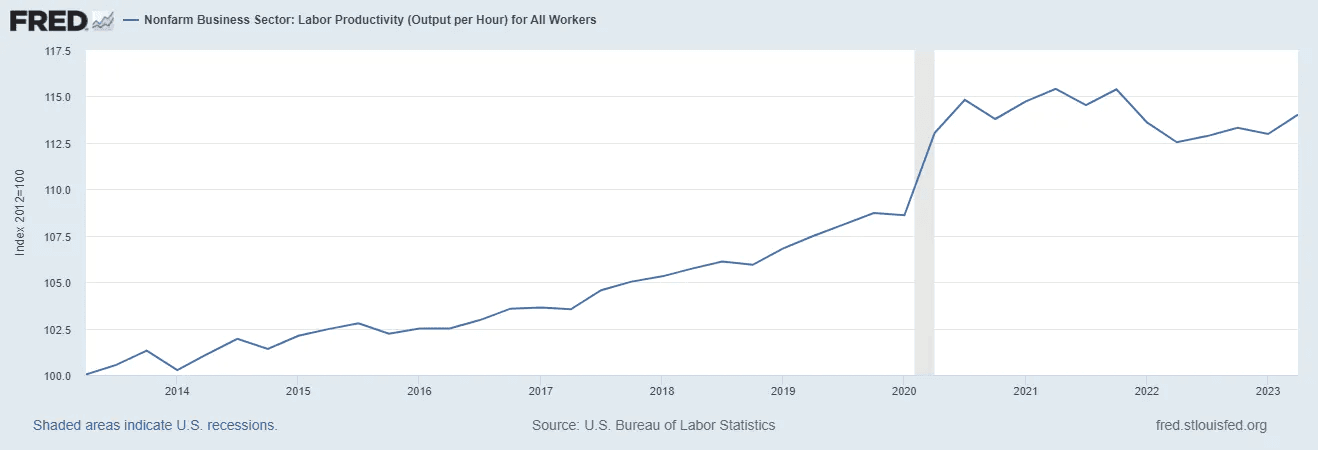

The FOMC doesn’t live and die by the Phillips Curve, but a significant drop in the inflation rate since June 2022, despite a continued robust labor market, implies that there is something else at play. Could it be that productivity on the job explains the difference?

You see, following the pandemic’s immediate negative effect on GDP growth, companies went on a hiring spree and were said to even “hoard” labor. Pay increases for so-called “job-switchers” surged and the ratio of job openings to workers likewise went to the moon. That also resulted in a severe drop in productivity as less work got done given the number of hours worked in the economy.

Job Growth Easing Following 2021’s Hiring Binge

Source: Bloomberg

Data show the trend has reversed. Three weeks ago, it was announced that US labor productivity notched its biggest increase in the second quarter in almost three years, effectively buttressing the case for a soft landing. While this is just a single print, it may be a sign that the Fed has more wiggle room to keep its policy rate high. Still, Powell contends that below-trend GDP growth is required to bring inflation back to its target. Here is where the FOMC must be careful – if growth is decent due to solid productivity, that’s not an inflationary sign.

US Q2 Productivity Bump, Supporting Expansion and Lower Corporate Costs

Source: St. Louis Federal Reserve

To the Stars

There is also renewed debate about what the FOMC’s neutral policy rate should be. The “r-star,” which is the level of interest rates that neither stimulates nor restricts economic growth in the long run, was thought to be near 5% in the go-go 1990s. As disinflationary trends emerged in the late 2000s and 2010s, however, even a zero-interest rate policy did little to stimulate real GDP growth above, say, 2%.

How quickly things change as we are now discussing whether 4% or so is a fair level that is not too hot, not too cold. Powell didn’t toss his hat into this academic ring for the most part last week, though his melodious message referring to stars amid cloudy skies was charming at the very least.

Going Abroad...Look If You Must

There’s more happening than just the Fed, though. Downright turmoil in parts of the China economy remains a critical risk as we head into the notoriously volatile month of September. It was reported over the weekend that its government halved its stamp duty on stock trades to spur demand, but that minor move is yet another in a series of lukewarm policy actions to drum up economic activity. President Xi Jinping appears to still be averse to taking bolder moves to free up capital in his nation. Luckily, the US has been a major driver of global economic expansion this year, making trends at home all the more crucial. China’s tepid policy actions come as growth in the Euro Area continues on a poor trajectory – we will get a new set of European PMI reads on Friday, the first of the month.

Contraction-Level Indicators Abroad, Fresh PMI Reads this Week

Source: Bloomberg

A Sweltering Summer: Hot Rates, Hot Dollar

Let’s turn from economics to the brass tacks of price action. The US Dollar Index showcases the strength of recent US data, both at the macroeconomic and company-specific levels. The greenback began earnings season under 100 in mid-July (when interest rates were at much lower levels). Q2 profit reports and macro data points have largely come in better than expected, as evidenced by a solid earnings beat rate for the previous quarter and a strong Citi Economic Surprise Index, helping to send both Treasury yields and the dollar higher.

Getting Real

With real rates peeking at 2%, even climbing above that psychological level on parts of the rate curve lately (the 20-year inflation-adjusted yield rose to near 2.2% at the height of bond market selling earlier this month), stocks should indeed be re-rated lower. Thus, the August dip across the board in equities makes sense. Encouraging last week was the resilience of tech and other longer-duration plays that had been under pressure for the last handful of weeks. We’ll be on the lookout for new market leadership considering that winning plays like the homebuilder stocks appear to be rolling over – a new group is needed to buck the current corrective pattern.

Our View

While there are bearish risks out there and as the calendar is no friend to the bulls over the next five weeks, overall positioning trends across asset classes remain somewhat conducive for equity gains going forward. Our tempered, though still sanguine, view on markets is based on some better momentum trends and an oversold market. We will keep close tabs on movements in both the dollar and on the Treasury curve.

The Bottom Line

The road ahead is full of twists and bends, and the Fed is navigating by the stars under cloudy skies. It makes for an economic-theme classic rock ballad, but it’s also the reality. With perhaps one more rate rise to come, a new challenge awaits the FOMC in terms of how long it will have to keep policy at a restrictive level. Maybe the jobs market will dictate that, and this week holds important clues as to the state of the employment market.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.