Updated September 19, 2023

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Recap

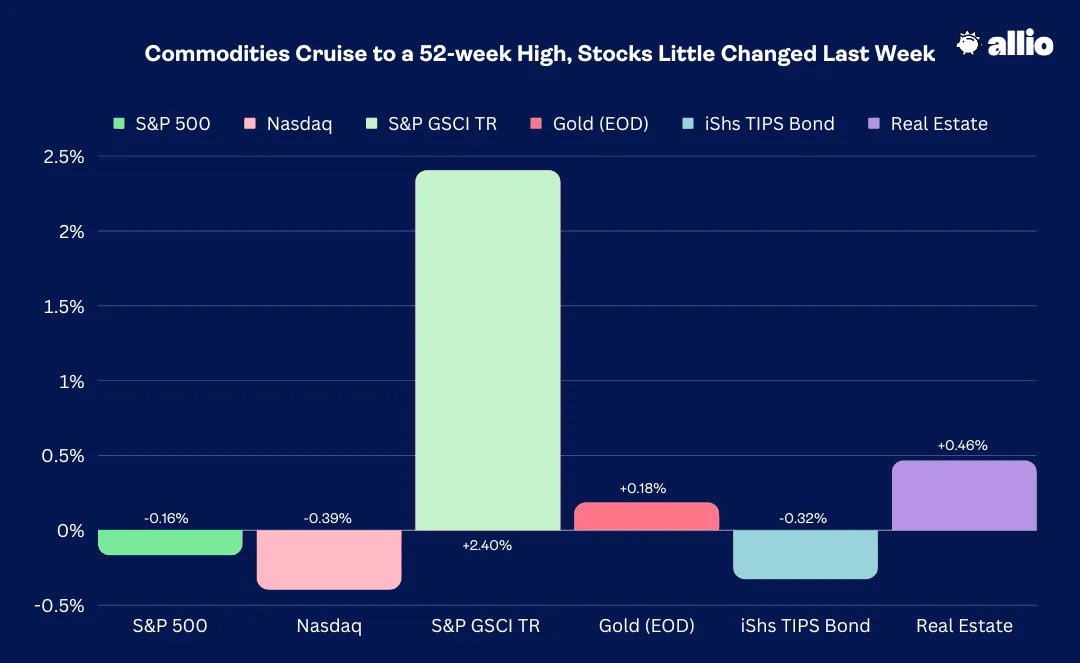

Stocks had a quiet week during what is sometimes a volatile stretch on the calendar. The S&P 500 was down just 0.2% after a few ups and downs while the Nasdaq Composite was off just slightly more at –0.4%. Information Technology was the worst sector, losing 2.3%, while Real Estate managed to finish in the black by half a percentage point.

A theme throughout Q3, commodities were in rally mode along with the US dollar – the broad commodity index jumped another 2.4% to settle at its best mark since August of last year. Gold, more sensitive to the greenback and changes in real interest rates, climbed just a few bucks, however.

Speaking of bonds, yields ticked higher after inflation data verified to the warm side and following a strong August Retail Sales report.

For the year, the S&P 500 is up 15.9% while the Nasdaq Composite is higher by 31%. Outside of US large caps, the Russell 2000 is barely outpacing inflation with its 5.3% rise and foreign equities are up 7.7%.

September 8, 2023 - September 15, 2023

The Look Ahead

This week, all eyes will be on the Federal Reserve’s two-day policy meeting with a rate announcement coming Wednesday afternoon. The 2 p.m. ET decision and 2:30 p.m. ET press conference will likely feature much fanfare, but also no change in the Fed Funds target rate. It will also be a busy stretch for housing market data with August Housing Starts and Building Permits data hitting the tape Tuesday before the bell, followed by MBA Mortgage Applications Wednesday morning.

The always-volatile Philly Fed survey crosses the wires Thursday at the same time Initial Jobless Claims are announced. Another drop in the Conference Board’s Leading Economic Index (LEI) is forecast – that hits 10 a.m. Thursday along with August Existing Home Sales figures. Finally, a first look at September S&P Global Manufacturing and Services PMIs arrives on Friday.

Key earnings include AutoZone (AZO) Tuesday BMO, General Mills (GIS) Wednesday BMO, FedEx (FDX) and KB Home (KBH) Wednesday AMC, and Darden Restaurants (DRI) Thursday AMC.

Labor’s Revenge

Many ingredients go into the inflation recipe. Rapidly rising and persistently strong demand for housing, commodity price climbs, and simply expectations for what the future consumer landscape will look like all get baked in. Perhaps the key element is the bargaining power of workers. After all, labor costs are often the biggest line item on the expense section of an income statement for firms both big and small. Maybe you’ve heard of the so-called “wage-price spiral,” an economic term describing the tit-for-tat that goes on between soaring wages to combat more expensive goods and services. The two go hand in hand.

Today, battles wage on between the United Auto Workers (UAW) and the big 3 car companies: Ford (F), General Motors (GM), and Stellantis (STLA) (which owns the Chrysler brand). I won’t get into the details of who is demanding what and when we can expect auto production to ramp back up, but the UAW is one of the most prominent and influential labor unions in the country. What’s more, the hotly contested compensation discussions underscore a broader theme at play in the United States – the worker still has power.

Power to the People: Workers Demand Nearly $80,000 in Annual Pay, up 11% YoY

Source: Bloomberg

A Sanguine Employment Picture Keeps Workers in the Driver’s Seat

It’s not like it was in the 2010s. Companies are simply not able to keep a lid on pay packages and limit annual raises to amounts barely above the inflation rate. Sure, the unemployment rate ticked up to 3.8% last month, the highest since early 2022, but the jobs situation remains robust. Just take a look at the last two weekly Initial Jobless Claims figures – they sum to the lowest amount in more than six months. While fewer people are quitting, evidenced by the July JOLTS report, there are not many indicators pointing to mass layoffs any time soon.

Pedal to the Metal on Auto Inflation?

Economists fear the UAW strike could be inflationary; car prices are a key determinant of both the Consumer Price Index (CPI) and the Personal Consumption Expenditure (PCE). It’s estimated that the price tag on new vehicles could rise upwards of 2% in the event of a two-week strike, according to automotive consulting firm J.D. Power. If the workers’ holdout lasts for an extended period, then more significant price impacts may be felt by consumers across the country. Used car prices could see an even bigger price increase, reversing a trend of cooling vehicle prices in recent months and contributing to ongoing inflation concerns. All of this comes as domestic auto inventories remain well below normal levels.

A Rust Belt Recession

There are political impacts, too. While the “Big 3” automakers are perhaps less crucial to the health of the Michigan economy than they were decades ago, a protracted strike would possibly send the Michigan economy into recession. With a general election less than 14 months away, expect both sides of the aisle to pounce on the labor dispute.

It’s the age-old battle between “corporate greed,” as UAW President Shawn Fain described it after rejecting the notion that worker wages were responsible for rising auto prices, and the power of organized labor. We have seen it play out on a smaller scale with UPS (UPS) and the Teamsters union, but an agreement inked in late August between those two groups averted a strike, and it resulted in a hefty pay raise for employees. The fear is that higher work pay will result in steeper costs to ship goods, right as the holiday season approaches.

Emerging Macro Themes

All of this is yet another step in a new macro direction. The 2010s was a decade of expanding S&P 500 profit margins (though it was aided by the growth of highly efficient tech companies), rising executive-worker pay gaps, easy money, and deflationary trends. With the mid-2020s on the doorstep, power has shifted from Wall Street to Main Street, at least moderately so.

As artificial intelligence looks to revolutionize the way goods are produced and services are rendered, everyday Americans’ fears of what the future could look like are many. History shows, though, that automation and technology create jobs, they don’t destroy them (at least in-net). This unease and volatility in the jobs market could cascade into financial markets, particularly as the S&P 500 enters its worst three-week stretch on the calendar, and especially with recent shifts in investor positioning. As a result we view the market through a more cautious lens in the near-term.

Higher Dollar, Higher Oil: An Unusual Correlation

Okay, let’s step off the soapbox and review where things stand for investors. Along with jitters in the jobs market, two significant developments stand to pressure near-term corporate earnings.

The US Dollar Index was higher again last week, finishing at the best levels since November 2022 on a weekly closing basis and marking a nine-week winning streak – the longest since 2014. Insert the usual refrain here – a stronger dollar hurts profits for multinational corporations. Once again, crude oil advanced in tandem with the greenback.

The prompt month of WTI settled above $90 – also the best in 10 months. The good news for consumers is that the cost to fill up your gas tank won’t rise much due to the cheaper winter blend of gasoline now being the front-month RBOB contract. Ian McMillan pointed out that these two key macro variables are moving together by the most in more than 20 years. Unfortunately, history doesn’t offer much of a guide as to where stocks might go from here in such a regime.

ECB Hikes as the Fed Likely Holds Tight

While traders attempt to suss out noise from trends, the Fed is surely watching the uptick in commodity prices and the strengthening dollar. Following a somewhat surprising rate increase announced by the European Central Bank (ECB) last week, investors would be truly shocked if the Fed hiked on Wednesday.

The market has priced in a virtual certainty that there will be no change in the policy rate this go around, but there remains a better than 1-in-3 chance of a final increase after the November 1 FOMC gathering. The first rate cut is currently expected in June of next year, but that would mean that the Fed Funds Effective Rate will have been north of 5% for more than a year.

One & Done? Rate Cuts Priced to Begin in Mid-2024

Source: Bloomberg

When Will the Economy Feel the Pain?

It’s said that the effects of changes in monetary policy, such as interest rate adjustments, on the economy have “long and variable lags.” When the Fed decides to change rates or take other policy actions, it may take several months or even years for these changes to fully influence inflation, employment, or economic growth. Also, the timing and impact of monetary policy can vary depending on a host of factors. Testy conditions between workers and employers, a sudden jump in the dollar, and surging oil prices make the Fed’s job all the trickier.

Retail Sales Solid, Consumer Inflation Expectations Ease

Meanwhile, the happy-go-lucky consumer keeps doing what they do best: spending. The August Retail Sales report verified stronger than expectations as excess savings dwindles. Helping families is the trend of higher inflation-adjusted wages and easing price climbs for many goods. Interest rates inched higher in the wake of the Retail Sales news and after digesting both the August CPI and PPI reports.

Then on Friday, inflation fears ticked up following some hot import price data and a strong August Industrial Production print. Sanguine inflation news came about later that morning via the preliminary University of Michigan Consumer Sentiment survey. The headline reading was lower than economists forecast, but the Fed certainly liked what it saw in both the 1-year and 5-10-year inflation outlooks – at 3.1% and 2.7%, the pair of gauges dropped to multi-year lows.

Wake Me Up in September. Oh, Wait...

It’s that time of year. While September and October catch a lot of flak for being weak months for the stock market, historical losses are primarily focused on the last two weeks of September. Years like 1987 and 2008 also influence the data, suggesting that the second half of October is likewise dicey. The VIX, however, rests comfortably near 14 – Wall Street’s “fear gauge” even notched a fresh 44-month closing low Thursday last week.

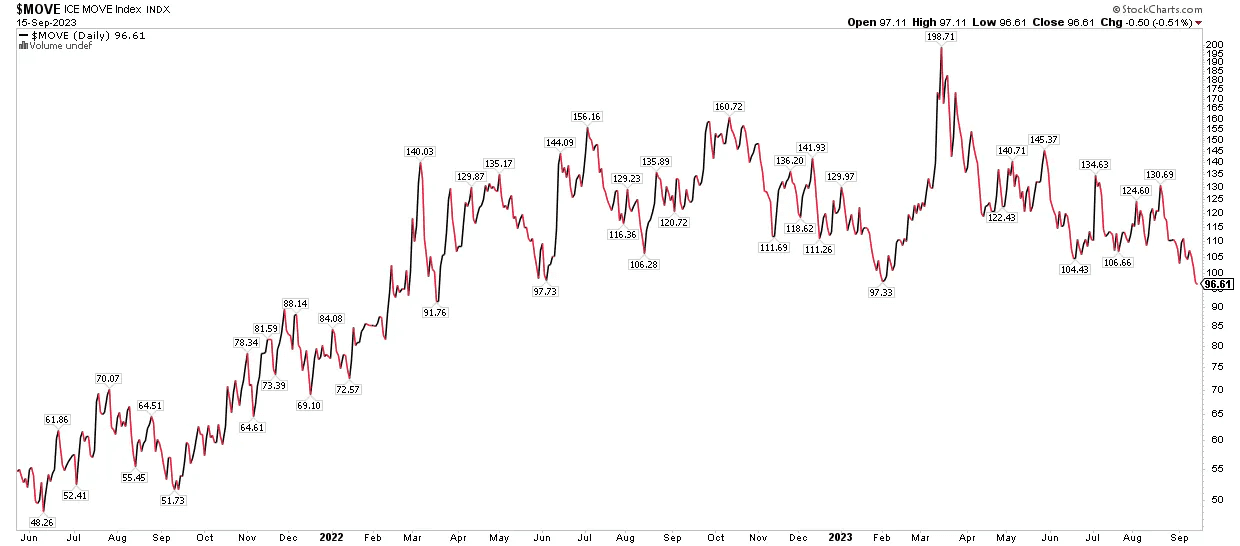

Furthermore, the Treasury market volatility index (MOVE) finally broke under 100 – the first time since February, and its weakest mark dating back to March 2022. While calendar trends and seasonality have been pretty solid indicators this year, traders remain in a wait-and-see mode for volatility and downside price action.

Treasury Market Volatility: Fresh 18-Month Lows

Source: Stockcharts.com

The Bottom Line

Commodities on fire, the dollar up big, heated labor market tensions, and ominous seasonal clouds. There’s a lot for the bears to feast on, but the market doesn’t seem to care. The VIX and MOVE are near and at 52-week lows, respectively, while the S&P 500 was essentially flat last week. Traders were blasé about August’s CPI and PPI reports, even though they were to the hot side. With rising S&P 500 earnings expectations and a soft landing still the expectation, the bulls look primed to continue leading the race as the 2023 finish line approaches.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.