Updated August 15, 2023

Raymond Micaletti, Ph.D.

Macro Money Monitor

Market Recap

Stocks continued their August retreat last week with the S&P 500 giving back less than 1% while the NASDAQ Composite fell almost 2% for its first set of back-to-back weekly declines since last December. Energy and Health Care were the two best sectors, each rallying better than 2% as oil prices notched their seventh consecutive positive week and as Eli Lilly surged on positive drug development news.

The Real Estate space was also higher despite the fourth week in a row in which the US 10-year Treasury yield rose. As inflation expectations looking out 10 years continue to creep up, bonds have been under pressure – the TIPS ETF ended lower on the week. Commodities, meanwhile, meandered with the GSCI Commodities Index up modestly while gold continues to back away from the $2,000 mark.

August 4, 2023 - August 11, 2023

The Look Ahead

Retail earnings season is in full swing this week with names like Home Depot, Walmart, Target, and TJX Companies all posting Q2 results. More than just the domestic consumer will be in the spotlight, though, as international and cyclical companies such as Tencent, Deere, and JD.com, along with Cisco and Applied Materials post second-quarter numbers and outlooks for the rest of the year.

On the economic front, Tuesday’s Advance Retail Sales report for July is the highlight along with Wednesday’s Industrial Production figures for last month. Later that day, the FOMC Minutes from the July Fed meeting will hit the tape which could bring about some market volatility. Housing market data crosses the wires throughout the week, but also keep your eyes on Thursday morning’s Initial Jobless Claims report – last week’s edition featured an uptick in initial claims. Finally, the Conference Board’s Leading Economic Index (LEI) is expected to show yet another monthly drop.

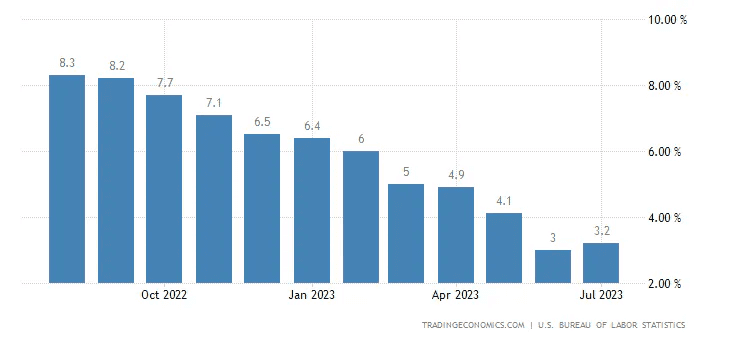

An Inflation Check

July’s CPI report didn’t hold too many surprises. Headline inflation rose by 0.2% last month while the Core rate (which excludes food and energy) rose by the same amount. Compared to a year ago, Headline CPI now runs at 3.2%, though that was a tick better than the Wall Street consensus estimate of +3.3%. Unfortunately, the Core rate is up 4.7% from year-ago levels, well above the Fed’s comfort zone. July also marked the end of a string of dozen consecutive drops in Headline inflation.

US Headline CPI Rate (Year-on-Year): First Increase Since Mid-2022

Source: Trading Economics

Not a whole lot changed in expectations for what Chair Powell and the FOMC may do at the upcoming September Fed gathering. It’s becoming the consensus view that there will not be a hike next month, but it is still up in the air as to whether a final policy rate increase comes on November 6. Traders have priced in a 37% chance that the Effective Federal Funds Rate will top out in the 5.50% to 5.75% range this year.Mixed Inflation Data Last Week: Hot PPI, Cool UMich

What we found eyebrow-raising last Friday was the Producer Price Index (PPI) report. It normally is overlooked and cast aside after the CPI’s release, but this time around, a hotter-than-expected monthly wholesale price climb sent the bond bulls scurrying. The report’s internals were not that scary, however. Much of the increase was attributed to a 7.6% rise in the cost of portfolio management, of all things. Nevertheless, the 10-year Treasury yield finished just shy of 4.2% on Friday after an eventful week of macroeconomic news.

What was encouraging on the inflation front was a first look at the August University of Michigan Consumer Sentiment. The 71.2 figure was right on the mark in terms of what economists had been expecting, but there were sanguine signals seen in both the 1-year inflation expectations of households and their 5-10-year outlook. Consumers feeling on inflations are said to trickle into their demands for pay increases at work, so while the survey results will be adjusted later in the month, it was generally good news, and the 10-year yield’s ascent eased.

The Bond Market’s Response

Coming off a July low near 3.75%, the benchmark 10-year rate had already been trending higher. Then, Monday night last week, very weak trade data out of China resulted in a buying thrust, sending yields sharply lower. The 10-year dipped from 4.1% to below 4%. That recessionary data overseas was then offset on Thursday, but not by the CPI report. It was a very poor US Treasury auction that featured tepid demand Thursday afternoon. Rates rose and continued their upswing into the close on Friday following the hot PPI data but cool UMich survey.

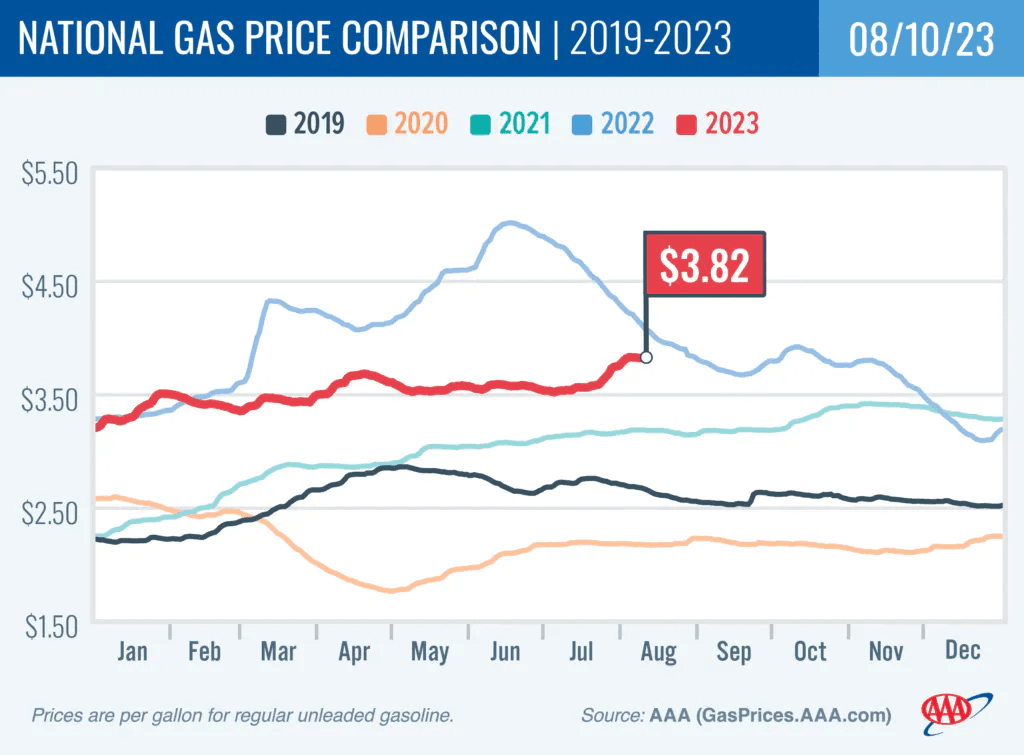

Commodities On Watch: Rising Gas Prices

Despite continued dismal data out of China, global energy prices continue their march higher. With WTI crude oil now up each week so far in the second half, inflation expectations have been turning higher. On top of the oil move, natural gas notched its best weekly advance in two months amid hot temperatures at home and a shrinking storage surplus as we creep ever closer to withdrawal season.

Consumers are already feeling the pinch at the pump – the national average for a gallon of regular unleaded is a stone’s throw from $4 once again. According to AAA, $3.82 is the current retail average nationwide, and that is likely to be higher than year-ago levels in a few weeks as kids are back in school, and commuters return to work from summer travels.

Gas Prices Inching Closer to $4 per Gallon, Near 2022 Levels

Source: AAA

Relative Strength in Energy, Weak Seasonal Trends Ahead

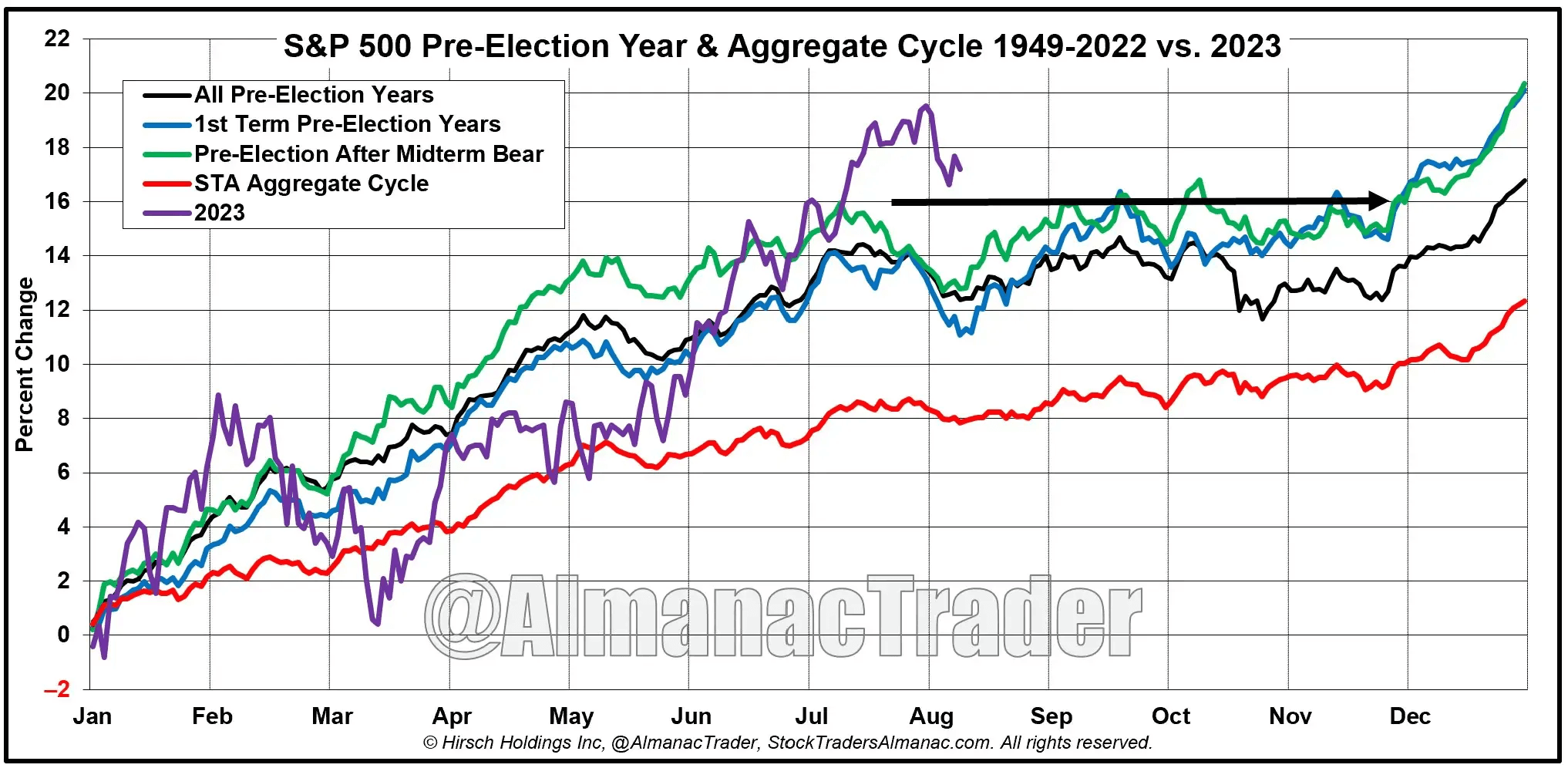

Not surprisingly, Energy was the top sector gainer last week while the tech-trade continues to pull back. This internal market churn is constructive, in our view. It’s generally healthy to see sector rotation – money moving into what has lagged over a certain period while the year’s winners take a breather. It is particularly encouraging to see that kind of market behavior during the often-volatile months of August and September. If we simply trade sideways from here through the early part of the fourth quarter, then the bulls can certainly chalk that up as a victory. Consider that the historical trend for stocks during a “pre-election” year is to see a significant first-half rally followed by a choppy and corrective few months, capped by a November-December run-up.

So, while our Alpha Blog outlined that several indicators pointed to a near-term peak in stocks around late July, we are taking a ‘buy the dip’ approach to equities over the coming weeks.

S&P 500 Price Action: Neutral, Volatile Bias Through Mid-Q4

Source: Stocktrader's Almanac

Rising Rates, Less Appealing Stocks

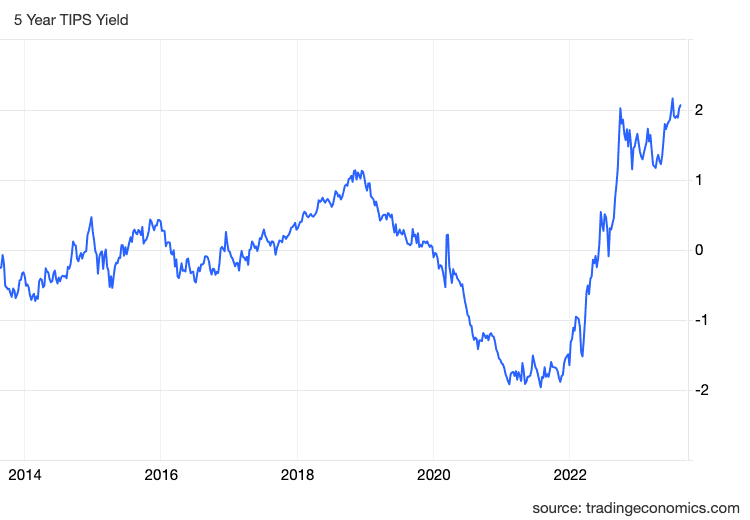

Beyond this year, it becomes more challenging to make a bull case for US large caps, particularly compared with other asset classes. Amid so many macro shifts in the last two years (consider that this time in 2021, the US 2-year Treasury rate was near 0%), the fixed-income market offers a compelling alternative. Consider that the 5-year TIPS yield, or the "real” return expected on 5-year government notes, is above 2%.

Go back 24 months, and that rate was minus 2%. That also means the equity risk premium, a gauge of how attractive stocks are compared to bonds, is near 20-year lows. Future stock returns are likely to be weaker than what we have all enjoyed in the last decade-plus. That also means there’s more opportunity for global macro investors to reposition to where growth at a reasonable price will be in the years and decades ahead.

US 5-Year TIPS Yield: Rising Above 2% As the Equity Risk Premium Dips\

Source: Trading Economics

What Summer Doldrums?

Sticking with the seasonal theme, Q3 is notorious for its volatility. We’ve indeed seen an uptick in the CBOE Volatility Index (VIX) while Treasury market volatility (the MOVE Index) continues to run high. Up and down moves in the S&P 500 are now at their widest since June, leading to a typical daily swing of 1.1% in the SPX. It is another sign that we may be in the throes of a correction after a torrid first seven months of gains this year.

While earnings and a few key economic reports could spur further intraday pops and drops, traders will begin to fixate on the upcoming Jackson Hole Economic Symposium late next week. Recall that it was just 12 months ago when Powell delivered a short and sour view of what the Fed must do to quell inflation. Stocks reacted by dropping more than 3% on that final Friday of August 2022. It’s unlikely that we’ll see that kind of response this time around as inflation trends appear better and much of the Fed’s work is done.

Flight to Treasuries

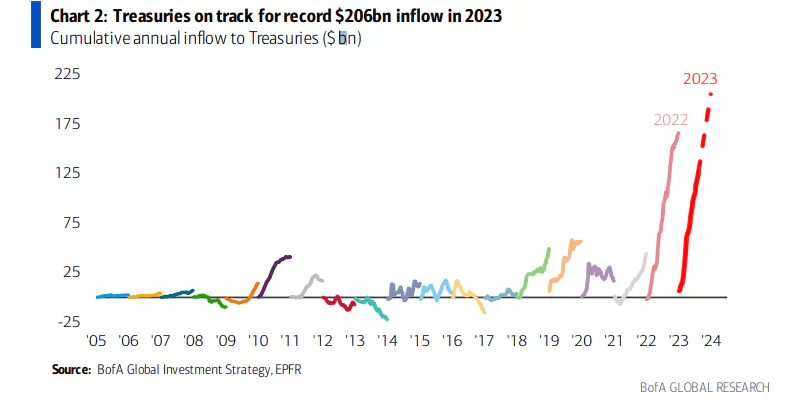

Investors, while much more upbeat about stocks now compared to their dour sentiment and positioning in Q4 last year, are still taking a measured approach as the year has progressed. EPFR publishes weekly fund flow data, and the latest update is striking in terms of just how much cash has piled into Treasuries. If we were to annualize the year-to-date cumulative inflow, then 2023 would set a record in terms of Treasury buying. That’s perhaps to be expected if stocks were down, but as yields have steadied and with a jobs market that remains strong, investors are putting cash to work in the perceived safety of government bonds.

2023 Potentially A Record-Shattering Year of Treasury Buying

Source: BofA Global Research

Stock-Bond Price Correlation Positive Again

Unfortunately for diversified investors in a static 60/40 index portfolio of US stocks and Treasury bonds, we have once again seen an uptick in correlations between those asset classes; as yields drop, the S&P 500 tends to do the same. And as was seen last week, when Treasury rates rise, equities struggle. This was a persistent theme throughout 2022 and during the early part of this year. What’s different this time, however, is that there’s the lingering worry that inflation could resurface or that a higher cost of debt for companies and individuals could result in further volatility. This is something to monitor as the Fed wraps up its rate-hiking campaign.

The Trend of Higher Yields, Lower Stocks Creeps Back in Play

Source: BofA Global Research

For the Love of Cash

What does it mean for us as money managers and for you as you consider your allocation? There remains a decent amount of cash on the sidelines with record volumes of assets in money market funds. So, despite the chance of equities pulling back as the third quarter wears on, pouncing on opportunities to get in at lower prices should prove wise in the intermediate term. Until then, you can always get the best short-term yields available through Allio’s High-Yield Portfolios.

The Bottom Line

The summer swoon is finally upon us. Volatility has ticked up just modestly as S&P 500 intraday swings grow wider. The consumer is in focus this week amid a slew of retail earnings releases and the July Advance Retail Sales report which are all sure to make headlines right as the back-to-school shopping season is in full swing. Investors are growing a bit more skittish, and rising interest rates and commodity prices are key risks as we approach September.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.