Updated October 4, 2023

Mike Zaccardi, CFA, CMT

Personal Finance

Housing affordability is near the worst levels since the early 1980s amid elevated mortgage rates and sky-high real estate prices around the country. It is a global phenomenon, too, as many other developed nations deal with home values that price out would-be first-time buyers. Compounding matters is the U.S. lending market which appears poised to turn much tighter following the ongoing regional banking fallout.

Now more than ever, it’s critical that young investors, particularly those in Gen Z, have a plan to go about the home-buying process. And we make the case that renting right now is OK! We do not agree with the popular narrative that there is NEVER a good time to rent. But there are many nuances about the rent vs. buy decision.

It all comes down to knowing your situation, forming a saving plan, knowing when and where to buy, and ensuring your long-term financial health is in decent shape. Here are 12 important questions to ask yourself as a prospective buyer in today’s challenging market:

1. Do you know all the costs that go into owning a home?

The rent versus buy decision is not as simple as comparing your monthly rent to a hypothetical mortgage payment. You must consider the upfront costs of purchasing a property which includes closing costs that often amount to 2% to 5% of the home’s price tag.

From there, interest payments and property taxes are sometimes baked into a mortgage, but other expenses like maintenance costs and homeowners' association (HOA) fees are always around – and those often increase as house prices appreciate over time.

Once you recognize that the American dream of being a homeowner does not immediately set you on easy street, you can then make a better decision about whether now is the right time to buy.

2. Are you ready to go through the mortgage qualification process?

Friends of Allio and our readers know we like to talk about your personal financial situation, including the importance of your credit score. That number plays a crucial role in the rate you will earn on a host of things, and a mortgage is the granddaddy of them all.

Be sure to keep your total debt in check while keeping your debt-to-income (DTI) ratio below 35%. If your DTI rises above 45% or so, then lenders will view you as a risk and offer you a higher mortgage rate – and that can cost you thousands of dollars over the life of the loan.

Also, when going about the mortgage qualification process, a major arrow in your quiver is being able to set aside at least 20% as a down payment. Twenty percent is a key amount since you can bypass so-called private mortgage insurance (PMI) as well as be in good standing to earn a lower borrowing rate.

3. Is a smaller down payment amount OK?

With the average price of a home now north of $450,000, it’s simply unrealistic for people in their 20s to easily accumulate $90,000 for a down payment. So, is 15% sufficient? 10%? Even 5%? If you and your partner are super-savers, then it’s fine to take the risk with a smaller down payment percentage. Just recognize that the lower the amount you put down, the slower you will build equity and the more your monthly PMI expense will be. That can be a real strain for cash-strapped couples. This is another reason taking your time and continuing to rent for a few more years could be worth it in the end.

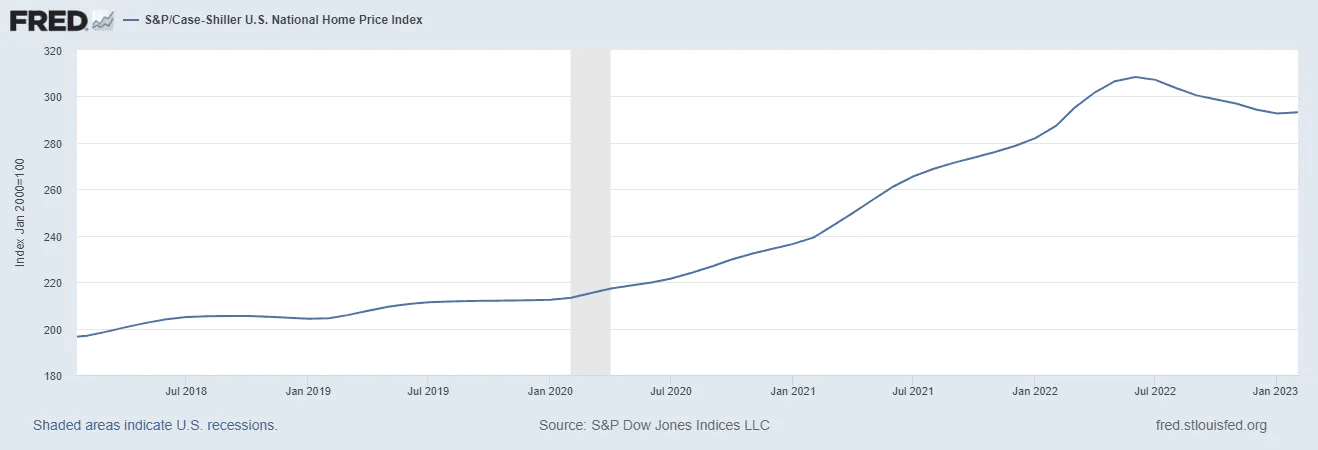

Allio believes that having some patience is also wise since mortgage rates are more likely to retreat in the years ahead as the Fed turns more “dovish” on its rate policy and since home prices are already beginning to decline. Bear in mind that one of the primary goals of FOMC Chair Powell is to chill out the real estate market.

U.S. Home Prices Falling

Source: St. Louis Federal Reserve

4. Is there an ideal time to buy? If so, when?

Just as timing the stock market is tough, so too is knowing when to pounce on real estate. You often hear of it being a “buyers’ market” or a “sellers’ market” but those are often just vague cliches tossed around by the real estate companies. Still, there’s no doubt today’s market might seem insurmountable for Zoomers looking to put down roots through home ownership.

But here is one nugget you won’t hear about in many places – one of the biggest factors that goes into the total cost of owning a home over the long haul is quite stretched right now: interest rate volatility recently notched its loftiest level since 2008. While it sounds like a complex financial calculation, the higher rate volatility is, the greater the average mortgage rate will be, all else equal. So, if we see interest rate volatility retreat once the Fed is through jawboning markets, then it’s likely it will become a better time to borrow and buy.

5. Waiting for Godot (or waiting on a market pullback). Is that a prudent move?

One thing about human psychology is that we all love a good deal. And we hate buying something, like a stock or cryptocurrency, then seeing its price plunge. The same logic can apply to real estate, but price trends are often more gradual.

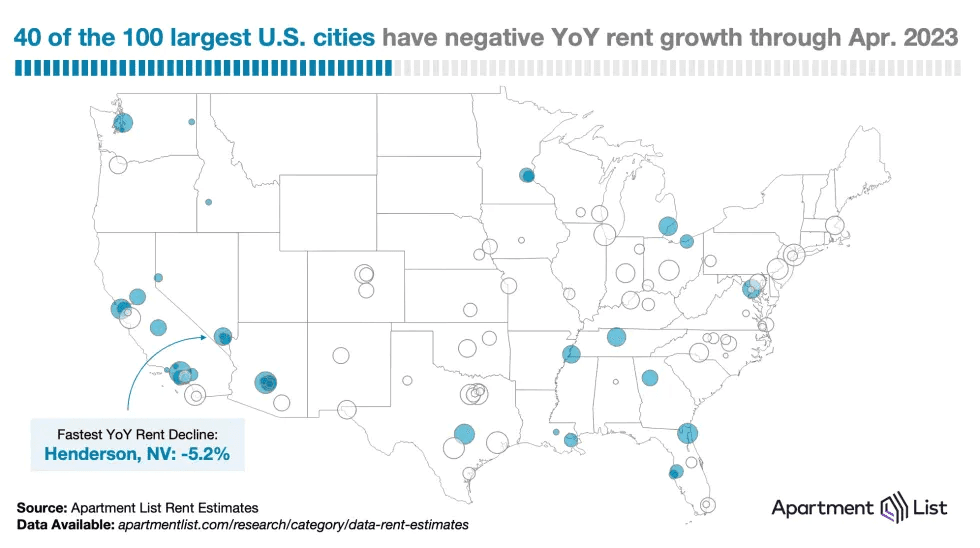

As it stands, home values are actually on the decline nationwide and many cities’ rent prices are easing, too. This further buttresses our case that now is a fine time to continue renting while saving up for a down payment and boosting your credit score.

Buying during a period of peak tightness in monetary policy is often the wrong call. Instead, think about investing in your career to score a promotion or saving up for other momentous life events that happen in your 20s and 30s.

And here’s one more upside to waiting it out – you might land a new job with higher pay elsewhere in the country considering that wage gains are best for job-switchers. Lastly, keep in mind that U.S. home values did not trough until 2012 (down 26% from the peak) following the ’08 Great Financial Crisis, so today’s 3% housing market dip could be just the beginning of a lasting trend.

Many Large Markets Feature Lower YoY Rent Prices

Source: Apartment List

6. Is it really all about location, location, location?

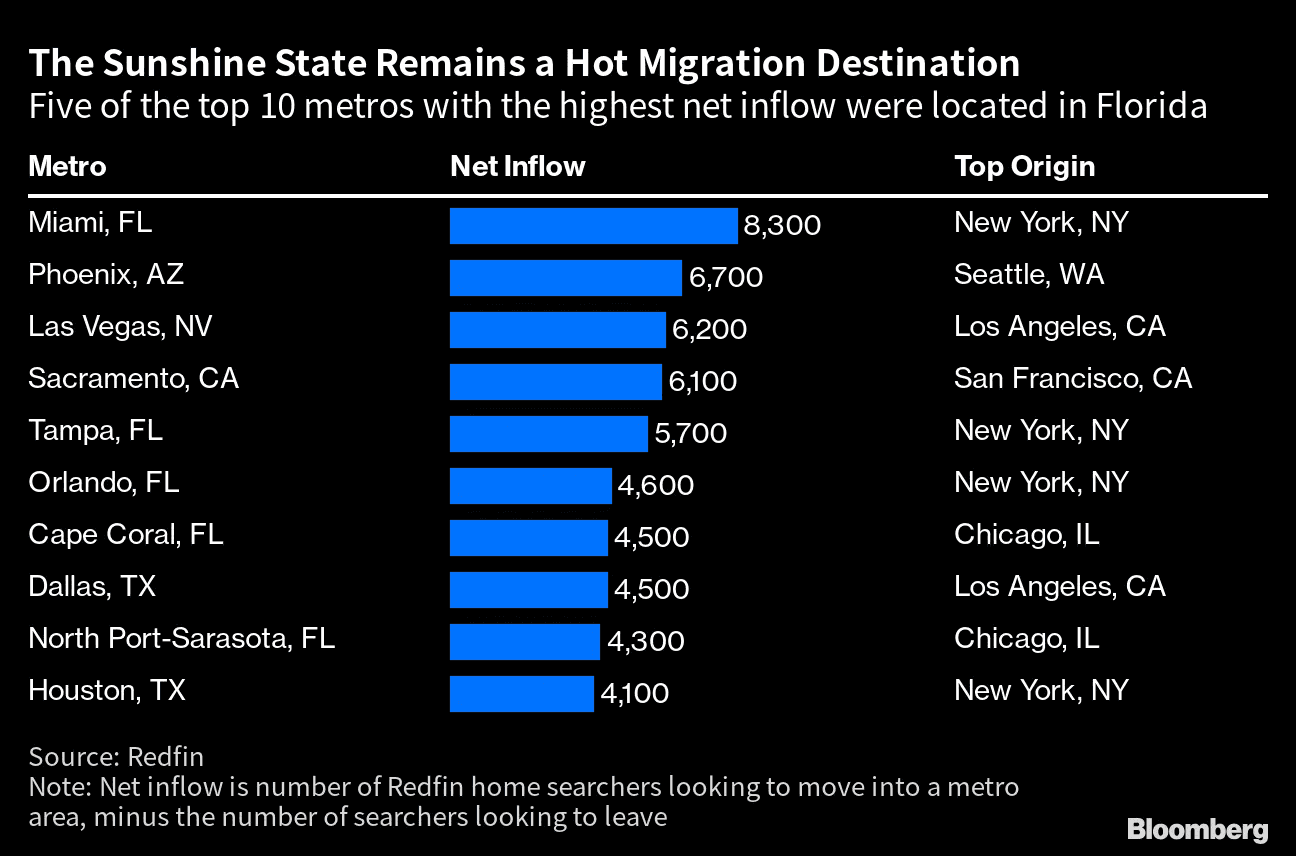

Yeah, it is. Now more than ever, hot states along the sunbelt and areas with low or no state income tax are seeing massive net migration. That comes as high-tax states such as Illinois, California, and New York struggle to keep folks within their borders.

So, if you live in an area that is seeing people flee for “greener” pastures, you must be careful about buying right now since the long-term housing fundamentals might not be great. But if you live in, say, Tampa or Miami where prices have shot up and are holding those gains, then you might feel like you and your significant other’s salaries are not enough. But you must think long-term since this could be the new normal where home values are now much higher for states people want to move to.

Ultimately, if you want to have kids and you are in a good school district, then it might be worth biting the bullet. What’s more, if you value a short commute, then paying up for that perk could be the right thing for you.

Migration Trends Favor Low-Tax Spots

Source: Bloomberg, Redfin

7. So, is buying a home a good decision?

Have we cast too much shade on becoming a homeowner? That is not the intent. It’s our view that owning real estate is generally still the safest and maybe even best investment because land is finite, and people will always need shelter.

Owning, as opposed to renting, is even more important right now considering that inflation will probably continue to run above the trend from the previous 25 years over the coming decade-plus thanks to all the liquidity thrown at the global economy since the pandemic.

Turning from the macro outlook to your personal situation, being a homeowner offers a sense of stability, practicality, and financial security. While there’s always the chance that you have to pack up and move for a new job or to help out family, the benefits to owning – stretched out over decades – outweigh being a perma-renter.

8. Will my home be my biggest asset?

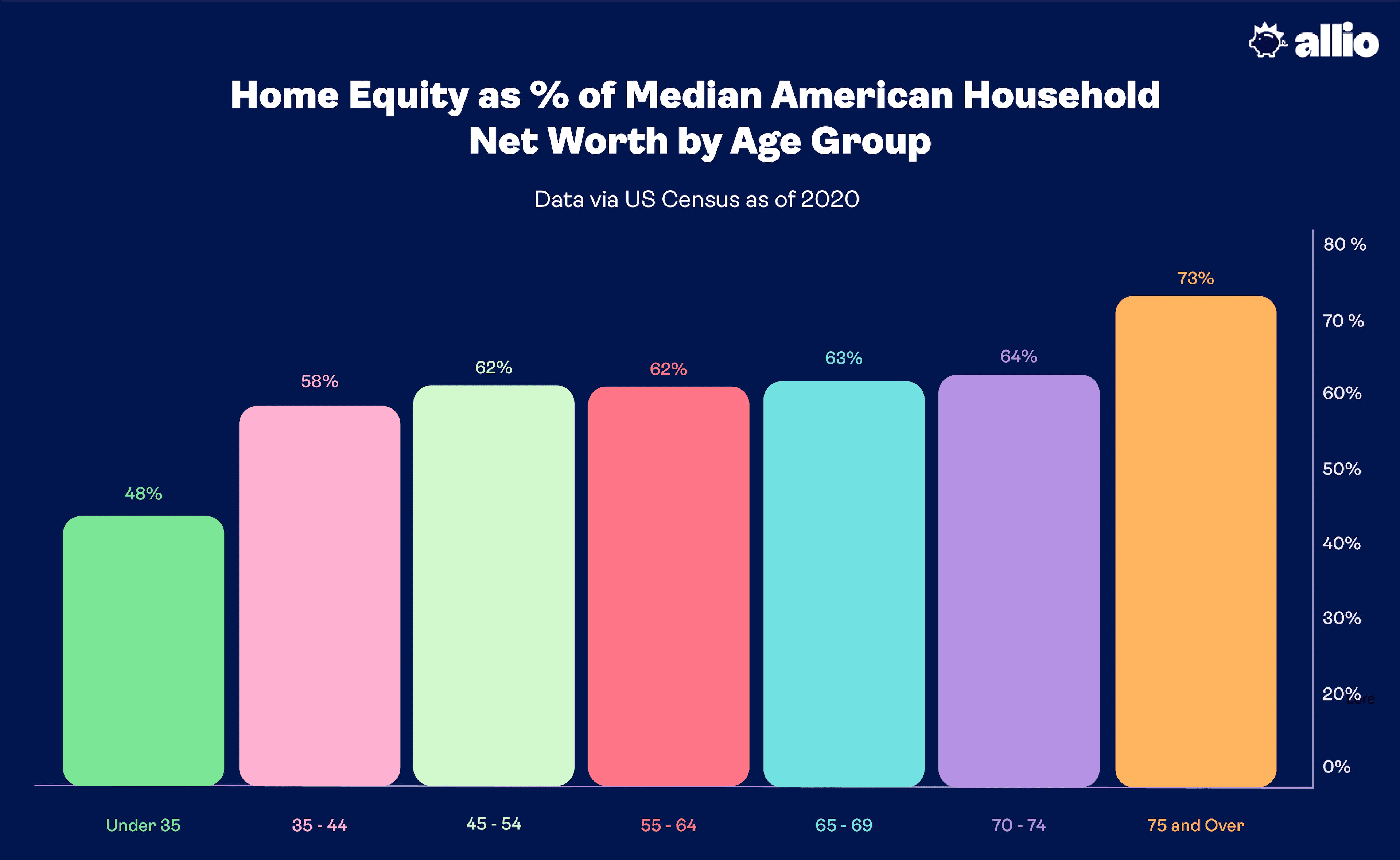

It’s commonly quipped that someone’s primary residence is their most valuable asset. And that is true for a lot of folks, but it boils down to how much equity you have amassed in the property.

Consider that the mortgage amortization math works out so that even with a 20% down payment, after five years of ownership, you might still have a small equity percentage. But as time passes, more of your monthly payment goes to the equity side of the ledger as the home’s value should steadily creep higher.

Thus, when you make that final mortgage payment, you might tally up your net worth and find that your house is the biggest asset on your balance sheet. While it is an asset, a house has characteristics of a liability, as well. It requires recurring expenses and one-off cash outlays like a new roof, A/C unit, or set of windows.

Your Home May Be Your Biggest Asset

Source: 2020 US Census

9. What’s the right way to think about the rent versus buy decision?

Comparing apples to apples is tough. You must carefully weigh all the costs that go into home ownership that we mentioned earlier. Also think about the opportunity cost of parking all that cash in what is usually a low-growth asset compared to owning a diversified portfolio of stocks that should feature a much greater average annual return. In general, renting does not require a down payment, so it feels like a victory in the short run, but in the longer term, being a homeowner usually wins out so long as you are not moving every few years.

10. What can you do today to get ready to buy a home?

Step one is to pay down any debts you have, starting with those with the highest interest rate. Not only does that help your financial situation in general, but bringing down your DTI ratio looks good to a lender.

Next, work to boost your credit score by not applying for new lines of credit and ensuring you pay all your loans and credit card bills on time, every time.

Third, consider building a budget if you do not already maintain one. A budget allows you to see what cash you have coming in and where it goes. It also serves as a guide to get you to save more strategically so you can quickly meet a down payment goal.

Finally, if you and your partner are working together on this endeavor, get on the same page about financial priorities so that you avoid any potential money conflicts down the line.

11. Are you thinking about your entire financial life?

Now that’s a loaded question, right? We find that so many personal finance matters tune out other key facets of long-term financial planning. Buying a house is no different. It’s not reasonable to push people to save every last penny for a down payment fund.

Don’t ignore the benefits of investing in your 401(k) to capture your employer’s matching contribution or the triple-tax advantage of a Health Savings Account (HSA). Additionally, having an emergency fund or rainy day fund helps with risk management.

Setting financial priorities and understanding that there are trade-offs with all money decisions helps you make the best holistic decisions. One last point: There are other ways to invest in real estate without needing a giant down payment.

12. What are the best ways to invest for a down payment fund?

With higher interest rates today compared to a few years ago, there are a bunch of possible avenues to take so that you earn a return on your savings. The safest asset is generally an FDIC-insured high-yield account, but with the Fed easing its policy rate, we expect today’s yields above 4% to dwindle.

Also, with high inflation, you don’t want to park cash in a plain savings account for very long. Another option is to buy a Treasury exchange-traded fund (ETF). While the rate on funds of that ilk will vary, you can buy and sell them with little to no transaction costs.

Certificates of Deposit (CDs) look appealing today since you can secure a rate (as of this writing) near 5% for up to two years. In general, if there’s less than five years until you use the money, you want to play it safe. But if you aim to buy a home a decade from now, then you can take some risk in the stock market, but being globally diversified is imperative.

The Bottom Line

Sometimes renting is the better alternative. Home prices remain stretched on many metrics while borrowing rates are costly. We don’t think real estate values are sustainable with a typical 30-year mortgage rate near 7%.

As the market continues to cool, and once the era of tight monetary policy is behind us, Gen Z should be ready to pounce on home ownership. In the meantime, rents are on the decline, and you can use this period to bolster your savings rate and invest for both the short run and long haul with Allio.

We offer a unique blend of investment options tailored to your lifestyle and financial goals. Choose one of our fully managed portfolios for hassle-free investing, handled by our team of experts. Prefer more control? Our dynamic macro portfolio option puts the power in your hands. We’re not your typical finance firm. Gone are the days of exclusive, complicated investing. We're here to make your financial journey approachable, transparent, and most importantly yours. At Allio, we’re shaping the future of investing.

Ready to harness the power of automation to help build your wealth? Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.