Updated September 12, 2023

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

September is living up to its billing so far. The holiday-shortened week featured a modest decline in the S&P, -1.3%, while steep losses in Apple (AAPL) sent the Nasdaq Composite to deeper losses – closer to –2%. Small caps and foreign equities also suffered, while rate-sensitive Real Estate sector shares were lower. It was a similar pattern to what has played out since mid-July with commodities and the dollar rallying in tandem, up 1.5% and 0.9%, respectively. Bonds caught a modest bid with TIPS creeping higher by 0.2%, but gold lost ground to the tune of –1.2%.

For the year, the S&P 500 is up 16%, the Nasdaq has surged 31%, commodities and the dollar are higher by just 6%, while TIPS and Real Estate stocks are up less than 1%.

September 1, 2023 - September 8, 2023

The Look Ahead

All eyes are on the consumer this week with August CPI numbers due out Wednesday morning. The market expects a jump in the Headline rate due to rising energy prices, though Core CPI is seen as moderating from July’s 4.7% year-on-year figure to just 4.3%. That comes after the monthly NFIB Small Business Optimism survey first thing Tuesday.

Thursday morning features a slew of market-moving data, including the Producer Price Index report (recall last month’s PPI data was particularly impactful to stocks and bonds), Advance Retail Sales for August, and the weekly Initial Jobless Claims report.

The week wraps up with import price data, Empire Manufacturing for September, an August glimpse at Industrial Production, and a preliminary look at consumer sentiment with the University of Michigan’s survey.

The Federal Reserve is in its blackout period before the September 19-20 policy meeting.

On the earnings front, Oracle (ORCL) reports Monday night, Cracker Barrel (CBRL) announces results Wednesday before the bell, and Thursday afternoon features a read on the AI theme and the state of the homebuilders via reports from Adobe (ADBE) and Lennar (LEN).

China’s Iron Fist (Or Iron Swipe)

Apple (AAPL) fell big last week, and shares are down about 10% from their all-time high notched two months ago. The world’s most valuable company endured a 2-day selling event that was nearly the worst in more than three years. Alas, dip-buyers swooped in ahead of the firm’s iPhone 15 reveal that takes place Tuesday. Normally, the stock rallies into such hoopla events, but there is a different tone this time around.

Reports that China has banned iPhone use by government employees sent ardent AAPL bulls scurrying last week. It comes as a new phone from competitor Huawei hits the market. Are fears overblown? Is the $200 billion market cap loss on the king of tech an exaggeration? We’ll leave that to the thousands of analysts covering the stock, but it is yet another sign that China, namely President Xi Jinping, continues to cast a cloud on free-market capitalism and global growth trends.

Checking In on Economic Growth Expectations

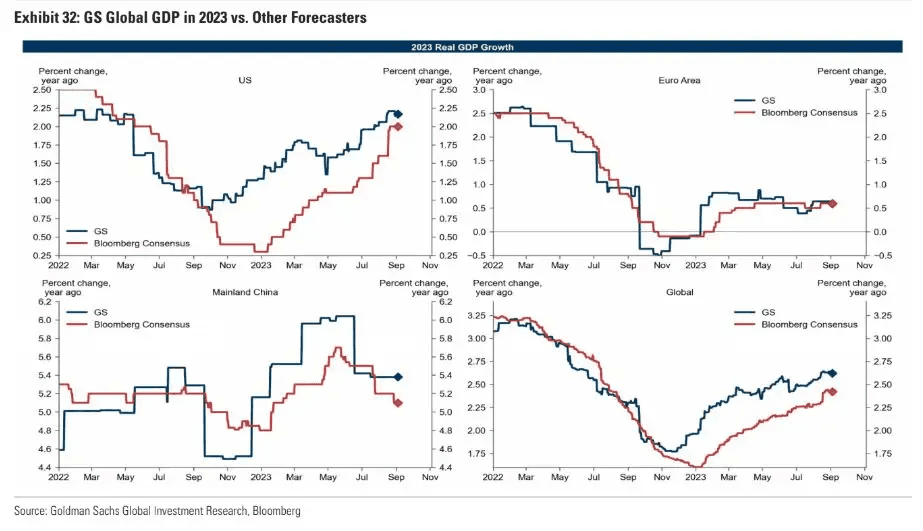

As it stands, 2023 US real GDP growth is seen at a healthy 2%. The consensus growth outlook has been on the rise throughout the year as recession fears in the short run wane. Notice in the charts below, however, that economic expansion in China is in full-blown retreat mode. Economists now see just a smidgen better than 5% in terms of real output from the world’s second-largest economy.

2023 US Real GDP Growth Rising, China Expansion Forecasts Falling

Source: Goldman Sachs

It seems doubtful that a few policy actions from Chinese authorities would be able to cripple America’s (and the world’s) premier companies. Still, Greater China accounts for 18% of Apple’s total revenue, making the region the third-biggest market for the $2.8 trillion enterprise. Moreover, ongoing tensions between China and Taiwan auger fears of possible disruptions in the semiconductor industry. Chip stocks likewise have paired recent gains so far this month. Shares of Nvidia (NVDA) are off 8% while rival Broadcom (AVGO) are down 7%.

Political Risk Set to Rise Over the Coming Quarters

Before we go down the bearish rabbit hole, it’s key to consider that these sorts of moves are totally normal. Over the last three years, Apple has routinely dropped ~6% over the course of a few days while chip stocks are notoriously volatile during market dips.

One cannot help but ponder, however, that China is increasingly turning adversarial to major US companies. It’s a risk that likely persists into 2024 – a year in which 3.1 billion people head to the polls around the world. BofA’s Michael Hartnett notes that the figure represents 80% of the global market cap, 60% of the worldwide GDP, and 40% of the world’s population.

Tensions Elsewhere

Geopolitical jitters are not confined to US-Sino relations. Saudi Arabia appears emboldened to prop up oil prices to finance many of its major recent investments. The prompt-month of WTI crude oil futures settled just under $88, a fresh high since November last year, following a 30% run-up off its June low. Brent oil, which is more globally focused, is above $90 and up 7 of the last 8 sessions heading into this week.

That is happy news for the Energy sector. The group of oil & gas names was the worst-performing area of the S&P 500 through the first half of 2023 but has led the way so far in H2. The XLE ETF, dominated by the majors (ExxonMobil and Chevron) is up 13% (dividends included) since June 30 as the S&P 500 wobbles around the unchanged mark.

Yields Continue their Upward Trajectory, Certain Sectors Hit Hard

Last week, I touched on how the stronger dollar and higher oil prices have been a power tag team since mid-July. There’s a third member of the squad, though. Rising rates are another headwind to corporate profitability. Higher yields have impacted the debt-heavy Utilities sector during the second half, too. The XLU ETF is the S&P 500’s worst-performing niche – off by about 3.5% in the last two-plus months. Leveraged companies in the Consumer Staples and Real Estate sectors have also underperformed the broader market.

Financial Conditions Tighten Ahead of Q3 Earnings Season

The DXY hovering near 105, WTI approaching $90, and rates around 5% have led to a tightening of overall financial conditions. The Goldman Sachs US Financial Conditions Index (FCI) has risen 0.5 percentage point in recent weeks, even with stocks rallying off their August lows. The FCI is a gauge of various financial indicators, including equity prices, the greenback’s strength, market volatility, credit spreads, long-term interest rates, and more, depending on which specific index you look at.

The upshot is that corporations and consumers become financially stressed when energy and borrowing costs rise. Moreover, multinational firms that repatriate overseas sales lose out due to currency fluctuations when their home currency rallies from one period to the next.

Good News...For the Fed

Tighter financial conditions are just what the Fed wants to see. When markets do the dirty work for the FOMC, that’s A-OK for Fed members. As Chair Powell has pointed out on several occasions, however, the jobs market and wage gains are a primary motivator to how interest rate policy is molded.

Just last week, there was more “good news” on that front, too. The world’s largest employer, Walmart (WMT) announced that it may slash starting pay amounts for new workers. Apparently, the labor market features enough slack so that the major retailer can buck the broader trend (since 2020) of impressive wage gains among the lower-income cohorts.

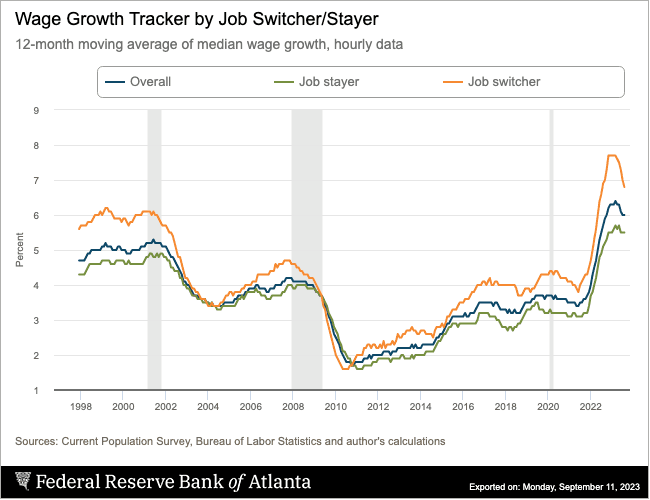

Wage Gains Slow

Also prompting a sly smile from Jay Powell is a turn lower in the rate of pay increases for so-called “job switchers” - those who hop around from company to company in search of significant salary bumps. After peaking last winter at +7.7% on an annual basis, the typical pay rise for this group is just 6.8% while job stayers’ wage gains are about steady at +5.5%. Combine this trend with the monthly employment gains that are clearly on the way down, and economic growth should be due for a dip, right? Not so fast.

Get Your Pay Raises Now, Trends Suggest Lower YoY Wage Gains Ahead

Source: Atlanta Federal Reserve

Is 5%+ Growth Sustainable? Probably Not.

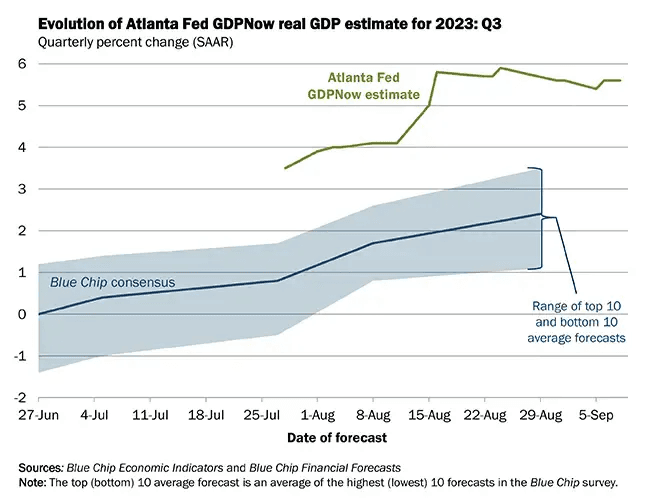

Never before has the Atlanta Fed’s GDPNow tool been so hip to use. The computer model currently spits out an estimated Q3 real GDP growth rate of 5.6% - far above the consensus estimate among Wall Street economists. Why the gap? And why does GDPNow fly in the face of a clearly softening jobs environment?

You can thank the American consumer. As it stands, consumer spending contributes nearly three percentage points to the hot 5.6% model output, with changes in private inventories also representing a significant piece of the current growth rate.

Q3 Modeled GDP Growth Stuns Wall Street, But Are Changes on the Way?

Source: Atlanta Federal Reserve

Perhaps families are feeling a bit more upbeat about the state of their finances considering that total household net worth notched all-time highs as of the end of the second quarter, at least according to the Federal Reserve. At $154 trillion ($174 of assets and $20 trillion of liabilities), the country has never been richer (at least by this measure).

Consumer Spending Strong as Household Net Worth Hurdles the Q2 2022 Previous Peak

Source: Federal Reserve

Big Headlines On Tap

That all brings us to this week. Is inflation still on the mend? Will the consumer budge? We’ll learn a whole lot more following both the CPI and PPI prints on Wednesday and Thursday, but the humdinger may come via the Census Bureau’s Retail Sales report. The consensus calls for a drop of 0.2% in the Core Control group (this subset excludes autos, gasoline, building materials, and food services because these products are volatile and can skew the overall number).

Recall in July, Core Retail Sales jumped 1%, much better than expectations, helping to send the GDPNow algorithm into a tizzy. Relatively tepid August spending would almost certainly simmer the GDPNow estimate. Furthermore, if we do get a hot number, the odds of a September rate increase would creep up with the chance of a hike by the November 1 meeting perhaps climbing back above 50%. Expect stocks to rally on soft CPI, PPI, and a downbeat Retail Sales report. If the easing-inflation narrative indeed plays out, we continue to expect stocks to rally into the first half of next year.

Capital Markets Check

Away from the consumer, institutional bankers are getting excited. The biggest IPO since Rivian is set to take place on Wednesday. Reports say that SoftBank’s ARM offering is six times oversubscribed – a sign that the IPO window could open significantly over the next handful of months. Wall Street banks would welcome that trend considering that the last year and a half has been frigid in the capital markets. We see it as a vote of confidence if more companies, new and established, test the IPO waters.

The Bottom Line

Apple led the declines last week, though many risk-on areas suffered just as much. This week, key macro data will once again impact expectations for what the Fed will do next. While there’s scant chance of a September hike, equities would likely not react well to rising chances of a November rate increase. I will be watching CPI, PPI, and Retail Sales along with how the dollar, oil, and Treasury markets react.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.