Updated June 3, 2023

Raymond Micaletti, Ph.D.

Macro Money Monitor

History doesn’t repeat itself, but it rhymes. You might be familiar with that quip, credited to Mark Twain. That’s often how financial markets work and how life is for professional investors. The past is never an exact prologue.

What’s more, technological breakthroughs (like Artificial Intelligence happening now) can cause sudden paradigm shifts while broader cycles, played out over decades, are more like a gradual tide turning. It is all part of the rhythm of the markets. Companies are born and die, some merge into other organizations, while others manage to pivot at precisely the right time to pounce on new themes—that's the circle of life for corporations, too.

Gaining a Broader Perspective Through a Historical Lens

Speaking of life. Think back to what it must have been like to be your average Joe in the 19th century. There was no "investing for retirement." Retirement wasn’t even a thing. You worked until you died. Case closed.

It was a life of manual labor in many cases, but the industrial revolution was just gaining steam. Soon life would be transformed for the better, but not without pain and major stumbling blocks along the way.

If we look back at that time in financial markets, there was enormous volatility. In fact, stocks were an awful place to put money from 1850 through 1920 and into the Great Depression—there was an 81-year period when U.S. stocks went nowhere. Venture away from the States, and some returns after inflation were far worse. Who’s to say we cannot see a similar long-term bear market for the rest of the 21st century in richly valued large-cap U.S. stocks? Deep dives into history reveal fascinating themes.

Tactical Investing for the Long Run

But what does it matter to investors like you and me with decades longer to invest right now? How do we prepare ourselves for inevitable changes to come? It takes an active approach using history, not as a replica but as a warning sign.

Here’s what we mean: Just buying and holding stocks for the long run, banking on ever-growing wealth with occasional temporary bouts of volatility, likely will not suffice for the balance of the 21st century. The macro winds are changing. You and I already see this in our everyday lives. The cost of living has risen significantly in the last few years while global tensions are beginning to boil over.

Additionally, at an investing and portfolio management level, stocks and bonds are moving in lockstep like we have not witnessed in decades. Hence, with the majority of mean-variance optimization tools used in traditional portfolio management today dependent on bonds zigging while stocks zag, emerging correlation flips may be quite problematic for investors taking a passive approach.

Let’s review a handful of other key macro changes that may lie ahead. Recognizing them is step 1. Acting to mitigate their risk, or even capitalizing on the opportunities that come with them, is step 2.

1. Populism

Capitalism rose to prominence throughout the 20th century. The industrial revolution was a kickstart to what would evolve into an era of flourishing corporate profits that would be revitalized after each healthy but painful recession. The downside was that there was a forgotten individual – the worker.

It started with poor labor laws at the onset of the 1900s and has evolved today into CEOs making record salaries compared to the typical employee. There is an uprising though, and we see it with a rekindling of labor union activity and surging wages for low-end workers. With populism comes riots, instability, and unrest. The general tranquility of the latter half of the 20th century, through much of the 2010s, appears to be ebbing and giving way to volatile populism.

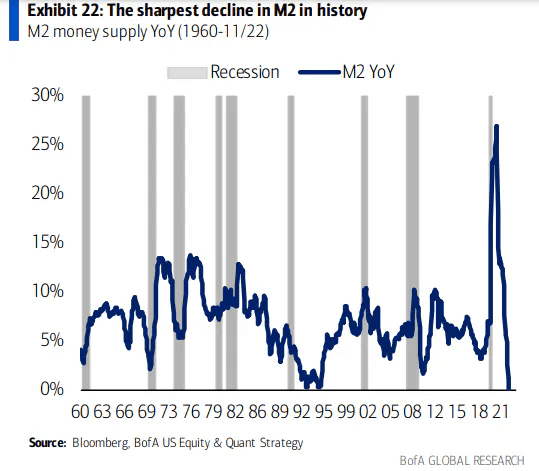

2. The Easy Money Era Is Over

Amid that broad shift, financial markets are also in flux. Quantitative easing was the dominant term associated with the Federal Reserve and other global central banks during the 2010s, and while that is certainly a 21st century phenomenon, the Fed is now forced into quantitative tightening (effectively selling off its balance sheet via allowing bonds it holds to mature while not reinvesting the proceeds). Case in point, the U.S. money supply shrank on a year-on-year basis for the first time since 1959 by early 2022. The implications for investors are huge. Free money dumped from the Fed’s proverbial helicopter appears to be relegated to the history books.

3. A Return of Volatility

Volatility is now front and center in both the stock and bond markets. You might’ve heard of the VIX Index, but there is a lesser-known measure of Treasury market movements known appropriately as the MOVE Index. We won’t get into the weeds, but the MOVE Index is the VIX for interest rates, and it has been hovering near the highest levels since it spiked during the 2008 Great Financial Crisis and at the COVID-19 March 2020 peak of fear.

Volatility was super high during the Depression but then eased back through the rest of the last century. There’s a case to be made that a return to volatility is in store.

4. Human Displacement by AI

We view the current world as entering the 4th leg of the industrial revolution where human displacement by AI will far outpace the displacement seen in the 2nd and 3rd legs. In those previous stages, human capital was simply reallocated, not displaced completely. By contrast, horses, for instance, were completely displaced by trains and automobiles. This go-around, we are the horses.

Making macro conditions more unsettling are other sources of instability. Let’s continue on this unnerving list of worries (take heart, though, there’s good news at the end!).

5. China & Government Intervention

China continues to ruffle the feathers of peacemakers. The world’s second-largest economy ruled by a strict political regime remains hellbent on making its currency the reserve currency of the world.

The party at the helm there has already intervened to control corporations domiciled within its borders while threatening both Taiwan and arguably the United States economically. And we cannot ignore what leaders of other nations are doing right now after such an extended period of global policymaker coordination.

6. Reshoring

AI and cold-to-lukewarm wars go hand-in-hand with an emerging trend in corporate America: reshoring. Reshoring is simply moving operations away from rocky regions to the perceived stability at home.

Supply chain issues over recent years only accelerated the trend, but CEOs and CFOs are looking for ways to avoid paying higher wages to domestic workers. Enter AI and robotics. We expect heavy investment into automation that will undoubtedly aim to replace people with AI and robots.

7. Inflation

The price to pay for years of fiscal and monetary excess along with deglobalization is inflation. We expect inflation to retreat from 40-year highs seen in 2022, but the 1% to 2% sanguine situation from the 2010s almost certainly is not coming back. You and I must own assets that can withstand if not benefit from rising consumer prices. Profiles in history, when researching other nations’ battles with high inflation, showcase the perils of what instability in a currency can come about.

With Volatility Comes Opportunity

Like we said, that is a scary list. Here’s the good news: Markets have endured a ton over the past two centuries from world wars to incredible inflation episodes to political upheavals to famines, floods, pandemics, and depressions... and plenty more turbulence.

But with many of those sources of volatility have naturally come bear markets that can last for years and decades – not just weeks and months like U.S. investors are accustomed to over recent history. We view the early to mid-2020s as akin to the 1920s through 1940s given the macro forces outlined above.

The Bottom Line

Tactical investing, not a passive buy-and-hold strategy, is the solution. Also, young investors today should shun bonds since correlations have flipped back positive between equities and fixed income.

Investors need to hold a portfolio that can take advantage of vast technological breakthroughs that pose both risks and opportunities in this 4th leg of the industrial revolution. The next 20+ years may look much different from the golden era of investing enjoyed by previous generations throughout much of the 20th century. Preparing now can result in a prosperous future.

At Allio, our team of hedge fund veterans is constantly on watch for the latest trends and risks across the global markets. It’s like a game of chess—determining what one moving piece will mean for the bigger picture. Our automated investing approach encapsulates our latest views to help mitigate risk and grow your portfolio through the good times and bad.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.