Updated June 27, 2023

Raymond Micaletti, Ph.D.

Macro Money Monitor

Market Recap

The S&P 500 fell 1.4% during the holiday-shortened week, halting a 5-week winning streak. The NASDAQ Composite gave back about the same amount, which snapped its 8-week winning streak. The tech-heavy index had its worst week since March but remains on pace for its best first-half performance since 1999. The Real Estate sector fell nearly 4% despite the modest drop in yields. Within the commodities space, the broad GSCI Index plunged almost 3% as crude oil continued to be under pressure, though many agricultural soft commodities have been in uptrends this quarter. Gold, however, notched 3-month lows on Thursday amid rising real interest rates before a modest reprieve to cap off the week.

FedEx issued a weak profit outlook last Tuesday, and we’ll get another feeler on the global economy from Nike Thursday night when the footwear firm issues its Q4 results.

June 16, 2023 - June 23, 2023

Geopolitical Tensions Back on the Rise?

The short trading week included fresh multi-year lows in the CBOE Volatility Index (VIX). Wall Street’s fear gauge touched its calmest reading since January 2020, pre-COVID, as the summer doldrums kicked in. This week is rather light on the economic data front and third-quarter corporate earnings season does not begin until the middle of next month. But is the market too complacent?

Perhaps so. Uncertainty took an uptick on Saturday when Wagner Group mercenaries took control of Rostov, a strategic city in Russia. The group, led by Yevgeny Prigozhin, then halted its march toward Moscow just hours later. While tensions appear to have eased after the sudden scare, it is a reminder that there remains heightened instability regarding Russia’s role in global markets and politics. The situation must be closely watched in the coming days and weeks. Keep your eye on movements in both the VIX and in energy markets for clues on where the money sees risk being the highest.

Fresh Weekly Cycle-Lows on the VIX Ahead of Weekend Tensions

Source: Stockcharts.com

Geopolitical jitters once again underscore how it’s often the unseen that brings about true volatility and fear. Consider that the last 12 months have featured troubling trends on the inflation front, unknowns about what the Fed might do, and shaky corporate earnings. Key questions lie within each of those market currents, no doubt, but nothing has truly unmoored investors’ expectations yet.

COVID, for instance, shocked most investors. While there were clues that the Coronavirus may be devastating for parts of Asia (as was the case with SARS, H1N1, and MERS-CoV), the impacts of COVID were wholly different. This concept is key for macro investors to recognize, and our team of hedge fund veterans has been around the block – they are constantly on the lookout for what could spark a new wave of volatility, sifting through data, eyeing trends, and spotting catalysts others are missing. Ultimately, there are still unknowns with the situation in Russia.

On the Homefront

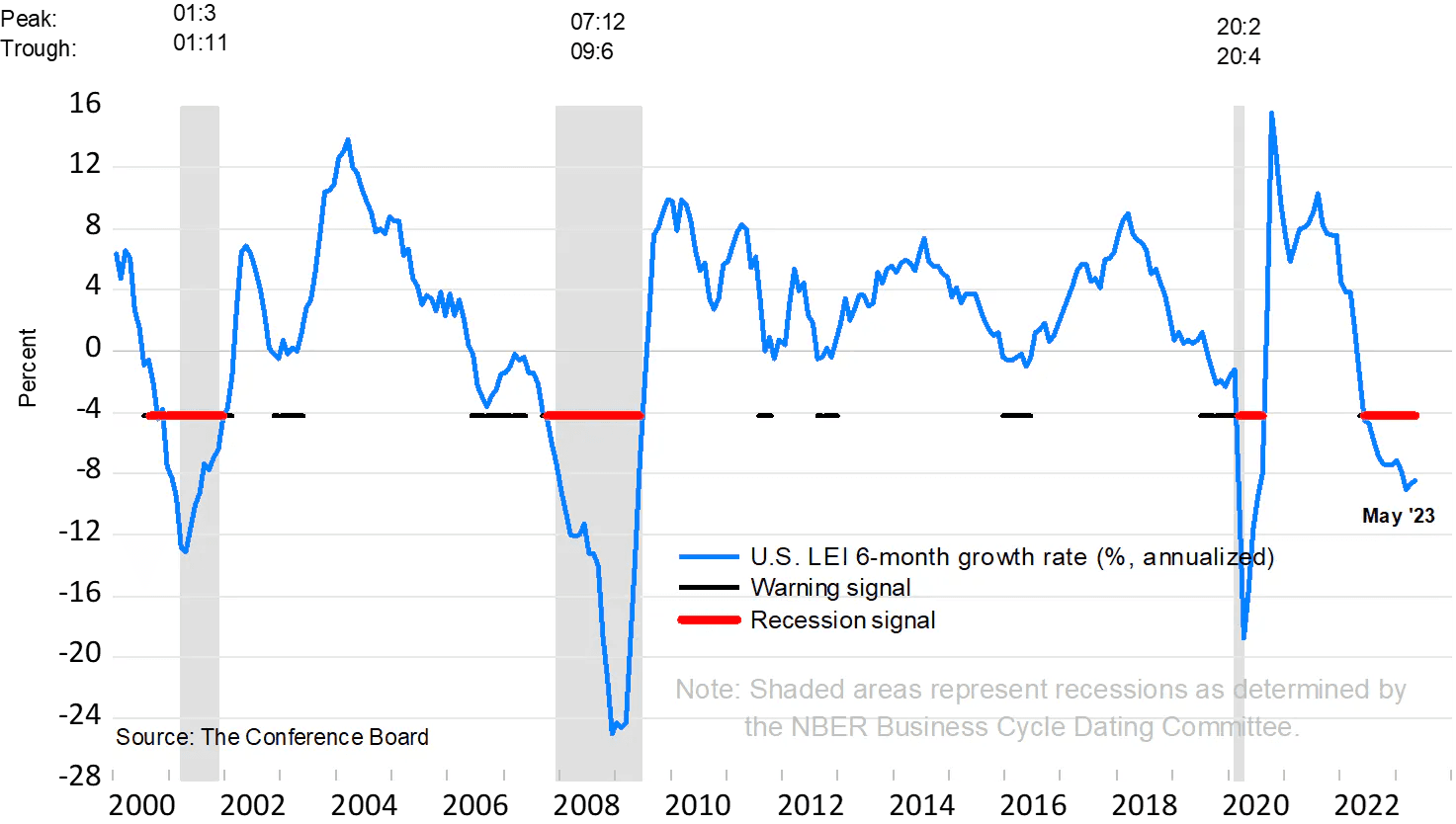

Focusing back on the here and now domestically, last week’s economic data shifted the recession dial more towards the hard-landing side. Indeed, the government’s Jobless Claims report, the Conference Board’s Leading Economic Index (LEI), and Friday’s June read on manufacturing and services PMI from S&P Global left something to be desired in the eyes of the soft-landing camp. As the GDP pendulum swings back and forth, stocks and bonds are the best gauges of where things stand economically.

US Leading Economic Index: 14 Straight Negative Monthly Readings

Source: The Conference Board

As the S&P 500 is down just fractionally from its 52-week high, economically sensitive small caps remain out of favor. The Russell 2000 was rejected at key resistance levels on the chart while several risk-on sectors, like Energy and Materials, just cannot seem to find a firm footing. Treasuries, meanwhile, have simply traded sideways in the last handful of weeks, but there’s a macro development within the yield curve causing some summertime apprehension among macro investors.

Yield Curve Inversion Sparks Renewed Growth Worries

Following the slugging economic data points late last week, and as the Fed insists that a pair of rate hikes are needed to bat down inflation, the Treasury yield curve has become increasingly inverted. Let’s establish what we are looking at in the chart below. Traders use the rate difference between the short-term 2-year Treasury note and the intermediate-term 10-year note rate as a proxy for recession expectations. The logic goes that if yields on the front part of the government bond curve are significantly above those going out many years, then there are restrictive credit conditions in the present. Moreover, investors may choose to be less aggressive with their capital, and park cash in high-yield Treasury bills compared to lower rates on longer-term government bonds. The upshot is that when the “2s10s” spread turns negative or becomes more sharply inverted, Wall Street is on recession watch.

The yield differential reached its climax in early March just before the U.S. regional banking crisis. We can perhaps thank Silicon Valley Bank for helping to bring the 2s10s spread from more than a full percentage point inverted to about –0.40 percentage points. Since early May, though, 2s10s have trended more recessionary. Short-term rates are back near their highs as the 10-year Treasury note yield ranges between 3.5% and 4%. Some Fed watchers contend that risks are building that the FOMC could be committing a foul, raising rates into a potential economic contraction.

But Will Worrying Yield Curve Moves Stymie Aggressive Positioning?

For markets, though not a red flag, caution is certainly warranted. Since the middle of the month, we’ve been expecting a pullback in stocks given aggressive investor positioning and frothy sentiment. All eyes will be on late July and early August for the next round of central bank meetings and interest rate decisions, along with Q2 corporate earnings season getting into full swing.

Macro Event Risk This Week

Looking ahead, the final week of the first half features stress test results to be released by the Fed, a European Central Bank (ECB) Forum, a meeting of EU leaders, Eurozone CPI, U.S. PCE data, and China PMIs. Along with softer data points at home, the economic outlook for the Euro Area turned less sanguine last week.

According to a fresh round of manufacturing and services activity data for June, Europe writ large experienced a significant slowdown over the last several weeks. Facing a rough end to the first half, policymakers may have their hands tied at key meetings this week. The euro zone’s flash composite PMI dropped to 50.3, down from 52.8 in May, according to S&P Global. (Economists were expecting 52.8.) Any number under 50 on that diffusion index suggests economic contraction.

European Recession Risks Mount, Per the Latest S&P Global PMI Data

Source: Bloomberg

Amid stalling growth, the ECB is forced to be aggressive with its monetary policy given bleak inflation trends in the area, particularly within the UK economy. Europe’s central bank has been hiking its policy rate at a steady rate for the past 12 months, and perhaps impacts are finally being felt across the bloc. Recall earlier this month when it was announced that Germany had entered a technical recession between Q4 of 2022 and this year’s first quarter.More Inflation Data on the Way

Central bank policy predictions will shift back toward the Fed this week as key PCE data is set to hit the tape on Friday. It is commonly known on Wall Street that the FOMC looks to Core PCE for the truest consumer price read, which then helps the Committee form its rate decision and steer monetary policy moves.

But we do not think there will be any shockers come Friday morning when the numbers are released. It will be a May reading, and we’ve already digested CPI and PPI data that were largely in line with expectations. What’s more, Prices Paid data within last month’s ISM reports were not too far off the consensus marks. Year-on-year Headline PCE is expected to be 3.8% while the Core rate (ex-food and energy) is seen at 4.7%. The Fed ultimately aims to get Core PCE back under 2.5%, but we don’t anticipate that happening until at least 2025.

Mixed Real Estate Market Signals

Before the inflation data crosses the wires to close out June, Tuesday features a preliminary read on Durable Goods orders for May along with April S&P Case Shiller Home Price Index data. While corporate investment has been lackluster (consensus for May durable goods demand is a drop of 1%), the U.S. real estate market has shown signs of a modest rebound. A lack of housing supply, the millennial generation seeking first-home purchases, and a strong labor market all support housing right now. Of course, mortgage rates inching back up near 7% is the major headwind for young families.

Last week, KB Home (KBH) issued its quarterly results. The company that often caters to first-time buyers cited robust demand for homes and raised its FY 2023 guidance. Its management team cited improving conditions through Q2 thus far, though its average selling price ticked lower sequentially to $479.5K from $494.5K. That is good news for the red-hot homebuilder stocks and homeowners locked into sub-4% mortgage rates, but draws head shakes from prospective buyers.

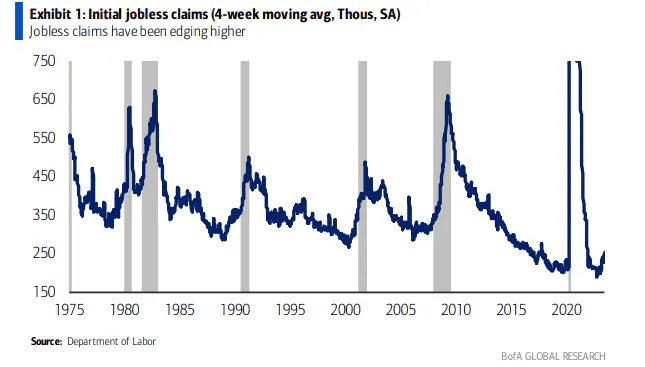

Growing Signs that the Jobs Market is Cooling

Lastly on the data front, the penultimate trading day of the first half features the usual Jobless Claims report. The previous three weeks of initial claims have been higher than consensus estimates. Though there are quirks in the compilation of statewide unemployment applications and some wonky seasonal adjustments, a fourth consecutive elevated number would surely imply a softer June payrolls report (to be released on Friday, July 7).

Initial Jobless Claims Ticking Higher, Implying a Labor Market Slowdown

Source: BofA Global Research

If we see an uptick from the current level of about 260K, then indecision might only grow as to what Chair Powell and the Fed might do on July 26 when the next rate decision is announced. Before both PCE data and the Jobless Claims numbers are released, Powell speaks abroad on Monday and Tuesday. As it stands, market participants price in a 72% chance of a quarter-point rate increase a month from today while the Fed’s terminal rate is seen at 5.33% in November.

Investors Remain Upbeat

The big question is: Will market sentiment be shaken following uncertainty abroad and ongoing macro risks across Europe, Emerging Markets, and (to a lesser extent) in the U.S.? Various pulses of investor confidence remain solidly in ‘bullish’ territory in contrast to despondent readings seen earlier this year. The team at Allio continues to parse through tells in positioning reports as well as what key economic and money flow barometers are suggesting.

The Bottom Line

Stocks snapped weekly winning streaks amid some not-so-impressive economic data last week. The Fed and other central banks remain focused on taming inflation, potentially quelling GDP growth in the second half. More key data is on tap this week along with some Fed Speak as unrest in Russia over the weekend reminds traders that geopolitical tensions remain a wildcard.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.