Updated June 3, 2023

Raymond Micaletti, Ph.D.

Macro Money Monitor

Market Recap

The S&P 500 was little changed during the holiday-shortened week, but there were big moves in the Treasury market with yields dropping hard in advance of the March employment report, which was released on Good Friday, an NYSE holiday.

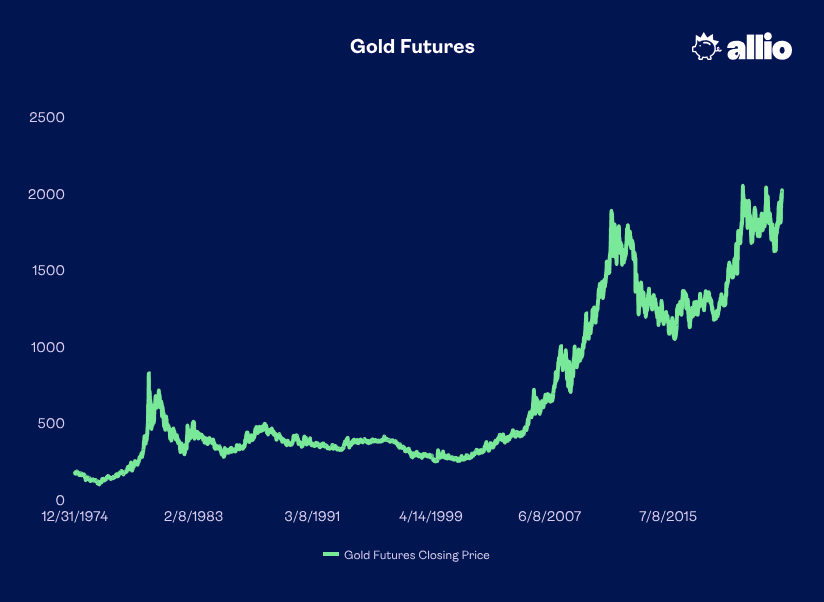

The Nasdaq fell less than one percent while gold soared above the key $2,000 psychological level. The commodity complex notched one of its best weeks of the year following the unexpected news that OPEC+ would be slashing oil production targets. TIPS, meanwhile, joined the Treasury party with a climb of nearly one percent while the Real Estate sector dropped modestly.

Eyes now shift to key economic data this week like the U.S. CPI and PPI reports, a look at March retail sales, and the minutes from last month’s Fed meeting. The yield curve, as measured by the difference between the 2-year and 10-year Treasury rates, inverted to nearly –60 basis points.

Investing with Allio

Allio is pleased to announce that we offer clients exposure to a combination of traditional and alternative investments including real estate, emerging markets, crypto, and gold. We believe in low-cost investing along with increasing exposure to areas we believe will be long-term growth drivers.

You can research how Allio manages portfolios along with why our team of global hedge fund veterans is well-equipped to navigate through volatile markets. Our research team is devoted to helping our clients build portfolios that are right for them based on their return objectives, risk characteristics, and personal beliefs. You can get your own basket of stock and bond funds, alternative asset ETFs, and even crypto in just a few taps.

Doing Diversification Right

What will you find by investing with Allio? Building long-term wealth is done by thoughtfully diversifying. That doesn’t mean owning the world of assets, though. We offer inexpensive index ETFs such as the Vanguard Total Stock Market Index Fund (VTI) and the Vanguard FTSE Developed Markets ETF (VEA) for exposure to the U.S. and non-U.S. developed markets. These ETFs feature extremely low annual expense ratios of just a few dollars per year on a hypothetical $10,000 investment. Also in the equity space, we use the Vanguard Emerging Markets Fund (VWO) and the Vanguard Real Estate Index Fund (VNQ), usually as smaller percentage weights in a typical allocation.

But with Allio, every person is unique. You have the ability to go overweight or underweight certain assets based on your preferences, all with the guiding hand of our global macro strategists. For instance, during this inflationary environment, holding more exposure to real estate or commodities could make sense as a tactical play. Speaking of inflation, some of the most popular funds we offer are commodity ETFs.

Why Commodities Can Work

The Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC) sounds complicated, but it’s actually a straightforward way to access the oil-heavy global commodities space without having to worry about filing complicated K-1 forms come tax time next year. While PDBC invests directly in commodity futures contracts which is a key diversifier for stock-heavy portfolios, we also believe that simply owning shares of energy companies is an efficient way to add real asset exposure.

Consider that the Energy Select Sector SPDR Fund (XLE) was up more than 60% in 2022 while the S&P 500 was down nearly 20%. It goes to show that you do not have to pay super high fees for a complex strategy that zigs when the market zags.

The Energy Sector Soared in 2022, Producing more than 80% of Alpha

The Macro Money Monitor begins with a look at markets, and perhaps the biggest story during the kick off to Q2 was gold busting through the $2,000 per ounce level. It’s near an all-time high in U.S. dollar terms but is easily at or near highs when priced in other currencies. As the greenback has fallen over the last few weeks, care of the March regional banking crisis and lackluster economic data of late, money from across the globe has flocked to the yellow metal.

Governments are buying up gold in droves while retail investors look to own the commodity for safety from stock and bond market volatility. Allio users access gold through the SPDR Gold MiniShares Trust (GLDM), and it costs only 0.10% annually (note: this is an expense ratio embedded in the fund, not a fee paid to Allio).

The Gold Rush Is On: Spot Gold Rallies Past $2,000, Nearing Its 2020 All-Time High

Learn About Our Bond Exposure

On the fixed-income side of the ledger, we use the iShares TIPS Bond ETF (TIP) as well as the Vanguard Intermediate-Term Treasury ETF (VGIT). This combination buffers against volatility in two ways. First, TIP’s inflation protection can offer a cushion against downside in the markets driven by rising consumer prices. For instance, TIP was up more than 5% (including dividends) in 2021 while the aggregate bond market, as measured by the iShares Aggregated Bond ETF (AGG), was off by about 2%.

As inflation fears remain elevated, there are growing calls for a U.S. recession. Last week, a slew of economic data was not so hot as everything from the ISM Manufacturing & Services data to the monthly JOLTS report to the March ADP report to weekly jobless claims figures all suggest the labor market is softening.

Of course, the biggest data point of all – the U.S. employment report released last Friday – suggested the labor market is hanging in there. Still, Treasury yields fell, and VGIT rallied to its best level on a total return basis since August 2022. Long story short, the combo of TIP and VGIT is an ideal way to get exposure to fixed income for the bond sleeve of your portfolio.

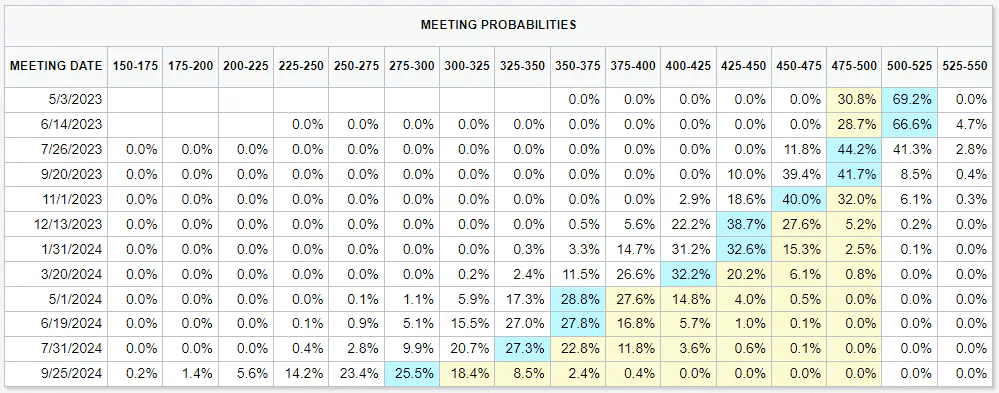

And we cannot ignore cash right now as the Fed remains on its rate hike path. After the March jobs report, the market’s pricing for the peak policy rate inched up to an even 5.00% - thus one more rate hike is expected before the FOMC may begin cutting rates as the economy struggles.

Fed Likely to Begin Lowering Rates in Q2: CME Fed Watch Rate Probabilities

Source: CME Fed Watch Tool

With high yields on the very short end of the Treasury curve, our preferred cash position, the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) may soon yield near 5%. That smashes the rate on the typical savings account which is a meager 0.37%, according to FDIC stats. But it’s not wise to hang out in cash for too long as inflation is still eating away at real purchasing power.

Smart Beta Strategies

Allio’s portfolios feature exposure to smart beta and thematic investments through three funds. First, the QVAL Alpha Architect US Quantitative Value ETF (QVAL) uses an academically-tested strategy of buying high-quality value equities – those that have a strong earnings profile and trade at low valuations.

Next, we employ the Alpha Architect US Quantitative Momentum ETF (QMOM) to tilt equity baskets to the historically impressive momentum factor that aims to buy shares in companies that have performed well over the recent past.

Rounding out the trio of factor funds is the Vanguard Dividend Appreciation ETF (VIG). This low-cost ETF owns companies that have a track record of increasing dividends over the decades. With all three of the smart beta options, you can potentially reduce portfolio volatility while enhancing returns.

Values-Based Impacting Investing at Allio

A popular method to invest is aligning your money with your values through Impact Investing. Many people attempt to do this through ESG portfolios, but ESG scores are assigned to some of the world’s most egregious companies through the purchase of carbon credits and the expansion of useless HR departments, not because they comply with social and environmental mandates.

Alternatively, Allio offers proprietary custom index funds for individuals focused on putting money directly into green energy, cancer research, water conservation, and other areas important to sustainability and improving the world. Other popular values-based investing methods include made-in-America, social justice, and animal welfare.

Through these tailored strategies, our clients have exposure to cutting-edge technologies and emerging industries that will reshape the business landscape in the decades ahead. The right way to do Impact Investing is to focus your dollars into causes and industries you believe in. While other firms offer token and cookie-cutter ESG ideas and funds, we have the real thing.

Adding Crypto to Your Portfolio

Finally, you don’t have to risk putting your money with a crypto website or an obscure lender in order to access Bitcoin. We prefer to use the ProShares Bitcoin Strategy ETF (BITO) which gives investors exposure to bitcoin-linked returns with the liquidity and transparency of the ETF wrapper. Bitcoin has been this year’s best-performing asset area with a nearly 50% return.

Putting it all together, Allio has exposure to the most innovative technology, and we focus on making appropriate investments in sectors that should do well in this hawkish, high inflationary monetary environment.

Right now, there is a split in the government, which has been historically good for markets, but that could change before long. What’s more, with interest rate cuts on the horizon come Q2 and beyond, having exposure to alternatives is critical. Positioning your mix of stocks, bonds, commodities, crypto, and other alternatives properly during this ever-changing macro regime will be crucial.

The Bottom Line

Is the Fed behind the eight ball? Troubling jobs data last week led to big-time Treasury buying while stocks were about flat. Globally, foreign equities continue to sport decent price action while domestic small caps generally struggle as regional bank shares fail to rebound off their March lows. Holding a properly diversified portfolio paid off last week with a steep climb in commodities such as oil and gold.

All eyes now turn to the Q1 earnings season that begins with a host of big banks on Friday.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.