Updated August 22, 2023

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Recap

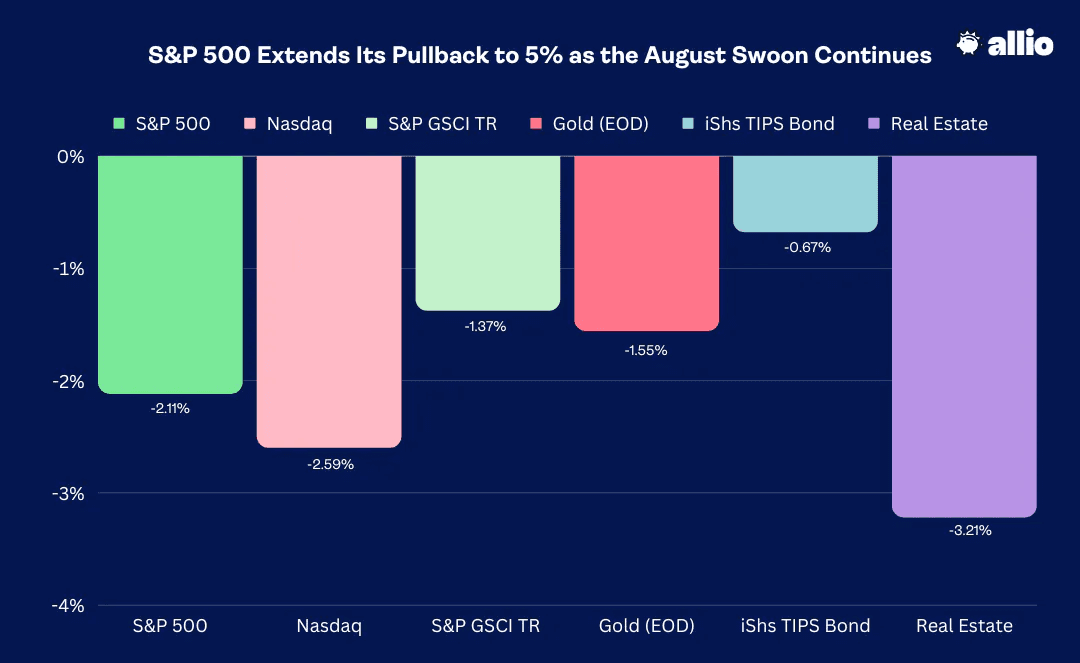

Stocks fell for a third straight week with the S&P 500 losing 2.1%. The Nasdaq Composite fell slightly more, dropping 2.6% as mega-cap tech names continue to retreat from their summer highs. Putting pressure on equities is undoubtedly weakness in the bond market – the TIPS market ETF was down by two-thirds of one percent, slightly underperforming the aggregate bond index amid a steep rise in the US dollar.

Strength in the greenback and rising real interest rates helped send gold prices south once again; the yellow metal settled at its lowest weekly mark since early March. Rising yields also took their toll on the embattled Real Estate sector – it was the second-worst area of the stock market next to the Consumer Discretionary sector.

August 11, 2023 - August 18, 2023

The Look Ahead

It’s the final significant week of Q2 corporate earnings as the summer doldrums wind down. Wall Street traders are wrapping up their vacations and will soon be heading back to the office just as the Federal Reserve traverses out west to its annual Jackson Hole Economic Symposium. Chair Powell will deliver remarks Friday morning shortly after the opening bell. All eyes will be on that key macro event, but not before key earnings hit the tape from perhaps the most anticipated company of all – Nvidia (NVDA). After posting seismic Q1 results and issuing second-quarter guidance that was beyond analysts’ wildest expectations, the onus will be on CEO Jensen Wong to step to the plate and knock another dinger.

We will get July Existing Home Sales Tuesday morning as well as a first read on August S&P Global US Services and Manufacturing PMI data Wednesday morning along with July New Home Sales. Durable Goods orders will be closely watched on Thursday, right as weekly Jobless Claims hit the tape. June’s 4.6% Durable Goods number was strong, and another hot reading could put further pressure on the Fed to consider a hike at the September meeting. Aside from NVDA, we will hear from Macy’s (M), Lowe’s (LOW), DICK’S Sporting Goods (DKS), BJ’s Wholesale (BJ), Toll Brothers (TOL), Kohl’s (KSS), Dollar Tree (DLTR), and Marvel (MRVL) in another retail-focused earnings week.

A Handful of Major Retail Earnings Reports on Tap, NVIDIA the Big Dog Wednesday Night

Source: Earnings Whispers

Too Hot to Handle

Just as struggles on Wall Street come about, economic data has been very strong. There has been much chatter about what third-quarter US real GDP growth will be. In the spotlight at the moment is the Atlanta Fed’s GDPnow tool. At present, the model spits out an estimated annualized economic expansion rate of a whopping 5.8%. That’s well above the long-term trend rate of growth, which economists estimate to be in the 2% to 3% range. It would also be the strongest quarterly rise since the final quarter of 2021.

But we must temper expectations – the GDPnow is merely a model; it is not a forecast. It will likely drift lower as the end of September approaches. Still, compared to the current 1.8% US real GDP growth rate for the quarter, it’s clear that the economy is humming along much better than was thought even a few weeks ago. And for a quick check on the Citigroup Economic Surprise Index, it continues to hover near 30-month highs.

Wall Street “Blue Chip” Economic Growth Estimates Likely to Rise Following Strong Recent Data

Source: Atlanta Federal Reserve

Consumer Spending Strong Amid the Back-to-School Season

Putting upward pressure on the current growth trajectory is a strong consumer, as evidenced by July’s red-hot Retail Sales data, solid Housings Starts figures, and Industrial Production that beat consensus forecasts. Remarkably, real personal consumption (which effectively comprises two-thirds of our economy) is pacing for +8.8% this quarter while real gross private domestic investment growth of +11.4% is off the charts. If Q3 actuals verify anywhere close to the nowcasts numbers, then the Fed has more work to do.

Implications for the Bond Market

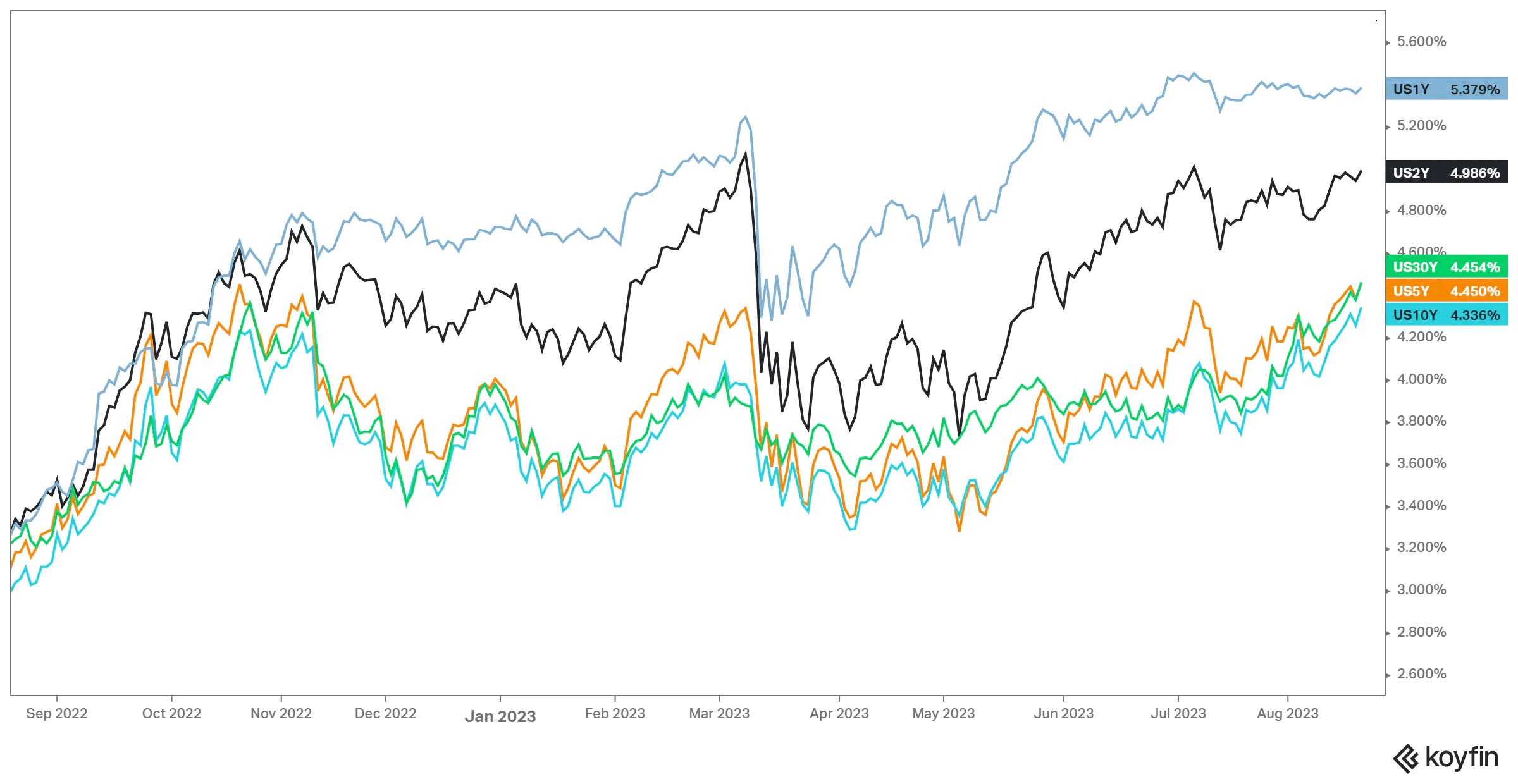

Interest rate markets have taken notice, too. Just since mid-July, the US 10-year Treasury yield has surged from 3.74% to last Thursday’s peak of 4.33%. While a nearly 60-basis point rise in about a month on intermediate-term yields is troubling, it’s the long end of the Treasury curve that has caught the attention of both equity and bond traders.

The 30-year rate was comfortably under 3.8% toward the end of the first half of 2023, but weak auctions and a surprising amount of debt issuance by the US Treasury, along with global macro events like the Bank of Japan’s relaxing of its yield curve controls, has been the rocket fuel to send its rate to 4.43% - matching the high from last October. Shorter-term yields have been steadier, with the 1-year barely budging from the 5.3% to 5.4% range lately.

Intermediate & Long-Term Treasury Rates Rising This Summer

Source: Koyfin Charts

Higher Rates, Lower Stocks

A re-rating appears underway. With stocks correcting lower and bond yields up, commodities have generally been outperforming. That has led to a rise in inflation expectations looking out the next decade. The current 5-year breakeven rate is calm at just above 2.2%, but the 5-year expected rate beginning five years from now recently topped 2.5%.

This comes as consumers turn more sanguine regarding trends in CPI going forward. Market-implied forward inflation rates are something to monitor as they could be a signal that the Fed might have to keep its policy rate higher for longer. If that happens, then stock market valuations could be notched lower. We’ll see if Chair Powell mentions the rise in 10-year inflation expectations (which has been ongoing for more than two months) in his remarks Friday morning.

Breakeven Inflation Rates Looking Out 5 Years and 10 Years Creep Higher

Source: St. Louis Federal Reserve

A Fed Check: A November Hike Remains in Play

As it stands, there remains just an 11% chance of a rate increase to be announced at the September 20 FOMC meeting. And odds are the Fed will hold tight at the November gathering, too (though there remains a 36% probability of a rate hike then). While current data has been strong and inflation expectations are on the rise, macro weakness abroad is a concern as well as potential US consumer headwinds as we approach Q4.

A Big Red Spot: China’s Property Market

China’s real estate market teeters on crisis mode. Recent events such as China Evergrande filing for bankruptcy and Country Garden, a major property development company, now expecting a first-half loss of as much as $7.6 billion, have brought down growth estimates for the world’s second-biggest economy. The current reality is a far cry from hopeful expectations at the start of the year when the Chinese government lifted its draconian zero-COVID policy.

The thinking then was that a renewed period of explosive growth would transpire. That has not come to fruition. Surging youth unemployment – which their government announced it will no longer report – and a crippled property market have weighed on global growth hopes for 2023. China's heavy reliance on real estate as an economic driver has become problematic due to excessive borrowing and overbuilding. The consequences of this worsening crisis include decreased consumer spending, job losses in housing-related industries, and uncertainty leading to reduced business investments.

China Stocks Battered Since Late January

For investors, we must watch what stimulus measures the Chinese government may announce as it navigates the turmoil. Relaxed mortgage requirements and interest rate cuts have happened, but they have yet to implement a major rescue package. After a hot start to 2023, ETFs tracking the China stock market have been a bad spot to overweight. Shares of the iShares China Large-Cap ETF (FXI) are down 14% from their highs just a few weeks ago and are off by more than 20%, dividends included, from the rebound peak notched in January.

Back to School, Back to Paying Down Loans

We mentioned potential weakness in the US consumer. Now, pundits have been saying that for quarters on end, but the next few months could see a cool-off in spending. Consider that the moratorium on student loan repayments is set to expire, with interest on that debt beginning in September and repayments due in October. That could pressure those burdened by hefty loans, which include higher-end income earners. Also, excess savings built up during the pandemic are now largely gone when you account for inflation, so coffers are running a bit drier these days.

Consumer Deathmatch: Rising Real Wages, Easing Job Market Tightness

Offsetting the normalization of savings is the positive turn in real wages. For the first time in two years, workers are enjoying pay raises above the stated CPI rate as the employment market remains healthy. Last week’s Jobless Claims data further asserts that employment readings are decent, though there’s a clear downward trend in monthly employment gains. We’ll get a fresh look at the jobs situation Friday morning next week ahead of the holiday weekend.

Fresh Lows in Housing Affordability (And It Will Get Worse)

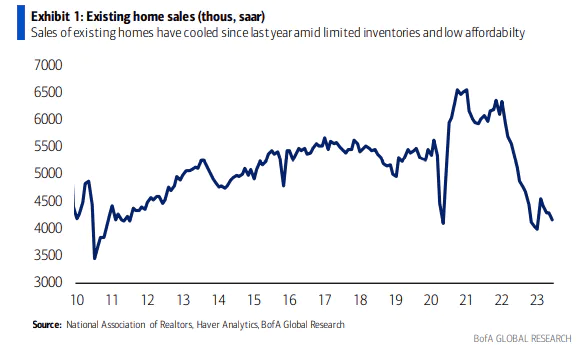

Longer-term, the housing situation appears bleak for first-time buyers. The National Association of Realtors publishes a monthly Housing Affordability report, and the June preliminary read reveals that an average family income is now in the poorest position to take on a 30-year fixed rate mortgage at today’s home prices dating back almost 40 years. Considering that yields have jumped another point since late Q2, affordability trends have only gotten worse, too. Just last week, mortgage rates rose to their highest level since 2000, and that uptrend is weighing on total transactions. Existing Home Sales are weak while New Home Sales have been slightly better, helping the homebuilder stocks.

Golden Handcuffs: Homeowners Reluctant to Give Up Low Mortgage Rates, Existing Home Supply Depressed, Few Transactions

Source: BofA Global Research

Intermarket Dynamics Ahead of the Spooky September-October Stretch

Lastly, let’s get back to the macro’s impact on the markets. We started this week’s outlook with an assessment of the interest rate situation. Well, along with a stair-step higher move in yields has been an incline in the US Dollar Index.

The “DXY” has vaulted from under 100 a month ago to above 103. That’s a significant increase, and it has unquestionably weighed on stock market performance. Now, usually a strengthening greenback is bearish for commodities, namely oil. That has not been the case in this instance. Since mid-July, the US Dollar ETF (UUP) is higher by 4.3% while a broad commodity tracking fund (DBC) is likewise up 3%. Over that time, what’s the worst-performing sector? Technology.

The XLK SPDR ETF, tracking the S&P 500’s largest area, is down 7.5%, including dividends, while the top performer is the Energy sector, up more than 9%. This is classic behavior during inflationary periods and what we often see in the later stages of economic cycles, at least according to intermarket analysis research. Also, the total US Treasury Market ETF (GOVT) is down more than 2% in that time amid intense bond selling pressure. These are key correlations and trends to monitor as we venture closer to the precarious month of September, notorious for producing volatility.

The Bottom Line

While there are ongoing battles between the bulls and bears right now, we remain confident that this short-run volatility is a shakeout and that the broader equity market uptrend will resume, but not before more unease takes place. Fostering further volatility could be ongoing troubles in China, interest rate uncertainty, and bearish seasonal factors. In the near term, all eyes will be on Nvidia Wednesday night and Chair Powell Friday morning this week.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.