Updated June 3, 2023

Joseph Gradante, Allio CEO

Macro Money Monitor

Advanced

Things have changed post-pandemic. That goes for life, politics, and the investment landscape. It’s clear that the trend toward globalization is over, and that has key implications for how you should consider tilting your portfolios.

Now that COVID-19 has essentially become endemic, we can reflect on just how much different the world is now compared to 2019.

What’s The Great Reset?

Klaus Schwab, the founder and executive chairman of the World Economic Forum (WEF) penned “COVID-19: The Great Reset” in 2020. The book assesses the global impacts of the pandemic and how individuals can prepare for a whole new world.

A major theme in the text is the supposed need for a reset across politics, societal constructs, and business and finance. Building sustainable societies with equality is a key theme, but that also sparked much debate as Schwab seemed to attack many personal and corporate freedoms that we hold dear.

We could go down the rabbit hole of what a move away from America being seen as a beacon of liberty and capitalism means for the future of politics, but preserving investment capital and even making money on the Great Reset is what we focus on at Allio.

The Great Reset: Is It Good or Bad?

The Great Reset is seen through the eyes of the beholder. Some progressives may interpret it as a step in the right direction toward equality while capitalists view the proposed world changes as diminishing the power of business. Key for us as investors, however, is to focus on the reality that great change can bring about great opportunities.

Disruptions brought about by the Great Reset could lead to lower long-run global growth, but with massive upside potential in key sectors. Allio’s duty is to track these key macro signals by positioning client portfolios to benefit from such upside. At the same time, we can use diversification techniques to mitigate downside risks to preserve compound growth.

Failed Promises from ESG

Digging into the details of the Great Reset, the so-called Environmental, Social, and Governance (ESG) movement is at the heart of the main policies. This is concerning as we have all been witness to the perils of ESG over the last few years. Additionally, many companies with dubious social justice backgrounds have earned strong ESG scores and large corporations with sketchy energy records can simply buy carbon credits to put them back into compliance.

The problem is that by some point, every company will have an ESG score, and those with weak scores will be chastised and even pushed out of many portfolios. As tactical investors, we can eventually buy stocks we deem as sufficiently undervalued, but that will require discipline and patience.

Bigger picture, a major flaw with ESG is that we probably shouldn’t look to a group of international bankers who financed and created the current flawed system with all of its inequities as the moral authorities – particularly as it pertains to corporate governance. The WEF is a consortium of non-elected, extremely wealthy globalists who are likely out of touch with what certain decisions mean for everyday investors. A better approach would be to allow the free market to dictate how capital is allocated with more modest guardrails compared to what the Great Reset asserts.

The Threat of Energy Crises

An unfortunate byproduct of the Great Reset’s precepts is an emerging risk of ongoing energy crises. Fears of a deadly winter in Europe in 2022-2023 were luckily averted due to a mild stretch of weather and diverted LNG supply, but who knows if we’ll be so fortunate the next time. While we all want clean and sustainable energy, we once again must allow the free market to have a say in this evolution to avoid setting ourselves back even further. Of course, it’s a balancing act – policymakers will have their say, too, but a better, more thought-out approach is needed.

European Natural Gas Prices Collapse Following a Historic 2022 Rally

Right now, so long as China and India maintain their dependence on coal and oil to fuel their economies, developed nations' curtailment of fossil fuel production is purely superfluous and will have a negligible impact on the biosphere. The problem is that even if we maxed out renewable energy production, just a fraction of global demand would be met. Thus, restricting energy generation from natural gas, coal, and even oil must be done in a very prudent manner so that we do not risk people’s lives and businesses’ livelihoods.

The smart solution, in our view, is to lean on natural gas as the bridge fuel to the future. This is where the United States can be a leader with our vast shale regions that can power the globe for decades to come. And we can do this since growth in clean energy solutions and technology will eventually make these fuel sources, such as solar, wind, and battery storage, cost-effective and scalable.

What makes it tough is that many governments have already dug their heels on this issue – just take a look at a recent ban on gas stoves in some districts. Policies like that do nothing to truly improve the environment and make energy more affordable for everyday folks.

A major task at hand is getting China on track with curtailing its emissions. All countries must be on board – particularly today’s biggest emitters. That requires a strategic trade policy with China that we simply do not have at the moment.

China is the World’s Biggest C02 Emitter

Source: Rhodium Group

We must address climate change, but in a way that’s congruent with innovation and ensure the transition does not put our economy and status on the global stage at major risk. The worst thing that can happen – and doesn’t need to happen – would be a self-inflicted energy crisis of epic proportions brought about through excessive regulation and taxation. That would have dire consequences for GDP, and even put the U.S. dollar’s status as the global reserve currency at risk.

The Perils of Traditional Progressive Taxation

Another tenant of the Great Reset is the notion that higher taxes paid by companies and wealthy individuals promote equality. But that is not always true. Sure, it sounds great and makes for catchy campaign slogans to tax those ‘evil’ private jet owners to the nines, but the downside is that these are the job creators and wealth generators for the world.

Policymakers must seek the right equilibrium point that is evidence-based, not formed on rhetoric. Progressive taxation is only progressive until the point of diminishing returns on capital investment. For instance, if a 50% corporate tax rate leads to a reduction in GDP, then the economy shrinks, and wealth is destroyed. A lower tax rate from a bigger economic pie is truly progressive in that it can pay for more programs to expand the social safety net.

It’s time for a history lesson – in the early 1960s, President Kennedy proposed cutting the top marginal tax rate from 91% to 65% (the policy was eventually signed into law by President Johnson). That free-market move sent the effective tax rate down to 41% from 44% for Americans while the corporate tax rate was reduced from 52% to 47%. Those changes helped promote economic growth by way of increased consumption and a massive jump in capital investment by business owners.

Bear in mind that the economic freedoms that were promoted back then occurred pre-globalization. Thus, it is intellectually dishonest to suggest that the wealth inequality seen today is the result of policies enacted post-globalization. What’s critical to setting up the broad economy for future success is to ensure that tax policies are growth-oriented, not focused on myopically punishing a chosen few.

Increased Government Spending: A Potential Growth Driver

The Great Reset supports the concept that the central government can coordinate activities for the greater good of the populous. We see this as a fine concept, but bringing in the private sector is the key x-factor.

Just like President Kennedy aimed for, targeted government investments alongside the expert guiding hands of the free market can expand the overall economic pie. That is the goldilocks outcome. It’s perhaps seen best in the NASA space race of the 1960s. Without high government spending in that endeavor, the world would not have so many of the technologies we depend on today. It was such a vast mission that could not have been executed by a single private company.

This is another avenue where Allio sees opportunities ahead for investors. While the phrase, “I’m from the government, and I’m here to help” should be met with some skepticism, today’s challenges can be met, in part, with data-driven and disciplined government spending.

Inflation on the Middle Class: Balancing Risks

Now, you might say that higher capital spending on the part of state and local governments as well as at the federal level would promote ongoing inflation. We agree. Once again, balancing economic growth with the ever-present risk of rising consumer prices is prudent and necessary. What’s obvious, though, is that raising taxes during an era of elevated inflation would be disastrous.

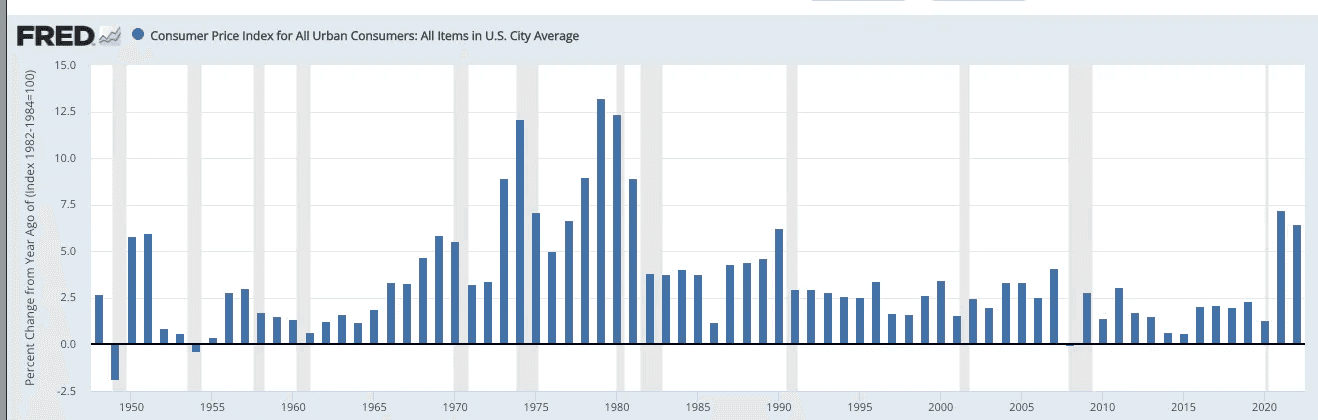

1990s: Peak Prosperity? Lessons Learned.

A parallel to today’s challenges and opportunities is maybe rightly compared to the 1990s. That’s a rosy outlook but consider that the ‘90s featured disinflation coming off the moderately inflationary 1980s and extremely high inflation years of the ‘70s. There was also an economic boom happening care of the tech revolution and favorable demographic trends in the USA, not all that dissimilar from today. Somewhat less talked about is what happened at the onset to springboard arguably our greatest decade: the fall of the Berlin Wall and the repudiation of communism and socialism as viable economic systems.

1990s Disinflation Promoted Wealth Generation

There was peak prosperity in the 1990s as a result of capitalism emerging as the premier engine for growth, freedom, and economic upward mobility. Today’s young investors (and voters) must acknowledge and embrace the pro-growth policies that spurred innovation and today’s most successful companies. Free-market initiatives from the ‘80s helped set the stage for the 1990s boom, and some of President Clinton’s policies, including the repeal of Glass-Steagall, helped take our nation to the next economic level.

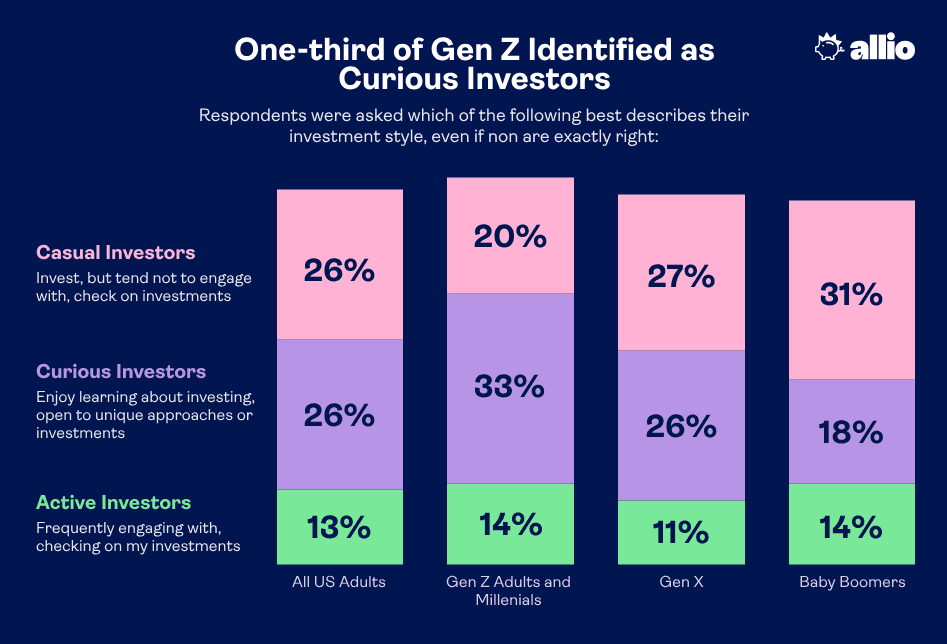

Gen Z: A Different Generation in a New Era

There’s no doubt that Gen Z has different priorities compared to older investors. And that’s a wonderful thing. At the same time, we should use history as a guide to see what policies work and which do not when it comes to economic advancement. Higher taxes and increased regulation often lead to economic struggles. Populist messages sound appealing, but they are often empty promises. Both sides are guilty – from Bernie Sanders to AOC to President Trump. It’s our hope that politicians such as Kristen Sinema, Joe Manchin, and Susan Collins can reign in some of the wild ideas and rhetoric of today’s populists.

Gen Z: Curious Investors, Open to Innovation

Source: Morning Consult

The Great Reset: Implications for Your Financial Goals

Putting it all together, growth could be slower in the years ahead, but there’s massive upside potential in key sectors and themes. Energy and real estate are two spots that could enjoy strong periods to come, albeit with some volatility. Seismic shifts in certain niches always lead to opportunities for investors who are positioned correctly.

Allio’s team of hedge fund veterans track developments in the macro landscape, then compare those signals to the data generated by our proprietary machine-learning investment engine to sequence your portfolio so that it’s in a position to benefit while preserving gains by diversifying, when appropriate, to buffer against downside risk.

The Bottom Line

That’s a lot to consider when pondering what lies ahead for the global economy, right? As investors, you and I are just here to reach our financial goals. Solving the world’s ills may not be your first concern, but investing alongside your values is something we embrace. The Great Reset brings about opportunities and risks when it comes to your long-term investing plan.

Allio’s finance app, powered by machine learning and managed by global macro hedge fund experts, helps you save money and build wealth in the 21st Century. Whether you are saving money for a short-term goal or investing for the future, Allio has you covered.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.