Updated January 5, 2024

Mike Zaccardi, CFA, CMT

Personal Finance

No matter what goals you set to achieve – be they at work, on the job, or just with your favorite hobby – it always helps to see that you’re making progress. Along life’s journeys, knowing where you stand fosters a clearer path toward hitting various milestones and destinations. It rings true for growing your wealth, too. Allio is all about helping our members and users reach financial independence through carefully constructed investment allocations and personal finance tips to make everyday life a bit easier.

What Is a Net Worth?

Understanding your net worth is super simple once you know the basics and have a gauge of what you want your future to look like. Your net worth is merely the difference between your assets (what you own) and liabilities (what you owe). Ask any business owner, and they can give you a ballpark estimate of their financial health via this metric.

At the personal finance level, your net worth is different from your annual income, though the two work together. Your yearly salary is no doubt critical when it comes to setting a budget, but your annual income doesn’t have the power to compound as much as your net worth does.

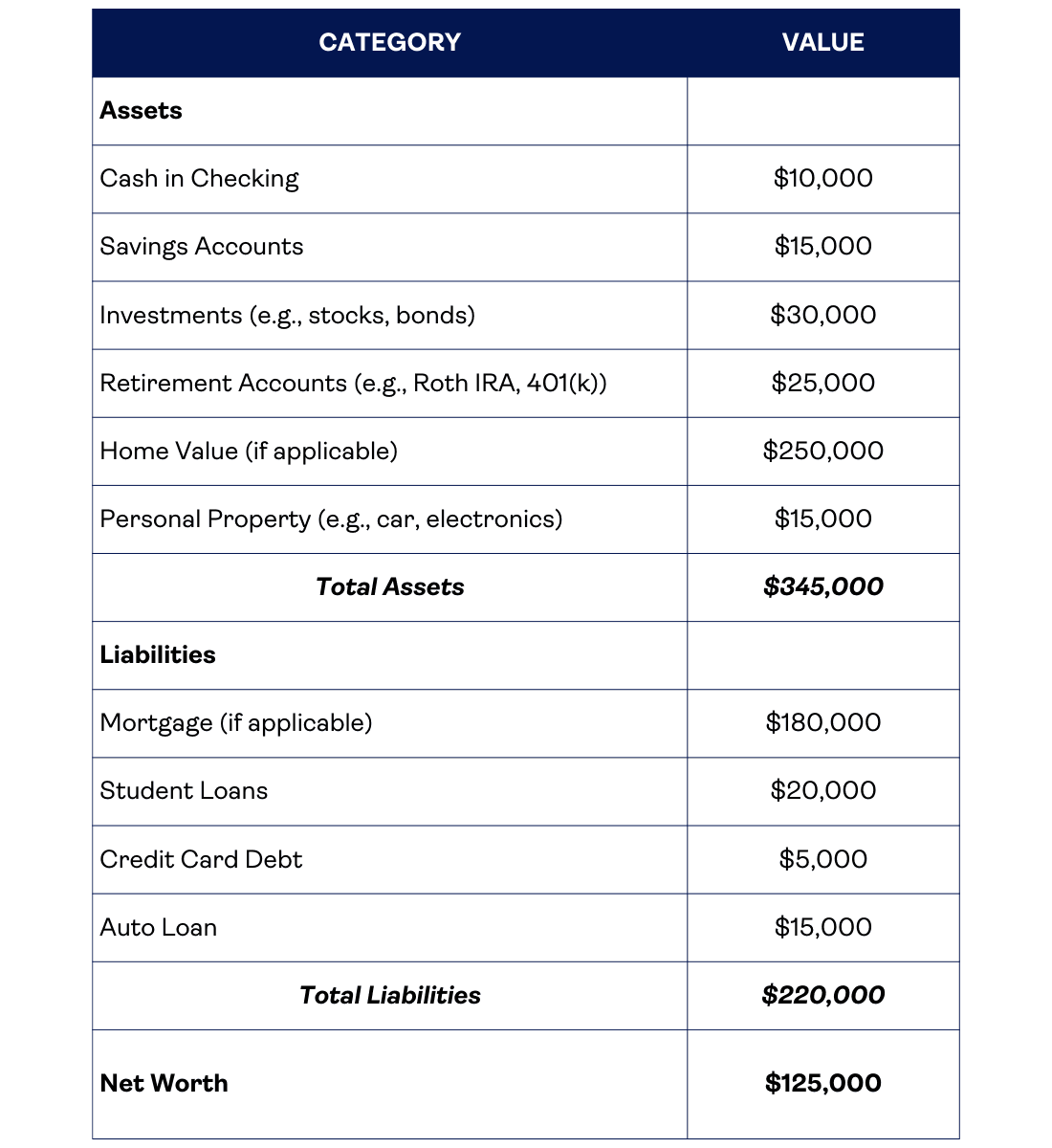

Example Net Worth Analysis

In the above hypothetical net worth table, the individual’s net worth is $125,000. That’s found by subtracting the $220,000 of liabilities from total assets of $345,000. Now, this is just a snapshot, and it will change all the time. As you grow older, pay down debt, and save for retirement, your net worth should climb. It then commonly begins to decline modestly starting in mid-retirement.

Many young people have negative net worths, though, and you know what? That’s OK! College debt for the average grad sums to about $30,000 and getting on your feet independently is not cheap these days. Over time, not overnight, sound saving strategies build your net worth. Before you know it, your investments can compound significantly, sending your net worth soaring.

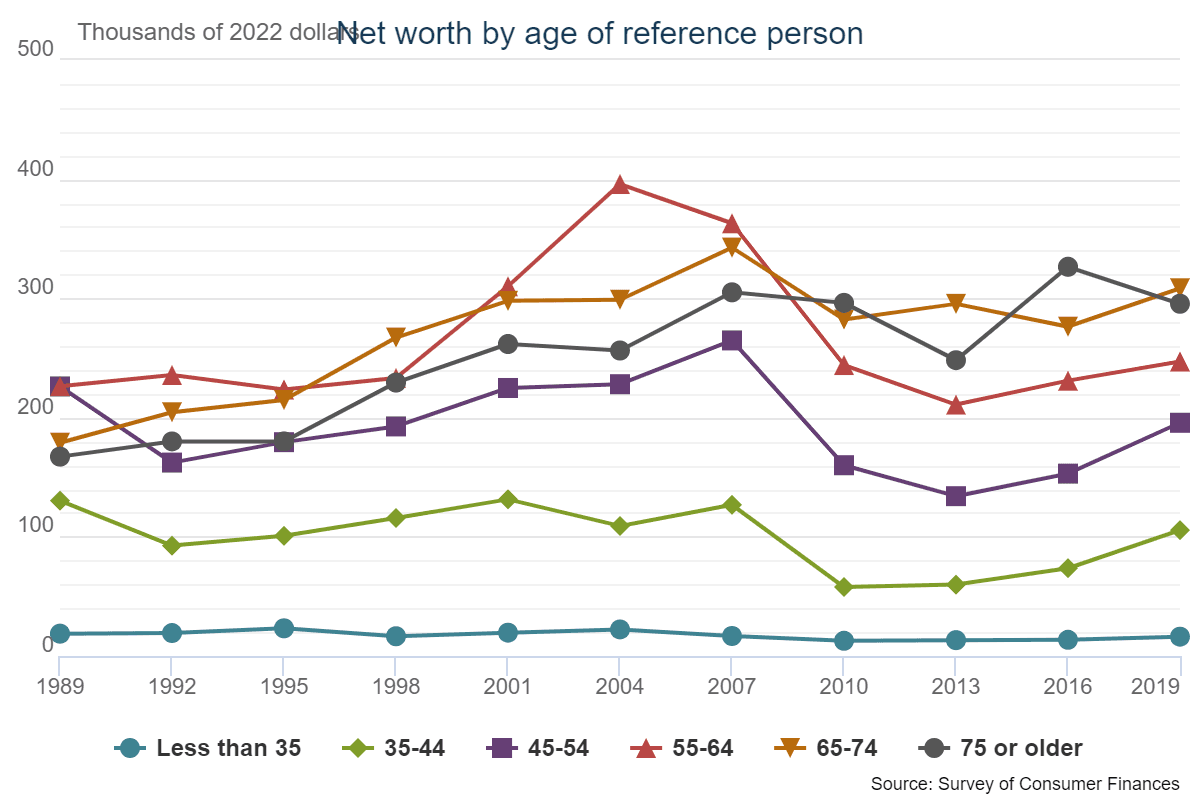

While the typical person in their 20s and 30s has a modest positive difference between their assets and liabilities, middle-aged and older Americans, per the Federal Reserve’s data shown below, have the largest net worths.

Survey of Consumer Finances, 1989 - 2019

Source: Federal Reserve

The Importance of Knowing Your Net Worth

There are several reasons why having a handle on your net worth is so useful.

It’s a financial snapshot

Imagine cruising down the highway unaware of your speed. Something bad’s going to happen eventually. Your car’s dashboard offers several indicators aimed at getting you to where you want to go safely.

With your money, your net worth is just the starting line, and it includes a list of all your financial assets like your investment accounts, savings balances, a car that’s paid off, and home equity, while your liabilities might consist of student loans, what you owe on credit cards, perhaps an auto loan or mortgage balance, and other unpaid bills. You know where you lie on the wealth spectrum after tallying all these numbers. This knowledge is especially valuable for young investors who are just starting to build their financial futures.

You can track how well you’re doing money-wise.

After a few miles down the road of monitoring your net worth, you will begin to see how your financial decisions are impacting your bottom line. Don’t get caught up in a few months of up and down moves among your investment accounts but do keep tabs on your after-tax income trends and expense ebbs and flows. Also, figuring out your net worth every, say, three months helps you establish and execute a plan to pay off high-interest-rate debt and prioritize savings buckets.

It brings life to your budget.

Here's where your net worth shines as the ultimate personal finance measurement. While budgeting is important, let’s be honest – it's no fun unless you are like us (a bunch of finance nerds). But suppose you want to take a vacation overseas or have your eyes set on saving up for a down payment on a house; a growing net worth through diligent saving strategies boosts confidence.

You’ll quickly spot parts of your budget that can be tweaked and optimized to bring your mini-money goals closer to reality. And for those of you striving to FIRE, tracking your net worth enables you to effectively set intermediate-term objectives, such as hitting $100,000 by age X and $200,000 by age Y.

You can better assess your risk tolerance.

Young people determined to see their net worth flourish can take more risk later on since their financial cushion may grow bigger compared to individuals living more haphazardly.

Think about it like this: If you have a net worth at age 30 of $100,000, then you can probably afford to invest more aggressively to earn a higher return versus another person who has no clue what they own and owe. A grasp of your net worth also prevents possible overexposure to risk that could otherwise jeopardize your financial security. Likewise, that knowledge instills the confidence to not be afraid of market swings.

The Connection Between Net Worth and Long-Run Investing Success

Unlike your yearly income, your net worth allows you to see the value of spending less than what you earn. There are plenty of families out there that appear to be making bank via lofty salaries, but reckless spending and taking on debt often result in a dismal net worth. To earn long-run investing rewards, you must maintain a positive savings rate.

Consider this: Let’s say you have take-home pay of $5,000 per month. If you can live on just $3,000, then you are free to put away a tidy sum into tax-advantaged accounts like a Roth IRA, 401(k), or even a Health Savings Account (HSA) if you qualify. Then, after regular contributions to investment accounts, you’ll find that your money is making money for you. Of course, investing in globally diversified macro portfolios, like what we do at Allio, can turbocharge your plan.

In effect, your net worth becomes a byproduct of sound saving habits and disciplined investing routines. From there, you may choose to embark on a bold new business venture, take part in real estate deals, or even seed exciting startup companies. Finally, from a risk management perspective, a larger net worth and an established emergency fund provide a safety net from occasional financial setbacks, keeping your long-term investment plan intact. You can track your net worth over time with a personal balance sheet in the palm of your hand using our app.

The Bottom Line

Your net worth, the difference between the value of your assets and liabilities, holds the key to financial independence and long-term investing success. It provides a glimpse of your financial health, helps track your money progress, enhances budgeting, and guides risk assessment. Unlike annual income, your net worth encapsulates both the income and spending sides of your ledger. Whether you want help saving money for a short-term goal or investing for the future, know your net worth, and rest assured that Allio has you covered.

Whether you want help saving money for a short-term goal, or investing for the future, Allio can help. Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.